本报告由Tiger Research撰写,阐述了我们基于创纪录的全球流动性、机构采用加速、以及向机构主导市场的结构性转变,对2025年第三季度比特币的价格预测,目标价为19万美元。

要点总结

比特币的机构采用加速- 美国401(k)养老金投资渠道开放,ETF及公司实体持续大规模积累

自2021年以来的最佳环境- 全球流动性处于历史高位,主要国家处于降息模式

从零售主导转向机构主导的市场- 尽管存在过热信号,机构买盘稳固支撑下行风险

全球流动性扩张、机构积累和监管顺风推动比特币的采用

目前有三个核心驱动因素推动着比特币市场:1) 不断扩张的全球流动性,2) 加速的机构资本流入,以及 3) 对加密货币友好的监管环境。这三个因素同时作用,创造了自2021年牛市以来最强劲的上行动力。比特币同比上涨约80%,并且我们认为在中短期内,可能破坏这种上行势头的因素有限。

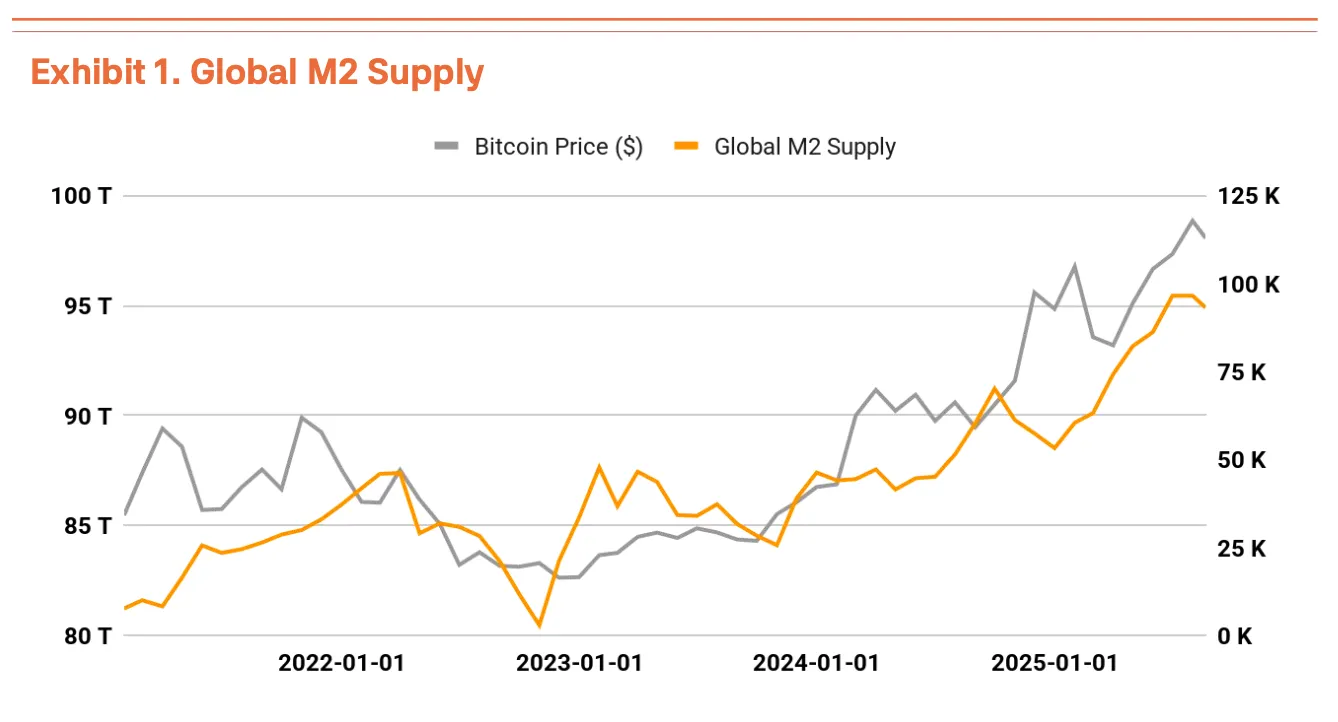

在全球流动性方面,突出的一点是主要经济体的M2货币供应量已超过90万亿美元,创下历史新高。历史上,M2增长率和比特币价格显示出相似的方向性模式,如果当前的货币扩张持续下去,则仍有很大的进一步升值空间(Exhibit 1)。

此外,特朗普总统施压降息以及美联储的鸽派立场,为过剩流动性流入另类资产开辟了道路,而比特币成为主要受益者。

与此同时,机构对比特币的积累正以前所未有的速度进行。美国现货ETF持有130万枚BTC,约占总供应量的6%,而仅微策略公司(MSTR)就持有629,376枚BTC(价值712亿美元)。关键在于这些购买代表的是结构性战略,而非一次性交易。微策略公司通过发行可转换债券持续购买,尤其标志着新的需求层正在形成。

此外,特朗普政府于8月7日发布的行政命令代表了一个改变游戏规则的因素。向比特币投资开放401(k)退休账户,创造了接触一个8.9万亿美元资本池的潜在通道。即使保守地分配1%,也将意味着890亿美元——大约相当于比特币当前市值的4%。鉴于401(k)资金具有长期持有的特性,这一发展不仅应有助于价格升值,也应有助于降低波动性。这标志着比特币从投机性资产向核心机构持有资产转变的明确信号。

机构推动交易量而零售活动消退

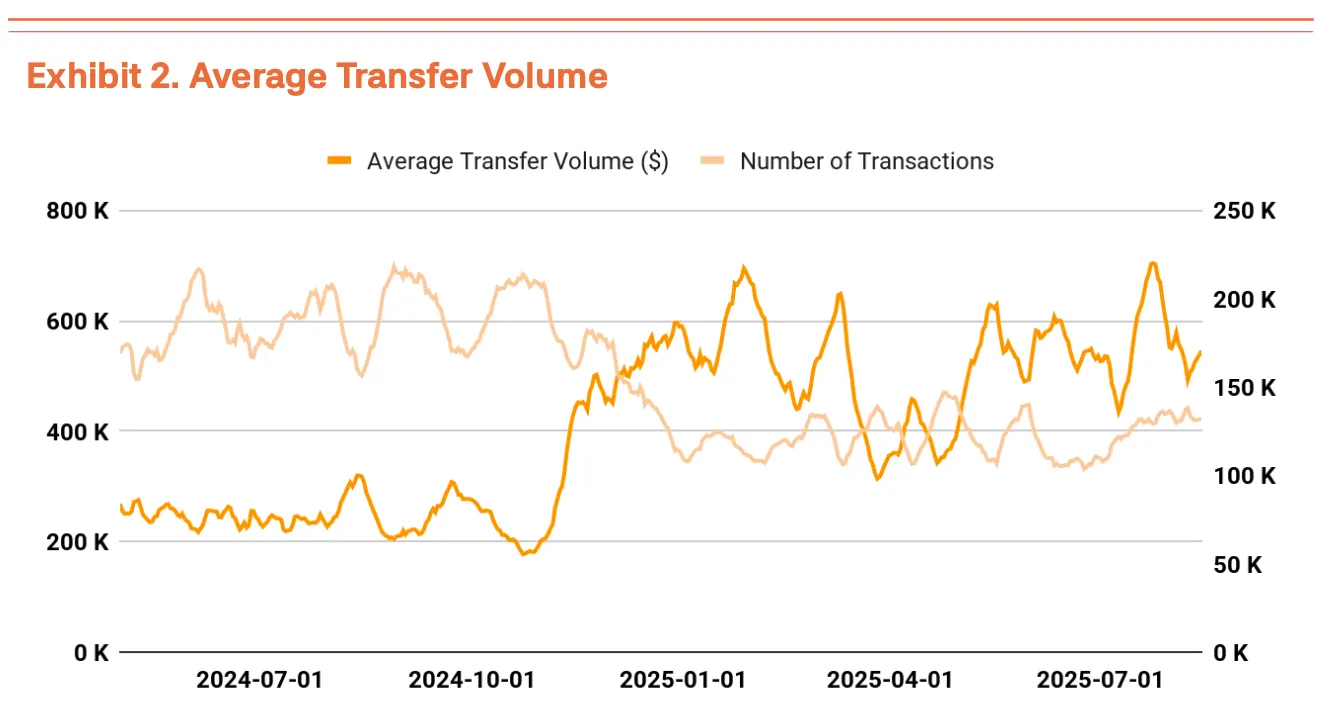

比特币网络目前正围绕大投资者进行重组。日均交易笔数从2024年10月的66万笔下降41%至2025年3月的38.8万笔,然而每笔比特币转账额实际上却增加了。来自像微策略公司这样的机构的日益增长的高价值交易扩大了平均交易规模。这标志着比特币网络从“小额高频”向“大额低频”交易模式转变(Exhibit 2)。

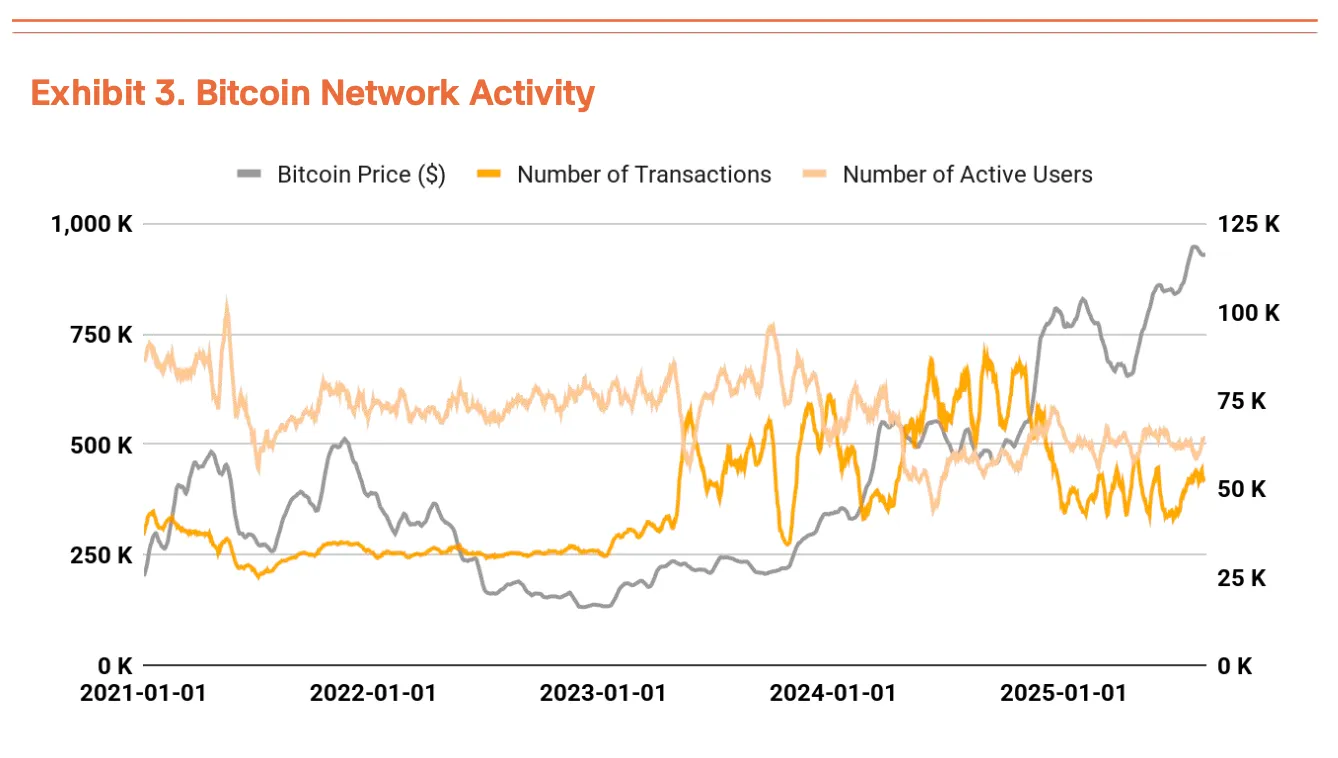

然而,基本指标显示出不平衡的增长。虽然机构重组显然推动比特币网络价值升高,但交易笔数和活跃用户数仍未恢复(Exhibit 3)。

基本面的改善需要通过BTCFi(基于比特币的去中心化金融服务)和其他举措来激活生态系统,但这些仍处于早期发展阶段,需要时间才能产生有意义的影响。

超买,但机构提供底部支撑

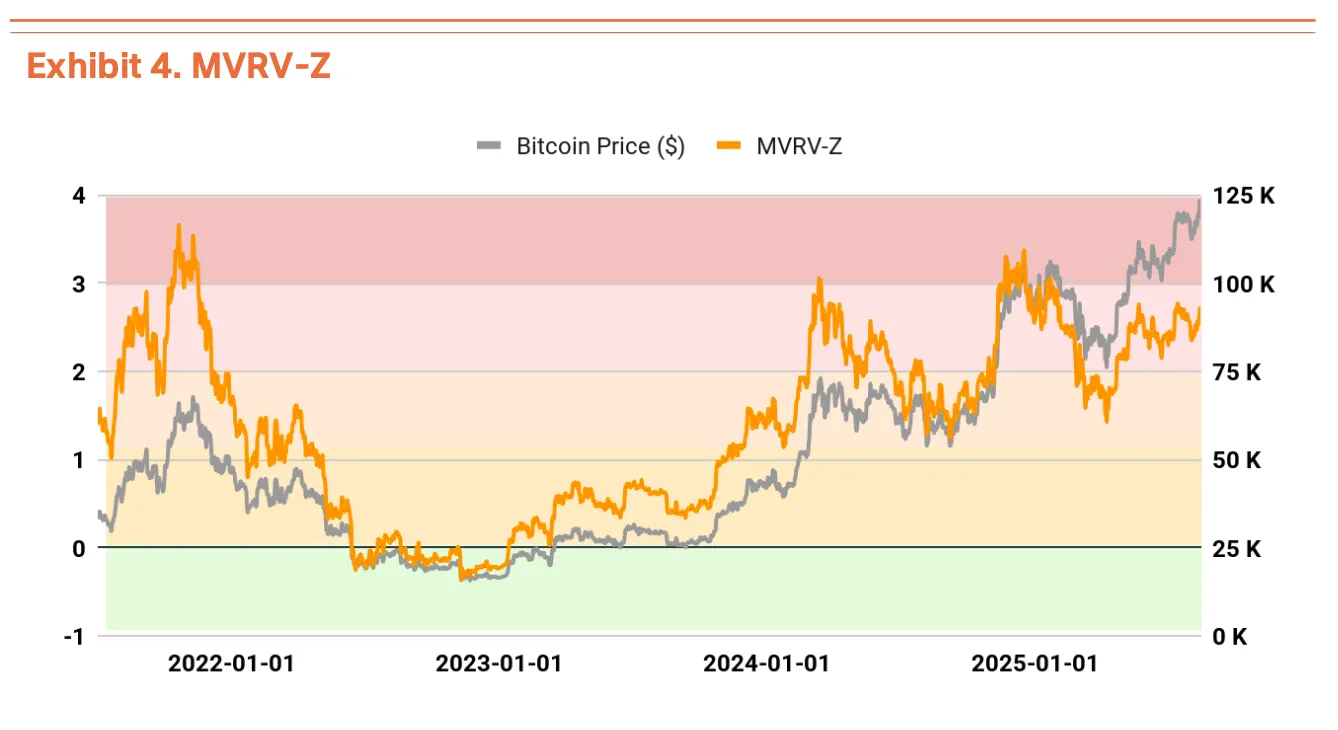

链上指标显示了一些过热信号,然而重大的下行风险仍然有限。MVRV-Z指标(衡量当前价格相对于投资者平均成本基础)处于2.49,位于过热区域,并且最近曾飙升至2.7,警告可能出现近期回调(Exhibit 4)。

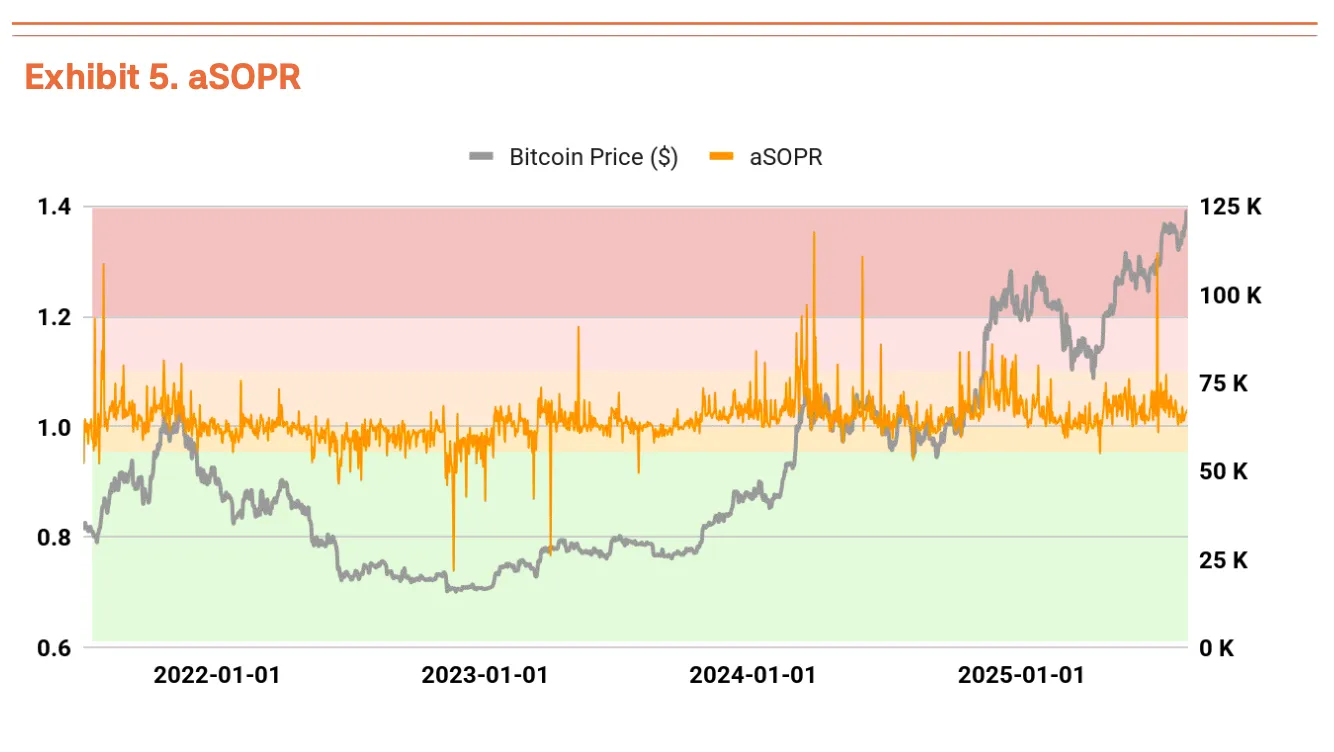

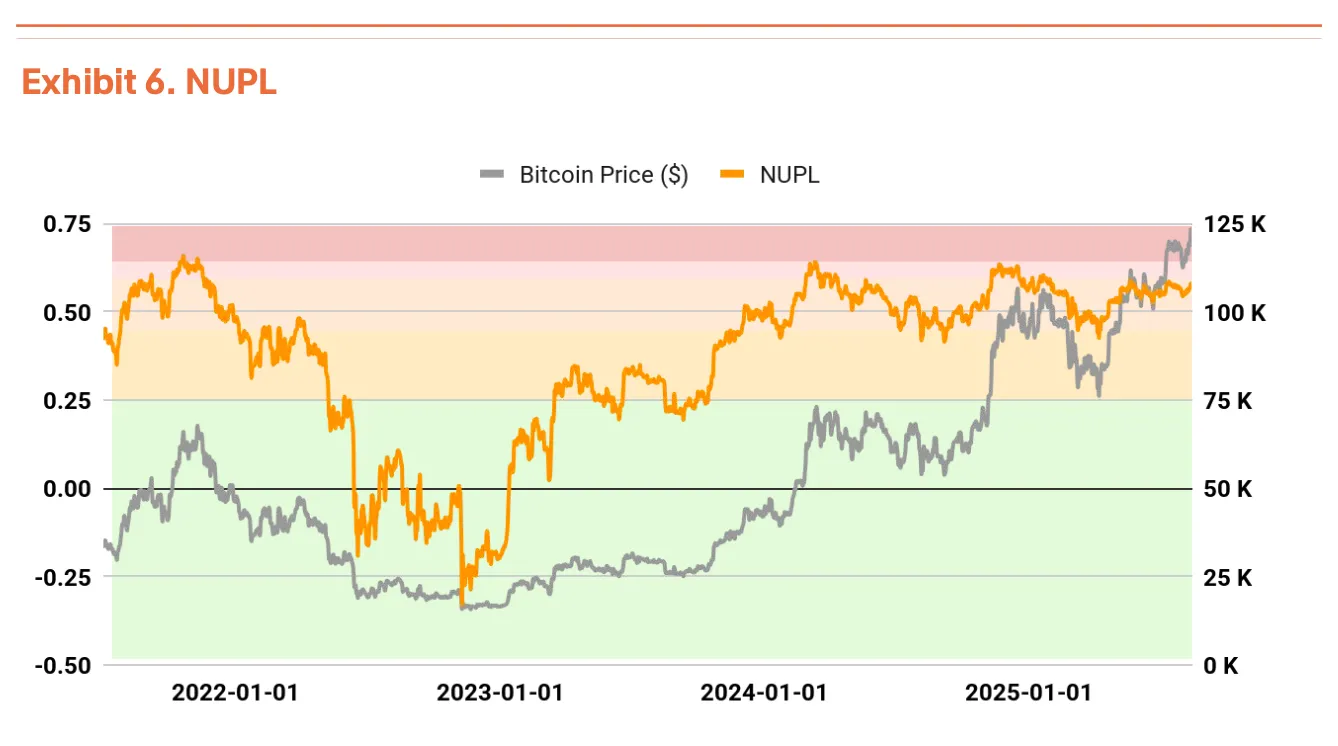

然而,追踪投资者已实现盈利/亏损的aSOPR(1.019)和衡量市场整体未实现盈利/亏损的NUPL(0.558)均保持在稳定区域,表明市场整体健康(Exhibit 5, 6)。

简而言之,虽然当前价格相对于平均成本基础(MVRV-Z)偏高,但实际卖出行为发生在适度盈利水平(aSOPR),并且整个市场尚未达到过度盈利区域(NUPL)。

机构购买力超过零售购买力支撑了这一动态。来自ETF和微策略公司类型实体的持续积累提供了稳固的价格支撑。短期内可能出现回调,但趋势逆转似乎不太可能。

目标价格19万美元,具备67%的上行潜力

我们的TVM(时间价值货币)方法论通过以下框架得出19万美元的目标价格:我们建立了一个13.5万美元的基础价格(从当前价格中剔除极端恐惧和贪婪情绪),然后应用了+3.5%的基本面指标乘数和+35%的宏观指标乘数。

基本面指标乘数反映了网络质量的改善——尽管交易笔数减少,但交易价值更高。宏观指标乘数捕捉了三个强大力量:不断扩张的全球流动性(例如,M2超过90万亿美元)、加速的机构采用(例如,ETF持有130万枚BTC)以及改善的监管环境(例如,401(k)资格解锁了8.9万亿美元)。

从当前水平来看,这意味着67%的上行潜力。虽然目标激进,但它反映了比特币从投机性资产向机构投资组合配置转变过程中正在发生的结构性变化。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。