撰文:Nathan Ma,DMZ Finance Co-Founder & Chairman

核心观点:

-

稳定币大爆发, 2025 年是区块链金融的 Skype 时刻

-

Web3.0 的建设失败了,建成了 Finance3.0

-

RWA 资产上链:账本必须是去中心化的,资产必须是中心化的

-

香港百币大战:新兴稳定币的挑战

-

RWA 的中东机遇:世界级数字资产中心

-

中国内地 / 香港与中东的 RWA 联动

作为区块链金融最核心的应用之一,稳定币在 2025 年迎来爆发式增长。

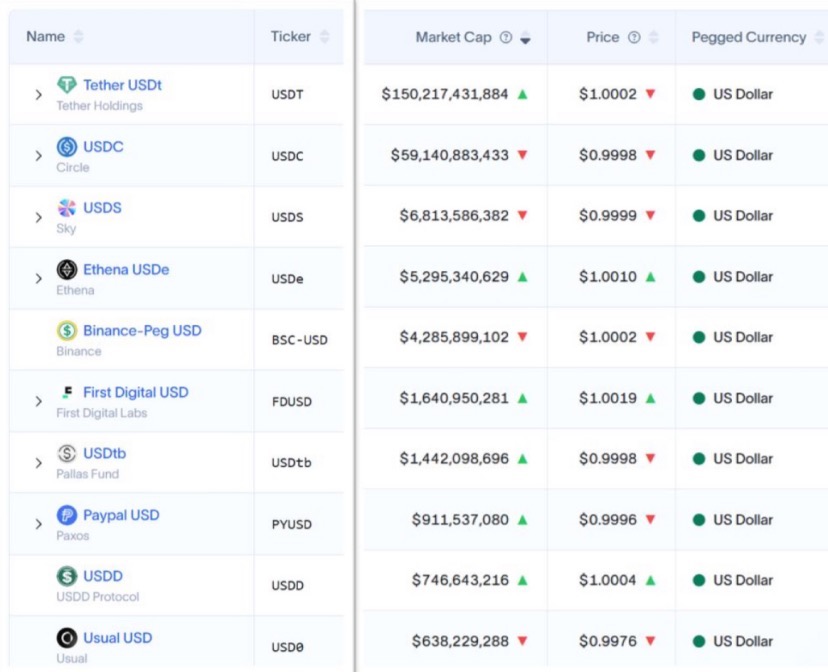

根据 RWA.xyz 数据,截至 2025 年 7 月,全球稳定币市场规模已突破 2,500 亿美元。过去 12 个月内,稳定币的活跃地址数量超过 2.4 亿个,支付笔数达 14 亿笔,交易总额高达 6.7 万亿美元。2024 年,稳定币的年交易额已超越 Visa 与 MasterCard 的合计交易额,成为全球最重要的支付载体之一。

据美国财政借贷咨询委员会(TBAC)预测,2028 年稳定币基础市值有望达到 2 万亿美元;若将付息型稳定币市场纳入统计,整体规模或将达到 3.5 至 4 万亿美元。

2025 年是区块链金融的 Skype 时刻

在 2003 年 Skype 诞生之前,打国际长途电话既昂贵又不方便。Skype 的出现彻底颠覆了传统电话网络,几乎免费地实现了全球语音与文字的即时传输。而这只是变革的开始。

2009 年 WhatsApp 上线,2011 年微信问世,微信支付与支付宝的崛起则正式拉开了互联网金融的大幕。

稳定币,作为区块链金融中最具代表性的应用之一,最初被发明是作为在链上的交易介质。但随着地缘政治制裁、全球性通胀以及国际局势的动荡,稳定币逐渐演变为对传统国际支付系统 SWIFT 的有力挑战者。

这一挑战源于其技术原生带来的效率和成本优势:传统的 SWIFT 跨境转账平均耗时约 5 个工作日,费用约为 2–3%;而基于区块链的稳定币支付则实现了 7×24 小时的全球实时到账。以 Solana 链为例,其平均每笔转账费用可低至 0.00025 美元,成本优势极其显著。

正如 2003 年互联网通信替代电话网络,今天区块链网络替代传统的银行间支付网络,这一趋势已不可逆转,而这场变革才刚刚开始。

建设 Web3.0 的努力失败了,建成了 Finance3.0

Web2.0 与 Web1.0 的真正分水岭,不在于交互方式的升级,而在于应用层的全面爆发。搜索、视频、支付、电商、游戏、社交,一切我们今天习以为常的互联网体验,都是在 Web2.0 时代集中涌现的。背后的驱动力,不是空洞的理念,而是「芯片性能与网络带宽」的飞跃式进步,直接引爆了一场前所未有的应用革命。

如果以应用爆发作为代际划分标准,过去所谓的「Web3.0」并未迎来真正的大规模应用爆发,主要是底层基础设施的创新——如分布式账本和加密货币技术。而单纯用功能层面的「中心化」与「去中心化」来区分代际,显然不够有说服力。

从这个视角看,Web3.0 的建设并未成功,建成的是「Finance 3.0」:在去中心化网络基础之上,利用加密货币作为媒介,将传统金融世界的交易所、衍生品、杠杆、借贷等功能搬上链。

-

Finance 1.0——传统金融体系

-

Finance 2.0——互联网金融

-

Finance 3.0——区块链金融

而 Finance 3.0 中最重要的应用,就是构建在去中心化网络上的稳定币,它正深刻重塑全球支付与清算网络。这种创新的颠覆性程度,可比拟火车取代马车,带来了效率与成本的质的飞跃。

RWA 资产上链:账本必须去中心化,资产必须中心化

与 Finance 2.0 不同的是,区块链网络自诞生之初便被设计为可交易资产的底层平台,最初主要支持加密原生资产如比特币(BTC)和以太坊(ETH),如今现实世界资产的代币化正在加速推进。美股代币、美债代币、黄金代币、房地产代币等纷纷上链。这不仅意味着资产可以实时转移,还能作为抵押参与借贷和 DeFi 等多样化金融服务,大幅提升了现实资产的流动性和收益潜力。波士顿咨询集团(BCG)预测,到 2030 年,RWA 代币化资产的市场规模有望达到 16 万亿美元。

在 RWA 上链过程中,有两个核心问题:一是账本(区块链)选择——公链还是联盟链,去中心化程度如何?二是上链资产的优先类型选择,哪些资产更适合率先上链?这两大问题直接影响资产上链的成败及规模。

笔者观点是:账本必须去中心化,而资产必须中心化。

一、账本选择:RWA 应首选去中心化公链

在 RWA 代币化实践中,建议首选 去中心化公链——如 Ethereum、Solana,或交易所生态公链 BNB Chain、Base 等。以美国国债代币(T‑Bill Token)为例,目前三大代表性产品: BlackRock 联合 Securitize 推出的 BUIDL、Franklin Templeton 的 BENJI、以及 QNB 联合 DMZ Finance 推出的 QCDT——全部发行在公链上。

核心原因在于它们的两大核心应用场景:

1)稳定币储备资产

BUIDL 已成为收益型稳定币 USDtb(Ethena)的主要底层资产,高峰时 USDtb 持仓占 BUIDL 发行量的 70% 以上。

Circle 已与 BlackRock 达成协议,将 USDC 储备中的 90% 的短期国债头寸换成 BUIDL,以提升链上透明度与收益。

2)交易所保证金抵押

传统金融领域早有先例:在芝加哥商品交易所(CME),超过 50% 的保证金是美债。

区块链世界也正复制这一模式:OKX 与渣打银行于 2025 年 4 月推出「Collateral Mirroring」试点项目,支持机构客户使用加密资产和代币化货币市场基金(如 Franklin Templeton 的 BENJI)作为交易抵押品。;据悉币安、Bybit 等交易所很快也将上线同类方案。

如果今天发行国债代币并上链,但选择的是联盟链或私有链,就很难参与到上述两个最关键的应用场景中,这将严重削弱上链本身的意义与价值。然而,从当前金融机构的实践来看,在初始阶段仍普遍倾向于选择联盟链或私有链,更多出于对安全性和市场控制力的考虑。至于这一选择在市场上的长期效果,仍有待进一步观察。

二、资产选择:必须中心化。

中心化程度越高,资产的标准化、评级体系与二级流动性就越成熟。按中心化程度来分:

国债 / 黄金 > 股票 > 大型银行存款 > 私募债 > 房地产 > 充电桩 > 马陆葡萄

资产的中心化对冲了区块链网络的去中心化属性,两者结合,才能在全球范围内释放流动性。充电桩上链并不能解决其流动性问题;葡萄上链,更像是概念炒作,难以形成深度市场。

香港百币大战:新兴稳定币面临的机遇和挑战

近期,随着以美国和香港为代表的国家与地区立法逐步清晰,稳定币市场的热度已达到前所未有的高点。

从功能上看,稳定币大致可分为三类:交易型稳定币、支付型稳定币和收益型稳定币,三者之间虽有交集,但侧重点各不相同。

其中,交易型稳定币的成功高度依赖于头部交易所的支持,而获得支持的代价通常是让渡大量利润——如 Coinbase 与 USDC 的关系;另一种方式则是交易所直接扶持,例如币安对 FDUSD 的深度整合与主导。

USDT/UADC 之后,形成一定规模的稳定币,主要为「收益型稳定币」,例如 Ethena 的 USDe 及 USDtb 等,其核心机制是通过收益结构(如资金费率或协议收入)向用户让渡利润,从而提高持币吸引力。

新兴的「合规型稳定币」则以支付场景为核心定位,其发行主体多为支付巨头(如 PayPal、Visa)或跨境电商平台(如 Amazon、京东等)。这类稳定币通常植根于其既有的全球支付业务中,采用「先 To B 再 To C」的推广路径。

笔者近期在香港调研时与多家机构深入交流,了解到已有上百家机构和公司正在申请或准备申请香港稳定币牌照,「百币大战」已在香港打响。但这场竞争面临诸多挑战:

1,无收益、难持有:根据美国及香港等地的监管框架,合规稳定币不得向持有用户直接支付利息,这使得用户在支付之外缺乏持有激励,影响其资金沉淀能力。

2,切入交易场景困难,交易所门槛高:热门合规稳定币发行方虽然在积极与主流交易所接洽,但由于头部交易所的「准入门票」稀缺、真正上线难度不小。

3,支付场景壁垒重重,破圈难度大:各大电商发行的稳定币多服务于自家生态,难以实现跨平台互通。很难设想 Amazon 会支持京东的稳定币,反之亦然。

为破解上述痛点,市场上已有新型创新公司围绕稳定币之间的清结算与收益整合打造解决方案。其中,获得大型银行支持的基础设施企业有着先天性的优势,其中:由新加坡金管局(MAS)孵化,专注于稳定币跨境支付,得到 DBS、J.P. Morgan、ENBD 支持的Partior;专注欧洲市场代币化,由 Credit Suisse 和 Deutsche Bank 支持的Taurus;以及 RWA 基础设施服务商,由 QNB 和渣打银行支持的DMZ Finance。

这几家机构均已入选由卡塔尔央行主导的 QFC 数字资产实验室,并被视为构建下一代稳定币基础设施的关键参与者。

RWA 的中东机遇:世界级数字资产中心

衡量一个区域 RWA 发展潜力,可从三大维度评估:监管、生态与市场。

监管维度:早在 2018 年 ,阿布扎比金融自由区 ADGM(FSRA) 就推出了业内广泛认为的 全球首批加密资产监管框架之一,包括对交易所、托管机构及发行机制的全面规范。VARA 于 2022 年成立,成为迪拜境内除 DIFC 外的虚拟资产监管机构,其后在 2024 年与 SCA 签署合作协议,为运营实体提供跨酋长国监管路径。目前,币安、OKX 和 Deribit 已获迪拜 VARA 正式牌照,Bybit 也已经取得临时牌照。

2025 年 7 月,迪拜监管 DFSA 正式批准首支代币化货币市场基金 - QCDT。该基金注册在 DIFC,由 QNB 与 DMZ Finance 合作推出,基金和代币托管都放在渣打银行(迪拜)。QCDT 融合了迪拜与卡塔尔这两大中东金融中心的力量,立足中东,辐射全球市场。

生态维度:数据显示,阿联酋主权财富基金持有的加密资产规模已超过 400 亿美元。今年 3 月,阿布扎比主权基金旗下的 MGX 公司投资币安 20 亿美元,成为首个入股顶级加密货币交易所的主权基金。与此同时,中东地区正斥资数千亿美元,建设除美国之外规模最大的 AI 算力集群。在迪拜,大量顶尖的财富管理公司、对冲基金、量化交易机构、私募基金及家族办公室都积极布局加密资产领域。

迪拜被誉为全球第三大金融中心,迪拜国际金融中心(DIFC)汇聚了 2600 多家金融机构和公司,截至 2024 年底,具体包括:

-

超过 260 家银行及资本市场机构;

-

超过 410 家财富管理及资产管理公司,其中包含 75 家对冲基金;

-

超过 125 家保险与再保险公司;

-

超过 800 家家族企业;

中国金融机构方面,DIFC 是阿联酋唯一的中国金融企业集群所在地,中国五大银行在 DIFC 银行及资本市场资产总额中占比超过 30%,且约 30% 的入驻中国企业为财富 500 强公司。

市场维度:数据显示,预计到 2025 年,将有约 9,800 位百万富翁移居阿联酋,成为当年全球吸引高净值人群最多的国家,超过美国和英国。阿联酋的加密资产渗透率预计在 2025 年达到 39%,远高于全球平均水平 6.8%。

迪拜、阿布扎比和多哈具备如下优势:

-

零个人所得税和资本利得税,且企业税率极低;

-

辐射全球的市场连接:迪拜的「十年黄金签证」政策门槛低,且与香港、新加坡、中国大陆时差仅 4 小时,和伦敦、瑞士分别相差 3 小时和 2 小时,形成理想的全球市场交叉枢纽。

因此,中东的 RWA 机遇远非传统意义上的「土豪市场」,更是面向全球机构和高净值投资者的合规市场。中东地区的 RWA 项目合规性将获得全球资本市场的高度认可。

监管、生态与市场这三大要素共同推动中东成为全球加密资产的重要中心。

中东与中国内地 / 香港的 RWA 联动

中东是离岸人民币稳定币的最佳市场,中国内地及香港与阿联酋的年贸易额超过 1,100 亿美元,与卡塔尔超过 300 亿美元。若能将部分贸易额,通过香港发行的离岸人民币稳定币进行结算,将极大激活 RWA 与中国稳定币市场的活力。

另外,国内优质资产也可以思考借助中东合规框架,在这一世界级数字资产中心舞台上展示和募资,也将为实际业务和品牌价值带来显著帮助和提升。

当 Web3.0 的理想在现实实践中受阻,Finance3.0 已凭借稳定币与资产上链,在支付、清算、交易抵押等核心金融场景中取得实质突破。其底层逻辑清晰:账本必须去中心化,才能获得全球信任;资产必须中心化,才能连接真实价值。

而在全球监管不断明朗化、传统金融机构加速入场的当下,中东正在迅速成为连接新金融基础设施与全球资本流动的关键枢纽。这里既拥有前瞻性的制度框架,也拥有全球流动性与资源配置能力,加之与中国内地和香港的经贸联动,为稳定币和 RWA 提供了可规模化的现实土壤。

我们正站在全球金融版图重塑的起点,稳定币与 RWA 的新时代,已经开启。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。