In the future, the gap between high-quality tokens and low-quality tokens may continue to widen.

Written by: Taiki Maeda

Translated by: Saoirse, Foresight News

Once upon a time, airdrops were the preferred method for Token Generation Events (TGE). Project teams distributed large amounts of free tokens to users, hoping to cultivate a group of loyal holders and promoters. For a while, this approach worked. The allure of "free tokens" created a viral hype cycle—Discord was bustling, posts on the X platform kept the momentum going, and users flocked to deposit total value locked (TVL) into untested smart contracts just to earn a little extra yield.

However, there is no such thing as a free lunch. The practice of airdrop farming became increasingly sophisticated, and "witch attackers" (users who falsified identities to claim multiple tokens) gained notoriety. Airdrops ultimately devolved into a "liquidity exit tool" during TGEs—arbitrageurs sold the tokens they received for free to investors who bought in on the first day. It was then that project teams realized they were not building a community but "feeding locusts" (a reference to arbitrageurs who only plunder benefits without participating in the community).

The New Trend of Public ICOs

Project teams no longer airdropped tokens to the public but found a new method. They discovered that by presenting a seemingly "generous" high valuation, they could raise more funds from retail investors and funds. What’s the new pitch? "We give you the opportunity to buy in early—almost for free!" The "dopamine rush" from this model is akin to airdrops, but with an added "paywall," packaged under the guise of "fair distribution."

Theoretically, this model makes sense. People tend to value things more highly when they pay for them, driven by psychological factors such as the "endowment effect" (a psychological concept where the valuation of an item increases once one owns it). Therefore, theoretically, users would not sell their tokens on the first day of the TGE. Additionally, this "generous ICO" allows project teams to raise more funds for their treasury instead of giving away tokens for free. In return, retail investors at least get to participate in a transaction with decent liquidity and a higher probability of profit.

Case Studies

PUMP raised about $600 million at a $4 billion valuation. Although the token price subsequently fell, it maintained a trading scale of about $4.4 billion, and presale participants indeed had the opportunity to sell their tokens for a 75% profit during the TGE.

XPL launched a liquidity mining initiative, allowing investors to enter at a fully diluted valuation (FDV) of $500 million, raising a total of $50 million. Somehow, when the cryptocurrency community fervently embraced the token, its FDV soared to $16 billion, yielding extremely high returns for investors. Even though the token price later dropped, presale participants still enjoyed about 6 times the return.

Future Outlook

Now, there are two highly anticipated ICO projects before the TGE: MegaETH and Monad. MegaETH is raising about $50 million at an FDV of $900 million to $999 million; Monad plans to raise nearly $200 million at an FDV of $2.5 billion. Notably, neither of these projects has launched their products yet.

While there are no absolutely risk-free trades, the market generally views these public sales as "good trades." This sentiment is also reflected in market reactions—MegaETH's fundraising subscription was oversubscribed by 27.8 times.

But here comes the question: where does the money come from? The answer is everyone who buys these tokens during the TGE (the logic of airdrops is the same). As long as people blindly chase these tokens during the TGE, it will be a profitable trade for most participants.

I expect this trend to continue, but I also want to remind everyone of a few points. In the future, more projects may conduct TGEs in this manner, but not all projects are good opportunities. As time goes on, the market will become increasingly efficient, and these arbitrage opportunities will not last forever. Public ICOs are by no means a "free money machine."

Since Coinbase acquired Echo/Sonar (project name), the future BASE token will likely be launched through an ICO rather than an airdrop.

Moreover, this new trend may create resistance in the entire altcoin market. The "marginal buyers" of these ICOs (referring to the last buyers who decide to purchase and influence market supply and demand balance) are mostly existing altcoin holders. As more funds flow into ICOs, the liquidity supporting high FDV "fantasy projects" (projects that only have concepts without actual products or implementation capabilities) will diminish. Many such projects have already faced setbacks as of October 10, and the future market's "player versus player" (PvP, referring to competition among investors) dynamics will only become more intense.

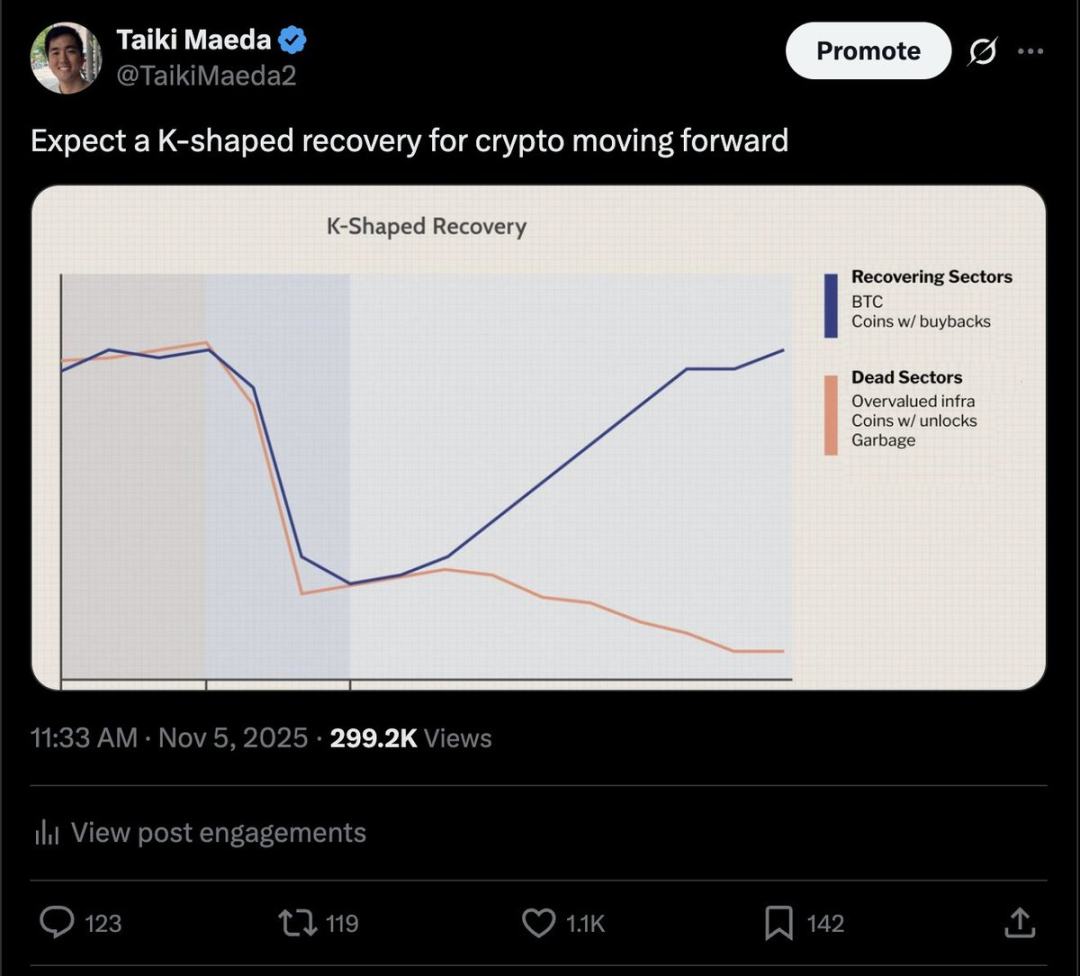

(Note: Taiki Maeda believes that the cryptocurrency market will exhibit a K-shaped recovery in the future, with Bitcoin and tokens with buybacks belonging to the recovery sector, while overvalued infrastructure, those under unlocking pressure, and junk projects will decline.)

In the future, the gap between high-quality tokens and low-quality tokens may continue to widen. Tokens with monetary premiums (referring to the value support inherent in the tokens themselves) and good cash flow will perform better, while tokens that rely solely on narratives or hype will perform poorly. Please manage your funds cautiously.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。