每日行情重点数据回顾和趋势分析,由PANews出品。

1.市场观察

受美联储降息25个基点及计划每月购买400亿美元短期美债的宽松预期推动,贵金属表现尤为亮眼,黄金涨破12月高点,价格逼近4290美元关口,现货白银冲上64美元续刷历史新高。然而,美国劳动力市场显露疲态,上周初请失业金人数激增4.4万人至23.6万人,创下疫情后最大单周增幅,叠加贸易逆差收窄数据,令市场对经济前景保持警惕。与此同时,中国召开了中央经济工作会议,为2026年经济工作定调,明确了实施更加积极的财政政策和适度宽松的货币政策,重点在于扩大内需与科技创新。但在具体消费品端,茅台价格持续承压,25年飞天茅台价格跌破1499元心理关口,自年初的2200元附近一路下跌,累计下跌超30%,业内人士担忧,价格持续下滑或导致渠道商利润减少甚至亏损,可能引发“价格下跌→抛售→进一步下跌”的恶性循环。展望未来,分析师普遍认为2026年全球央行政策将进一步分化,美联储结束QT并扩表将带来流动性拐点,但美元贬值压力或迫使欧洲央行在通胀与汇率间艰难平衡。

人工智能领域近期热潮在本周遭遇现实考验,市场对AI投资回报率的疑虑引发科技股普遍回调。甲骨文因云基础设施收入增速不及预期及上调资本支出指引至500亿美元,股价盘中一度暴跌16%,市值单日蒸发逾689亿美元(甚至有统计达1020亿美元),瑞银、摩根士丹利等投行纷纷下调其目标价。财报显示,其利润增长主要依赖非经常性收益,核心业务盈利能力承压。博通尽管第四季度营收与利润超预期,人工智能收入增长65%,但股价盘后仍下跌1.94%,显示市场情绪谨慎。同时,OpenAI发布其最先进模型GPT-5.2,并宣布与华特迪士尼达成10亿美元合作协议,直接导致谷歌股价下跌2.43%。国内方面,摩尔线程作为“国产GPU第一股”上市后股价一度飙涨超723%,市值突破4400亿元,股价在创下941.08元新高及723%的累计涨幅后,官方昨日晚间公司发布风险提示公告,称基本面未变,新产品尚处研发阶段,短期内对业绩影响有限。今日早盘股价一度跌超15%,短时回落至800元以下。

比特币目前在92,000美元至94,000美元区间内博弈,链上数据显示,大户向交易所的转账减少,卖压有所减轻,CryptoQuant指出若趋势持续,BTC有望反弹至99,000美元甚至112,000美元。Man of Bitcoin分析认为,BTC仍处于上升趋势线之上,若突破楔形上沿将看向96,962至102,432美元区域。然而,空头势力依然强劲,分析师Astronomer已在92,700美元处开仓做空,目标回看87,700美元;Killa则表示短期内比特币可能冲高到94,000美元甚至更高,但随后或出现回落。他计划在95,000至98,000美元区间加仓,并预计明年比特币可能跌至70,000美元甚至60,000美元。Ted也指出当前走势与上个周期惊人相似,若剧本重演,将在冲高10万美元后暴跌至7万下方。预测市场方面,交易员普遍认为年底前突破10万美元的概率仅为30%左右。而彭博分析师Mike McGlone则警告新“圣诞老人行情”可能不会出现,BTC年底可能低于84000美元。目前市场关注BTC能否守住90000-91000美元支撑区,若失守可能测试当前区间底部,若企稳则可能再次挑战94000美元阻力位。

以太坊方面,市场情绪在ETF资金回流与技术面压力之间摇摆。尽管现货ETF净流入回升至215亿美元,但价格仍受制于关键阻力位。Ali指出,ETH下方存在两道坚实的筹码支撑墙,分别为积累了280万枚代币的3,150美元一线,以及积累了360万枚代币的2,800美元一线;Glassnode数据则将关键支撑定在2,770美元。对于未来走势,Delphi Digital分析师that1618guy持乐观态度,认为ETH已守住日线交叉并完成回踩,若比特币能突破94,000美元,以太坊有望跟涨至3,600-3,800美元区间。不过,Man of Bitcoin提醒投资者注意风险,他观察到价格正在形成小型看跌三角形,不排除再次下探3,150美元的可能性,若跌破趋势线将是明确的预警信号。

此外,Do Kwon的审判终于落幕,纽约南区联邦检察官宣布,Terraform Labs创始人Do Kwon因证券欺诈与电汇欺诈等罪名被正式判处15年监禁。这一消息的落地,直接导致LUNA、LUNC及USTC等相关代币在24小时内暴跌近30%。

2. 关键数据(截至12月12日13:00 HKT)

(数据来源:GMGN、CoinAnk、Upbit、Coingecko、SoSoValue、CoinMarketCap)

比特币:92551美元(年初至今-1.12%),日现货交易量465亿美元

以太坊:3253美元(年初至今-2.5%),日现货交易量为240.1亿美元

恐贪指数:29(恐惧)

平均GAS:BTC:1.2 sat/vB、ETH:0.04 Gwei

市场占有率:BTC 58.46%,ETH 12.2%

Upbit 24 小时交易量排行:XRP、ETH、BTC、SOL、BARD

24小时BTC多空比:49.95% / 50.05%

板块涨跌: Layer2板块上涨3.6%,DeFi板块上涨3.2%

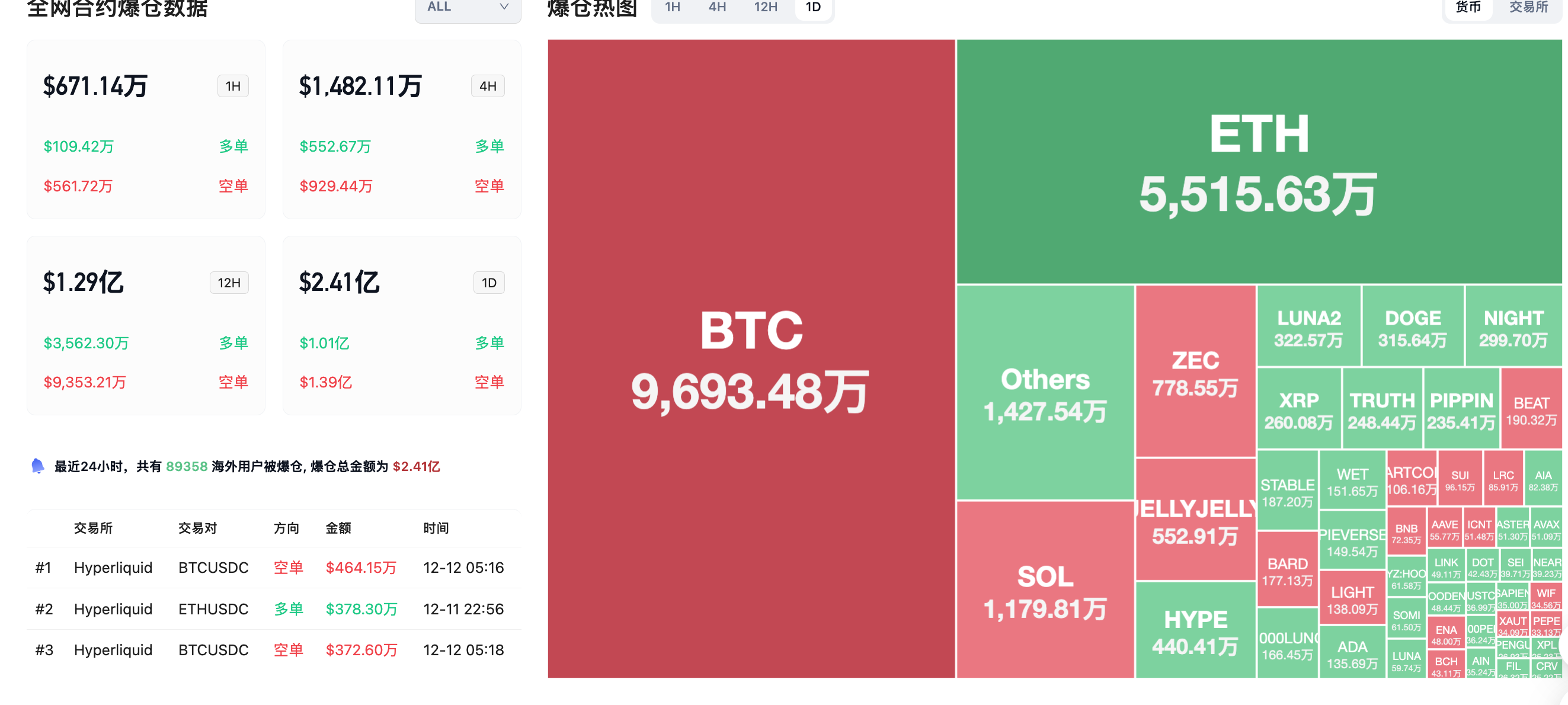

24小时爆仓数据:全球共89358人被爆仓 ,爆仓总金额为2.41亿美元,其BTC爆仓9693万美元、ETH爆仓5515万美元、SOL爆仓1179万美元

3.ETF流向(截至12月11日)

比特币ETF:-7734.19 万美元

以太坊ETF:-4237.34 万美元

Solana ETF :+1102 万美元

4. 今日前瞻

Aptos(APT)将于12月12日零点解锁约1131万枚代币,与流通量的比值为0.83%,价值约1930万美元;

Cheelee(CHEEL)将于12月13日上午8点解锁约2081万枚代币,与流通量的比值为2.86%,价值约1080万美元;

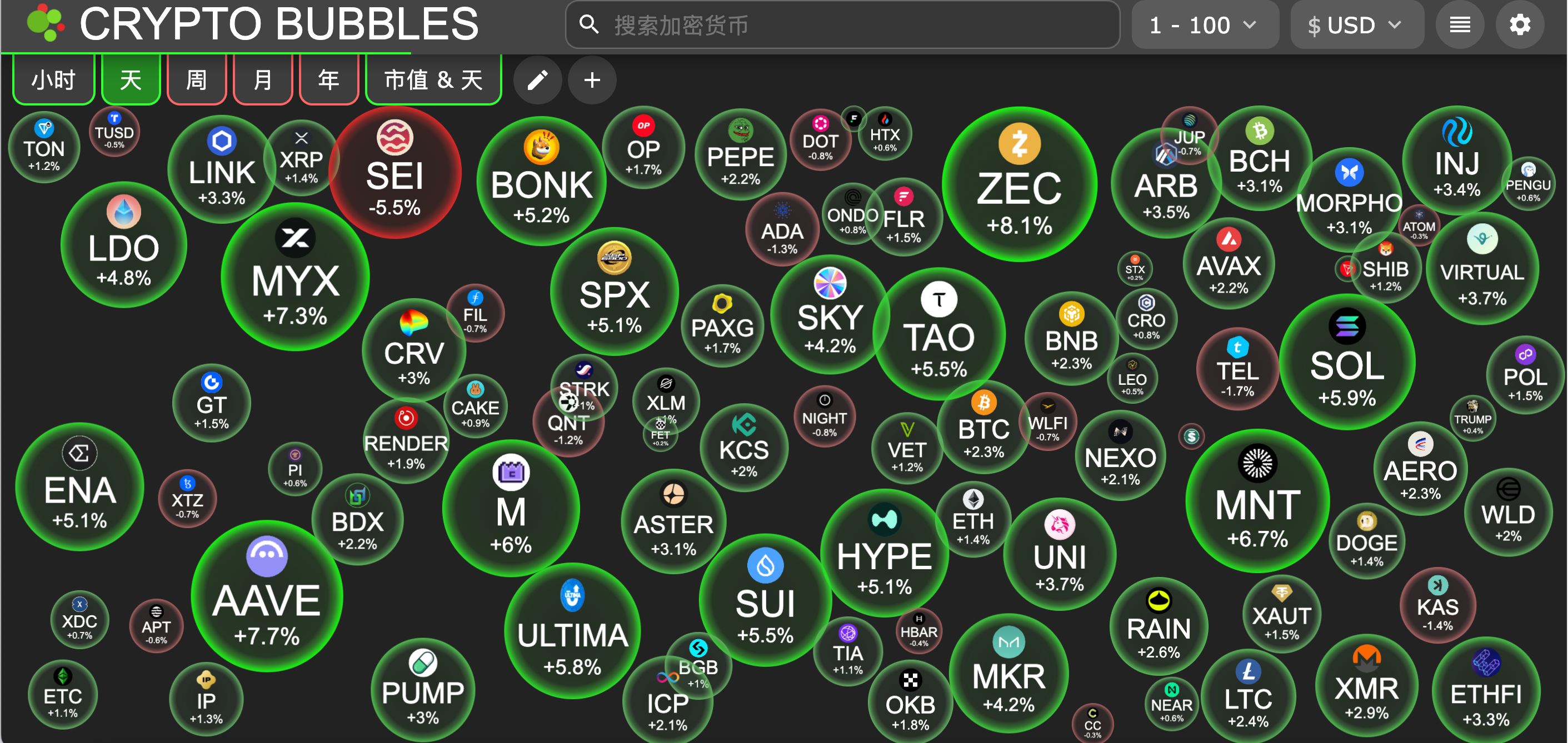

今日市值前100币种最大涨幅:Zcash涨8.1%、Aave涨7.7%、MYX Finance涨7.3%、Mantle涨6.7%、MemeCore涨6%。

5. 热点新闻

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。