详细的美国财政债务回购 2025年9月24日:TIPS、规则和市场影响

今天,2025年9月24日星期三,进行了7.5亿美元的美国财政债务回购。此举旨在改善政府债券市场的流动性。此次回购针对的是较老的通货膨胀保护证券(TIPS),显示出在联邦债务增加和市场波动的交易环境中,持续稳定局势的努力。

其目的是改善市场操作,促进国债的顺利交易。美国财政部启动了一项回购 TIPS,金额为7.5亿美元,这表明了控制流动性和增强投资者对价值36万亿美元的美国债务市场信心的举措。

来源:美国政府官方发布

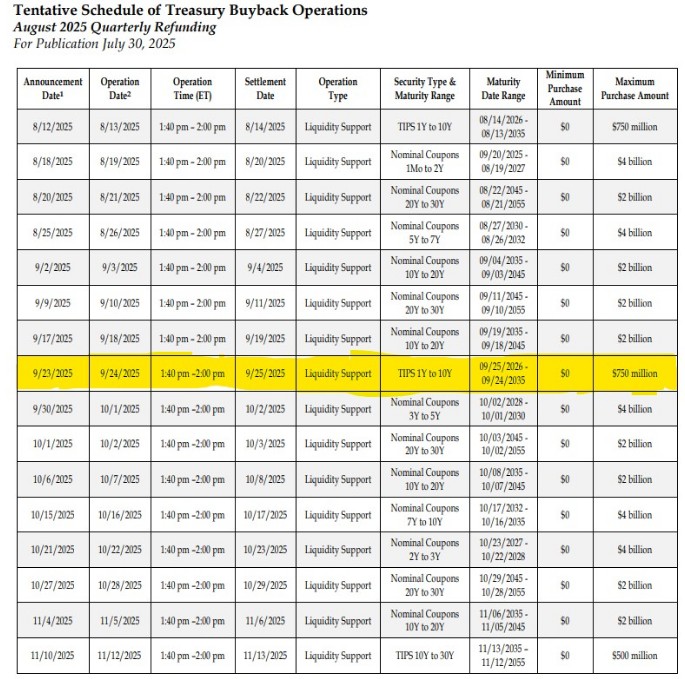

TIPS回购的详细信息

- 合格证券和到期日。

此次回购针对的是到期日介于2026年10月15日和2035年7月15日之间的TIPS。这些是非在跑证券,即较老的证券,通常记录较低的交易量和增加的买卖价差。财政部希望再次购买这些债券,以缓解流动性紧张并提高市场效率。

- 最大面值和报价规则。

最大金额设定为7.5亿美元,操作中要求最低贡献为100万美元。多个报价的形式为100万美元,每个参与者每种证券最多允许九个报价。价格以每100美元面值表示,保留三位小数,确保透明和标准化的提交。

- 操作时间和结算

回购于2025年9月24日进行,时间为东部时间下午1:40开始,下午2:00结束,为参与者提供了20分钟的窗口期。被赎回债券的赎回日期为次日,即2025年9月25日,财政部将向购买的证券参与者支付款项。

来源:美国财政部官方时间表

历史背景和影响

债务回购并不是第一次经历。它们自2019年起作为常规操作引入,通过减少买卖价差和波动性,尤其是在流动性较差的证券中,帮助调节债券市场的效率。

2023年国际货币基金组织的一项研究发现,回购可以将价差降低5%–10%,改善定价一致性。

此次回购也发生在美联储大幅加息的时代,这使得长期国债的波动性加大。

分析师观察到,此次干预可以稳定市场,这将为投资者带来缓解,因为收益率较高。

对其他市场的更广泛影响。

加密货币是受到回购影响的更广泛金融行业的一部分。由于感知到的流动性变化,像$TWEET这样的代币购买出现了投机性热潮。经验表明,2020年类似的回购伴随着比特币价格几乎上涨了15%,这表明传统和比特币类似的数字资产是相互关联的。

结论

该操作是政府融资需求与投资者信任之间战略平衡的措施,有助于稳定美国的债券市场。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。