Kalshi’s $185M Raise Marks Big Win for Regulated Markets

Kalshi, the US based regulated prediction market platform, has successfully raised $185 Million in a fresh funding round by Paradigm which is basically a crypto-focused investment firm.

This deal catapults Kalshi’s post-money valuation to $2 billion, making a major milestone for the company and the broader prediction market space.

The funding was confirmed by both Kalshi and Paradigm, and firstly reported by The Wall Street Journal.

Source: WSJ

“This Feels Like Crypto in 2010”

Paradigm’s co-founder and managing partner Matt Huang, voiced strong support for Kalshi’s vision, drawing a bold comparison between the current state of forecasts markets and the early, high-potential days of crypto.

“Prediction markets feel like crypto did 15 years ago- an emerging asset class with the potential to grow into the trillions,” Huang said.

“Kalshi has the right team, to led his transformation and change the way people engage with everything from elections and economics to sports and even the weather.”

Source: X

Competition Heats Up: Polymarket’s $200M Fundraising Plans

Kalshi’s funding news arrives just as competitor Polymarket reportedly seeks to raise $200 million in a round led by Founders Fund, valuing the company at around $1 billion pre-money, according to bloomberg .

That deal, however, is still in the works, and Founders Fund has declined to comment.

Despite Polymarket eyeing a larger fundraising total, Kalshi's Investors are paying a higher premium- a sign of investor confidence in its regulatory clarity and the US market accessibility.

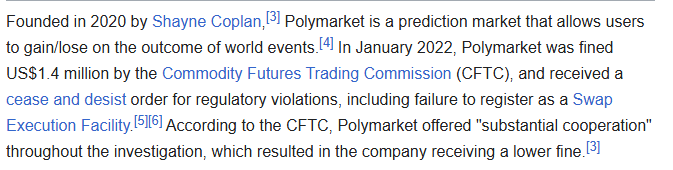

Regulatory Paths Make all the Difference

The core difference between these two companies lies in their status. The Platform collaborated extensively with the Commodity Futures Trading Commission (CFTC) to secure regulatory approval, positioning itself as a fully compliant and legally operating prediction market in the US.

US residents can use platform without restrictions, making it a safer bet for institutional investors.

On the other hand, Polymarket has been banned from operating in the US since 2022 due to regulatory issues with the CFTC .

Its services are also restricted in several countries and regions, including the UK, France, Singapore, Ontario, Belgium and more citing legal definitions that frame the platform as either unlicensed gambling or securities trading.

Safer Bets Attract Bigger Checks

In the world of risk capitals, especially for firms managing funds on behalf of institutional clients, regulatory clarity is often non-negotiable.

Kalshi’s ability to operate legally in the US gives it a remarkable edge over competition facing regulatory headwinds.

“Kalshi’s status as a entity gives investors peace of mind.” noted one by an industry analyst.

Polymarket’s Trump Card? A potential Regulatory Shift Ahead

Till now, Polymarket is not out of the game. The Kalshi's platform could benefit from a potential change in the US political landscape.

Actually, Polymarket has already made waves by securing a partnership with Elon Musk’s platform X, becoming its “official” predictions market.

The full scope of the collaboration is still unclear, but the move suggests growing mainstream interest in prediction platforms - regulated or not.

Outlook: A Defining Moment For Prediction Market

The latest funding round of signals that the prediction market is stepping into the spotlight in a more serious way.

Kalshi may redefine how people engage with the real-world events from elections and economics to sports and climate with the help of institutional backing, regulatory approvals and growing public interest.

As investors look for the next big thing beyond crypto and AI prediction markets might just be the next frontier.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。