BNB has recently reached a new historical high, driven by a strategic transformation: shifting from an exchange token to an institutional-grade reserve asset backed by multiple publicly listed companies.

Written by: Luke, Mars Finance

Recently, the price trend of BNB has broken a long-standing silence, surging past $850 with astonishing force, continuously setting new historical highs. This round of explosive growth has sparked widespread discussion and inquiry in the market, leaving many observers puzzled. Accustomed to its stablecoin-like fluctuations, they suddenly find it difficult to understand the driving forces behind this surge. However, the apparent price spike is just the tip of the iceberg; what it deeply reflects may be a carefully orchestrated and fundamental strategic shift: BNB is transforming from a functional token deeply tied to a single exchange's fate into an institutional-grade reserve asset aimed at traditional capital markets, backed by the balance sheets of multiple publicly listed companies.

The core of this transformation lies in the reshaping of its value capture path. In the past, the market generally believed that Binance would have to seek a traditional initial public offering (IPO) route to embrace mainstream finance. While this path is orthodox, it is fraught with thorns, especially in the heavily regulated U.S. market. It requires BNB to be legally "de-risked" to avoid being classified as a security, but this has also imposed a heavy shackle on BNB's valuation.

Now, a brand new path, more aligned with Web3's native characteristics, is emerging. It no longer fixates on the compliance listing of a single entity but instead builds a "BNB Reserve Asset Alliance" composed of multiple independent publicly listed companies, creating a bridge to Wall Street in a more decentralized and resilient manner. The recent market's intense reaction is the first and most direct pricing of this emerging capital narrative.

Valuation Cage: The Self-Imposed Constraints of the IPO Path

BNB has performed mediocrely for a long time, and the reason may lie in the core constraints of the traditional IPO path—the Howey Test. According to the U.S. Securities and Exchange Commission (SEC), a transaction constitutes an "investment contract," i.e., a security, if it meets four criteria: an investment of money, investment in a common enterprise, expectation of profits, and profits primarily coming from the efforts of others. For exchange tokens, the "new project" returns provided to holders through platforms like Launchpad easily touch the red line of "profits coming from the efforts of others (project parties and exchanges)."

To clear the obstacles on this compliance path, Binance has conducted a series of precise iterations of its product matrix over the past few years, with clear legal intentions. This is not a simple functional upgrade but a "surgical operation" aimed at systematically stripping BNB of its securities attributes.

The initial Binance Launchpad was a typical Initial Exchange Offering (IEO) model, where users obtained shares in new project investments by holding BNB, closely resembling the definition of an investment contract. Subsequently, Binance launched Launchpool, shifting the model to liquidity mining. Users provided liquidity for projects by staking BNB and other assets to earn new token rewards. This shift cleverly changed the narrative from "investment" to "farming," subtly weakening the direct association with "common enterprise" and "efforts of others" from a legal standpoint.

The latest evolution is the emergence of Megadrop. This platform not only requires users to lock BNB but also introduces a mechanism for completing Web3 tasks. This means that part of the rewards users receive depends on their active participation and "proof of work," rather than passively relying on third parties. From Launchpad to Launchpool, and then to Megadrop, BNB's empowerment method has gradually shifted from direct investment returns to a reward mechanism that requires more user participation, closer to the native DeFi model.

The cost of this series of operations is evident. It diluted the most direct and robust economic incentives for holding BNB, leading to its performance in bull markets being far inferior to other leading public chain tokens, with price fluctuations at times approaching that of stablecoins. This "valuation cage" built in pursuit of a traditional IPO, while legally prudent, has directly resulted in the long-term suppression of its market value and laid the groundwork for the subsequent strategic shift.

Pioneer Tron: A Demonstration of Financial Engineering on Wall Street

While BNB struggled on the compliance path, another player in the crypto world—Justin Sun and his Tron—executed a textbook-style breakthrough in the capital market, providing a new idea for all mainstream crypto assets. Tron did not choose the long and uncertain traditional IPO process but instead merged with Nasdaq-listed toy manufacturer SRM Entertainment through a reverse merger, quickly entering the U.S. capital market.

The essence of this operation lies in its complexity; it is not merely a shell listing but a sophisticated financial engineering feat. The key step involved Justin Sun's affiliates using $100 million worth of TRX tokens to subscribe for shares in the newly restructured company (Tron Inc.). This move set a precedent: using crypto assets themselves as capital to directly purchase entry tickets into the traditional financial system. After the transaction, the newly listed company Tron Inc. had hundreds of millions of TRX tokens on its balance sheet, making it the world's largest TRX listed enterprise reserve. The image of Justin Sun ringing the opening bell at Nasdaq symbolizes a successful convergence of the crypto world and Wall Street.

A deeper analysis reveals the power of this financial engineering. It not only creates a compliant, publicly tradable TRX proxy investment tool for traditional investors who cannot or do not wish to hold cryptocurrencies directly but also provides an efficient value realization channel for the founding team and early investors. Analysis indicates that by injecting tokens with costs close to zero at protocol prices into the listed company and then leveraging the public market's valuation premium, it is theoretically possible to create billions of dollars in paper gains. This model can both drive asset narratives and solve the problem of large-scale cashing out for the founding team, demonstrating significant effects. It proves to the market that bypassing the stringent scrutiny of direct IPOs and building a reserve of listed company assets can also achieve market capitalization revaluation and institutional acceptance.

BNB's Institutional New Path

Inspired by the Tron case, a larger and more intricately structured strategic blueprint centered around BNB is rapidly unfolding. It is no longer a solo act by a single company but aims to create a "BNB Reserve Asset Constellation" composed of multiple publicly listed companies, forming a diversified and sustainable source of institutional-grade demand.

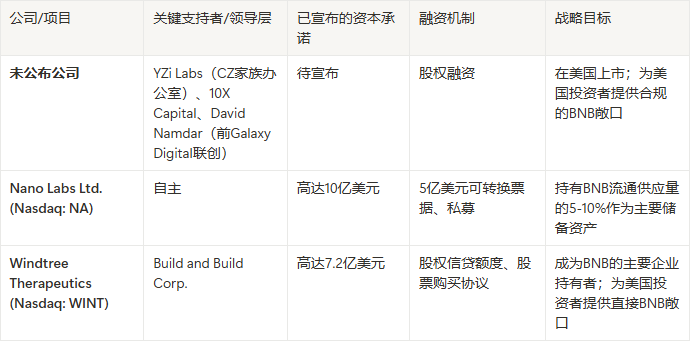

The cornerstone of this initiative stems from the collaboration between Binance founder Changpeng Zhao (CZ)'s family office YZi Labs and investment firm 10X Capital. According to multiple media reports (such as CoinDesk, The Block, etc.), YZi Labs, which was formerly Binance Labs and manages over $10 billion in assets, publicly announced its support for 10X Capital to establish a new company focused on purchasing and holding BNB, with plans to list on major U.S. stock exchanges. Crucially, the leader of this new company has been confirmed as David Namdar—the co-founder of Galaxy Digital, a well-known digital asset financial services company on Wall Street. This appointment sends a clear signal: this is not an internal game within the crypto circle but a serious initiative led by top traditional finance talent aimed at opening institutional funding channels.

Meanwhile, a market rumor has caused a stir: "CZ has set up a listed company, holding 28% of the shares, to raise funds for BNB micro-strategies." This rumor quickly gained traction, suggesting that CZ was directly orchestrating behind the scenes. In response to market speculation, Changpeng Zhao himself succinctly replied on social media X (formerly Twitter) with one word: "scam." This response initially left the market confused, but soon, a more detailed analysis clarified the facts: CZ's response did not deny the entire BNB reserve strategy but precisely refuted the inaccurate information that "he set up a listed company and personally raised funds." A more accurate interpretation is that there is indeed a new company with BNB as a strategic reserve, led by David Namdar as CEO, with 10X Capital as the asset manager, and CZ's family office YZi Labs as one of its investors, rather than a direct operator. This separation aligns with CZ's current legal identity and explains why he defined the rumors attributing direct involvement to him as "false."

Beyond this main line, a "pioneer fleet" composed of trailblazers has already set sail, demonstrating remarkable capital firepower. Nasdaq-listed Chinese chip design company Nano Labs announced a BNB acquisition plan of up to $1 billion, funded by a $500 million convertible note issuance, aiming to hold 5% to 10% of the circulating supply of BNB in the long term. Recently, the company has purchased 120,000 BNB through over-the-counter (OTC) transactions, totaling approximately $90 million. Another Nasdaq-listed company, biotechnology firm Windtree Therapeutics, has also announced a transformation, securing up to $720 million in financing commitments through equity credit lines, most of which will be used to purchase and hold BNB.

What truly reveals the scale of their ambition is the information disclosed by Changpeng Zhao on another occasion: "There are over 30 teams" exploring the establishment of publicly listed companies for BNB reserve assets. This indicates that what we are witnessing is no longer sporadic cases but a rising, coordinated capital movement.

Compared to Tron's single-point breakthrough model, BNB's "constellation" strategy clearly takes it a step further. By nurturing a decentralized network of publicly listed companies, it constructs a more resilient and scalable capital bridge. This structure disperses risk, avoids reliance on a single entity, and creates sustained demand for BNB from multiple dimensions, representing a profound practice of applying Web3's decentralization philosophy to solve traditional financial integration issues.

Win-Win for All: Building the Value Flywheel

Behind this strategic shift is a sophisticated, win-win value model. It cleverly combines BNB assets, core stakeholders, and the demands of traditional capital markets, forming a powerful positive cycle.

First, for the BNB asset itself, this strategy creates an unprecedented "permanent demand pool." When BNB is written into the balance sheets of multiple publicly listed companies, its identity shifts from a purely functional token reliant on on-chain activities to a digital commodity or strategic reserve asset recognized and endorsed by institutions. The purchasing actions from these listed companies are typically driven by capital market tools such as stock issuance or convertible bonds, making them structural and long-term rather than short-term speculative behaviors. This provides solid bottom support for BNB's price and introduces a new grand narrative based on institutional asset allocation into its valuation model.

Second, for Changpeng Zhao and the entire ecosystem, this is a highly intelligent layout in the post-regulatory and reconciliation era. By investing and supporting through his family office YZi Labs, he can maintain a legal and operational distance from the Binance exchange, where he has stepped down as CEO, thus continuing to promote the development of the BNB ecosystem while complying with legal agreements. As one of the largest holders of BNB, this strategy allows the value of his core assets to rise with the success of the entire "BNB Reserve Constellation," without the need to directly sell tokens in the public market, perfectly balancing personal legal constraints with maximizing ecological economic influence.

Finally, for traditional capital markets, this model addresses the core "access" issue. Many institutional and individual investors are unable to invest directly in crypto assets due to compliance and custody issues. However, purchasing a stock traded on Nasdaq, such as Nano Labs (NA) or Windtree (WINT), is a simple, mature, and fully compliant operation. These publicly listed companies act as a "converter," encapsulating the complexities of the crypto world and providing a seamless interface for traditional capital, potentially guiding trillions of dollars from the global stock market into the BNB ecosystem.

Dawn of a New Paradigm

In summary, the recent price breakthrough of BNB is not without foundation or origin. It is an external signal of BNB completing a profound transformation: evolving from a compliance-bound exchange utility token into an institutional-grade reserve asset supported by public market capital. The path of this transformation is not through traditional direct IPOs but rather by drawing on and surpassing the financial engineering of Tron, innovatively constructing a "Reserve Asset Constellation" composed of multiple publicly listed companies.

This model is expected to form a powerful value flywheel: publicly listed companies purchase BNB, driving the price up; the rising BNB price enhances the asset value of these companies, subsequently boosting their stock prices; higher stock prices make it easier for them to raise funds in the capital market; the newly raised funds can then be used to purchase more BNB. Once this self-reinforcing cycle is established, it will provide continuous growth momentum for BNB.

More significantly, the practice of BNB may herald the birth of a new paradigm—an "Asset-Backed Network." In this model, the value of a mature decentralized network is no longer defined solely by its on-chain economic activities but is supported by the value of assets anchored behind it that flow within compliant capital markets. This may point to a new direction for how all mainstream crypto ecosystems can deeply integrate with the global financial system and draw strength from it. Therefore, the historical new high of BNB we are witnessing may not be the endpoint of this market cycle but rather the beginning of a grander narrative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。