撰文:imToken

义乌,USDT,这两个看似风马牛不相及的名词,如今正在被放到同一个语境里。

作为「世界小商品之都」,过去义乌商户要把商品卖到中东、拉美、非洲,往往需要经过层层代理银行转账,不仅时间长、费用高,还常常遇到资金滞留的风险。

而近年来,情况正在悄然发生变化,据华泰证券研报显示,在义乌,稳定币已成为跨境支付的重要工具之一,买家只需在手机上完成转账,几分钟之内资金即可到帐,Chainalysis 更是估算,早在 2023 年义乌市场链上稳定币流动已经超过百亿美元。

虽然 21 世纪经济报道后续调研指出,义乌大多数商户未听说过且不了解稳定币,仅个别商户支持稳定币收款,但这恰恰说明它尚处于早期阶段,却已显示出扩散趋势。

换句话说,稳定币正在成为全球小微贸易商跨境收款的「新型美元」——支付,不仅是稳定币的起点,更是它们进入全球金融体系的最直接切口。

01 从「支付」,到「全球支付」

稳定币发展至今,应用场景已经多元化:有人用它参与 DeFi 挖矿,有人用它赚取利息,还有人将其作为抵押资产。但在这些用途背后,支付始终是最核心的功能。

尤其是在跨境支付场景的「全球支付」,更是稳定币与传统金融形成鲜明对比的场景。

众所周知,长期以来,环球银行金融电信协会(即 SWIFT)系统一直是跨境交易的核心支柱,但在现代金融需求下,其低效已难以为继——一笔跨境汇款往往要经过多家代理银行,手续繁琐、结算缓慢,可能需要数天才能完成,而在此期间,层层加收的手续费让交易成本居高不下。

对于依赖现金流的企业,或是需要汇款回家的个人用户来说,这些延迟和成本几乎难以承受。说白了,尽管 SWIFT 仍有全球影响力,但它并不是为数字经济的高效率需求而设计的。

在此背景下,稳定币则提供了一条快捷、低成本、无国界的替代路径。它们天然具有低成本、无国界、实时到账的属性,一笔跨境转账,无需层层代理,只要几分钟就能完成,手续费也因网络差异而显著降低。

例如目前主流以太坊 L2 网络上的 USDT/USDC 等稳定币转账,单笔成本都已经降至数美分级别,几乎可以忽略不记,这让稳定币天然成为「全球支付」的可行方案,尤其是在东南亚、拉美等跨境资金活跃、传统渠道不畅的地区,逐渐成为小额支付的主流选择。

更重要的是,对于欠发达甚至经济社会发展动荡的国家来说,稳定币不仅仅是「支付工具」,它们还兼具短期价值储藏的功能——在这些身处本币贬值风险中的用户眼中,持有稳定币意味着更稳定的购买力保障。

这种「支付 + 避险」的双重作用,正是「全球支付稳定币」值得单独拿出来探讨的原因。

来源:imToken Web(web.token.im)的「全球支付」(汇款型)稳定币

而从 imToken 的视角来看,稳定币早已不是一个单一叙事能概括的工具,而是一个多维度的「资产集合体」——不同用户、不同需求,会对应不同的稳定币选择。

在这套分类中,「全球支付稳定币」(USDT、USDC、FDUSD、TUSD、EURC 等)正是专门面向跨境转账与价值流通的独立一类,它们的角色越来越清晰:既是全球资金流动的快车道,也是动荡市场中用户的「新型美元」。

02 为什么全球制度绕不开稳定币?

如果说「支付」是稳定币的初心,那么「全球支付」就是它们最具竞争力的落地场景。原因很简单:稳定币几乎天然契合跨境支付的三大痛点——成本、效率与可接受度。

首先,对于支付场景而言,成本与效率就是核心。

正如上文所言,传统跨境汇款往往需要经过多家代理银行,时间以「天」计、成本动辄几十美元。相比之下,稳定币的优势一目了然,以太坊 L2 网络的单笔转账手续费通常远不到 1 美元,在东南亚、拉美等地已成为跨境小额支付的常用工具。

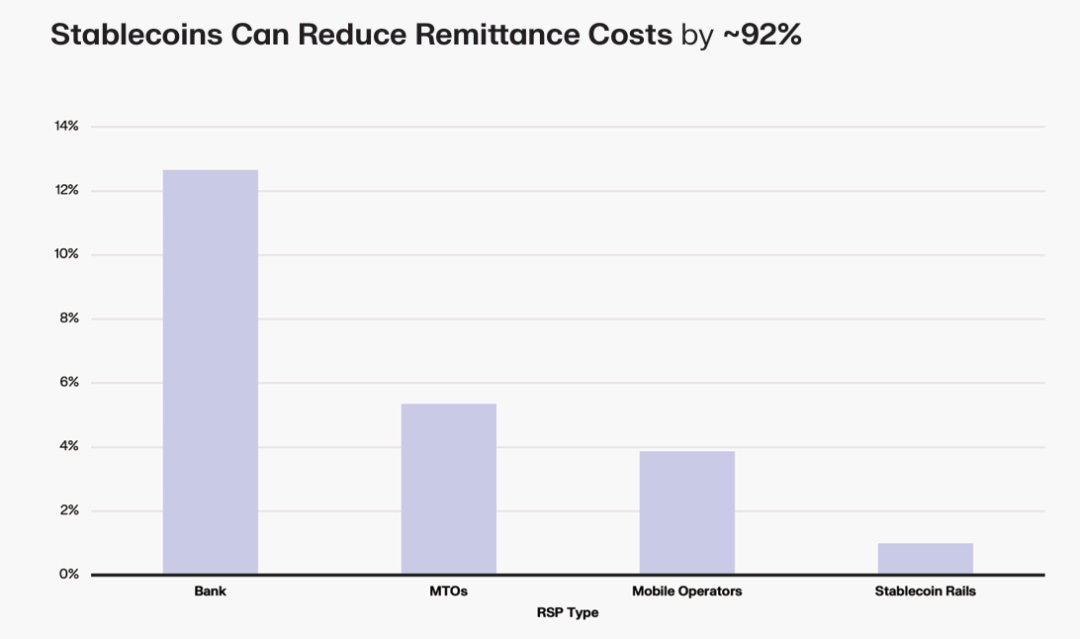

据 Keyrock 报告,传统银行跨境汇款 200 美元的费用约 12.66%,MTOs(汇款运营商)约 5.35%,移动运营商约 3.87%,而稳定币平台可将同类转账成本降低至 1% 以下,大幅提升资金流转效率,且一笔稳定币转账在以太坊主网上通常只需几秒确认,而在部分 L2 或新兴公链上甚至可实现更短时间结算,这种体验与 SWIFT 体系的 T+N 完全不是一个量级。

其次,除了效率和成本,支付能否被广泛采用,还取决于对方是否愿意接收。

这则得益于加密市场与稳定币多年来的互相成全——USDT 作为全球最大稳定币,目前市值早已长期稳定在千亿美元级别,是最广泛被接受的支付媒介,USDC 则因合规与透明度受到机构青睐,在欧美金融体系中渗透度高。

持续渗透之下,在土耳其、阿根廷、尼日利亚等本币贬值严重的国家,USDT 几乎成为事实上的「储蓄货币」;USDC 则以透明储备和合规性吸引机构,在欧美市场渗透度高;EURC 虽然规模较小,但在欧洲区跨境结算中具有不可替代的作用。

最后,对于支付而言,速度和成本重要,但「资金是否真的安全」更是关键。

随着美国《GENIUS 法案》落地、香港《稳定币条例》实施,以及日本、韩国等市场的相继试点,合规发行已逐渐成为稳定币「通行证」。

在未来,能够进入全球支付体系的稳定币,大概率都会是合规化路径上的「白名单玩家」。

综上所述,稳定币之所以正在成为「全球支付」的基础设施,不是偶然,而是因为它们在效率、成本、接受度和透明度上全面对传统跨境支付形成了替代优势。

03 支付是起点,也是更大的未来

也正因如此,对已经逐步拓展「全球支付」属性的稳定币而言,其所面临的已远远不只是 Crypto 原生用户的交易需求,而是延伸到更广泛的群体:

-

有跨国汇款或支付需求的个人与企业;

-

需要在不同交易所之间快速转移资金的加密交易者;

-

面临本国货币贬值、寻求美元或欧元等稳定资产避险的用户;

从这个角度看,「全球支付」既是稳定币的初心,也是它们最现实、最迫切的落地场景——它们不是要推翻传统银行体系,而是提供了一种效率更高、成本更低、更普惠的补充方案,让过去需要跨越多家代理银行、动辄数天到账的跨境结算,变成一个「几分钟 + 几美分」就能完成的动作。

未来趋势也愈发清晰,随着美国《GENIUS 法案》落地、香港《稳定币条例》生效,以及日本、韩国等市场相继启动试点,无论是跨境支付、企业财库,还是个人避险,全球支付稳定币都将成为金融体系中不可或缺的一环。

当我们再回看义乌商户收取 USDT 的实验性尝试,或许会发现,这并非一座城市的故事,而是一个全球性的缩影——稳定币正从边缘走向主流,从链上走向现实,最终成为全球价值流动的新基础设施。

从这个角度来看,支付,是稳定币的起点,也是它们走向全球金融基础设施的更大未来。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。