The Cosmos ecosystem is at a critical historical moment.

Written by: Yanz, Deep Tide TechFlow

From the end of 2024 to the beginning of 2025, the performance of the Cosmos ecosystem has drawn significant attention, but not for good reasons.

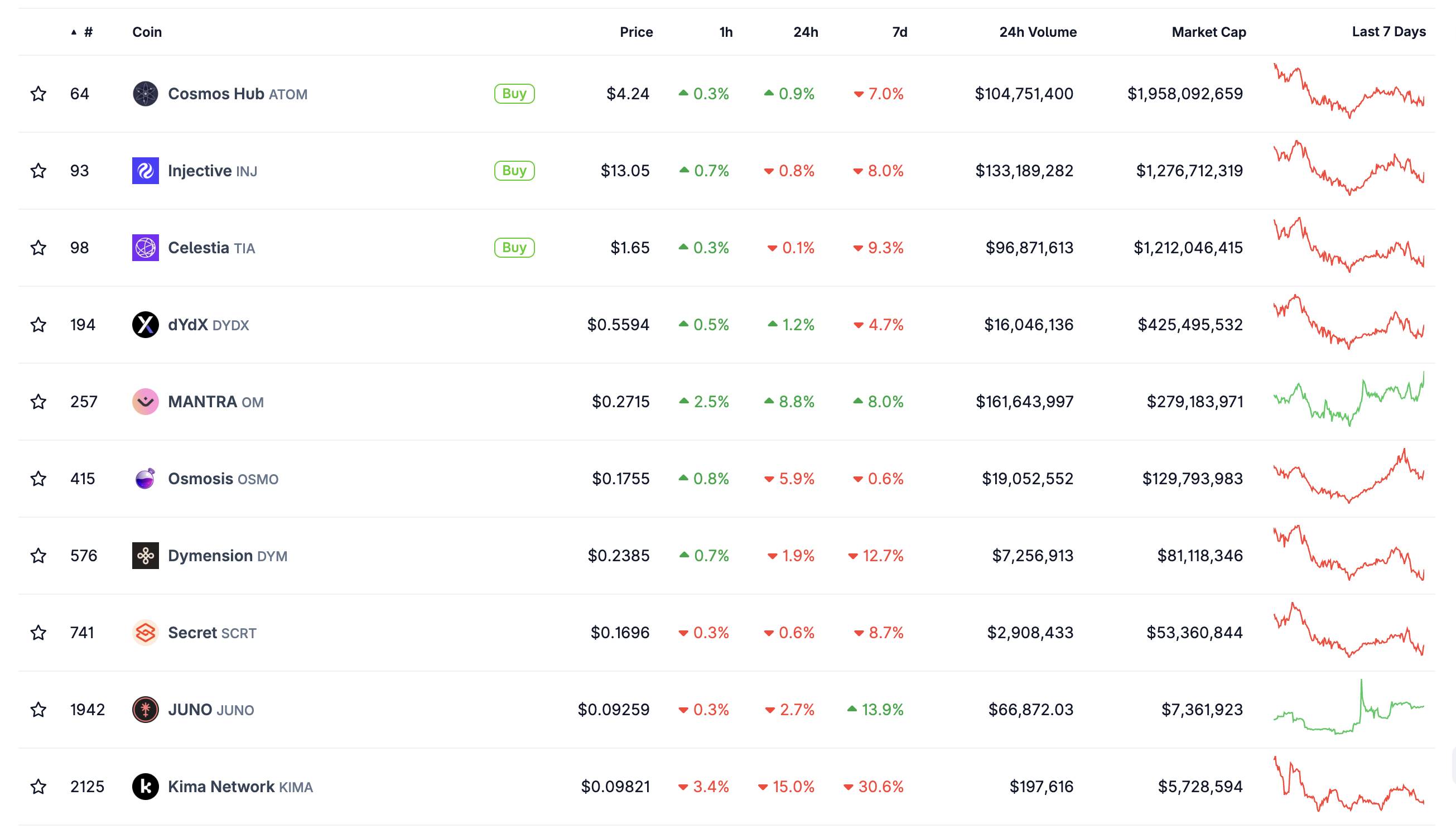

As of August 5, 2025, the core token of Cosmos, ATOM, has shrunk to $4.20, a staggering 90% drop from its peak. Meanwhile, compared to the end of 2024, major projects like Osmosis (OSMO) have fallen by 79%, and JUNO's price has plummeted by 82%, nearly reaching zero. Even the relatively strong Injective (INJ) has dropped from $34 to around $12, not to mention the widespread declines of Kava, Evmos, Cronos, and Fetch.AI…

Once experiencing counter-cyclical growth in 2022, with a TVL ranking second, Cosmos now faces a collective destruction of value. What exactly has happened to the Cosmos ecosystem, which was once seen as the core of the blockchain internet? From being a star project during the DeFi boom in 2021 to its current lackluster market performance, what are the underlying reasons for this transformation?

When we carefully analyze its recent performance, we find that this significant drop has deeper contextual backgrounds—not just simple market fluctuations.

Airdrop Frenzy, Death Loop

At the beginning of 2024, when the news of the Celestia (TIA) airdrop spread throughout the crypto community, no one could have predicted that this free wealth feast would mark the beginning of a nightmare for the entire Cosmos ecosystem.

Celestia, a modular data availability network built on the Cosmos SDK, is deeply integrated with the Cosmos ecosystem through the IBC (Inter-Blockchain Communication) protocol.

A year ago in spring, TIA's price skyrocketed to a peak of $20.17, with social media filled with tales of overnight wealth. However, this frenzy lasted only two months before a wave of selling surged, causing TIA's price to plummet by 91.9%, currently hovering around $1.60.

Coincidentally, the crash occurred throughout the entire Cosmos ecosystem.

The Celestia airdrop event perfectly illustrates the entire process of the "hype—sell-off" vicious cycle within the Cosmos ecosystem. When the airdrop news was released, a large amount of speculative capital rushed in, driving prices up rapidly and creating an illusion of prosperity.

However, this growth based on expectations rather than actual value was destined to be unsustainable. As early holders began to sell to lock in profits, prices started to decline, panic spread quickly, triggering larger-scale sell-offs, ultimately leading to a price crash.

Osmosis experienced a similar process during the liquidity mining craze in 2022, with its price dropping from a peak of $11 to the current $0.17.

Each cycle like this erodes the ecosystem's trust and financial foundation, and this short-term speculative behavior drives away genuine long-term builders, leaving the entire ecosystem in a restless atmosphere.

Puppet Emperor and Divided Kingdoms

The ecological projects are trapped in a death loop, and the price performance of ATOM, as the core asset of the Cosmos ecosystem, also faces a bottleneck.

Under the multi-chain parallel architecture, the positioning of ATOM as network fuel has not formed an effective closed loop. Many sub-chains have independent native tokens that do not directly rely on ATOM, making it difficult for ecosystem traffic and value to flow back.

The high-inflation model without a total supply cap, while incentivizing staking and governance participation, also creates long-term price dilution pressure. More critically, the free chain-building philosophy of Cosmos, while encouraging innovation and competition, leads to fragmented traffic, with projects acting independently, contrasting sharply with Ethereum's model of locking most value in ETH.

ATOM has become the puppet emperor of Cosmos, and governance issues have further spread, with the federation not benefiting.

The JUNO project is the most typical case: in April 2022, the JUNO community discovered that a whale user had circumvented airdrop restrictions through multiple wallets, acquiring JUNO tokens worth approximately $35 million.

After intense community debate, JUNO DAO officially voted on April 29, 2022, to pass Proposal No. 20, deciding to confiscate these tokens, which took effect on May 4.

This controversial decision severely divided the community and led to a significant decline in investor confidence in JUNO's governance mechanism. The failure of the governance mechanism not only failed to address the technical and market challenges faced by the project but also accelerated its decline, with JUNO's price dropping from $43 to $0.09, a staggering 99% decrease.

However, these are not the only issues facing Cosmos, nor are they unique crises.

The "Midlife Crisis" of Multi-Chain Ecosystems

When we talk about the predicament of Cosmos, we are actually analyzing the collective anxiety faced by the entire multi-chain ecosystem—the profound disconnection between technological innovation and market adoption.

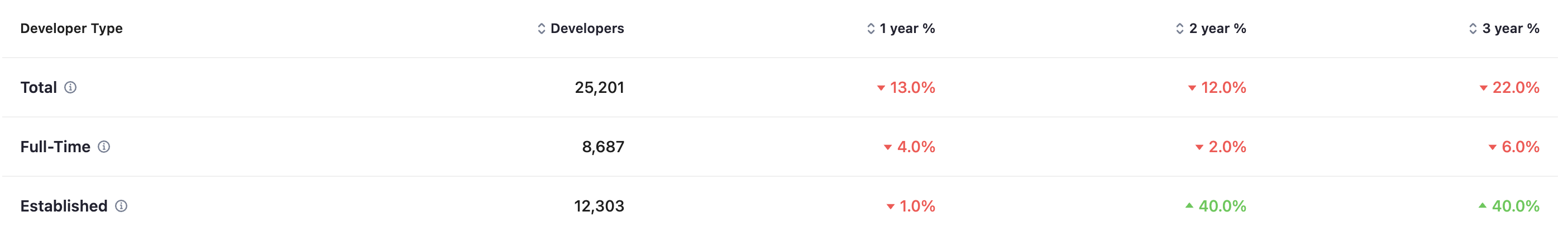

In April 2025, Cosmos development events ranked first among blockchain projects. While seemingly leading, this does not mask the gradual decline in active crypto developers.

Source: developer report

Other multi-chain ecosystems are similarly sluggish: the number of Ethereum developers has decreased by 2.54%, BNB Chain development metrics have dropped by 9.45%, and Polygon, Arbitrum, Optimism, and Avalanche have seen declines of 10.35%, 7.62%, 6.82%, and 12.08%, respectively.

Polkadot ranks tenth with 3.4K developer activities, with contributors decreasing by 0.91% to 325. In the face of the JAM upgrade and slow responses to market competition, the community has even issued an urgent call of "React or die."

Multi-chain ecosystems face similar structural challenges:

Lack of network effects: Compared to Ethereum, there is a lack of sufficient user base and application scenarios to form a self-reinforcing ecological cycle.

Insufficient developer incentive mechanisms: Although technologically advanced, there is a lack of sufficient economic incentives to attract and retain talented developers.

Ambiguous market positioning: In competition with Ethereum, these projects often fall into the dilemma of having technological superiority but lacking applications.

This inherent dilemma has been further amplified by the current special market environment changes.

In the second quarter of 2025, the total market capitalization of the crypto market surpassed $3.5 trillion, but the dominant force behind this growth has been institutional funds, which operate under a completely different investment logic: controllable risk, ample liquidity, and regulatory compliance.

For institutional investors seeking stable returns, Bitcoin and Ethereum are clearly more attractive than technologically innovative multi-chain projects. This shift in capital flow has directly led to the further marginalization of multi-chain projects in terms of financing and liquidity.

Even more critically, the institutionalization process has brought about another unexpected consequence—the "Matthew Effect" in infrastructure construction is accelerating.

Stablecoins are becoming the core infrastructure connecting traditional finance and the crypto world. However, this infrastructure development mainly revolves around mature networks. As stablecoins become the utilities of the new financial system, multi-chain ecosystems find themselves standing on the margins.

This predicament forces these ecosystems to reassess their value propositions, shifting from pure technological competition to a more pragmatic approach that emphasizes user experience and real application scenarios.

This shift is not only a necessity for survival but may also become the starting point for the next cycle of innovation.

Crossroads: Rebirth or Decline

Standing at the time node of 2025, the Cosmos ecosystem is at a critical historical moment.

From the grand vision of the blockchain internet at the launch of the mainnet in 2019, to the market's fervent pursuit of interoperability when ATOM reached its historical high of $44.70 in 2021, and to the deep reflection as prices fell to around $3.50 during the bear market from 2022 to 2024, Cosmos has traversed a typical yet unique growth trajectory of a blockchain project.

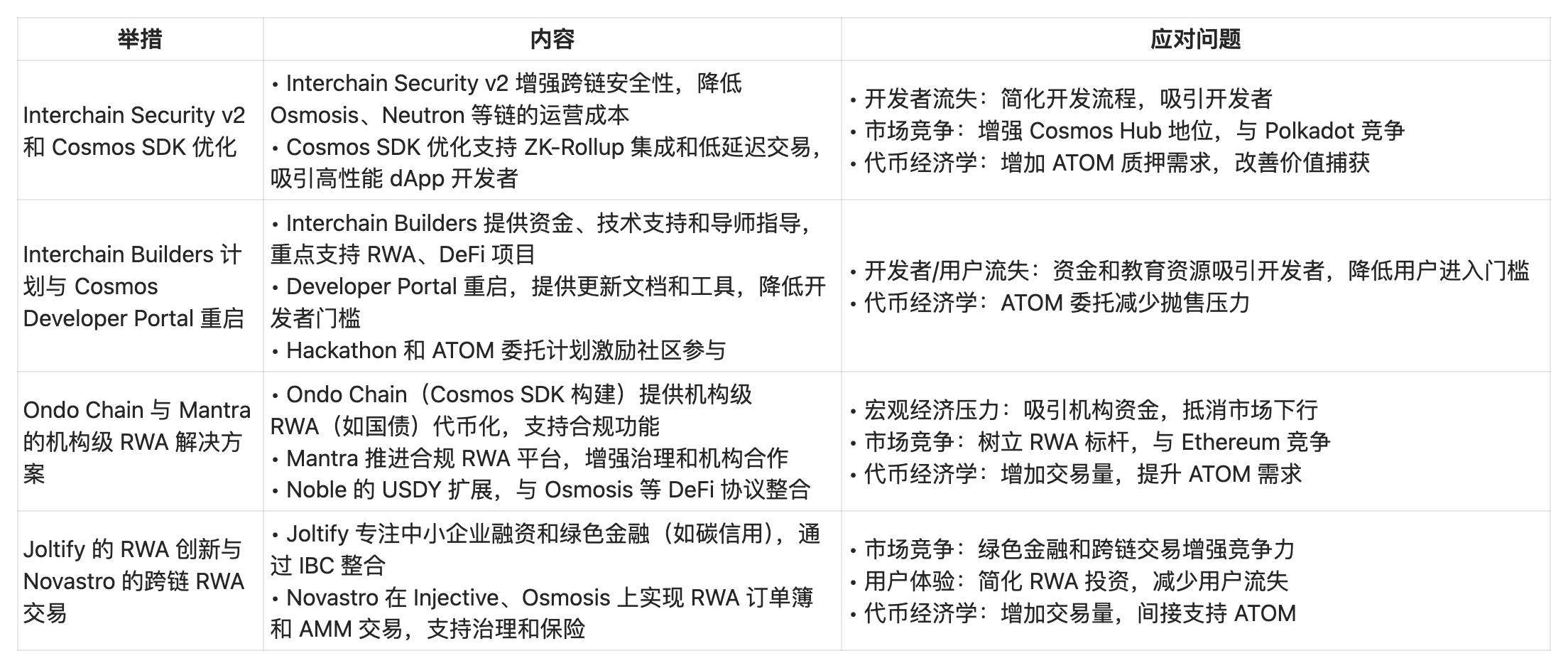

In this darkest hour, although the data is bleak, Cosmos is indeed undergoing a profound self-revolution.

Different institutions' predictions for the Cosmos (ATOM) ecosystem and price trends show diverse expectations, with significant short-term discrepancies. CCN and Changelly are more pessimistic, emphasizing the bearish pressures indicated by technical indicators (such as RSI, moving averages), while CoinLore and CryptoNewsZ are more optimistic, expecting a bull market to push prices beyond $20–$40.

For the uncertain future of Cosmos, ecosystem expansion, technological upgrades, market sentiment, regulatory environment, and competitive pressure are frequently mentioned considerations.

It cannot be denied that the actual effects of technological upgrades and governance reforms require time to validate.

The competitive pressure from Layer-2 and other interoperability solutions continues to exist, and the impact of Federal Reserve policies and geopolitical risks on the entire crypto market cannot be ignored. More importantly, this shift from idealism to realism is itself a painful process that requires finding a delicate balance between technological innovation and the market.

History tells us that truly great technologies and ecosystems often emerge in the darkest moments. Cosmos also needs time to verify whether what awaits is a future or a deeper night.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。