The growth of stablecoin scale signifies a significant increase in the supply of on-chain DeFi assets.

Author: XinGPT

For those in the Web3 industry, stablecoins seem to be a term that is all too familiar. From the first day of trading cryptocurrencies, depositing funds to buy stablecoins has been a standard action.

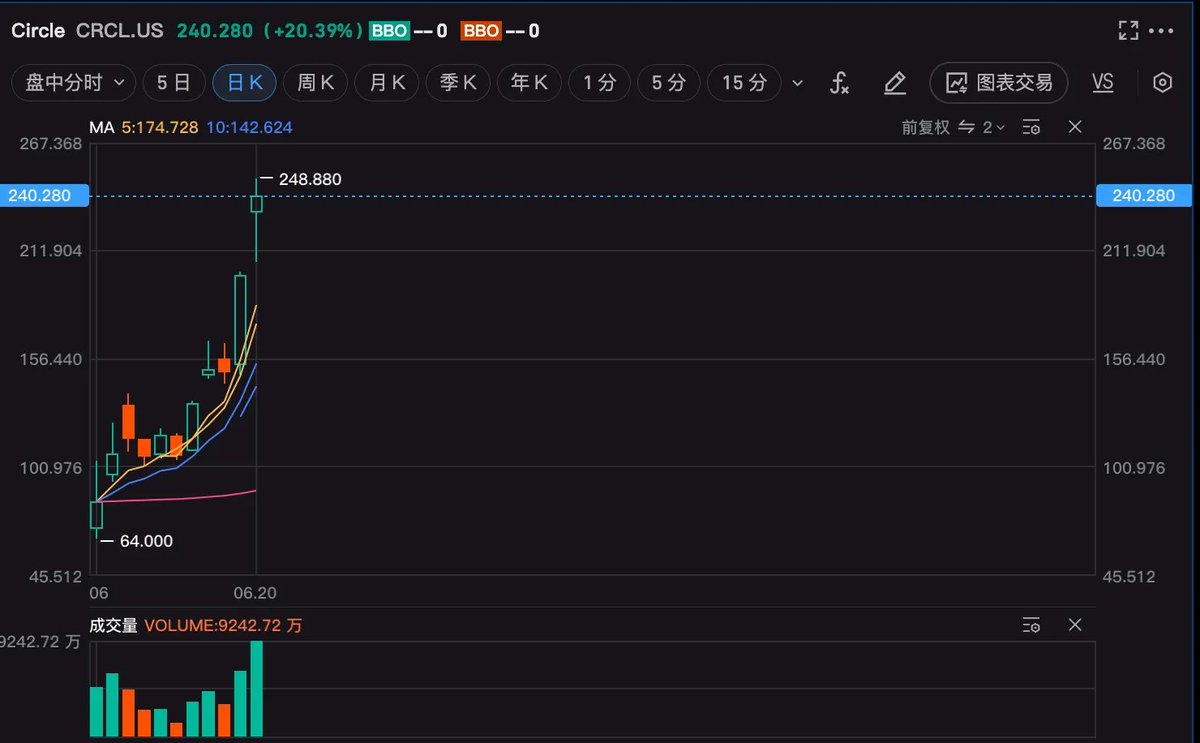

So why has Circle, the first publicly listed stablecoin company, achieved an astonishing threefold increase in just two weeks since its IPO?

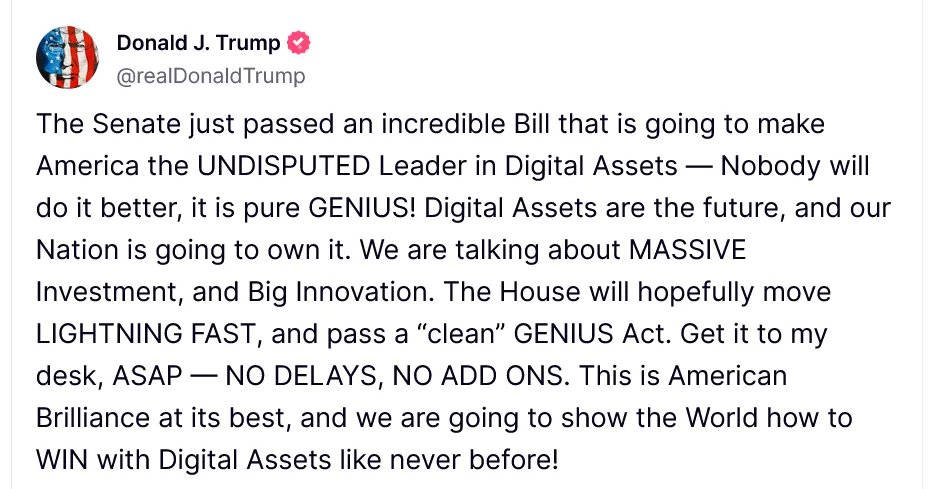

The most important catalyst comes from the U.S. Senate's approval of the GENIUS stablecoin bill on June 17. Let's analyze the main content of this bill and why it was able to pass the Senate and is likely to be officially implemented.

The main regulatory points of the stablecoin bill are as follows:

Dual-track regulatory system: The GENIUS bill establishes a clear operational framework for the stablecoin market by creating a federal and state "dual-track" regulatory framework. Stablecoin issuers must choose a federal or state regulatory path based on their scale. Large-scale issuers (with issuance exceeding $10 billion) must fall under federal regulation to ensure compliance and transparency.

1:1 reserve requirement: The bill requires all stablecoins to maintain a 1:1 reserve ratio, limited to highly liquid and safe assets. The bill explicitly allows reserve assets to include: U.S. dollar cash, insured bank demand deposits, U.S. Treasury bills maturing within 93 days, repurchase/reverse repurchase agreements, government money market funds that only invest in the aforementioned safe assets, and tokenized forms of the aforementioned assets that comply with the law. Issuers are prohibited from using high-risk assets such as cryptocurrencies as reserves.

Information disclosure and audit mechanism: To enhance market transparency, stablecoin issuers must disclose reserve status monthly and undergo independent audits. This aims to increase public trust in the stablecoin system and prevent the risk of bank runs.

Licensing and compliance requirements: Issuers must apply for licenses from regulatory agencies and comply with banking regulatory requirements. There is an 18-month transition period for existing market stablecoins to complete compliance adjustments.

Anti-money laundering and sanctions compliance: Stablecoin issuers must comply with the Bank Secrecy Act (BSA) and anti-money laundering (AML) regulations, establishing customer identification (KYC) and monitoring systems to prevent illegal fund flows.

Consumer protection: The bill stipulates that in the event of bankruptcy of the stablecoin issuer, holders have priority repayment rights, ensuring that their reserve assets are not misappropriated.

Among these points, the second one reveals a significant insight, which is likely the biggest reason why the stablecoin bill received attention during Trump's administration: debt monetization.

Senator Bill Hagerty's vision of "strengthening the dollar's hegemony" is being rapidly realized by capital: Standard Chartered Bank estimates that if the bill passes, the global stablecoin market value could soar to $2 trillion by 2028, equivalent to a giant buyer that could consume short-term U.S. Treasury bonds out of thin air. More shockingly, Tether and Circle, the two major issuers, currently hold $166 billion in U.S. Treasury bonds. Wall Street analysts predict that in the coming years, stablecoin issuers will surpass hedge funds to become the third-largest players in U.S. Treasury bonds, following the Federal Reserve and foreign central banks. Treasury Secretary Scott Bessent has calculated that if the stablecoin market reaches several trillion dollars by the end of this decade, the private sector's demand for U.S. Treasury bonds could lower government borrowing costs by several basis points—essentially using hot money from the crypto world to reduce the financing costs for the U.S. Treasury. More subtly, this demand is essentially "sucking money" for U.S. Treasury bonds globally, reinforcing the dollar's status as a reserve currency through the stablecoin pipeline. It is no wonder that Trump commented on this bill, saying, "Get it to my desk as soon as possible, the sooner the better."

Although the final passage of the bill still requires review and approval by the House of Representatives before being submitted to the President, market expectations suggest that the stablecoin bill's eventual passage and implementation are already a foregone conclusion.

What impact will the stablecoin bill have on investments?

Let's first look at Circle. With Circle's current market capitalization estimated at around $50 billion, the profit for 2024 is projected to be $160 million, and for 2025, based on optimistic estimates from Q1 financial reports, the annual profit is expected to be $490 million, corresponding to a price-to-earnings ratio exceeding 100 times. This assumption requires the issuance of USDC to approach three times that of the end of 2024, reaching a scale of $120 billion, needing to double from the $60 billion base in June 2025, while Tether USDT's issuance scale is only $150 billion. Such financial estimates are clearly an almost impossible task for Circle.

However, the market is not foolish; why is Circle given such a high premium?

Arthur Hayes, founder of Bitmex and investor in the Ethena stablecoin, commented:

U.S. Treasury officials believe that assets under stablecoin management (AUC) could grow to $2 trillion. They also believe that U.S. dollar stablecoins could become a spearhead, both promoting/maintaining dollar hegemony and acting as buyers insensitive to Treasury bond prices. This is an absolutely important macro tailwind.

The dream of market capitalization is that stablecoins are almost portrayed as Trump maintaining dollar hegemony, enhancing the attractiveness of U.S. Treasury bonds, and further driving the Federal Reserve to lower interest rates as a financial lever. For such a leading stock in this track, is $50 billion too expensive? Even if it were $100 billion, it wouldn't be considered expensive.

What other investment opportunities exist in the stablecoin sector?

If we view stablecoins as cars, the automotive industry chain can be divided into manufacturing (automakers), selling (distribution channels), car parts, car maintenance, and car service; in the case of stablecoins, the industry chain includes creating stablecoins (stablecoin issuers), selling stablecoins (stablecoin channels), related application scenarios (services), and technical support (parts).

The issuance of stablecoins has already become a track for the elite. Tether occupies the market for all underground dollars (black and gray markets) and is actively working to launder and legitimize its operations. Circle currently leads in the compliant market but will face significant competition in the future, as payment giants (PayPal, Stripe) have their own channels, and distribution costs will inevitably be less than half (for a detailed cost analysis of Circle, see my previous writing https://x.com/xingpt/status/1930305013404053909); the USD1 backed by Trump's team is likely to take a share from Tether and Circle.

I prefer to view other issuers as extensions of channels, such as multinational logistics and e-commerce companies, where issuing their own stablecoins may not be as cost-effective as using mainstream stablecoins to earn commission revenue.

For startups, I am more optimistic about stablecoin service providers in niche scenarios, similar to traditional payment companies like Square, which focus on stablecoin acquiring in specific scenarios. If I tell merchants that my acquiring fee rate is 90% lower than traditional cards, it will be much easier to accept than trying to convince them to accept a stablecoin payment called USDC.

As for the choice of niche scenarios, I believe that small cross-border payments are a pain point. Remote small remittances through SWIFT cost $10-30, with an arrival time of 1-3 business days. In contrast, stablecoins offer near-instantaneous arrival times and almost negligible transfer costs, enhancing user experience by more than 10 times. Channels that can bridge this niche demand may become the PayPal of the stablecoin era.

Technical support service providers, such as custody and Regtech, are, in my opinion, a relatively low return on investment entrepreneurial direction. Compliance costs are high, operations are heavy, profit margins are low, but they are very stable, counter-cyclical, suitable for defensive entrepreneurs looking to earn stable cash flow, or for large companies to incubate internally, such as Ceffu, CB Custody, etc.

What other opportunities exist in the secondary market for stablecoin concepts besides Circle?

The increase in Circle's market capitalization directly benefits Coinbase. Before the unequal treaty is abolished, Coin can reap the benefits with a 50% channel fee;

Other newly listed stablecoins may also be subject to speculative trading similar to Coinbase, and some brokerages, payment, and card organizations will depend on the progress of integrating into the stablecoin network:

In the crypto space, the growth of stablecoin scale means a significant increase in the supply of on-chain DeFi assets, benefiting leading lending protocols like Aave and Morpho. It also means that companies like Ondo and Maple Finance, especially those that are tokenizing U.S. Treasury bonds, have the most direct advantages.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。