Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

U.S. Bitcoin Spot ETF Net Outflow of $897 Million

Last week, the U.S. Bitcoin spot ETFs experienced a net outflow over four days, totaling $897 million, with a total net asset value of $14.356 billion.

Seven ETFs were in a net outflow state last week, with the outflows primarily coming from FBTC, ARKB, and BITB, which saw outflows of $737 million, $123 million, and $92.4 million, respectively.

Data Source: Farside Investors

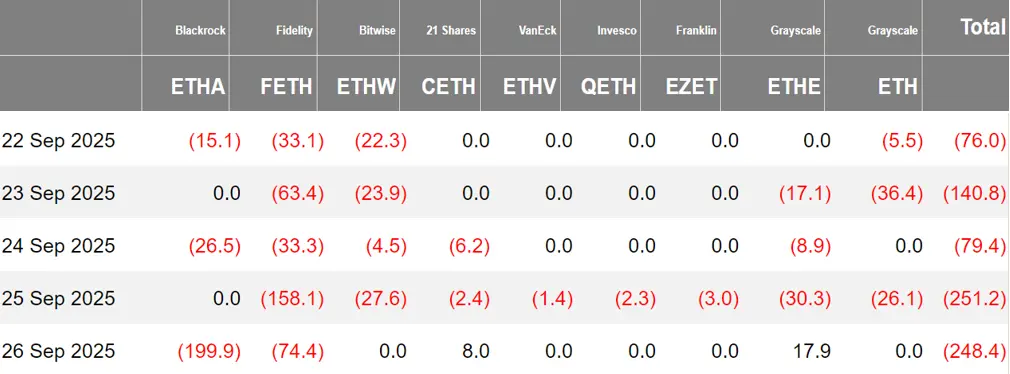

U.S. Ethereum Spot ETF Net Outflow of $795 Million

Last week, the U.S. Ethereum spot ETFs experienced a net outflow over five days, totaling $795 million, with a total net asset value of $2.601 billion.

The outflow last week primarily came from Fidelity's FETH, which had a net outflow of $362 million. Nine Ethereum spot ETFs were in a net outflow state.

Data Source: Farside Investors

No Fund Inflows for Hong Kong Bitcoin Spot ETFs

Last week, there were no fund inflows for Hong Kong Bitcoin spot ETFs, with a net asset value of $47.4 million. The holdings of the issuer, Harvest Bitcoin, decreased to 292.29 BTC, while Huaxia maintained 2,310 BTC.

There were no fund inflows for Hong Kong Ethereum spot ETFs, with a net asset value of $12.4 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of September 25, the nominal total trading volume of U.S. Bitcoin spot ETF options was $2.73 billion, with a nominal total trading long-short ratio of 4.68.

As of September 25, the nominal total open interest of U.S. Bitcoin spot ETF options reached $26.65 billion, with a nominal total open interest long-short ratio of 2.11.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 45.06%.

Data Source: SoSoValue

Overview of Crypto ETF Dynamics Last Week

Simplify Adds Options Strategy to Its Gold and Bitcoin ETFs

According to CNBC, asset management company Simplify has added an options strategy to its ETF products YGLD and MAXI, which provide exposure to gold and Bitcoin futures, in an effort to seek returns. Although these ETFs are still relatively small in scale, analysts believe that as gold prices reach new highs and Bitcoin adoption continues to grow, gold and Bitcoin are no longer traditional "safe-haven" assets but are transitioning into revenue-generating investment assets.

BlackRock Launches New Bitcoin Income ETF Using Covered Call Options Strategy

According to Bloomberg ETF analyst Eric Balchunas, BlackRock has applied to launch a new product called iShares Bitcoin Premium ETF, which is a fund that employs a covered call options strategy.

Unlike traditional spot ETFs that passively track Bitcoin prices, this product will earn premiums by selling covered call options while holding Bitcoin or related instruments, distributing these earnings as income to investors, thereby converting Bitcoin's volatility into investment returns. Balchunas noted that this move could impact competitors already developing income-based Bitcoin products.

BlackRock Registers Bitcoin Premium Income ETF in Delaware

Market news indicates that BlackRock has registered the "iShares Bitcoin Premium Income ETF" in Delaware, with the entity type being a statutory trust, and the registered agent being BlackRock Advisors, LLC, established on September 25, 2025. This ETF aims to provide investors with Bitcoin-related premium income.

Hashdex Nasdaq Crypto Index U.S. ETF Adds Support for XRP, SOL, and XLM

Hashdex announced on X platform that its Hashdex Nasdaq Crypto Index U.S. ETF (NCIQ) has been expanded to include support for XRP, SOL, and XLM, allowing this product to provide U.S. investors with exposure to five crypto assets: BTC, ETH, XRP, SOL, and XLM through a single investment tool.

Bitwise Submits Hyperliquid ETF Application to U.S. SEC

Bloomberg analyst James Seyffart announced on X platform that Bitwise has submitted a Hyperliquid ETF (exchange-traded fund) application to the U.S. SEC.

REX Shares' Ethereum Spot + Staking ETF "ESK" Begins Trading

The REX-Osprey™ Ethereum + Staking ETF ESK has begun trading.

This ETF provides investors with exposure to Ethereum spot and combines real on-chain staking rewards, seeking to provide monthly distributions.

U.S. SEC Approves Hashdex Nasdaq Crypto Index U.S. ETF Under New General Listing Standards

Nate Geraci, president of investment advisory firm NovaDius Wealth Management, announced on X platform that the Hashdex Nasdaq Crypto Index U.S. ETF has been approved by the U.S. SEC under the new general listing standards. The fund will now be able to hold crypto assets beyond Bitcoin and Ethereum, potentially including XRP, SOL, and XLM.

GSR Submits Application to U.S. SEC for Digital Asset Treasury Company ETF and Multiple Crypto Funds

Crypto market maker GSR has submitted an application to the U.S. SEC to launch a digital asset treasury company ETF, with at least 80% of its assets allocated to publicly traded companies holding cryptocurrencies, initially planning to include 10 to 15 stocks, including Strategy, Bitmine, SharpLink, and SUI Group. Additionally, GSR has applied for four funds related to Ethereum staking, crypto staking, core three assets (BTC, ETH, SOL), and Ethereum income.

Previously, the SEC relaxed the listing standards for commodity trust funds, making the approval environment for crypto ETFs more favorable.

GSR Submits New Applications for DAT ETF and Crypto Strikemax ETF

Bloomberg ETF analyst Eric Balchunas announced on X platform that GSR has submitted new applications for the DAT ETF and Crypto Strikemax ETF, with consulting provided by Tuttle.

Amplify ETFs Submits SOL and XRP Options Income ETF Application to U.S. SEC

According to GlobeNewswire, exchange-traded fund solution provider Amplify ETFs has announced that it has submitted an application to the U.S. SEC for a Solana and XRP options income ETF, seeking to balance income and capital appreciation through investments in XRP, SOL price returns, and covered call options strategies.

U.S. SEC Approves Grayscale Ethereum ETF Under General Listing Framework

According to Crypto Briefing, the U.S. SEC has approved Grayscale's Ethereum Trust and Mini Trust for listing under the new general Rule 8.201-E of NYSE Arca.

This change allows the relevant ETFs to be listed and traded without separate SEC approval, aiming to simplify the process and enhance market competitiveness. Grayscale may accelerate the ETF conversion of other funds. Other issuers are also expected to advance the listing of ETF products like XRP and Solana through this framework.

21Shares Spot Dogecoin ETF Launches on DTCC, Code TDOG

According to Watcher.Guru, 21Shares' spot Dogecoin ETF has launched on the Depository Trust & Clearing Corporation (DTCC) in the U.S., with the stock code TDOG.

VanEck has submitted an updated version of its spot Solana ETF S-1 application

Canary has submitted an updated version of its spot Solana ETF S-1 application

Views and Analysis on Crypto ETFs

The ETF Store President Nate Geraci posted on the X platform, stating, "Today, another wave of S-1 amendments for SOL spot ETFs has been submitted, involving institutions such as Franklin, Fidelity, CoinShares, Bitwise, Grayscale, VanEck, and Canary. The documents include staking (yes, this is a good sign for Ethereum spot ETF staking), and it is speculated that these products will be approved within the next two weeks."

Insider: Vanguard Exploring Cryptocurrency ETF Services for U.S. Brokerage Clients

According to Crypto In America, Vanguard, the world's second-largest asset management company, is preparing to allow clients to invest in cryptocurrency ETFs on its brokerage platform. Anonymous sources revealed that due to strong client demand for digital assets and the evolving regulatory environment, Vanguard has begun preparations and engaged in external discussions; currently, Vanguard does not plan to launch its own products like BlackRock but is considering allowing brokerage clients to invest in certain third-party cryptocurrency ETFs. However, it is unclear when a decision will be made or which products will be offered.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。