撰文:Prathik Desai

编译:Block unicorn

7 月 18 日,美国时间星期五,全球两大稳定币发行商的首席执行官——Tether 的保罗·阿尔多伊诺和 Circle 的杰里米·阿莱尔——在白宫东厅的观众席中并肩而坐。在他们面前,美国总统唐纳德·特朗普刚刚签署了《GENIUS 法案》,这是美国首次为稳定币制定联邦规则。

几年前,这一刻是不可想象的。

因为曾几何时,泰达币是加密货币领域的「问题儿童」。交易者喜爱它,监管者厌恶它,调查如影随形。它曾支付罚款,回避审计,极少与美国监管机构接触。但在这个七月的下午,其首席执行官却得到了美国总统的公开认可。

这是一个信号,表明这位「亡命之徒」稳定币准备成为合法公民。

《GENIUS 法案》是美国期待已久的稳定币监管尝试。该法案要求发行商建立等额储备、进行月度审计、提供赎回保证,并设立名为「许可支付型稳定币发行商」(PPSI)的许可制度。要获得资格,发行商必须持有高流动性的储备,主要持有美国国债,定期接受合格会计师事务所的鉴证,并接受美国反洗钱(AML)和合规监管。

像 Tether 这样的外国发行商只要达到同等标准并接受美国货币监理署(OCC)的监督即可参与。该法律提供了一个宽松但有限的三年过渡期,以达到这些门槛。这个过渡窗口至关重要,它让 Tether 有时间调整其结构、储备金,并将其旗舰产品 USDT 和一种新的符合美国法规的代币纳入体系。

对于总部位于萨尔瓦多的 Tether 来说,这一公开承诺标志着不小的转变。在多年规避监管和在离岸司法管辖区运营后,该公司终于踏入了全球最受审查的市场。不是出于绝望,而是出于主导地位。

尽管被高度监管的美国市场拒之门外,Tether 在全球市场上始终表现更佳。其代币 USDT 主导交易对,在新兴市场用于现实世界的支付,并在 12 个以上区块链上以无与伦比的流动性流通。USDT 的流通量超过 1600 亿美元,仅去年一年的净利润就达到 130 亿美元,不仅是最大的稳定币,也是全球盈利能力最强的金融机构之一。

这正是 Tether 进入美国的重要性所在。

保罗·阿尔多伊诺明确表示:Tether 将遵守规定。它计划调整储备金,寻求四大审计机构的审计,并与 OCC 合作,成为新法律下的许可外国发行商。与此同时,Tether 将推出第二种仅限美国的 USDT 版本,专为注重效率的机构设计。这一战略旨在同时占据市场两端:全球加密货币流动性和世界上最大经济体的受监管机构轨道。

这一新的美国金融篇章聚焦于大资金——基金发行商、银行、金融科技公司和对冲基金。对 Tether 来说,进入这个市场不是生存问题,而是谁将引领下一波全球金融轨道的问题。

如果 Tether 能向行业证明,它可以在不牺牲利润率的情况下遵守规则,它将巩固其作为稳定币行业不可或缺的领导者的地位。

然而,合规的成本是房间里的大象。

由大型事务所进行的月度审计每年可能花费数千万美元。反洗钱系统需要专门的员工和技术。美国法律下的报告义务将使公司面临更大的审查,甚至可能面临未来的政治风险。还有机会成本:为了满足流动性和透明度要求,可能需要从储备金中剔除风险较高、收益较高的投资工具。但凭借其规模和利润,Tether 有能力承受这些成本。

对 Tether 来说,转型将带来文化和运营上的挑战。该公司长期以来定位为反建制选项,特别是在对传统机构不信任度高的市场。承诺接受美国监管可能疏远这一用户基础。过去,Tether 因冻结资金已招致批评。尼日利亚或阿根廷的用户会信任一个开始回应美国传票的 Tether 吗?如果是这样,USDT 曾经提供的自由感会被什么取代?

此外,合规可能无法消除批评。

透明度倡导者和金融监管机构仍对 Tether 的过往记录表示质疑。其过去拒绝提供完整审计、不透明的所有权结构以及涉嫌参与影子银行业务仍是关注话题。监管合规可能安抚机构,但不会立即重建公众中持怀疑态度群体的信任。

与此同时,Tether 有让出更多市场份额给其最接近的竞争对手 Circle 的风险。

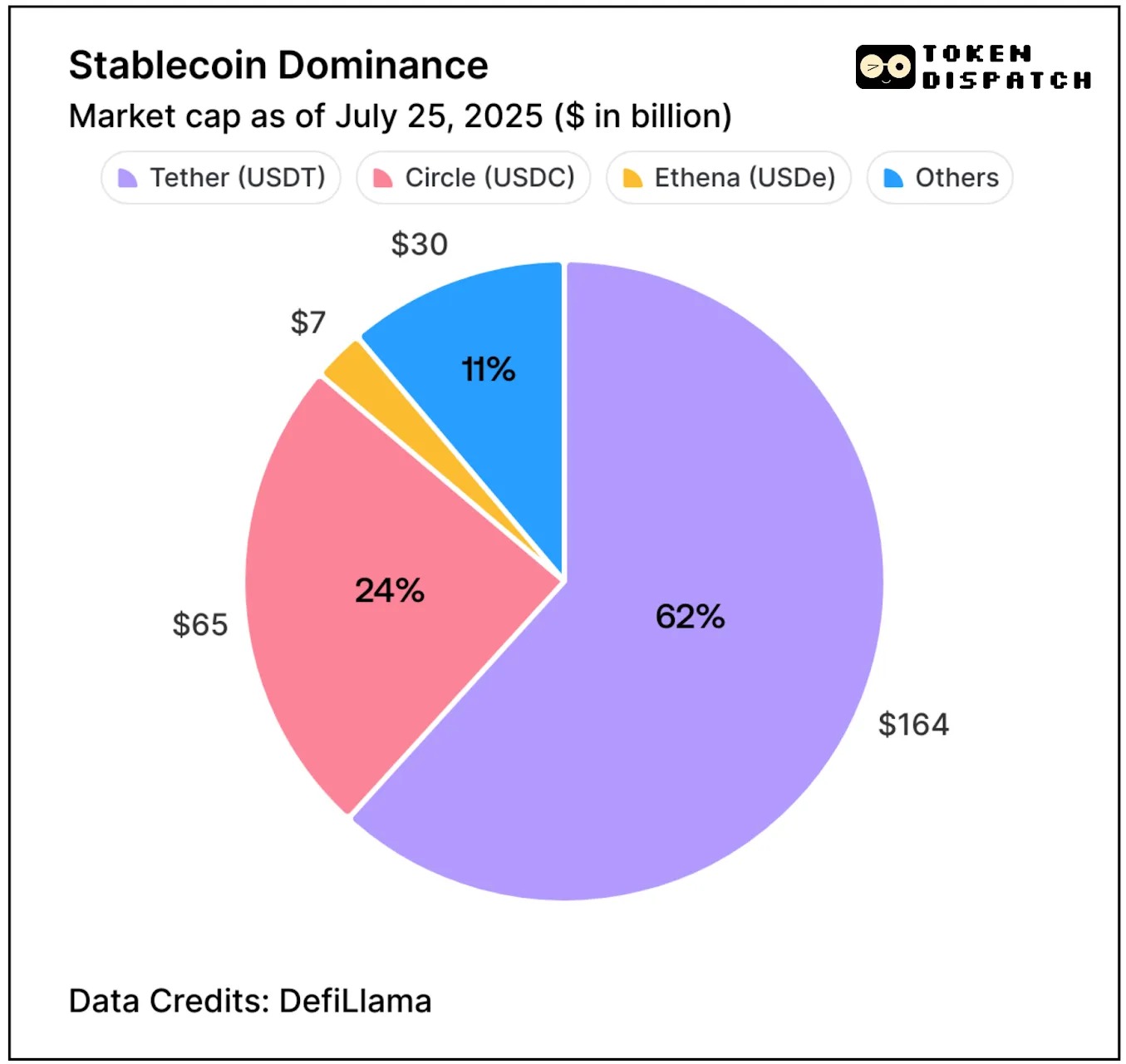

截至 7 月 25 日,Tether 在稳定币行业的主导地位已降至 61.76%,自 2024 年 11 月的 69.69% 下降了八个百分点。同期,Circle 的市场份额增加了四个百分点,达到 24.44%。

这家总部位于美国的 USDC 发行机构在合规方面也占据先机。它长期以来一直接受审计,在美国 48 个州保持着全面的监管覆盖,最近更是在华尔街首次亮相,引起了轰动。首席执行官 Jeremy Allaire 将《GENIUS 法案》视为绿灯,并指出这实际上正式确立了 Circle 多年来一直遵循的模式。尽管 Circle 近期的市场份额有所增长,但对于这家近期在华尔街首次亮相的公司来说,仍有很长的路要走。

2024 年,Tether 录得 130 亿美元的利润。年底,其持有 1130 亿美元的美国国债,70 亿美元的储备缓冲,以及超过 200 亿美元的股权。截至 2025 年 3 月 31 日,Tether 持有 980 亿美元的美国国债。以保守的 4.4% 收益率计算,其年收入已超过 40 亿美元。即使合规削减 10-15% 的收益率,其商业模式依然可行。

合规还可能带来未来收入。一个合规的 Tether 是可信的 Tether ,这可能会带来更多业务。对于迄今保持观望的机构来说,这可能就是他们所需的全部激励。

多年来,USDC 拥有信任优势。它透明、受监管、接受审计。但其市值增长停滞。与此同时,Tether 在阴影中蓬勃发展——增长更快,扩展到更多地区,成为美国公司不愿触及的市场中不可或缺的存在。

白宫的支持

在商务部长霍华德·卢特尼克(前坎托·菲茨杰拉德公司,现为 Tether 储备管理者)的政治支持下,Tether 在华盛顿有了保障。

此外,还有与比特币储备公司的联系。卢特尼克的儿子运营着坎托股权伙伴(CEP),这家特殊目的收购公司与 Twenty One Capital 合并——一家由 Tether、软银和坎托支持的比特币原生公司。这一交易进一步将 Tether 的利益与美国资本市场和政策圈交织在一起。

有了给予 Tether 三年过渡期的法律,它有足够的时间。凭借全球交易量的优势,它显然拥有杠杆。

美国市场格局取决于规模。如果 Tether 能够把握成本效益,它或许就能稳固领先地位,即使是 Circle 也难以匹敌,更不用说其他落后的稳定币发行商或新进入者了。

但这是一把双刃剑。美国刚刚为稳定币提供了一份蓝图。如果 Tether 能很好地执行,它将继续领先。如果它在合规、披露和监管上失足,它可能会发现,合法性可能像获得批准一样迅速被撤销。

在加密货币的整个历史中,Tether 是大多数用户使用的稳定币,即便他们并不信任它。

现在,它请求成为他们信任的那个。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。