撰文:simple_peanut

编译:Felix, PANews

鉴于集换式卡牌游戏(TCG)RWA 领域热度不断攀升,加密领域的非收藏者和非加密原生的收藏者在其未曾涉足且可能不熟悉的领域存在知识空白,因此决定在上周末写下这篇文章。此文的目的有三:

-

向加密玩家介绍宝可梦 TCG 收藏爱好及其市场

-

帮助那些只了解其中一个领域的人士理解,并指出宝可梦 RWA 协议需要填补或无需填补的空白

-

分享对这一细分领域的看法

个人是加密货币爱好者,并且在这个行业工作。个人对待加密行业就像收集宝可梦卡牌并与爱好者们互动一样——善于交际,喜欢结交朋友,也喜欢和朋友们一起出去玩,但同时也很注重个人隐私。

个人从小就开始收集宝可梦卡牌(高中 / 大学期间暂停过,后面又重新开始收集)。

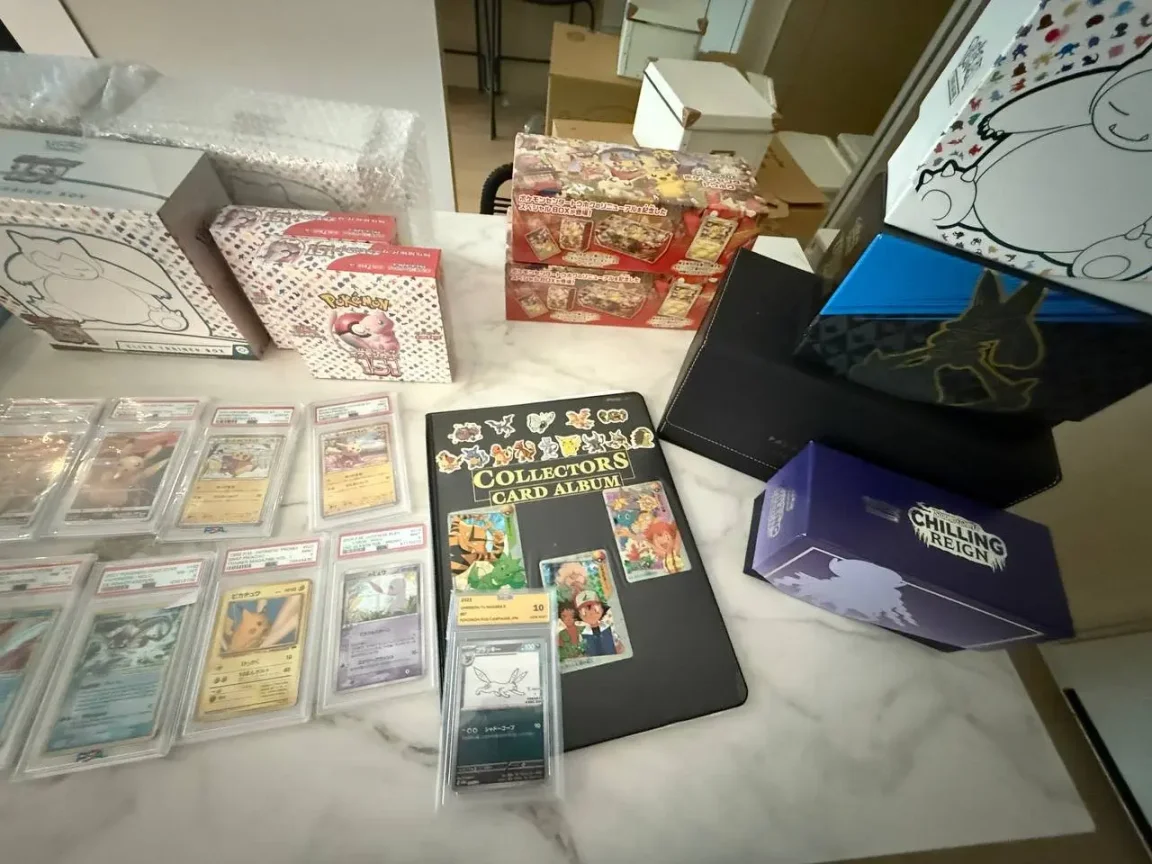

在加密圈子里,没多少朋友知道个人有这个爱好,但鉴于现在这股热潮,现在说说也挺合适的——从下面的照片中,可以看出来是个认真的收藏者。个人还有未拆封的卡牌和产品。你们可以说在蹭热度,最近才买了一堆这些东西来显摆。但事实是,这些卡牌和产品(照片里的和仓库里的)的起源,是建立在童年的纯真之上,再加上成年后的努力和坚持(大学期间暂停过,因为那时宝可梦不「酷」)。

对于富有的加密货币玩家来说,这可能不算什么,但对个人来说,花了很多时间 / 精力,经过深思熟虑,凭借直觉和运气(不是专业地,而是作为宝可梦收藏者),才把个人的收藏发展到如今这个规模。

童年时期(从卡包中抽取)和成年时期(在之前的周期购买)的卡片。这里大多数密封的产品来自当前周期。其他来自之前周期的卡片则存放在仓库中。

童年活页夹

鉴于阅读此文的大多数(如果有的话)来自加密货币领域,不会详述有关 $CARDS FDV、宝可梦 TCG RWA 协议数据的内容,因为此类讨论已经有很多了;此外,本文会尽力从宝可梦收藏者 / 投资者的角度提供更多见解。

宝可梦 TCG 收藏 / 投资市场周期

简而言之:

-

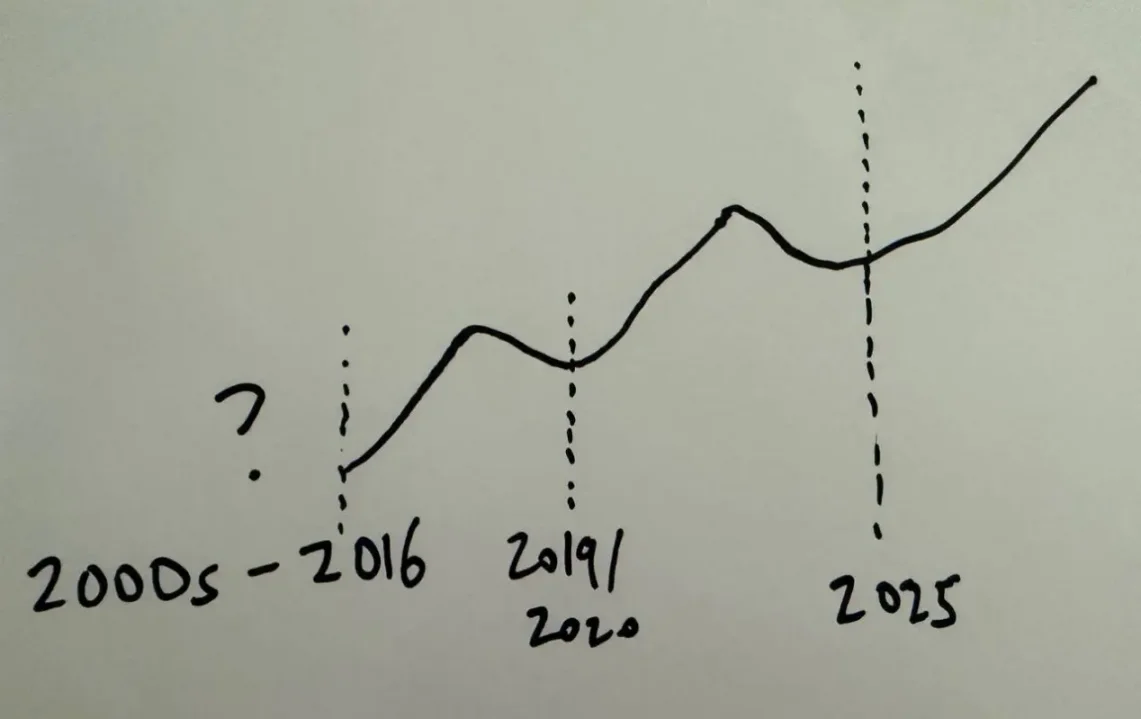

宝可梦 TCG 市场有繁荣与萧条的周期,这与宏观经济和 / 或加密市场非常相似。

-

尽管存在繁荣与萧条的周期,但宝可梦卡牌和密封产品的价格多年来一直像阶梯一样稳步上升。

-

话虽如此,就像股票或代币一样,每张卡牌和每件密封产品并非都以「二元的方式波动」——即价格上涨未必盈利。

在此,还要说明一下,在 2000 年代,个人处于童年到青少年时期,那时没有任何金融知识,也不了解周期。直到大学时期和成年后,才在宝可梦 TCG 领域理解并经历了周期。

下面粗略绘制了一张关于个人所经历过的宝可梦集换式卡牌游戏周期,以及每个繁荣周期的催化剂的详细描述。

2016 年繁荣周期的催化剂:

大学快毕业的时候,重拾这个爱好(2016/17 年),当时正值宝可梦 TCG XY Evolutions 系列发售。

这个爱好之所以开始流行,是因为 XY Evolutions 系列的卡牌是原版基础系列的翻版,虽然略有不同,但差异明显。这让许多小时候玩过基础系列的年轻人充满了怀旧之情,从而在 2016 年开启了宝可梦的热潮。

有趣的是:2016 年也是马里奥和路易吉皮卡丘促销卡发布的年份——当时每盒售价 30 到 40 美元。如今马里奥皮卡丘全画版的价格在 1 万到 1.4 万美元之间。

2020 年繁荣周期的催化剂:

1.《Pokemon GO》(手游)推出后风靡全球。

2. 新冠疫情:

-

人们感到无聊

-

政府发放补贴

3. 新冠疫情冲击后,宏观经济 / 风险偏好上升。

4. 洛根·保罗和其他名人的影响——高价值卡牌被视为身份象征:

-

洛根(网红)炫耀其 BGS 10 第一版基础款卡牌集齐喷火龙和 PSA 10 限量版皮卡丘

-

洛根在直播中公开首版基础款补充包

-

史蒂夫·青木(日裔的美国 DJ、音乐制作人)公开他的收藏兴趣并开设青木卡牌屋

5. 许多普通民众也纷纷效仿——购买密封产品并在直播中打开,并以高价向观众出售卡包。

2025 年繁荣周期的催化剂:

1.整体利好的宏观环境利于风险资产 / 牛市。

2. 宝可梦 TCG 登陆中国市场:

-

宝可梦卡牌中文版正式在中国发售

-

中国玩家(富豪)纷纷购买高价值卡牌,因为对他们来说,这些卡牌价值不高

3. 宝可梦口袋版 (Pokemon Pocket) 的推出——在移动端开启数字卡包,吸引人们在现实生活中体验这种感觉。

4. 卡牌展和卡牌商的兴起; YouTube 上卡牌商的观点越来越流行——人们喜欢看到交易达成。

5. 上述因素的连锁反应:(i) 加密原生用户和 RWA 协议用户纷纷购买整套和密封产品,用于投资和 / 或出售给用户;(ii) Kevin O『Leary 宣布最近也成为了一名卡牌收藏家(体育卡);(iii) 各主播再度购买密封产品,就像上轮周期一样,溢价出售给消费者并在直播中公开。

每轮宝可梦热潮的相似 / 常见的特征:

-

积极的宏观 / 风险偏好环境

-

宝可梦公司总是能巧妙地引入一个可能引发怀旧情绪的催化剂

-

就像加密领域一样,普通人(即非宝可梦卡牌收藏者)开始谈论它,向你询问,并在 Instagram 分享卡牌。

-

就像加密领域一样,新玩家进入市场。

-

宝可梦产品供应紧张;黄牛出现,在 Target / 沃尔玛等商店为争夺宝可梦卡牌产品大打出手(7 月份发生了一起刺伤事件),每个周期都会发生因排队而产生争执事件。

-

名人参与:Logan Paul 和 Steve Aoki 是 2020 年热潮的亮点,Kevin O』Leary 是 2025 热潮的亮点

-

主播涌现:大量购买密封产品(进一步推高了密封产品的价格),然后在直播中拆开并卖给观众以谋取利润。

2025 年这一轮的新变化(从财务和市场周期的角度来看,可能最终无关紧要):

-

商家和卡牌展的兴起 + 商家视角的视频——电视节目《当铺之星》式的体验

-

中国市场和中国的大买家

-

加密原生参与者和加密货币巨鲸

加密货币与宝可梦 TCG 收藏 / 投资的共同点

-

两者都是「赌博」的形式:无论是以负责任和精心策划的方式,还是以 Degen 的方式(例如拆包、开盲盒、交易 NFT/ 模因币等),这两个领域都在大脑的赌博心理 / 人类思维的盲从本能和囤积本能之间引发心理反应。

-

两者都有繁荣和萧条的周期:人们对它们的态度 / 看法可能反复无常、见风使舵——繁荣时追捧,萧条时则对其嗤之以鼻。(就像去年嘲笑以太坊,今年又以持有以太坊为荣一样)

-

两者都是波动较大的资产类别:两者的表现都远超传统资产类别(例如标准普尔指数)。

细微差别:加密原生用户和纯粹的宝可梦收藏家 / 投资者需要了解的内容

此处将更多地强调「加密货币爱好者需要了解的内容」,因为阅读这篇文章的大多数人是加密人士,而非纯粹的宝可梦收藏者 / 投资者。

-

购买宝可梦 RWA 协议的代币或模因币可能看起来很愚蠢,尽管如此,还是有赚钱的机会。就像印有宝可梦图案的纸牌一样,看似不起眼,却也能带来收益。

-

通过区块链技术,TCG RWA 协议有可能为收藏者提供独特的东西。只是在当前的状态下,还没有看到其最大的潜力。

-

值得称赞的是,将卡牌作为贷款抵押品,对加密玩家和收藏者来说都是巨大的价值提升——这是 TCG RWA 协议相对于现有传统解决方案在该领域的优势。

-

就像宝可梦卡牌和密封产品一样,在加密领域,代币的上涨也并非能让所有「船只都乘风破浪」(带来收益)。

加密爱好者需要了解的内容(如果你不在乎,可以忽略)

1.就像加密货币一样,收集宝可梦需要经验、技巧、知识、感觉和运气。

2.声称宝可梦 RWA 协议可以解决流动性碎片化问题的想法很愚蠢,原因如下:

-

以股票市场为例,有很多传统场所,比如 Saxo、IBKR 等。在代币化股票之外,还有一个更广阔的世界和更大的市场。同样,在 TCG 二级市场,大部分交易量都在 eBay、TCGplayer、通过 Telegram OTC(面对面交易)、世界各地的众多卡牌展以及类似于 Facebook 市场的地方进行。

-

此外,就目前 RWA 协议上的代币化股票而言,流动性很弱。而且,越来越多的 RWA 协议以自己的包装提供代币化股票,只会进一步加剧股票市场的碎片化。

3. 对于加密原生的非收藏者来说,TCG RWA 协议正在做些新颖 / 革命性的事情可能是真的,但对于收藏者而言,这大多只是个神话:

-

像 eBay 这样的市场和像 PSA 这样的卡认证机构已经拥有保管箱托管服务——将您的卡片寄到保管箱,他们甚至会验证卡(即评级卡)是否合法。您可以选择将卡片留在那里以便轻松交易,或者选择赎回并让实体卡片寄回给您。将 TCG RWA 协议的提议与现有的传统解决方案放在一起比较,在其当前状态下,它们并没有太大的护城河。

-

资产(如股票或国债等)的代币化之所以非常可行,一个巨大的原因是区块链技术能够提供 t+0 结算——(i)这比传统支付解决方案的 t+1/t+2 结算时间有所改进,(ii)将交易时间从周一至周五扩展到全年无休的 24/7,(iii)股票或国债的买家并不想要实体资产握在手中。相比之下,热情的收藏者 / 投资者往往希望实际拥有卡片——从情感上讲,他们喜欢拥有实体卡片,从实际操作上讲,他们喜欢时不时地把它拿出来欣赏实物卡片。

-

然而,当卡牌被用作贷款抵押品时,卡牌的代币化是可行的——这对消费者来说是一个巨大的价值提升,对于非加密原生的 TCG RWA 协议来说,这可以被视为具有变革性的。

-

话虽如此,也有一些投资者纯粹是为了收益而参与,而非出于对宝可梦或艺术的喜爱——也许这些非加密原生的收藏家可以从 TCG RWA 协议中受益。不过,这样的解决方案已经存在,只是没有区块链记账技术。

-

传统平台上已经有类似赌博的活动——比如 Whatnot。不过,想补充的是,TCG RWA 协议中的 Gacha 元素做得比传统平台上的 Gacha 至少不差,甚至更好。

4. 就像加密领域当前周期中的代币一样,在宝可梦卡牌领域,水涨船高并不一定能让所有船只都受益。

5. 就像代币一样,有蓝筹股,有中端代币,还有低价 / 模因币,它们有小概率暴涨,但很可能永远不会暴涨,只会维持在几美分 / 美元。

6. 与那些平庸的模因币或 NFT 不同,优质的宝可梦卡牌和密封产品不会归零——这在宝可梦 TCG 的历史上一直如此(约 30 年)。

7. 收藏者与宝可梦卡牌中的艺术和宝可梦之间存在着一种主观且个人的情感(有时甚至是感伤的)联系。这种无形的因素至关重要,是卡牌与代币、股票或模因币之间的一个关键区别因素。

8. 今天可以卖掉 1 个比特币或 100 亿枚模因币,如果明天价格飙升,随时都能在各种交易所轻松买回来。然而,举个极端的例子,如果我今天卖掉一张全球仅存 41 张的皮卡丘插画师卡牌,可能要等上几个月甚至几年才有机会再买回来。(这里就引出了关于可替代性与不可替代性、供应量、交易场所等等的讨论。)

好吧,那又怎样?

关于 TCG RWA 协议是否是必要的解决方案

如果读了上面所写的内容,会发现就目前而言,TCG RWA 协议并没有真正创造出什么革命性的东西。除了贷款方面,它就像模因币和 NFT 一样,为加密原生的非收藏者和加密原生的 TCG 收藏者提供了另一个赌博和交易的渠道。然而,这样的解决方案已经存在,因此从收藏者的角度来看,不认为 TCG RWA 协议填补了现有传统解决方案所没有的空白。

话虽如此,但个人仍然认为 TCG RWA 协议能够(一)尝试与现有的传统解决方案竞争,(二)如果能充分运用区块链技术,还能填补某些空白。而且希望这种情况能够发生,因为这只会让这个爱好和加密领域共同发展。

关于市场周期以及如何处理收藏

鉴于市场周期,现在知道宝可梦 TCG 市场存在繁荣和萧条的周期,你可能会说,应该在某个时候获利了结或出售一部分收藏。

个人不会卖。从纯粹的财务角度来看,你可以叫我傻瓜,个人也同意。然而,再次强调,仅仅因为与加密货币不同,如果现在卖掉一些东西,可能就无法立即以想要的价格重新购入。稀有卡牌很难找到,而且拥有者也不愿意轻易出售他们的卡牌。

基于入场时间,个人愿意承受一定的损失,因为自身入场时间非常早。话虽如此,就像在交易中一样,入场和出场都很重要,个人在处理收藏中的卡片或产品时也会考虑这一点。你也应该如此,就像在交易中一样。

值得担心的是,那些在交易领域涉足的加密原生非收藏者,一旦宝可梦卡牌不再为他们带来丰厚收益,或者市场崩溃,就会抛售并放弃这个爱好——因为就像股票或加密货币一样,加密原生的非收藏者仅仅将这些收藏品视为金融资产,而非具有情感联系的东西。不过承认这是不可避免的,就像任何其他市场在牛市和熊市周期中的情况一样,个人对此并不介意。

当这个叙事随着更广泛的牛市结束或宝可梦卡牌牛市周期结束而结束时,这篇文章会逐渐被人遗忘,写这篇文章的时间可能纯属浪费。然而,相信这里的信息超越了宝可梦卡牌的牛市周期,所以如果你愿意,可以去看看。

宝可梦卡牌 RWA 协议可能对宝可梦卡牌市场产生的影响

也许很多交易加密版宝可梦卡牌的加密玩家其实对卡片本身并无感情,他们参与其中只是为了获利、赌博,或者两者兼而有之。

就像加密领域大多数被炒作的概念一样,热潮不会长久,因为大多数使用 TCG RWA 协议的用户都是加密用户。而且由于很多交易加密版宝可梦卡牌的玩家对卡牌本身并无感情,当这个概念不再流行时,卡牌就会被抛售,协议的代币也会随之被抛售——就像对待那些毫无价值的模因币和普通 NFT 一样。

被用户抛售的卡牌可能会被协议回购,但如果协议因收入减少而无法维持下去,这些卡牌也可能被协议自身抛售,或者创始人会带着他们手中的卡牌库存回归传统的宝可梦集换式卡牌市场。

这就是为什么宝可梦卡牌 RWA 的炒作 / 叙事可能会对宝可梦卡牌市场产生负面影响,从而损害那些非加密原生的宝可梦卡牌收藏者,而他们甚至都不知道原因。对于新入行的人来说,这可能是一个教训,或者他们可能会彻底放弃这个爱好。同样对于加密领域的新入行者来说,如果他们最初几次链上体验就是跟风买入 $CARDS,而 $CARDS 在入场后下跌,他们就会害怕参与加密领域。

话虽如此,对此的反驳观点可能是:从更宏观的角度来看,宝可梦卡牌的 RWA 领域太小,无法长期影响如此庞大的 TCG 市场。对此个人也表示认同。

无论如何,希望这篇文章对大家有所启发。如果不是,至少希望它能让你有所收获。

工具:卡牌 / 产品价格的定价和追踪机制

交易时如何评估卡牌价值 / 通常如何追踪价格

以下是宝可梦卡牌收藏者 / 投资者在实际操作中如何协商价格,以及您可以使用的工具——不同的人有不同的理念 / 方法,可能会根据自己的计情况而改变:

1.查看过去 X 笔在 eBay 上完成的交易,取平均值:这是在实际交易中尝试达成协议时最常用的方法。

2. 聚合器:价格图表(https://www.pricecharting.com/)——在实际交易中可能会用到,也可能不会用到,作为交易时评估卡牌价值的参考。不过,与上述工具相比,它的使用频率要低得多。个人认为这是一种粗略查看未评级卡牌(即未评级的卡)或评级卡牌(即评级卡)价格的便捷方式。

3. 其他聚合器 - Collectr(移动应用程序):与上述情况相同。适合记录您的卡和密封产品、买入和卖出价格,并对您的投资组合有一个总体的估算视图。还有其他类似的替代方案。

4. TCGPlayer(tcgplayer.com)——与上述情况相同。不过,这里的报价大多反映的是未经评级的原始卡牌或产品的价格,其品相从轻度使用过到近乎全新不等。

TCG 市场定价存在的缺陷 / 额外因素

TCG 市场的定价与加密货币市场不同,加密货币市场有从主要的 CEX 和 DEX 获取价格参考的预言机——它较为集中。然而,TCG 市场的定价较为分散。

多年来,人们建立了聚合器,汇总来自 eBay 等主要市场的已售商品。但需要注意的是:

-

许多「场外交易」(OTC)在卡牌展、Facebook 市场、Telegram/WhatsApp 群组等非正式市场中进行,且未被追踪。因此,定价在一定程度上仍然分散且效率低下。

-

有许多人在线上交易和场外 / 线下交易之间进行套利——卡牌展上的商家就是大规模进行此类操作的,其主要收入来源类似于做市商或流动性提供者,他们赚取价差,主要依靠交易量和波动性维持。

-

尽管这些聚合商在定价方面有所改进,但仍有一些操纵者会在拍卖中抬高价格,以操纵这些聚合商的定价,只为「抬高自己的货价」。

以下是这个爱好领域中一些典型的参与者 / 玩家:

1. 黄牛 / 倒卖者:投机取巧。在繁荣周期中,许多人涌入这个爱好领域,同样也会像来时一样轻易离开。可以说他们是其中最不感兴趣、最缺乏热情的一群。有些人甚至对宝可梦本身知之甚少,只是为了谋取经济利益而来。

2. 收藏者 / 投资者:

-

收藏者 / 投资者可以按照自己的方式玩自己的游戏——很多这类人能够以明智且具备金融素养的方式对待这一爱好,既怀有真正的热情,又不忘投资视角。

-

其他人可能只是收藏和购买毫无价值、不会增值的东西,纯粹是因为自己喜欢——而这种喜欢本身也是无价的。

-

就像交易员一样,有些人可能在短时间内频繁交易,而另一些人则采取缓慢而稳健或定期定额投资(DCA)的方式。有些人可能只是不断买入,从不卖出,纯粹出于热爱。

3. 供应商:他们出现在卡牌展上,对卡牌的热爱程度各不相同。大多数都很热情。可以把他们看作是加密领域的市场制造者 / 流动性提供者。

4. 分销商:如果你认识任何分销商,这些人都是元老级人物,而且很可能是公司。他们与宝可梦公司有直接联系,能以低价大量进货。这些人向宝可梦中心和一些卡牌店供应密封产品。要成为分销商,主要是基于多年建立的关系,无论市场状况如何,都要持续购买宝可梦发行的 TCG 产品。

5. 经销商的经销商:与上述情况类似,只是没有长期经营。可能是 B2B(例如向卡牌店供货)或 B2C(例如向收藏者 / 投资者销售)。

希望以上信息对您有所帮助。作为一名资深收藏家,衷心希望您在宝可梦热潮结束后仍能保持这个爱好。就像加密货币周期一样,热潮的结束会促进退出,但仍会有新的进入者。如果您纯粹是为了赚钱而参与其中,那祝您好运。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。