Author: Nancy, PANews

After multiple market expectations fell short, Uniswap has finally welcomed a significant positive development regarding the fee switch.

On November 11, Uniswap Labs and the Uniswap Foundation jointly announced the initiation of a governance proposal called the "UNIfication Proposal," which plans to officially enable the protocol fee switch and launch a UNI burn mechanism. The news sparked a strong reaction from the community, and the price of UNI rose in response.

Proposal to Activate Fee Switch and Token Burn Mechanism, Approval May Take 22 Days

For a long time, the value capture ability of Uniswap's token has been criticized by the community. Although Uniswap has processed approximately $40 trillion in transaction volume to date, compared to protocols like Aave, Hyperliquid, Jupiter, Curve, and Raydium that have already activated their fee switches, Uniswap's related proposals have been repeatedly put forward over the past few years but have not been implemented due to regulatory risks, opposition from major holders like a16z, and failed votes. This has resulted in limited means for UNI's value appreciation, primarily relying on governance decisions, leading to relatively lackluster price performance.

As the regulatory environment in the U.S. becomes clearer, the DeFi industry is reaching a compliance turning point. In August of this year, the Uniswap Foundation proposed adopting the DUNA DAO framework, which was interpreted as paving the way for activating the protocol fee switch. As expected, on November 11, the UNIfication governance proposal was officially put forward, aiming to activate the protocol fee switch and unify the incentive mechanisms across the entire Uniswap ecosystem, thereby making the Uniswap protocol the default DEX for tokenized value. Unlike previous proposals, this one was initiated directly by the Uniswap team.

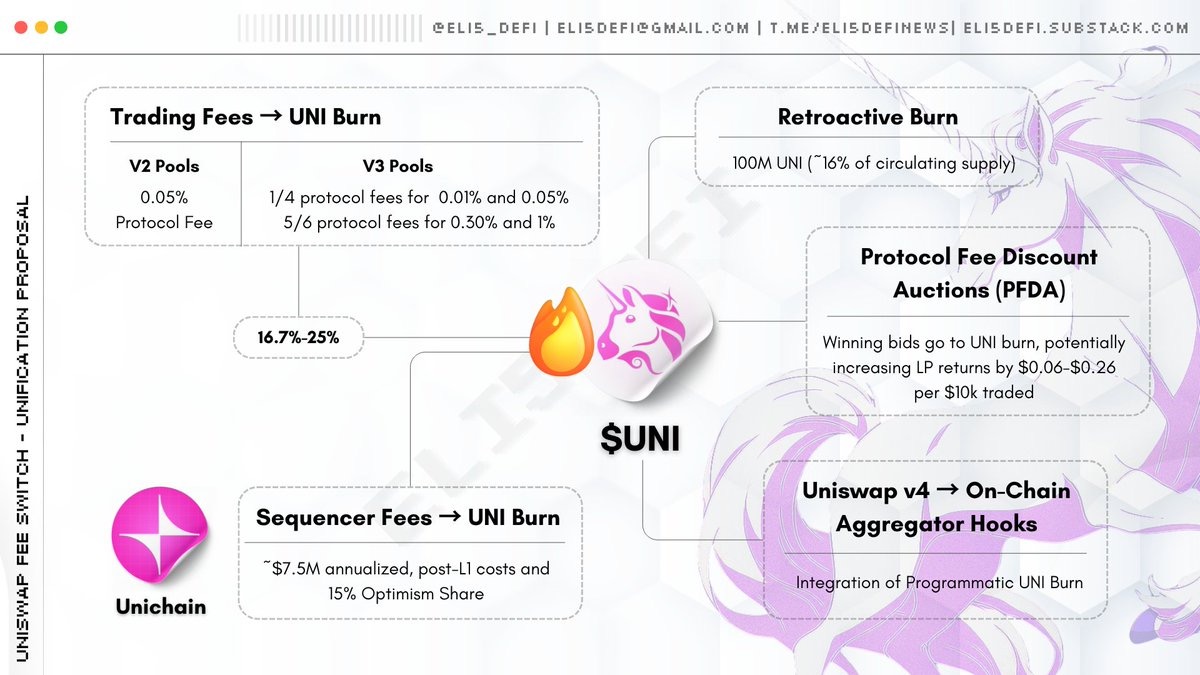

The proposal plans to enhance UNI's value capture ability through a multi-faceted approach. According to the plan, UNI governance will vote to decide on enabling the fee switch, with a portion of transaction fees entering an automated UNI burn mechanism. The fees will be activated in phases, with v2 and v3 pools implemented first, followed by expansion to L2, other L1s, v4, and UniswapX. Additionally, Uniswap will integrate Unichain sorter fees, which have generated approximately $7.5 million in annual fees since its launch nine months ago, with the proposal planning to inject all these fees into the UNI burn mechanism. Furthermore, 100 million UNI tokens in the foundation's treasury will also be directly burned to further enhance token value.

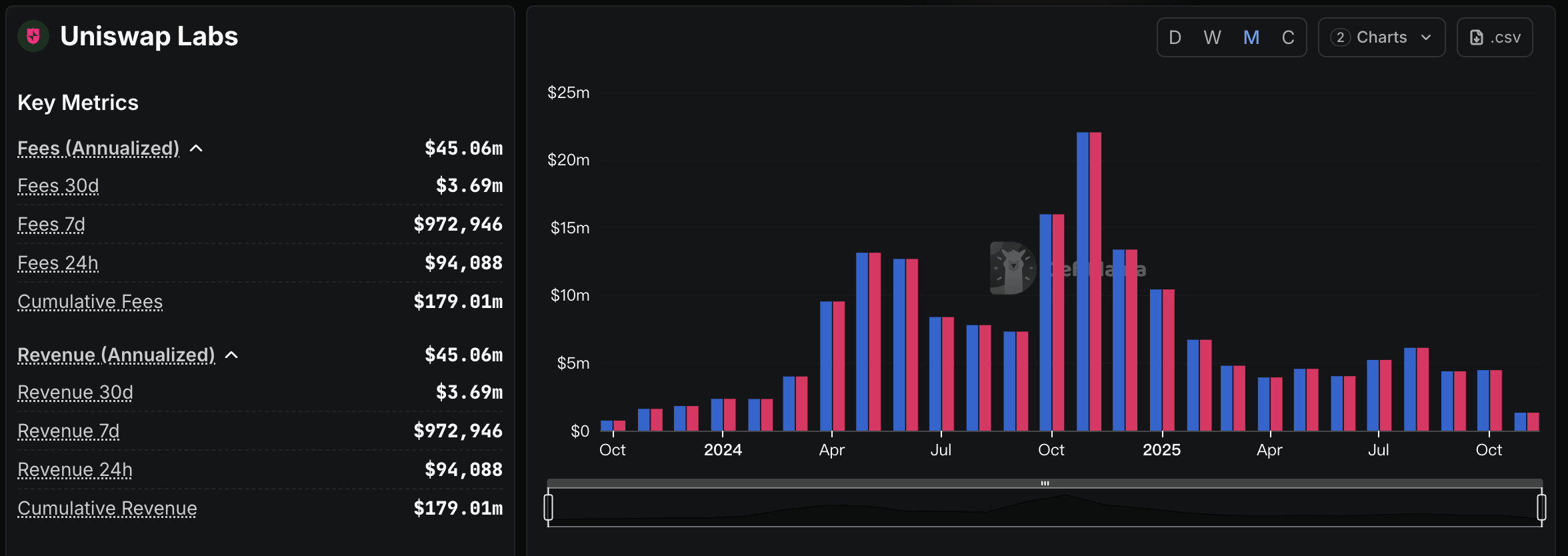

To expand revenue sources, the proposal introduces an innovative auction mechanism called PFDA, which will auction off rights to exempt from protocol fees, converting MEV income and protocol fees into UNI burns and additional LP earnings, thereby optimizing liquidity provider returns while enhancing the protocol's long-term value. Uniswap v4 will upgrade to an on-chain aggregator through Aggregator Hooks, integrating liquidity from other protocols and executing token burn logic, further expanding the protocol's revenue scope. At the same time, the proposal explicitly prevents Uniswap Labs from obtaining fees through front-end interfaces, wallets, and APIs, as its cumulative earnings from the Ethereum front end have exceeded $179 million.

In terms of organizational structure and budget arrangements, once the UNIfication proposal is approved, Uniswap Labs will focus on protocol development and growth, while the foundation team will transition to Labs, taking on functions such as ecosystem support, governance maintenance, and developer relations. The foundation's board will expand to five members, including Hayden Adams, Callil Capuozzo, Devin Walsh, Hart Lambur, and Ken Ng. The proposal also suggests establishing an annual growth budget of 20 million UNI, to be released quarterly starting January 1, 2026, for protocol development and ecosystem building.

According to Uniswap founder Hayden Adams, the governance process is expected to take about 22 days, including a 7-day opinion solicitation period, a 5-day snapshot voting period, and a 10-day on-chain voting and execution phase, with the specific effective date possibly delayed slightly due to actual arrangements.

Reduced LP Earnings May Trigger Liquidity Outflow, Competitors Call It a "Strategic Mistake"

The UNIfication proposal marks a fundamental transformation of UNI from a pure governance token to a revenue-generating infrastructure.

According to analysis by BREAD, a member of MegaETH Labs, the proposal adjusts Uniswap's fee mechanism from the original 0.3% paid to LPs to 0.25% for LPs and 0.05% for UNI buybacks. With Uniswap's annual fee revenue estimated at around $2.8 billion, this could lead to approximately $38 million in UNI buybacks over 30 days. This amount would exceed PUMP's $35 million but fall short of HYPE's $95 million. CryptoQuant CEO Ki Young Ju pointed out that if the proposal is enacted, UNI's price could experience parabolic growth. Based on the $1 trillion transaction volume of Uniswap v2 and v3 from the beginning of the year to now, the annual burn value is expected to be around $500 million.

As market expectations for UNI's value growth increase, CoinGecko data shows that UNI rose by 38.9% in the past 24 hours, reaching a peak of $9.9.

However, the new proposal is also seen as likely to reduce liquidity provider (LP) earnings in the short term, potentially leading to liquidity outflow. Although the proposal introduces multiple compensation mechanisms and long-term optimization strategies to enhance overall LP returns, competitive pressure remains significant.

Crypto investment firm Arca analyst Topher noted, "What people don't see is that this is good for Aerodrome but bad for Uniswap… Some predict that Aero's announcement on Wednesday will extend to the entire EVM ecosystem, and if that's true, then Uniswap may be thrown off its rhythm, trying to steal the spotlight with this news (which could backfire). Aero's lead over Uniswap on the Base chain (with a trading volume ratio of about 2:1) is because LPs only care about how much return they can get for every dollar of liquidity invested. Aero does this better. If Uniswap activates the protocol fee switch, it means LPs' actual earnings may be lower, or the trading fees on Uniswap will increase, creating a dilemma."

Aerodrome co-founder Alexander publicly stated that Uniswap's activation of the fee switch is a huge mistake. "I never expected that on the eve of Dromos Labs' most important day, our biggest competitor would make such a significant blunder… This is a massive strategic error made at the worst possible time." Cap'n Jack Bearow, head of DeFi at Berachain, commented that Aerodrome may announce cross-chain expansion on Wednesday, while Uniswap's activation of the fee switch would reduce LP profitability, benefiting Aerodrome's competition.

Proposal Considered Beyond Expectations, Creating a Demonstrative Effect for DeFi Value Capture

However, after the release of the UNIfication proposal, the market generally believes it exceeds expectations, significantly boosting confidence and expectations for Uniswap and the entire DeFi sector.

DeFi researcher CM pointed out that the UNIfication proposal far exceeds market expectations, reinforcing token value capture through multiple measures, reflecting a strong commitment to empowering UNI. CM believes that the proposal is more likely to be executed through buyback and burn rather than a dividend model, and currently, compliance barriers have been cleared, making the chances of the proposal passing very high. However, he also cautioned that Uniswap's ecosystem budget is relatively high.

On the other hand, the market also sees this proposal as having demonstrative significance for the value capture of the entire DeFi ecosystem. According to crypto KOL @Michael_Liu93's analysis, the proposal not only retroactively burns 100 million UNI, accounting for about 10% of the total supply, compensating for previously unburned portions, but also allocates 1/6 of each transaction fee for buyback and burn. With approximately $230 million in fee revenue over the past 30 days, annualized to about $2.76 billion, this corresponds to a buyback and burn scale of about $460 million/year, with an annual deflation rate of less than 5% of the total token supply. Based on this estimate, UNI's current market value is about $9.5 billion, corresponding to a price-to-earnings ratio of 21 times and a price-to-sales ratio of 3.5 times, which is relatively undervalued among crypto assets. In contrast, Hyperliquid has a fully diluted valuation of $42.1 billion, with annual revenue of $1.29 billion and annual buybacks of $1.15 billion, resulting in a price-to-earnings ratio of 37 times and a price-to-sales ratio of 33 times; Pump's fully diluted valuation has an annual revenue of about $550 million to $730 million (100% buyback), with a price-to-earnings ratio of 6-8 times. These businesses might be valued at a 3-5 times premium in the U.S. stock market, while in the crypto market, they have become undervalued assets.

According to crypto analyst Haotian, the long-awaited UNIfication community proposal has finally changed its protagonist, and this time it is jointly initiated by Uniswap Labs and the Uniswap Foundation, no longer a vague game of "the wolf is coming," which recognizes UNI's goal of capturing value. Based on the current proposal content, it is conservatively estimated that there will be hundreds of millions of dollars in continuous buyback demand over the next year, providing ample room for sustainable growth in the future. Currently, all blue-chip DeFi projects are using real income to drive token buybacks to prove they are not just air, and Uniswap, as the leading DEX, has only now officially announced this, which is intriguing and may set a benchmark for the entire on-chain protocol that "protocol income must feed back into tokens." It also pressures those projects that still rely on so-called governance rights and community faith to hold the stage to prove themselves. Altcoins have finally embarked on the path of "self-proof," "self-support," and "self-expansion" of value.

Additionally, the UNIfication proposal is also believed to play a role in security and ecosystem health. According to data analyst jpn memelord, one major effect of Uniswap enabling the fee switch is that fraudulent liquidity pools (such as honeypots and automated rugs) could disappear overnight, as these pools rely on a protocol fee rate of zero. Rough estimates suggest that half of Uniswap's trading volume on Base may belong to such pools; official unfiltered data shows that Uniswap's trading volume on Base in 2025 is $208.07 billion, but after adding some filtering conditions, the non-fraudulent trading volume is only $77.38 billion.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。