Author: Wang Lijie

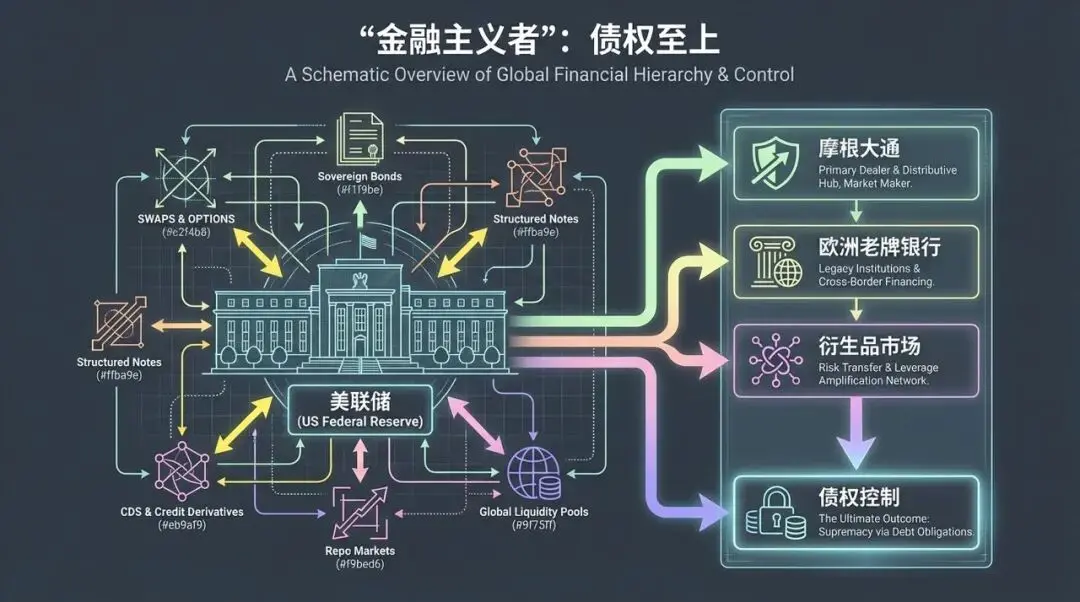

"Financialists": The Empire of Debt Stacking

First, let us get to know a certain force—“Financialists.” Who are they? They include the Federal Reserve, JPMorgan Chase, the historic banking families of Europe, and the complex derivatives market that supports them. It can be said that since the secret establishment of the synthetic currency system in a small room in 1913, they have controlled the world for over a century.

Their core means of controlling the world is not through direct ownership of assets, but through the continuous circulation and accumulation of “debt.”

Collateral

Yield

Price signals

Credit systems

Eurodollars, swaps, futures, repos

These tools are layered and tightly interconnected, firmly holding the entire financial track and currency flow in their hands. They exist as the “behind-the-scenes killers” in the financial world, constructing a vast financial empire through debt.

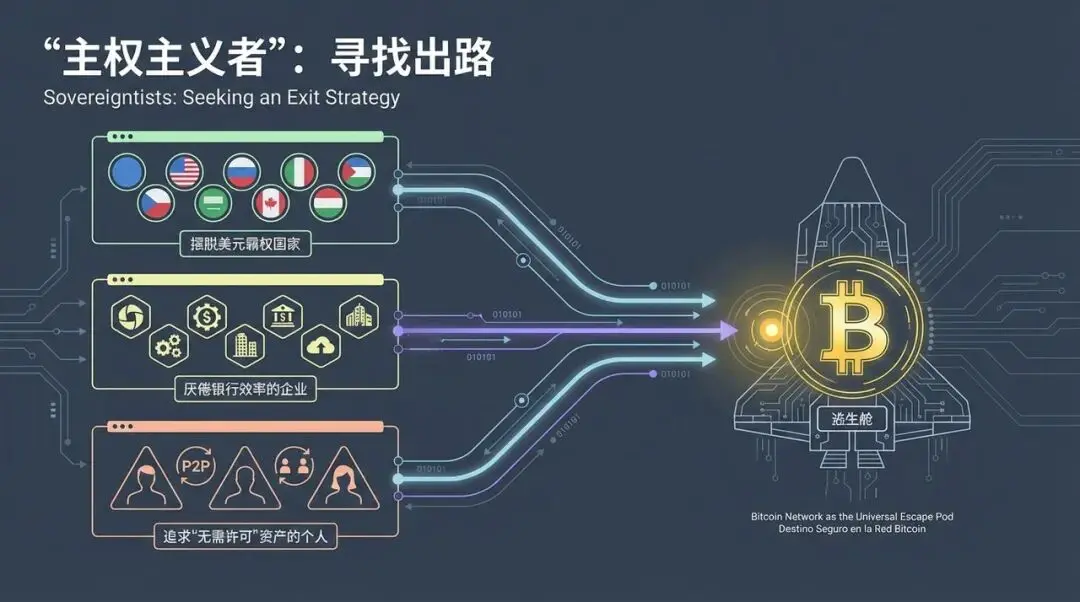

"Sovereignists": Seeking a Way Out

In stark contrast to the “Financialists” is another emerging force—the “Sovereignists.” They include:

Countries attempting to break free from the constraints of dollar hegemony

Businesses tired of the inefficiency and exploitation of the banking system

And ordinary people like you and me, choosing to firmly control their wealth and pursue “permissionless” assets

Despite their differing motivations, their core demands converge: they all yearn to find a way out of the old, blood-sucking financial system. Bitcoin has become the first “escape pod” they see.

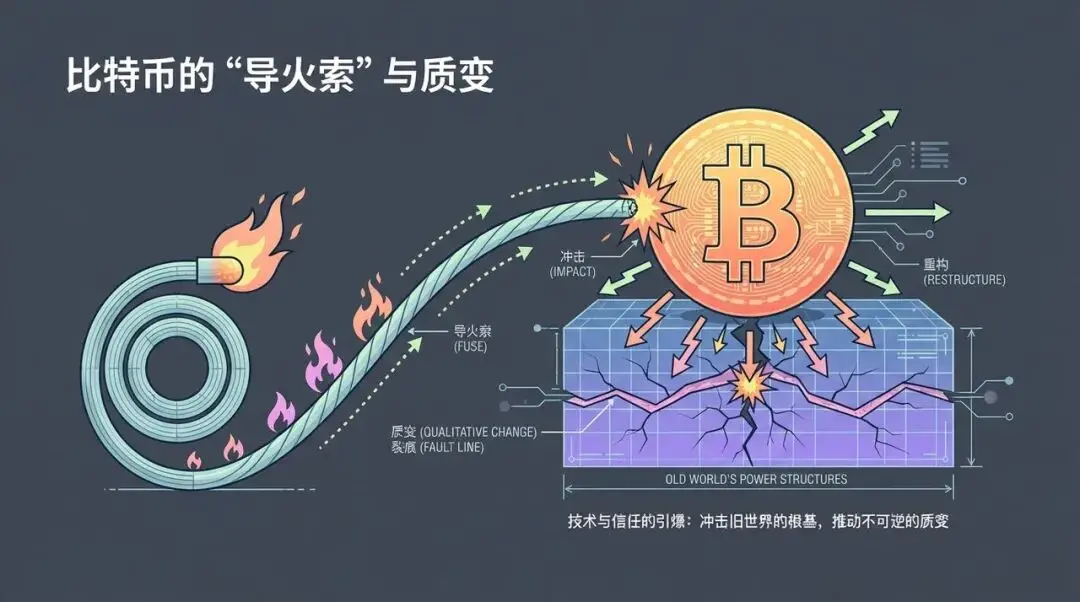

The "Trigger" of Bitcoin and the Transformation of MicroStrategy

Initially, it was not Bitcoin itself that ignited this war. Bitcoin is more like a trigger; it shook people's perceptions and showcased another possibility for finance. However, it was MicroStrategy that truly shook the foundations of the old world’s power. This company has demonstrated through action that Bitcoin can serve as collateral, deeply integrating into the capital markets, which undoubtedly marks a qualitative change in its position within the financial system.

This is not a simple fluctuation in price, but the true prologue to a financial war. It reveals that Bitcoin is no longer a marginalized digital currency, but a key collateral with the potential to impact the core of traditional finance.

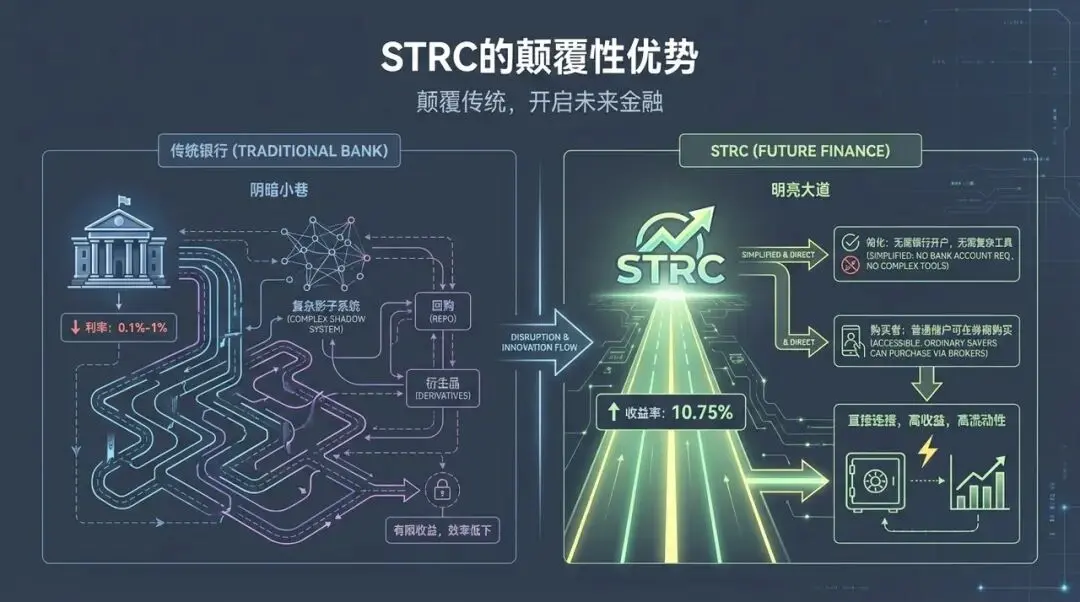

To better understand this transformation, we must mention a product that sounds quite hardcore—STRC. STRC is not an ordinary bond, nor is it a typical new financial product; it is not even something created out of thin air by MicroStrategy.

STRC: The Disruptive Bitcoin Financial Engine

STRC is the world’s first regulatory-compliant financial engine backed by Bitcoin. What does this mean? It means that ordinary savers can now openly purchase a product supported by Bitcoin that can generate returns in their brokerage accounts. You do not need to open a bank account, nor do you need to engage with the complex shadow banking system. Even more striking is that the current STRC yield can reach up to 10.75%, while traditional bank savings interest typically ranges from 0.1% to 1%, forming a stark contrast.

However, what is most remarkable about STRC is not just its high yield, but the monetary feedback loop mechanism it embodies—this is the fundamental reason that makes the “Financialists” uneasy.

Investors purchase STRC: funds flow into MicroStrategy.

MicroStrategy uses these funds to buy real Bitcoin: thus tightening the supply of Bitcoin in the market.

Bitcoin prices rise: as supply decreases and demand increases.

The value of Bitcoin as collateral increases: thus lowering MicroStrategy's borrowing costs.

Low costs attract more investors to buy STRC: forming a virtuous cycle, and the company needs to buy more Bitcoin.

This is a perfect self-reinforcing flywheel, a perpetual motion machine with increasing scarcity! This is what truly terrifies traditional financial giants.

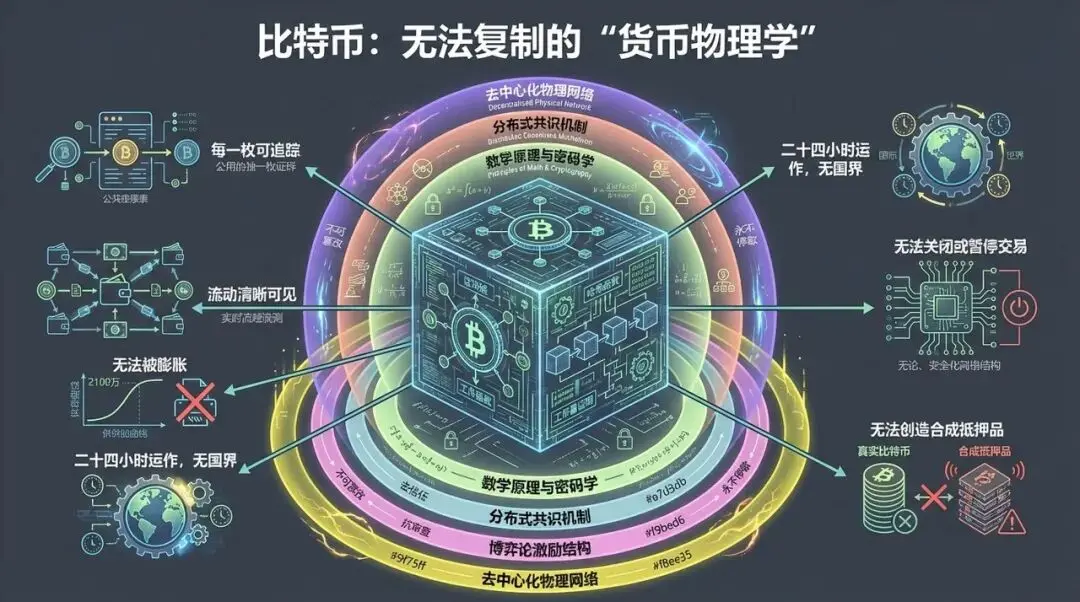

The traditional banking system cannot operate this mechanism. They cannot accept Bitcoin as collateral, cannot use Bitcoin for settlement, cannot “print” Bitcoin out of thin air, and cannot easily freeze it. In the past, they were able to control everything because they could infinitely create “debt”; now, Bitcoin is a physical asset, a hard currency.

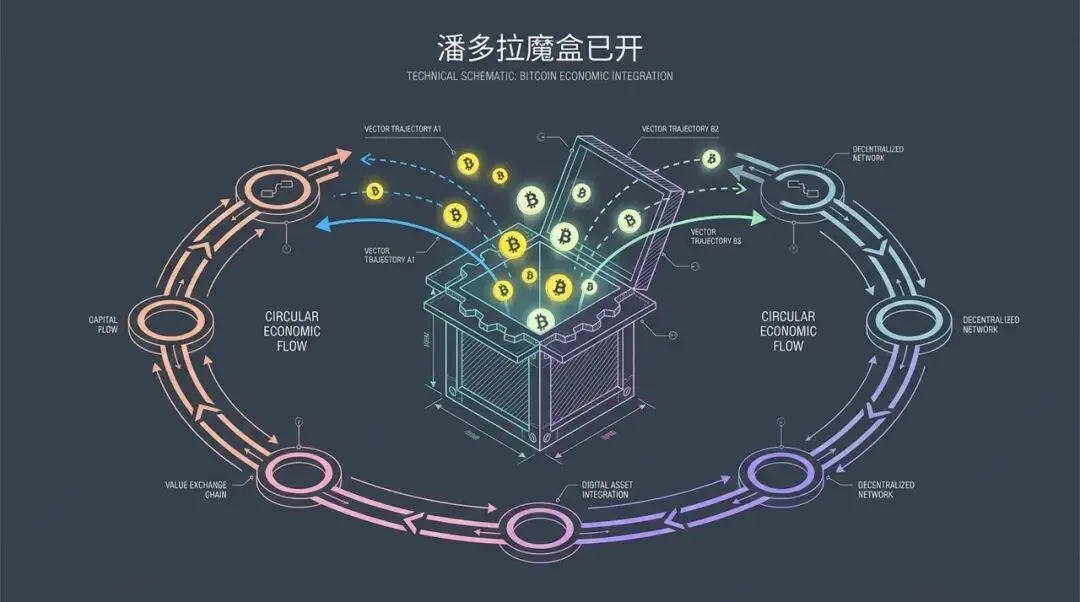

This is the first time in human history that ordinary individuals can participate directly in the capital cycle within a regulatory framework, bypassing the banking system. When this Pandora's box is opened, the first wave of attacks quietly arrives.

JPMorgan's Sniping and the "Synthetic Counterattack"

In July 2025, JPMorgan's “gold medal brokerage” department suddenly announced that it would raise MicroStrategy's margin requirement from 50% to 95%. This means that if you want to purchase $100,000 worth of MSTR stock, you now need to put up $95,000 in cash, almost completely blocking the possibility of leveraged trading.

This is not a typical market adjustment. It is worth noting that JPMorgan has not taken similar actions against high-volatility stocks like Tesla, Nvidia, or Coinbase. MSTR has become the sole target. Behind this, it is clearly not a simple market competition, but more like a premeditated and coordinated suppression action.

Immediately following, the “synthetic counterattack” came. On November 25, 2025, JPMorgan submitted documents to the U.S. Securities and Exchange Commission to launch a leveraged Bitcoin structured note linked to BlackRock's IBIT ETF. This is a textbook demonstration of Wall Street's “old tricks.”

Wall Street does not control assets; they control the “debt” of assets. They have never owned gold, yet they control synthetic gold; they do not have silver, yet they can control synthetic silver; synthetic government bonds, synthetic credit. So, naturally, they also want to create “synthetic Bitcoin” in the realm of Bitcoin.

The Repetition of History: Unreplicable "Monetary Physics"

Looking back at history, whether it is the transition of the U.S. from agricultural finance to industrial finance in the early 20th century, or the various patterns of power concentration and narrative control over the past century, we find astonishing similarities. Whenever the old system is threatened, the response is always to concentrate power, control the narrative, and suppress anything that does not conform to the new standards.

However, this time, the script cannot be repeated. Because the real war has long transcended the scope of Bitcoin versus the dollar, or even Bitcoin versus Wall Street. It concerns the competition for “tracks”—those systems that bring value into Bitcoin and create credit from Bitcoin. Whoever controls these tracks controls the future monetary system.

MicroStrategy, through its STRC product, has revealed a secret that Wall Street does not want the world to know: Bitcoin can serve as flawless collateral and operate in the capital markets!

Once this fact comes to light, the model of the “Financialists” begins to crumble. For over a century, their power has been rooted in the ability to multiply collateral: gold can establish a 100:1 paper debt system, the dollar can infinitely multiply through a fractional reserve system, and government bonds are repeatedly pledged in the banking system. However, Bitcoin breaks all these advantages. You can create synthetic Bitcoin exposure, but you cannot create synthetic Bitcoin collateral!

Wall Street's Demand: Submission and Struggle

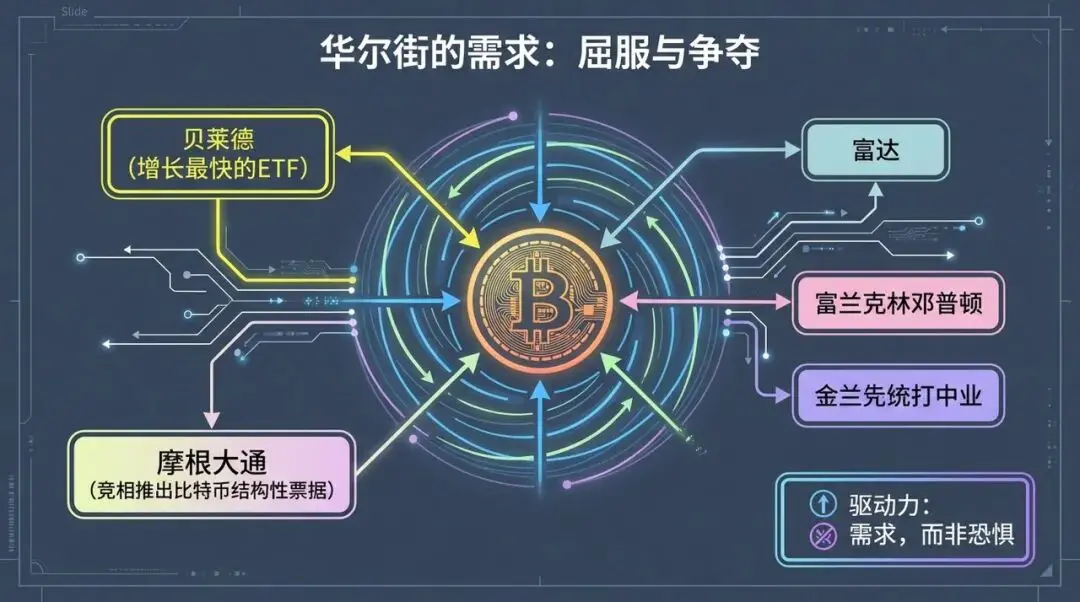

Wall Street's own actions are the best proof. BlackRock launched the fastest-growing ETF in history, and its underlying asset is not bonds, stocks, or gold, but Bitcoin! Fidelity and Franklin Templeton quickly followed suit. Even JPMorgan, which once raised MicroStrategy's margin requirements and specifically targeted Bitcoin-related companies, is now competing to launch structured notes linked to Bitcoin. This inevitably raises the question: “Why?”

The answer is simple: they know very well what Bitcoin is becoming—a new layer of collateral that will absorb more liquidity than any other asset in the financial system.

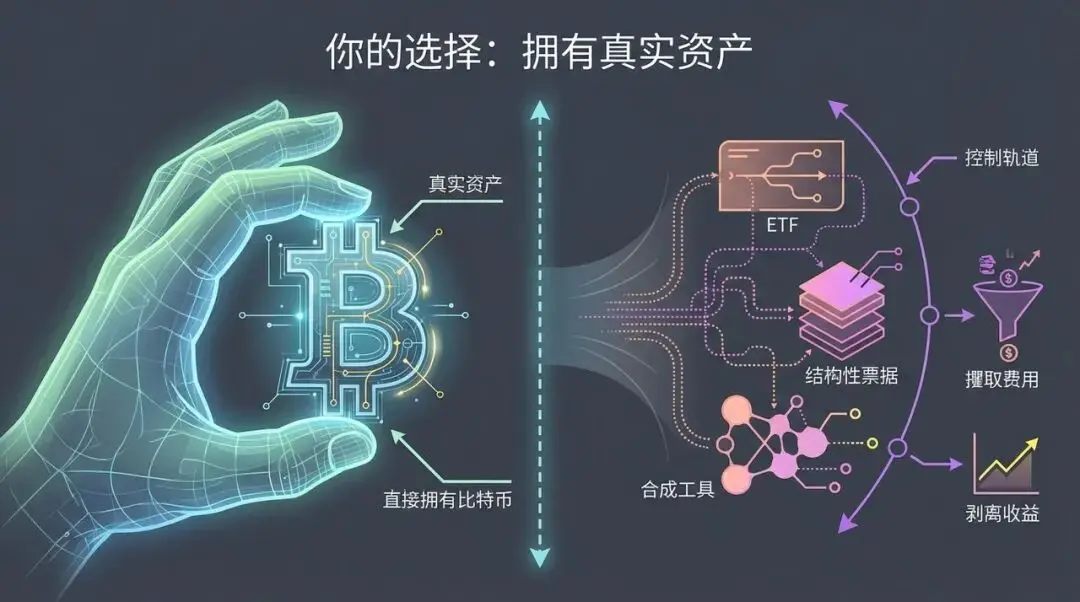

This is not out of fear, but a profound market demand from the largest financial institutions in the world. What they do not want us to understand is that in every Wall Street product they launch, whether it is an ETF, structured note, or synthetic tool, they are controlling the tracks, seizing fees, mastering convexity, and extracting upward profits. You may gain some exposure, but they capture most of the economic benefits.

Your Choice: Own Real Assets

However, you do not need to purchase these synthetic versions at all. You do not need banks to act on your behalf, nor do you need those structured notes, third-party custodians, or derivatives trading desks. You can directly own Bitcoin—this real asset, this scarce collateral—which is exactly what Wall Street is rushing to package, repackage, and attempt to strip from you! This is the true return.

The “Financialists” are not opposing Bitcoin because it poses a threat; they are fighting to get a piece of the pie because they realize that Bitcoin is the cornerstone of the next system. They are trying to control the tracks because they know where liquidity will flow. But you do not need their tracks. Bitcoin has already provided you with its own track.

Those who can understand this early and prepare before this transformation becomes apparent will be the true winners in this era change. The choice is now in your hands.

Recommended Reading:

Why is Asia's largest Bitcoin treasury company Metaplanet not bottom-fishing?

Multicoin Capital: The Era of Fintech 4.0 Has Arrived

a16z-backed Web3 unicorn Farcaster is forced to transform; is Web3 social a false proposition?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。