DeFi 的风险不在于去中心化,而在于不够去中心化????聊聊最近处于风口浪尖的Morpho

我正在研究利用 Morpho 构建 Delta 中性和偏 Delta 中性策略。没想到稳定币脱锚和借贷兑付事件接连发生,将 Morpho 推向了舆论的风口浪尖。

金融工具的价值在于提高资本效率。

按这个标准,Morpho 是一个提升资本效率的优秀项目。Morpho v1 在 Aave 和 Compound 点对池借贷的基础上,匹配点对点借贷需求,将存借双方的利差降为零。

Morpho Blue 允许个人或机构,无许可地为主流或长尾资产创建借贷市场,可自定义抵押品、清算贷款价值比(LLTV)等参数。

这使得 Morpho 不再是单纯的借贷市场。用户可以利用 Morpho 自由创建 Delta 中性或偏中性的收益策略,或对冲自己的敞口风险。

这也是贝莱德等传统机构,推动 RWA 的原因——区块链在效率层面是对传统金融的极大补充。

极强的可组合性和可定制性,也为 Morpho 带来了外部风险。首先是道德风险,策略创建者 Curator 为了用高收益吸纳更多存款,调高清算贷款价值比 LLTV,变相增加杠杆,增加循环贷风险。

其次是抵押品风险,即借贷收益池底层抵押品带来的风险。合格抵押品的缺失,尤其是抵押品本身的风险和透明度问题,是当前制约 DeFi 发展的重要因素。

本文将探讨:

1)什么是 Morpho?通过 Morpho 可以实现什么?

2)Morpho 的风险。

3)经过 USDe、xUSD 等事件,我们还能相信 DeFi 吗?这些事件背后凸显的真正问题是什么?

什么是 Morpho?通过 Morpho 可以实现什么?

使用 Morpho 主要有两个选项:Earn(收益)和 Borrow(借款)。

在 Earn 页面:

1)Curator 是当前借贷收益池的创建者。

2)Collateral 是当前借贷产品收回的抵押品。抵押品风险决定了策略池的风险。

Morpho Blue 的核心特点是 Curator 可定制参数的灵活性。Curator 可以决定:

1)接受的存款类型,通常是 USDC 等流动性较好的稳定币。

2)可接受的抵押品,可以是 ETH、WBTC 等主流资产,也可以是长尾资产和 PT 代币。抵押品决定了该策略的风险。

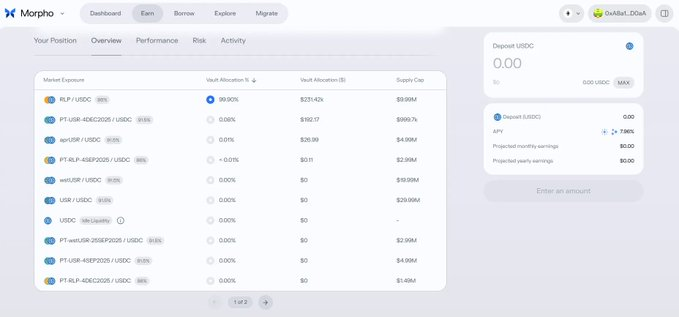

3)存款资金的分配策略,即分配到哪些资金池赚取收益。如下图。

4)预言机类型,可以是 Chainlink 或 TWAP 等。

5)LLTV(Liquidation Loan-to-Value,清算贷款价值比),即当借款价值达到抵押品价值的多少百分比时触发清算。数值越高越激进,越利于循环贷。

6)清算惩罚。

7)费用结构。如下图。

8)供应上限。

9)根据市场数据,动态启用或停用该策略。

等等。

基于这些自定义模块,其他项目方和机构可以实现不同策略:

1)利用 Pendle PT-Token 和 LST 的未来收益兑付特性,支持这两类代币作为抵押品,吸引 USDC、USDT 等稳定币存款。本质是以未来收益为抵押,换取当下流动性,构建一个债券市场。

2)调高 LLTV,支持稳定币或 PT-稳定币为抵押品,放大杠杆,吸引循环贷。

3)利用抵押借贷(尤其是循环贷)的杠杆做多属性,在 Hyperliquid 做空等值资产,完成 Delta 中性对冲,赚取合约资金费率。

4)建立新型稳定币与 USDT、USDC、DAI 等成熟稳定币之间的双边抵押借贷市场,结合 PT-Token 的远期收益属性,为新稳定币扩大流动性。

Morpho 的风险

1)道德风险

道德风险,也叫「公地悲剧」,是指收益策略创建者 Curator 为了获得更多管理费,刻意调高 LLTV,鼓励循环贷,并将资金分配到风险更高、APY 也更高的资金池中。

LLTV 越高,循环贷空间越大,杠杆也越高,风险随之增加。通常,Aave、Compound 等借贷协议的稳定币、ETH 等资产 LLTV 在 75%—83.5% 之间,而 Morpho 某些池子会超过 90%。

不过,Morpho 在 Earn 页面已标记了 LLTV 数值。在详情页面,也标注了资金分配和管理费收取情况。

2)抵押品风险

抵押品风险来自 Curator 创建的收益池所支持的抵押品。尤其是新稳定币项目,它们结合 PT-Token,用未来高收益吸收当前 USDC、USDT 流动性,往往接收这些新稳定币的 PT-Token 作为抵押品。当新稳定币底层机制出现问题——如 Delta 中性对冲策略或清算策略失效时,该收益池就会暴雷。

好在 Morpho 收益池之间风险是隔离的,不会影响整个协议的安全性。

3)资金利用率过高导致兑付问题

在「点对池」借贷模式中,常见一个现象:同样的 ETH 池子,存款 APY 可能只有 0.1%,但借款利率却达到 2.7%。

为了将资金利用率保持在 100% 以下,保证资金随存随取,存款人向资金池提供的资金远多于最终被使用的资金。因此大量资金闲置在池中,实际存款 APY 就低于借款 APY。

Morpho 池子一旦 LLTV 过高,对循环贷过于友好,有时会出现流动性不足的情况。在极端情况下,资金全部在使用中,存款用户无法提现。

经过 USDe、xUSD 等事件,我们还能相信 DeFi 吗?这些事件背后的真正问题是什么?

我始终认为,最近发生的 USDe、xUSD 事件,恰恰暴露的是中心化带来的问题。

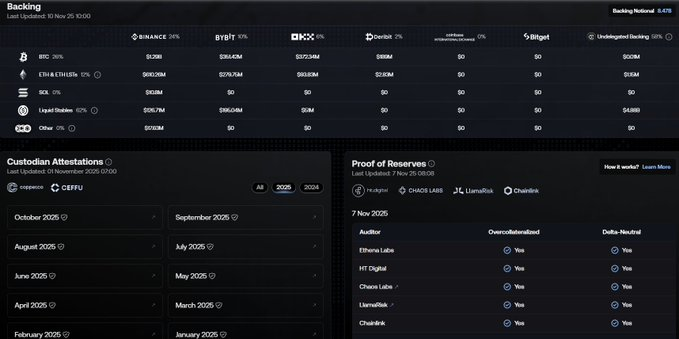

实际上,Ethena 在官网 https://app.ethena.fi/dashboards/transparency 页面详细披露了准备金和各交易所仓位占比。这些数据还得到了包括 Chainlink 在内的预言机储备金认证。

USDe 在币安脱锚,首先源于巨量卖盘。卖盘伴随提币限制,引发了脱锚恐慌。巨量卖盘的来源可能涉及利益关系,真相永远不会浮出水面。

但结果是,USDe 迅速回锚——因为在 Ethena 官网,USDe 兑付正常,储备金仍为 100%。

而 xUSD 脱锚是否因杠杆比例过大触发 ADL,也只能由坊间猜测,真相无从得知。

所以这些事件凸显的不是 DeFi 的脆弱性,恰恰是 CeFi 以及数据、规则不透明带来的脆弱性。

Morpho 最初是为了解决「点对池」借贷模式的资金利用率问题——该模式下,借款利率显著高于存款 APY。

比如,同样的 ETH 池子,存款 APY 可能只有 0.1%,但借款利率却达到 2.7%。

为了将资金利用率保持在 100% 以下,保证随存随取,存款人提供的资金远多于实际使用的资金。因此大量资金闲置在池中,实际存款 APY 就低于借款 APY。

另一方面,「点对点」匹配缺乏效率,需要借贷双方在还款时间和资金体量上达成一致。

Morpho 的设计非常巧妙——利用现有的「点对池」借贷协议 Compound 和 Aave,在此基础上创建「点对点」借贷市场,让借贷双方利差为零。

具体来说,用户向 Morpho 存款,Morpho 会转存到 Aave 或 Compound。若有借款请求,则优先匹配需求并优化利率。

假设 Alice 是第一个 Morpho 用户,她存入 1 ETH。如果没有其他人使用 Morpho,一年后 Alice 赚取 0.1% 年化,与直接存入 Compound 无异。

此时,假设 Bob 通过 Morpho 借入 1 ETH。这两个用户将被点对点匹配。一年内,Alice 将赚取 1.4% 的折中年化,Bob 需要支付的利息也变成 1.4%,而不是 Compound 原有的 2.7%。

所以使用 Morpho 存款和贷款,最差的结果是使用 Aave、Compound 当前利率,而一旦需求点对点匹配,就能获得优化利率。

2024 年之后,Morpho Blue 的推出使 Morpho 成为 DeFi 基础设施之一。最重要的是,在已经发币套现、且吸引了数十亿美元 TVL 的情况下,项目方仍在原有产品上重建改进,而不是另起项目,说明其志向不止于赚钱。

回到开头,如果说金融工具的价值在于提高资本效率,而机构推广 RWA 的原因是区块链能补充传统金融效率问题,那 Morpho 是一个值得关注的、契合当前叙事的优秀项目。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。