Written by: Tia, Techub News

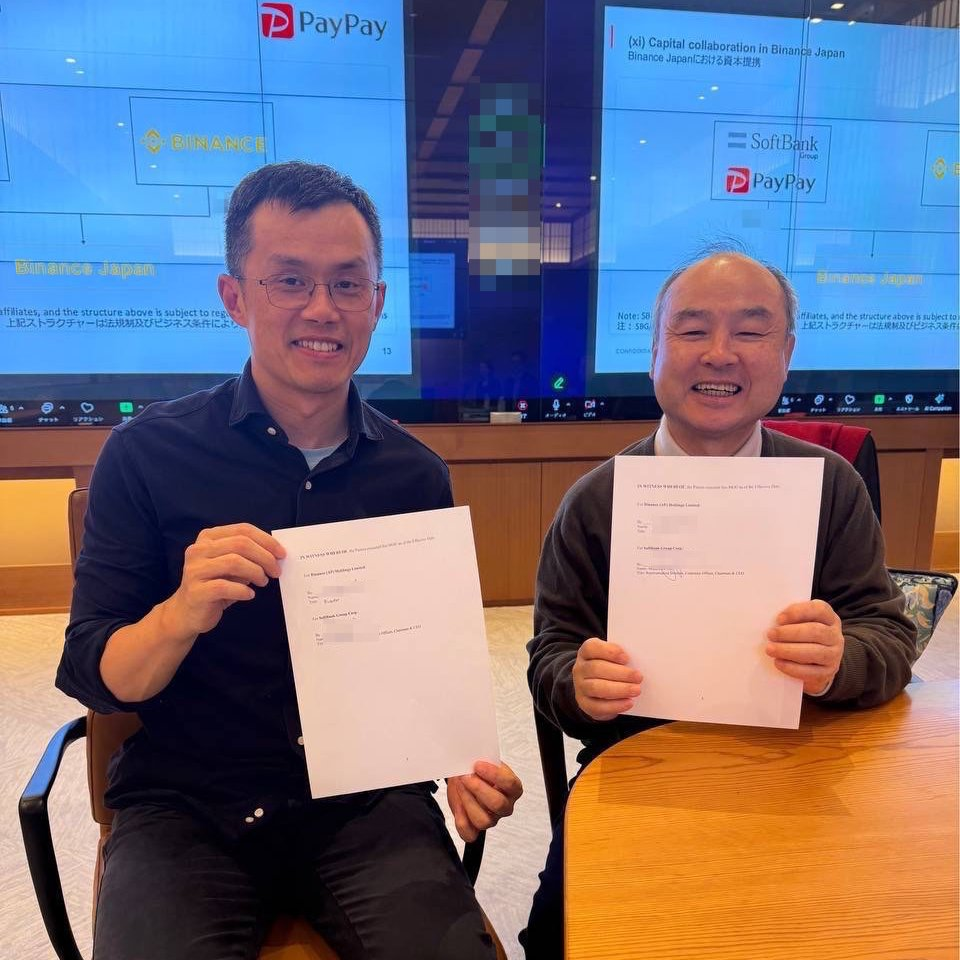

On the afternoon of October 9, Binance co-founder He Yi posted on the X platform, "The big one is here," along with the announcement of "PayPay forming a strategic alliance with Binance Japan." At the same time, Binance founder Zhao Changpeng also shared a photo with Masayoshi Son on social media, sparking widespread discussion in the industry.

This series of actions quickly made headlines in Japanese and international financial media. The market soon realized that this was not just a simple corporate partnership announcement, but a dual layout of capital and strategy.

According to the official announcement, Japan's national payment software PayPay has acquired a 40% stake in Binance Japan. As a star product under the SoftBank Group, PayPay has over 70 million registered users and is a cornerstone of Japan's cashless movement. Binance Japan, on the other hand, is the compliant subsidiary of the world's largest cryptocurrency exchange, Binance, in Japan. This transaction is not just a cross-holding at the capital level, but a strong signal: the crypto world is penetrating the core of the mainstream financial system.

A Handshake from Payment to Blockchain

According to the information disclosed by both parties, the cooperation between PayPay and Binance Japan will start from the most practical aspect: allowing users to directly purchase cryptocurrencies using PayPay Money and withdraw the proceeds back to their PayPay wallet for offline QR code payments, online shopping, or peer-to-peer transfers. In other words, the circulation of fiat currency and crypto assets will achieve a closed loop for the first time in Japan's public payment system.

This is a seemingly simple yet highly symbolic integration. For a long time, cryptocurrency trading and daily payments have been strictly separated. Even in Japan, which is friendly to regulation, users still need to repeatedly switch between banks, exchanges, and wallets, resulting in a cumbersome process and fragmented experience. The addition of PayPay means that blockchain assets are integrating into people's lives in a "daily" manner.

Masayoshi Yanase, Chief Financial Officer of PayPay, stated in a statement: "We hope to provide users with a digital financial experience that combines convenience and security through this cooperation." Chino Takeshi, General Manager of Binance Japan, responded: "With PayPay's user scale and trust foundation, we will push Web3 services to truly reach the masses." The core of this cooperation is not only complementary channels but also a collision of ideas—cryptocurrency is no longer just an investment product but a part of financial life.

SoftBank's Ambition: From Mobile Payments to Financial Hub

From a broader perspective, PayPay's move is not surprising. Since its establishment in 2018, PayPay has been a key engine for SoftBank's push for digital payment transformation in Japan. Over the past five years, PayPay has expanded from QR code payments to wealth management, loans, and insurance, gradually forming a financial ecosystem centered around the "wallet." Now, it is extending its reach to crypto assets—this is both a natural extension of financial technology development and an opportunity for SoftBank Group to restart its financial narrative.

Masayoshi Son has repeatedly expressed interest in crypto assets and blockchain technology. According to multiple sources, Binance founder CZ met with SoftBank executives last year to discuss potential cooperation. Now, PayPay's investment can be seen as SoftBank's formal step into the "digital asset era." In the past, Alipay and WeChat Pay shaped the embryonic form of the digital financial ecosystem in China; now, Japan is trying its own version—a financial infrastructure with a blockchain background created by SoftBank and Binance.

Binance's Grounding Logic: Balancing Regulation and Localization

For Binance, the strategic value of the Japanese market is evident. As the world's third-largest economy, Japan has a well-established financial regulatory system and a high level of digital adoption, but it also has very strict scrutiny of crypto assets. Since obtaining its official license last year, Binance Japan has been seeking deeper localization strategies—both compliant and aimed at expanding its user base.

Partnering with PayPay provides Binance with a breakthrough. PayPay's payment infrastructure and user trust offer Binance "local legitimacy," while Binance's blockchain technology and global liquidity open up new growth opportunities for PayPay.

This also resonates with Binance's global strategy in recent years. Faced with tightening regulations in various countries, Binance has gradually shifted from "going it alone" to "local collaboration." Whether in France, the UAE, or Thailand, Binance has been embedding itself into local financial systems through joint ventures, alliances, or licensing partnerships. The cooperation in Japan may be the most iconic case of this model.

The Significance of Success or Failure

The significance of this cooperation goes far beyond the Japanese market. If PayPay and Binance Japan can successfully launch integrated products, even if it just allows millions of users to purchase cryptocurrencies through a familiar payment gateway, it would be enough to change the global perception of the feasibility of crypto payments.

Conversely, if user interest is low or regulatory tightening hinders the project, it will indicate another fact: cryptocurrency is still a long way from "daily life," and the public still needs stable, simple, and predictable payment methods rather than assets filled with uncertainty.

Therefore, this is not just a business partnership but a gamble about the future form of finance. Masayoshi Son and CZ are betting—whether blockchain can be tamed by mainstream payments to become a visible and tangible part of life’s infrastructure; and Japan is testing whether the ideals of Web3 can take root in the real financial soil.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。