Why Yunfeng Financial Buys Ethereum Over Bitcoin in 2025

Yunfeng Financial Buys Ethereum: A Bold Web3 Leap from Jack Ma’s Circle

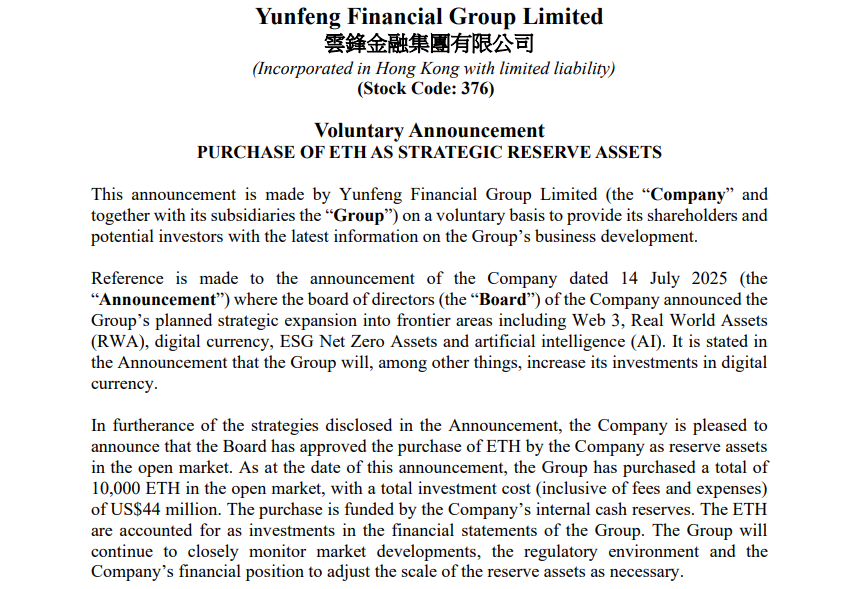

In an eye-catching move, Yunfeng Financial purchases Ethereum , taking out $44 million in cash reserves to purchase 10,000 ETH. Yes, you read that right: this Hong Kong-listed firm, backed by Alibaba co-founder Jack Ma, is dipping its toes into the world of Web3, tokenization, and crypto innovation.

Source : Website

The company made the announcement voluntarily with no regulatory pressure, just bold ambition. The board sees this coin not just as digital gold, but as infrastructure—the foundation for everything from RWA tokenization to new DeFi and insurance models. It’s all part of a sweeping strategy unveiled in July to expand into digital assets, artificial intelligence, and frontier markets.

Cloud of innovation: why Yunfeng Financial buys Ethereum matters

This isn't just about stacking crypto, it's a statement. By building an Ether treasury, company signals that corporates are accepting and encouraging not just as a speculative asset, but as infrastructure for decentralized finance and next-gen services

Unlike Bitcoin’s narrative of “digital gold,” ETH brings programmable power smart contracts, DeFi, staking, tokenization all essential for tokenized finance and Real-World Assets. Since June, corporate Ether holdings have surged by 384%, jumping from around 916,000 to 4.4 million coins an inflow worth billions and Yunfeng’s stake plays right into that trend

Ethereum’s rise versus Bitcoin’ s reign

Here’s where things get interesting: broader corporate ETH adoption is changing the perception about altcoins, especially Ether. It’s no longer seen as the “also-ran” to Bitcoin—it’s carving its own niche in DeFi, RWAs, and corporate treasuries.

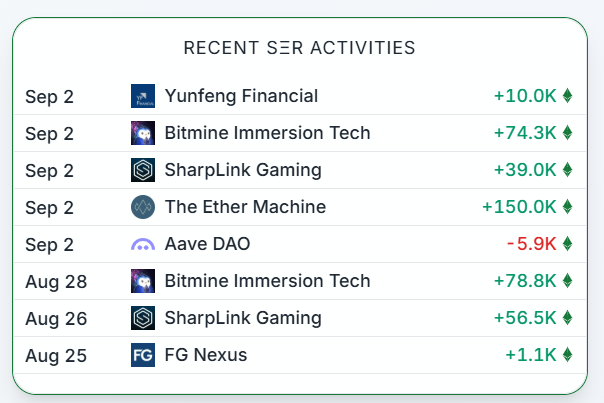

Source : https://www.strategicethreserve.xyz/

It isn’t alone; SharpLink Gaming, Bitmine Immersion, ETHZilla, and others are stacking ETH as part of their strategic reserve strategies. They’re viewing ETH as more than a balance-sheet hedge; it's the “go-to” blockchain for programmable finance. SharpLink Gaming has been actively accumulating layer-2 tokens. In a recent surge, it bought 39,008 coins at an average price of $4,531. Ether Machine raised $654 million worth of ETH via private financing specifically, 150,000 coins that will be delivered to its wallet later this week

Yes, Yunfeng Financial buys Ethereum, and in doing so it’s signaling a deeper alignment with the institutional crypto trend, especially in Asia. With about 4.44 million tokens under corporate holdings worth ~$19 billion tokens isn’t just a decentralized token anymore. It’s becoming a mainstream financial instrument.

What This Indicates for the Market and the Reaction of Stock Prices:

-

Following the Yunfeng Financial buys Ethereum news, the company's stock fell a little, indicating investor hesitancy given the significant volatility of cryptocurrencies.

-

Regulatory watch: Hong Kong regulators noted the filing was voluntary, and reminded everyone: exercise due diligence. In crypto, both opportunity and risk walk hand in hand.

-

Potential future moves: the firm hinted it might scale up its ETH holdings but that depends on how market dynamics and regulatory clarity evolve.

Final Thoughts

To wrap it up, Yunfeng financial buys Ethereum is a strategic and symbolic acquisition. Whether you’re a crypto enthusiast or just crypto-curious, this is a smart, yet friendly step that mainstream finance is just dipping its toes with blockchain and decentralized innovation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。