作者:Nancy,PANews

一纸监管消息,让近来沸腾的币股热潮骤然降温。近日,纳斯达克传出将加强对持有加密货币上市公司的审查,DAT(加密财库公司)股价随即承压,不少溢价率mNAV在情绪反转中跌入“水下”,曾高速运转的财库飞轮或随之放缓。

纳斯达克欲出手,美股DAT股价与溢价率承压

9月4日,据The Information援引知情人士透露,纳斯达克正在加强对上市公司的审查,重点是那些通过筹资购买和囤积加密货币来推高股价的企业。

作为绝大多数加密股票交易的交易所,纳斯达克认为此类行为可能误导投资者,因此决定加大监管力度。具体措施尚未公开,但预计将要求相关公司披露投资规模、策略及潜在风险,并对频繁进行加密资产交易的公司进行特别审查。若公司不遵守规定,交易所可能采取暂停交易或退市等措施。

实际上,在DAT中,美股上市公司占据着主导地位。据咨询公司Architect Partners数据,自今年1月以来,美国至少有154家上市公司参与购买加密货币。同时,据Bitcointreasuries追踪比特币财务上市公司数据显示,美股有61家公司,而加拿大、英国、日本等市场则远低于此水平。一旦纳斯达克出手,DAT整体市场发展将迎来不小冲击。

而随着纳斯达克监管加码的消息一出,市场信心正受到冲击。美股中DAT类公司股价普遍承压,今日开盘后,例如MSTR下跌0.81%,SBET跌幅8.26%,BTCS下跌2.3%。

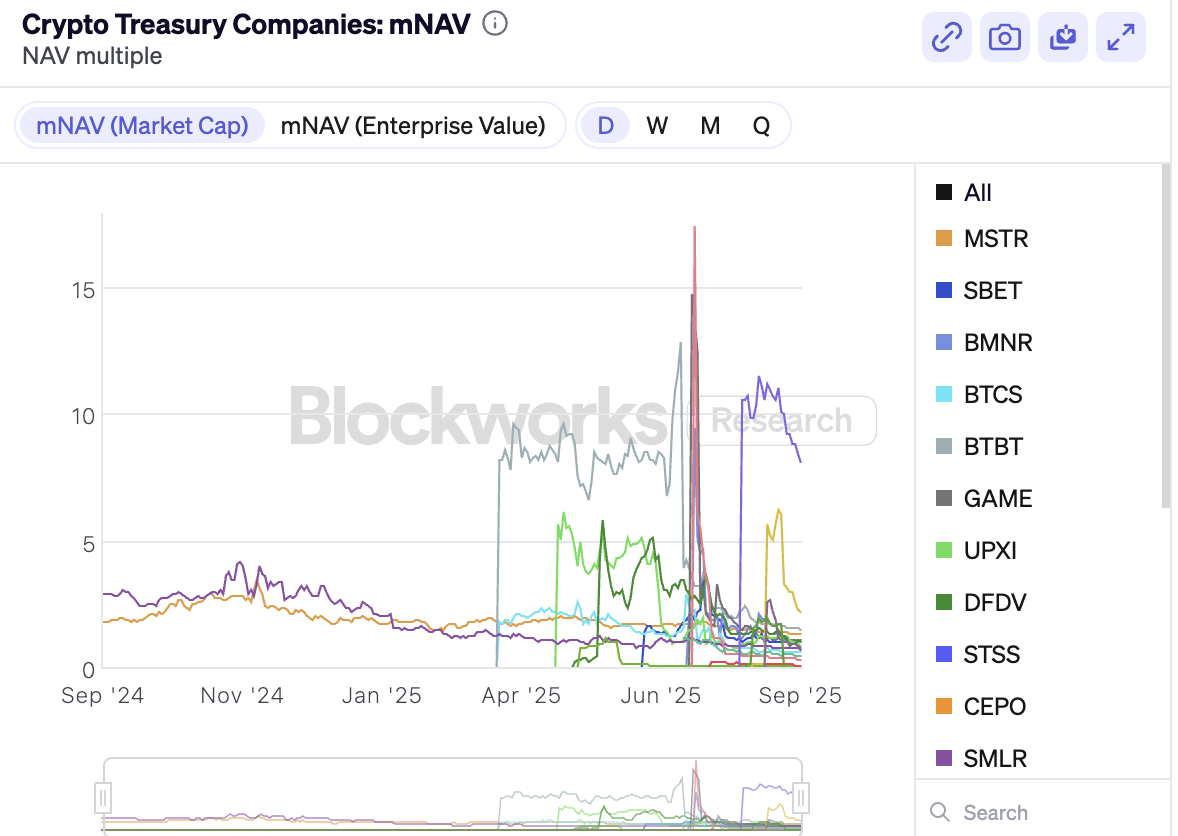

与此同时,mNAV(市值与净资产价值比)也普遍下行。Blockworks数据显示,截至9月4日,例如,MSTR的mNAV从峰值3.5倍跌至1.3倍,SBET从3.72倍跌至0.82倍,BMNR从9.45倍跌至0.88倍。更值一提的是,仅6家DAT公司的mNAV高于1,其余公司持续负溢价,此前依赖加密资产增值的蓄水池效应正在进一步减弱。

监管收紧或加剧市场分化,边缘币种面临生存压力

随着监管压力的即将到来,DAT市场格局或将迎来新变化。

一方面,监管强化促使DAT公司在加密资产投资策略上更加透明和谨慎,这有助于降低潜在的市场操纵和内幕交易等风险。据《财富》报道,多家上市加密财库公司曾出现股价异常波动。例如,SharpLink 的股价在4月和5月初徘徊在3美元以下,但在5月27日宣布计划增持4.25亿美元以太坊储备资产后,其股价一度飙升至接近36美元。而公告发布前三个交易日,SharpLink股价已从3美元翻倍至6美元,但公司未向SEC提交相关文件或发布新闻稿。类似情况还出现在Mill City Ventures、MEI Pharma、Kindly MD、Empery Digital、Fundamental Global和180 Life Sciences Corp等公司中。

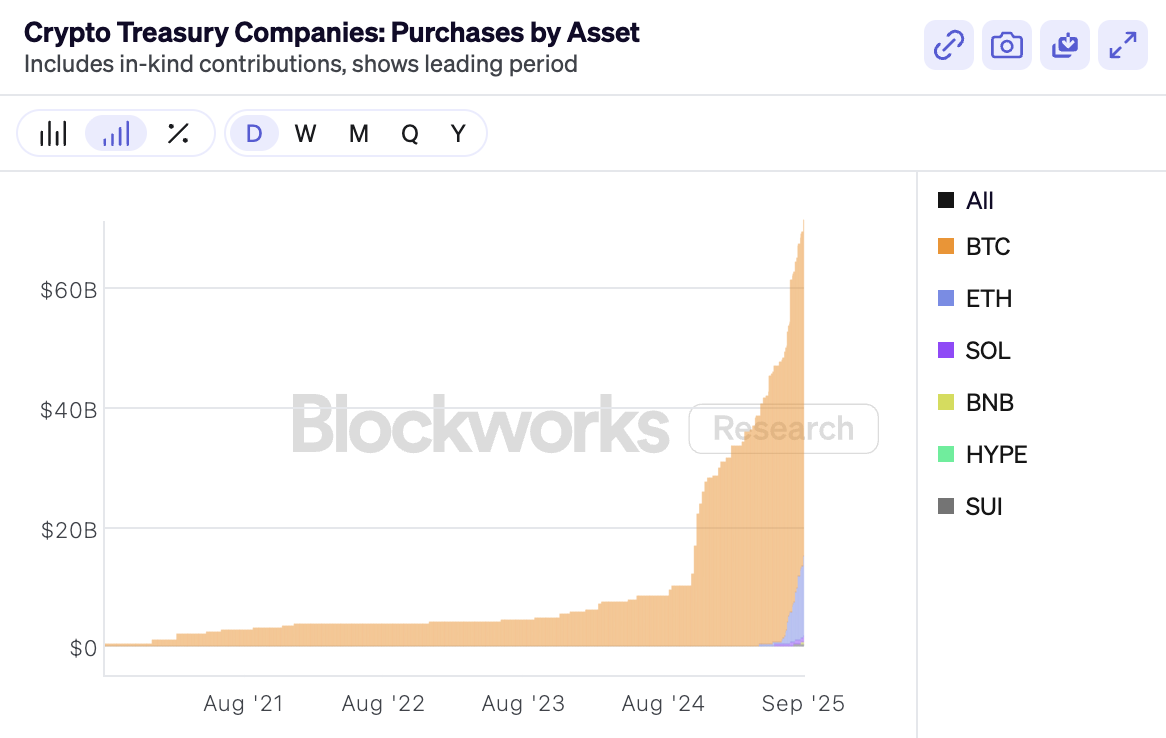

另一方面,DAT市场的头部效应将更加明显。尽管加密财库策略在市场上日益流行,涵盖了比特币、以太坊、Solana、Tron、BNB、Chainlink、SUI、Ethena等多种资产,但Blockworks数据显示,截至9月4日,DAT公司持有的加密货币总价值已超过695亿美元,其中主要集中在比特币和以太坊,金额达到681亿美元。而在这些资产类型中,仅比特币的mNAV达到1.17,其余资产均低于1,反映出投资者对其他加密资产的认可度不足。

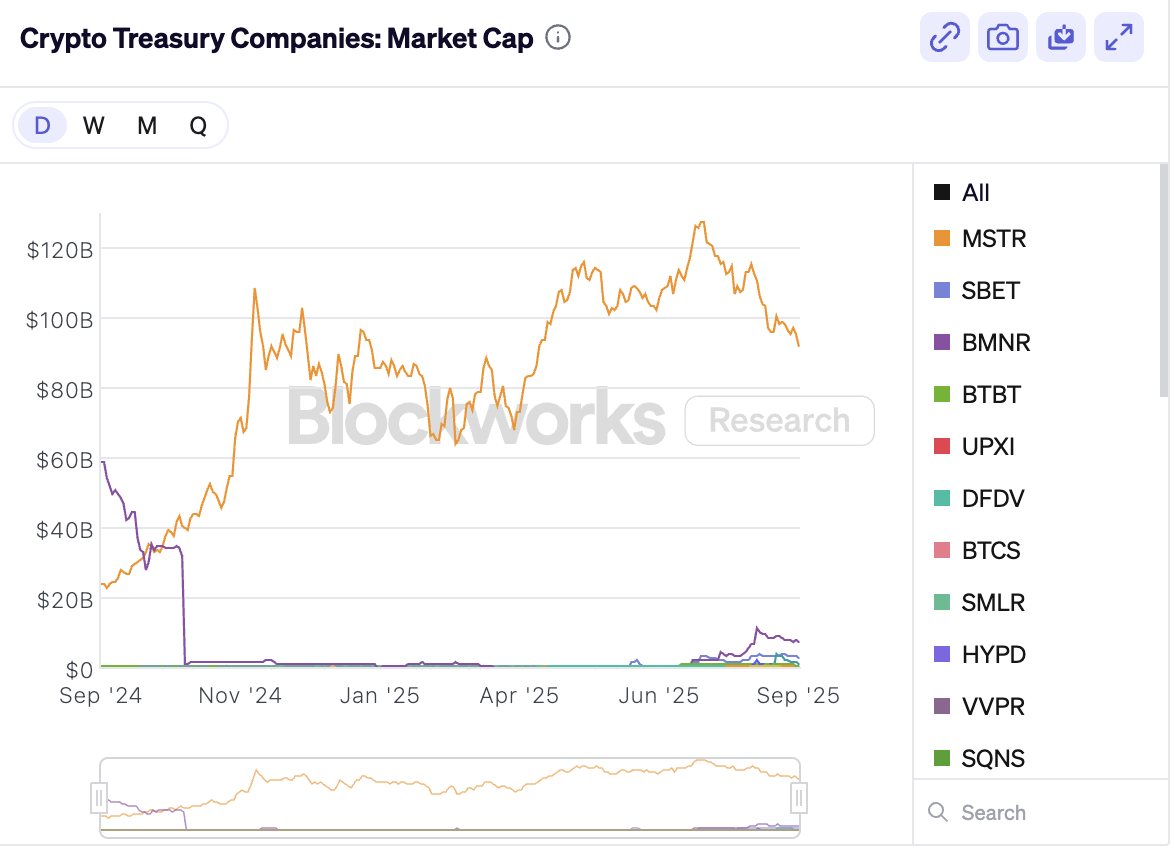

不仅如此,头部公司也占据着绝大部分市场份额,Blockworks数据显示,截至9月4日,加密财库公司的总市值超1084.8亿美元,其中比特币和以太坊的储备龙头Strategy和BitMine贡献了超91.4%的市场份额。这意味着未来市场中,头部公司和主流资产的优势可能进一步强化,而边缘资产则面临生存压力。

此外,监管收紧还可能放缓整个DAT市场的扩张。若DAT上市公司的融资成本和难度增加,将直接影响投资节奏,即囤币的规模和速度。同时,套利空间和市场机会的缩小,也将降低DAT模式的吸引力,尤其对财务实力有限或专注于单个小币种的公司。

“市场正在筹备的DAT公司除非把美股壳的股票先全部吃掉(百分百收购),否则再首次宣布转型DAT微策略模式时得先开股东大会,进行投票。实际上增加了新的DAT财库公司的运作成本和运作周期;之前已经转型成为DAT财库模式的上市公司,在之后再增发股票也必须先召开股东大会投票。发债或者可转债不属于发行新股应该不在此规定之内。”加密KOL@qinbafrank分析指出,纳斯达克官方此举是给DAT模式降温,提高壳公司转型的难度,也增加了已转型公司增发新股的流程,短期内应该给市场浇了一盆冷水,很多山寨币的DAT财库公司可能会越来越难。而那些已转型成DAT财库要想赢得股东认可,拿到股东大会多数投票,也不能再玩资本运作套路(比如代币直接置换股份、购买低价打折代币)。

流动性创新还是金融泡沫?DAT的可持续性惹争议

对于DAT愈演愈烈的发展趋势,市场也呈现出两极化反应。

支持者将其视为加密资产链上与链下转移的最佳桥梁,认为这一新模式或将改写加密金融市场的流动性格局。比如,HashKey Group 董事长兼首席执行官肖风认为,DAT可能是加密资产从链上向链下转移的最好方式,并详细阐述了DAT相对于ETF的四大核心优势:流动性更好。ETF申赎需要耗费较多时间,DAT有助于投资者更加便捷、高效地进行资产转移;价格弹性更高。DAT市值波动较大,且具备风险隔离属性,能够为机构提供更多套利工具;杠杆率设计更合理。DAT公司提供了带杠杆的融资结构,相较于加密货币自身价格增长,DAT能够为投资者带来更高溢价;DAT自带下跌保护机制。当股价下跌幅度超过了企业所拥有的资产净值,投资者就获得了打折买入比特币或ETF的机会。而这样股价低于资产净值的情况,会很快被市场所磨平。

更有多家加密VC加大DAT投资力度,比如,Pantera Capital首次对外披露已向DAT公司累计投资超过3亿美元;DWF Labs执行合伙人Andrei Grachev也在近日表示,愿为推动美股上市公司建立代币财库的项目提供融资额的10至20%。

然而,也有不少声音对DAT的可持续性提出了质疑。在Ledn联合创始人兼CEO Adam Reeds看来,热衷囤币的数字资产财库公司正面临转折。比特币财库公司曾是行业的革命性创新,但现在这种超额收益难以重现。真正消退的是创造独特价值主张的能力。多数DAT公司CEO声称其唯一目标是提升每股加密货币持有量,但他们是否拥有独特的管理团队,以及是否具备卓越的资本运作能力都不得而知。

同样的,Glassnode首席分析师James Check也认为,比特币财库策略比大多数人预期的要短得多,而且对于许多新进入者来说,它可能已经结束了。这并非“一场衡量竞赛”,关键在于一家公司的产品和战略在长期比特币市场中的可持续性。且由于投资者青睐早期采用者,新成立的比特币财库公司正面临一场艰苦的战斗。

更多质疑还有来自对DAT金融本质的判断。The ETF Store总裁Nate Geraci 发文更是表示,若真看好比特币和以太坊,投资者完全可以直接买入现货或ETF,而非依赖DAT这一衍生品式的替代工具。他强调,这类公司的繁荣很大程度上依靠监管套利,而随着监管壁垒逐渐被打破,市场对它们的需求也会自然消退。富兰克林邓普顿的分析师则警告,如果DAT市值低于其资产净值,新股发行将产生稀释效应,阻碍资本形成。若叠加加密货币价格下跌,企业或被迫出售资产以维持股价,进一步打压市场和信心,从而形成自我强化的下行螺旋。前高盛分析师Josip Rupena 更将DAT与2007–2008年金融危机中的CDO(担保债务凭证)类比,指出尽管加密财库公司表面上持有无交易对手风险的无记名资产,但实际却引入了多重风险,包括管理能力、网络安全和造血能力不足,这种叠加效应可能放大为系统性风险。

总的来说,DAT的发展前景,关键在于能否摆脱单纯依赖监管套利与杠杆放大的逻辑,通过长期维持市值高于净资产、持续创造增值交易,并建立有效的风险管理框架来实现可持续发展。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。