(Any opinions expressed here are solely those of the author and should not be taken as investment advice or interpreted as recommendations for investment trading.)

Want more? Follow the author on Instagram, LinkedIn, and X

Visit the Korean version here: Naver

Subscribe to see the latest events: Calendar

While free markets provide an ideal mechanism for adjudicating scarcity, granting the market uncontrolled freedom does not guarantee a linear progression toward economic prosperity. Society seeks to mitigate economic volatility through the regulation of markets and currencies—this is the primary role of government. Governments provide goods and services that are deemed best managed collectively or restrict markets to prevent exploitative and other unethical outcomes. In addition to these powers, governments also exert some control over the price and quantity of money. Sometimes this control is benevolent; in other cases, it is nearly authoritarian. Because governments legally monopolize coercion—including the use of force in extreme cases—they can enforce the use of specific currencies. This can yield both positive and negative outcomes.

According to any governing theory, all governments inevitably devalue their currency supply in pursuit of a post-scarcity future. True post-scarcity requires not clever fiscal strategies but a deeper mastery of the physical universe and its dimensions. However, politicians cannot wait decades or centuries for scientific breakthroughs. As a default response to an unstable and uncertain world, the instinct is to print more money.

Despite the immense power of governments, people always find ways to maintain their sovereignty. In many cultures that have experienced long-term inflation across regimes or dynasties, traditions have emerged around significant life milestones (birth, marriage, death) involving the exchange of hard assets. Through these cultural practices, individuals save outside of formal systems. No leader dares to disrupt such rituals without risking legitimacy and potential status.

In modern times, as central governments—whether democratic republics, socialist republics, or other forms—have become more powerful through advancements in information technology and the internet, how do individuals retain the right to obtain sound money? The gift that Satoshi Nakamoto bestowed upon humanity in the Bitcoin white paper is a technological marvel, arriving at a critical moment in history.

Bitcoin represents the best form of currency created at the current stage of human civilization. Like all currencies, it has relative value. Given the dominance of the dollar in the U.S. financial system, we value Bitcoin in dollars. Assuming this technology endures, the price of Bitcoin will fluctuate with the price and supply of the dollar.

This philosophical preface lays the groundwork for understanding the duration of Bitcoin/USD price cycles. To date, there have been three cycles, each reaching an all-time high (ATH) every four years. As we approach the fourth cycle's four-year anniversary, traders apply historical patterns to predict the end of this bull market. However, they often do so without grasping why past patterns were effective, thus missing why this pattern may be ineffective.

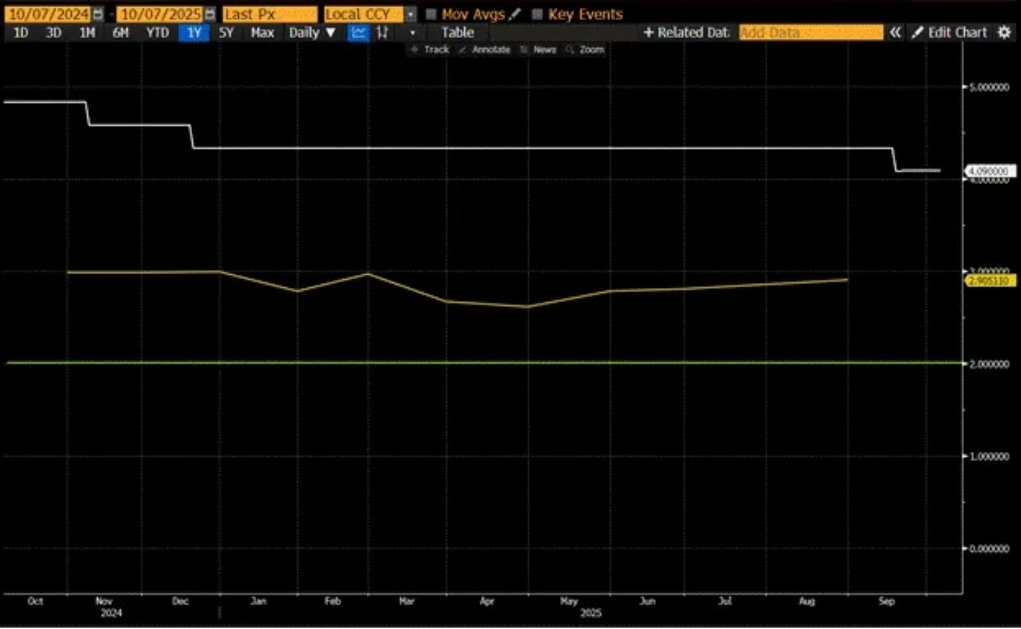

To illustrate why the four-year cycle is outdated, I will examine two simple charts. The primary theme is the price and quantity of currency, such as the dollar. Therefore, I analyze the effective federal funds rate and the dollar credit supply charts. The secondary theme is the price and quantity of the renminbi (RMB). For most of human history, China has been the wealthiest region on the map. After a half-millennium interruption from 1500 to 2000, it has re-emerged as a global economic powerhouse. The question is: do the currency trends at each Bitcoin ATH have clear inflection points to explain the peaks and subsequent crashes? For each four-year cycle, I will outline the current currency trends to place these charts in context.

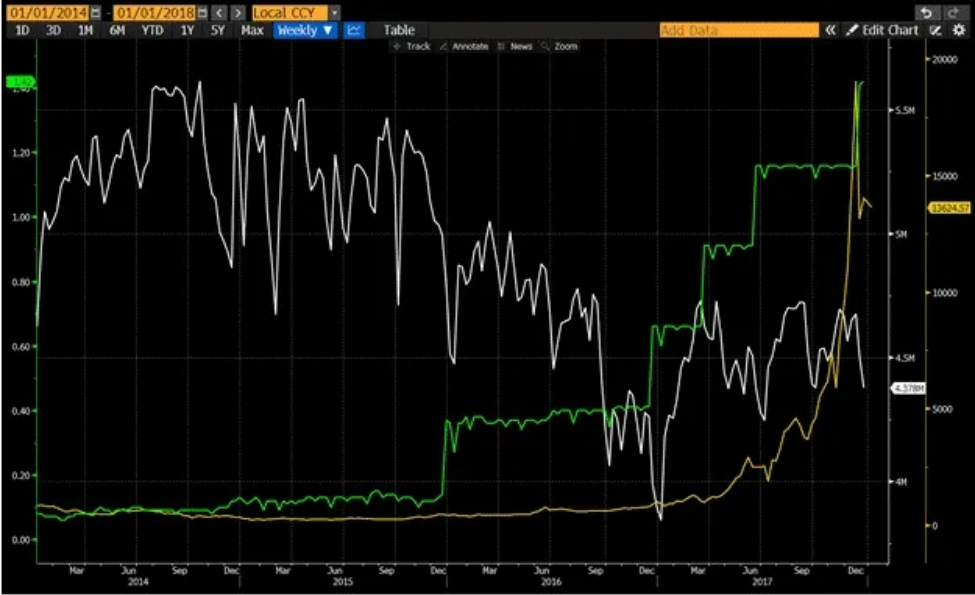

● Dollar chart white line: An indicator measuring the price and supply of dollar credit—the sum of Federal Reserve bank reserves and other deposits/liabilities in the U.S. banking system. The Federal Reserve publishes this data weekly.

● Green line: The effective federal funds rate set by the Federal Open Market Committee (FOMC).

● Gold line: Bitcoin/USD price.

Renminbi chart: China's economy is even more reliant on credit than the U.S., so I use Bloomberg Economics' China Credit Impulse Index (12-month percentage change). A similar pattern emerges if you check nominal GDP year-on-year growth.

Genesis Cycle: 2009–2013

The genesis block of Bitcoin was mined on January 3, 2009, during the global financial crisis (GFC) that swept through global institutions. This crisis nearly caused a global economic collapse, but Federal Reserve Chairman Ben Bernanke "saved" the system through the announcement of unlimited quantitative easing in December 2008, implemented in March 2009. China supported the global recovery by increasing infrastructure spending credit. By 2013, the Federal Reserve and the People's Bank of China (PBOC) wavered in maintaining unlimited monetary expansion. As shown in the chart below, this led to a slowdown in credit growth or a complete contraction of the money supply, ultimately ending Bitcoin's bull market.

Dollar chart:

The dollar price actually touched 0%. Supply surged dramatically, peaking at the end of 2013 before retreating.

Renminbi chart:

The significant increase in credit growth flooded the global market with renminbi, with trillions of dollars flowing into Bitcoin, gold, and global real estate. By 2013, although growth remained impressive, the rate of growth had fallen far below previous levels—consistent with the slowdown in dollar credit. The synchronized deceleration of U.S. and renminbi credit growth burst the Bitcoin bubble.

ICO Cycle: 2013–2017

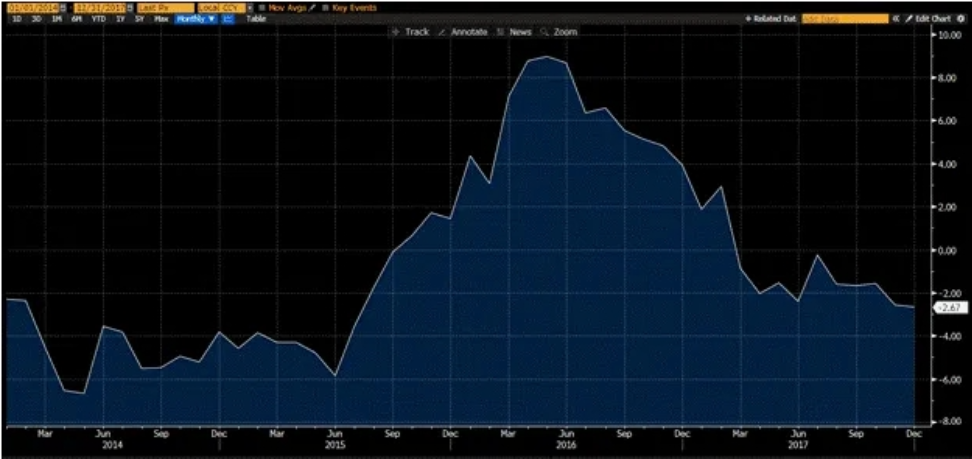

This era is known as the ICO cycle, as the launch of Ethereum's mainnet facilitated a boom in token issuance through public blockchains and smart contracts. Bitcoin reignited, not driven by the dollar but by the soaring renminbi. As shown in the chart below, the Chinese credit impulse accelerated in 2015, while the renminbi depreciated against the dollar. U.S. supply contracted, and interest rates rose. Bitcoin surged, driven by a spike in global market renminbi liquidity. Ultimately, the slowdown in renminbi credit growth from the 2015 peak, combined with U.S. tightening policies, crushed the bull market by the end of 2017.

Renminbi chart:

Dollar chart:

COVID Pandemic: 2017-2021

While COVID-19 caused millions of deaths, suboptimal global government policies exacerbated the crisis. It became an excuse for measures that restricted freedom, transcending any single political ideology. In a "throw everything at the wall" manner, the pandemic provided cover for unprecedented stimulus measures under President Donald Trump— the largest since Franklin D. Roosevelt's New Deal. Trillions of printed dollars flooded into the crypto market. Trump's policies ignited all assets.

Dollar chart:

Supply doubled, and the price of money plummeted to near 0%.

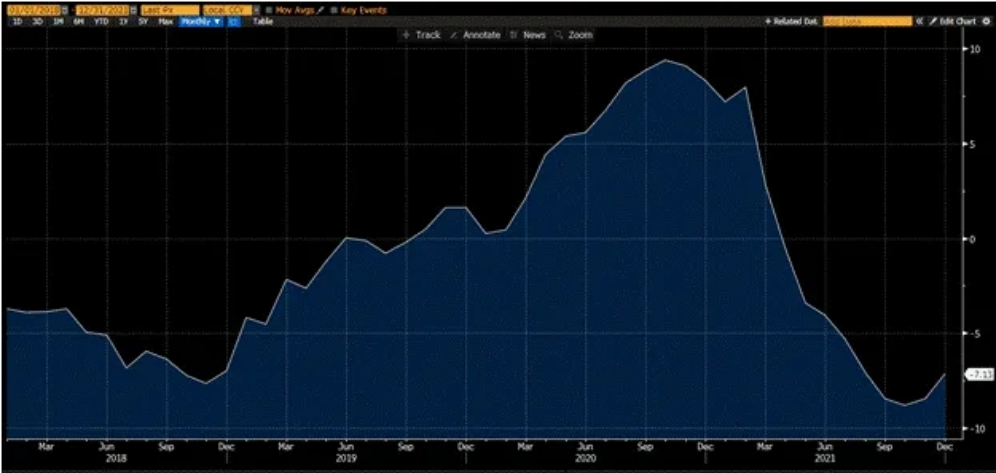

Renminbi chart:

China's credit impulse rose during the COVID pandemic, but under President Xi Jinping's leadership, it was not actively pursued. He used this time to address the real estate bubble. This level of renminbi credit growth did not prevent the local housing collapse triggered by the "three red lines" policy—but that was intentional. Through strict border controls, capital outflows and domestic turmoil were curtailed. Thus, China's monetary policy did not make a substantial contribution to this Bitcoin bull market. By the end of 2021, inflation resulting from the policies of Trump and subsequently President Biden became untenable. Those without significant financial assets felt the pressure. The federal government ceased stimulus measures, the Federal Reserve began tapering, and announced rapid interest rate hikes—marking the end of the bull market.

New World Order: 2021 to Present?

The unipolar dominance of the U.S. system is gradually fading, becoming a source of nostalgia. What will happen next? Global leaders are struggling to navigate this transition. Change will create economic winners and losers; when losers gain political or economic influence, it challenges the status quo. To protect the populace from disruption, policymakers print money.

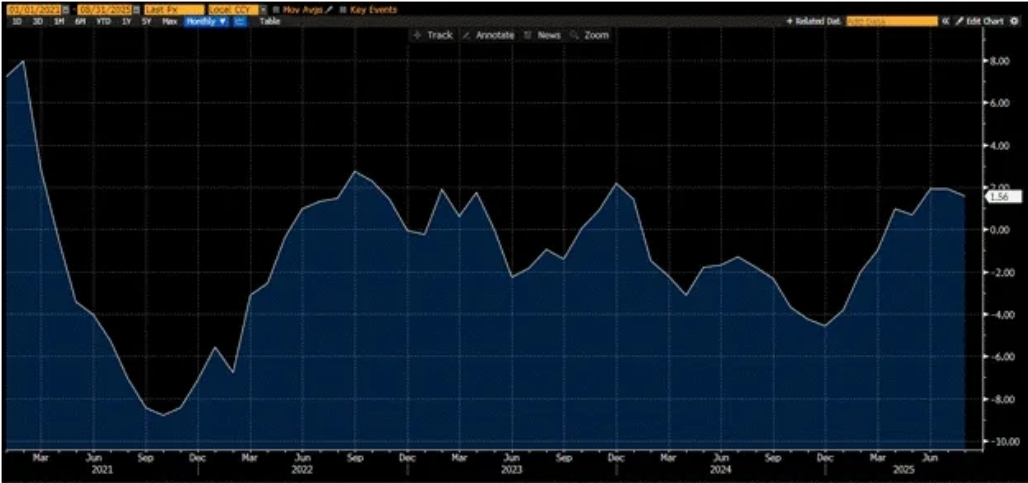

This time, credit growth stems from the Federal Reserve's reverse repurchase agreements (RRP, shown in magenta, with the y-axis inverted). The price of money rises, but supply decreases. However, to stimulate the market, Treasury Secretary Janet Yellen issued more bonds than notes/bonds, depleting the suggested retail price. This injected about $2.5 trillion in liquidity. Her successor, Scott Bessent, continued this practice until today, with RRP nearing zero. China has entered a deflationary phase, with negative credit impulse. President Xi remains focused on curbing the enormous role of housing in the economy. If the policy outlook for the U.S. and China shows no other signals or shifts, I agree with many cryptocurrency traders: the bull market is over. But recent statements and actions from the Federal Reserve and the People's Bank of China suggest otherwise.

Dollar chart:

Renminbi chart:

In the U.S., newly elected President Trump aims to drive growth to alleviate the debt burden. He criticizes the Federal Reserve's policies as too tight. His vision is taking shape: despite inflation exceeding the Federal Reserve's target, the Fed resumed rate cuts in September.

● White line: Effective federal funds rate.

● Yellow line: Core PCE inflation.

● Green horizontal line: The Federal Reserve's 2% target.

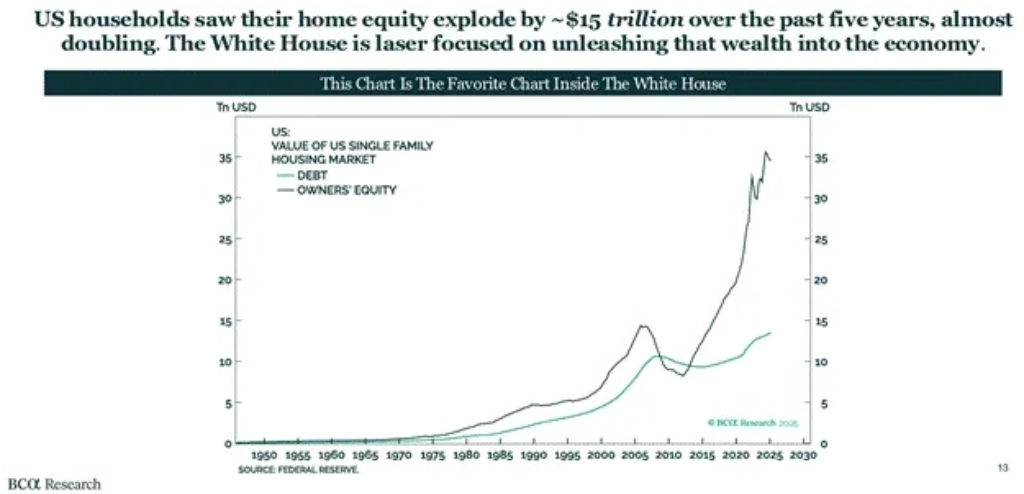

President Trump also seeks to lower housing costs, releasing trillions of dollars in trapped home equity from the price surge after 2008.

Finally, Scott Bessent plans to ease bank regulations and provide more loans to key industries. The future envisioned by the power elite is one of lower interest rates (rather than higher) and higher growth in the money supply (rather than lower).

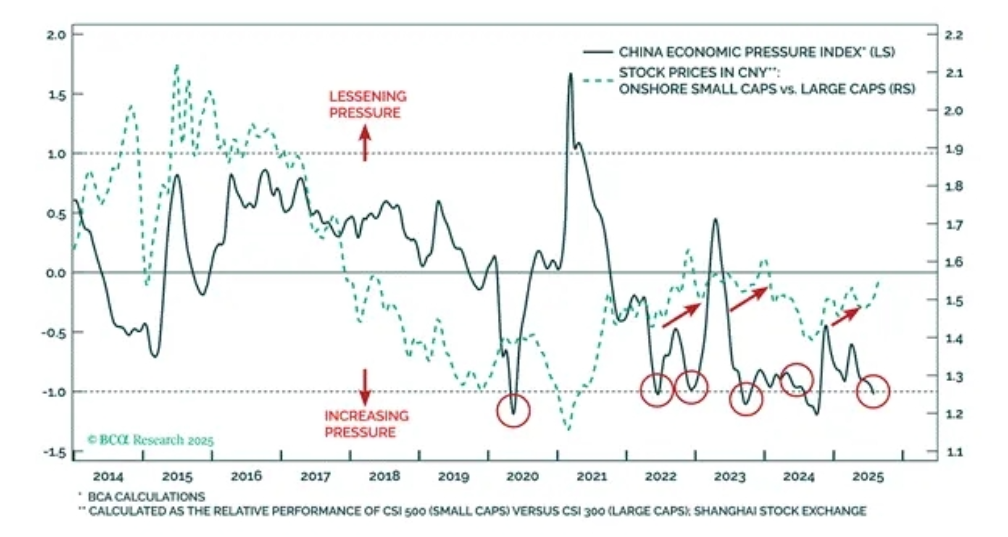

While Beijing authorities avoided aggressive credit issuance as seen in 2009 or 2015, they are attempting to end deflation. When pressure increases (as shown in the above chart), Chinese policymakers intervene through easing policies. I doubt China will now lead global fiat credit growth, but it will not hinder it either.

Listen to the monetary authorities in Washington and Beijing. They signal a future of cheaper and more abundant funding. Thus, Bitcoin rises in anticipation of this possible future. The old regime declines; long live the new regime!

Want to know more? Follow the author's Instagram, LinkedIn, and X

Visit the Korean version: Naver

Subscribe to see the latest events: Maelstrom Events · Events Calendar

[1] The Federal Reserve represents the United States Federal Reserve System.

[2] QE stands for Quantitative Easing.

[3] PBOC stands for the People's Bank of China.

[4] ICO stands for Initial Coin Offering. The most famous ICO was that of EOS, where Block.one raised $4 billion from global investors.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。