The role of tokens has gone through a cycle of prosperity, disillusionment, and iterative progress.

Written by: Stacy Muur & Binance Research

Translated by: Felix, PANews

Binance Research released a report on the evolution of token models on June 12. Recently, crypto KOL Stacy Muur summarized the report, and this article expands on the 10 key points to provide a comprehensive overview. Here are the details.

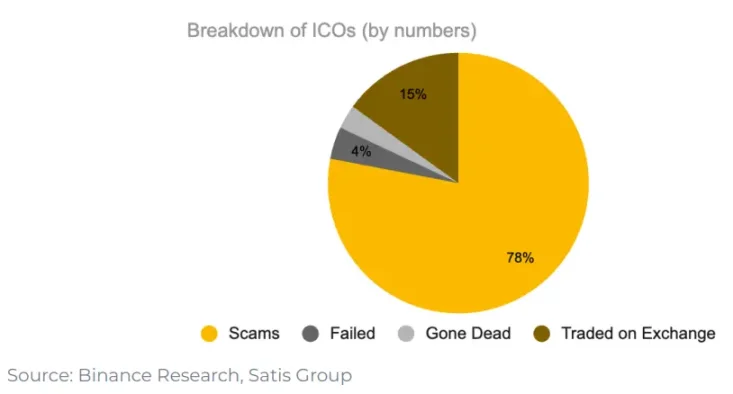

1. In the ICO era, only 15% of projects made it to exchanges

In the ICO era, only 15% of projects were able to enter exchanges. Among them, 78% were outright scams. The rest either failed or became irrelevant.

ICOs indicated a strong demand from retail investors to participate in startup financing. It was a new type of funding channel, functioning like a free market—no permissions, no intermediaries. Although many projects failed, it paved the way for the future, making remaining investors more savvy and cautious in choosing investment companies. This ultimately gave rise to more resilient projects such as Aave, 0x, Filecoin, and Cosmos.

Key points:

ICOs created an incentive dilemma for founders, which could hinder protocol development.

ICOs also attracted a wave of developers drawn by strong retail interest, although not all projects were built with long-term sustainability in mind.

Overall, ICOs represented a new form of capital formation accessible to all, showcasing retail investors' strong interest in participating in startup financing.

2. Liquidity mining has advantages in guiding protocol growth

Liquidity mining began with Synthetix in July 2019 and quickly gained popularity in the DeFi space. Compound Finance further deepened the concept of liquidity mining by granting governance rights to its tokens. The yield aggregation platform Yearn Finance borrowed the concepts of governance rights and liquidity mining and iterated on them. Similar to Synthetix and Compound, the YFI token is used to guide liquidity through liquidity mining and holds governance rights over the protocol. Yearn Finance also adopted liquidity mining as a fair launch mechanism.

3. The practice of treating governance as token utility has not worked

However, the idea of treating governance as token utility has not led to sustained demand for tokens. Taking Uniswap as an example, after the airdrop, only 1% of UNI wallets increased their holdings, and most airdrop recipients sold their tokens. 98% of wallets never participated in the governance process (voting).

Despite the good intentions behind these experiments aimed at fairly and targetedly distributing tokens, governance rights ultimately did not provide token holders with sufficient reasons to continue holding.

Key points:

Liquidity mining was the first iteration of token distribution, guiding protocol users through rewards, later experimented as a fair distribution method.

Retroactive airdrops were also introduced as another form of token distribution, aimed at rewarding organic use of the protocol and achieving a broader distribution of governance participants.

Governance rights were the first form of token utility, allowing token holders to participate in decision-making at the protocol level. However, given the reflexivity when prices began to drop, governance could not maintain demand in the long term.

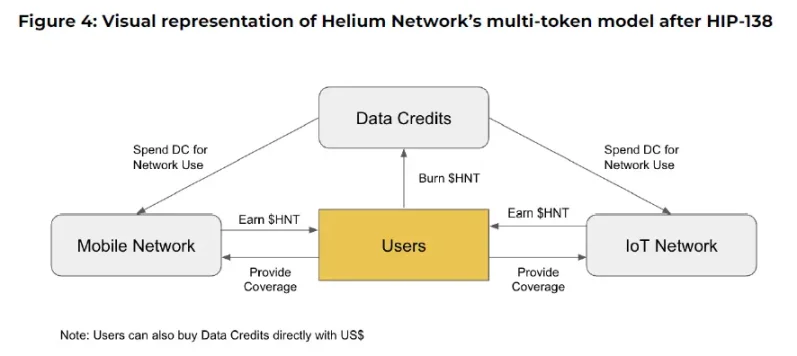

4. The idea of distinguishing speculative demand from native economics in a multi-token model is difficult to execute

The novelty of liquidity mining extends far beyond the summer of DeFi. The ability to use protocol tokens for free as a tool for resource acquisition led to the rapid success of Web3 games like Axie Infinity and DePIN networks like Helium. Both Axie Infinity and Helium did not adopt a single-token model but instead used a multi-token model to distinguish between speculation and utility. One token was used for value accumulation, while another was used for network usage. However, in both cases, this distinction did not work. Speculators flocked to buy the wrong tokens, leading to misaligned incentives and value disconnection. Ultimately, both returned to simplified models.

Key points:

The concept of liquidity mining further expanded, becoming a guiding tool for other use cases like gaming and DePIN.

The idea of distinguishing speculative demand from native economics through a multi-token model is difficult to execute and often fails due to the lack of utility of one of the tokens.

Token economics is an iterative process, and only when a product gains attention do the interests and needs of stakeholders become clearer.

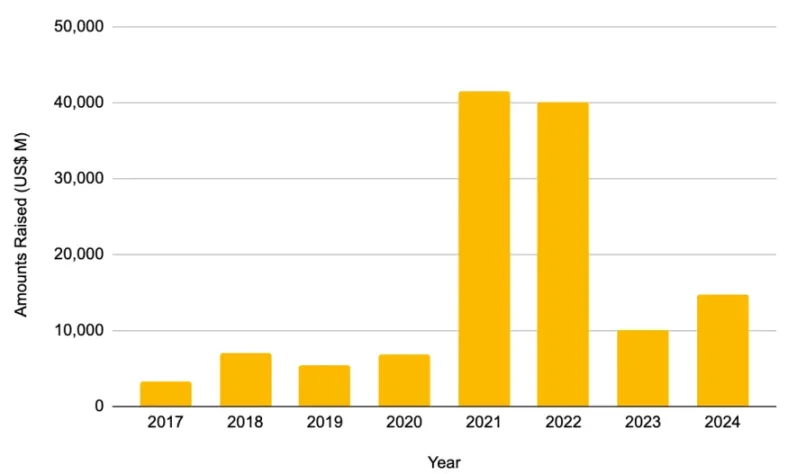

5. Surge in private financing: a shift to valuation games

The years 2021-2022 witnessed explosive growth in private financing, raising $41.46 billion and $40.12 billion, respectively. In another perspective, the funding amount in 2021 alone was nearly double that of 2017-2020 ($22.6 billion). Since then, this growth pattern has not reappeared.

To accommodate the influx of funds, projects began to conduct more rounds of financing to accommodate more investors and extend their development paths. Given the increased rounds of financing before TGE, private investors often extended token lock-up periods, leading to a decrease in the proportion of circulating supply at the time of token issuance. Coupled with airdrops and incentive mining, this could lead to inflated metrics, thereby helping to boost the initial FDV. Private funding inadvertently shifted the focus from token utility to optimizing valuation.

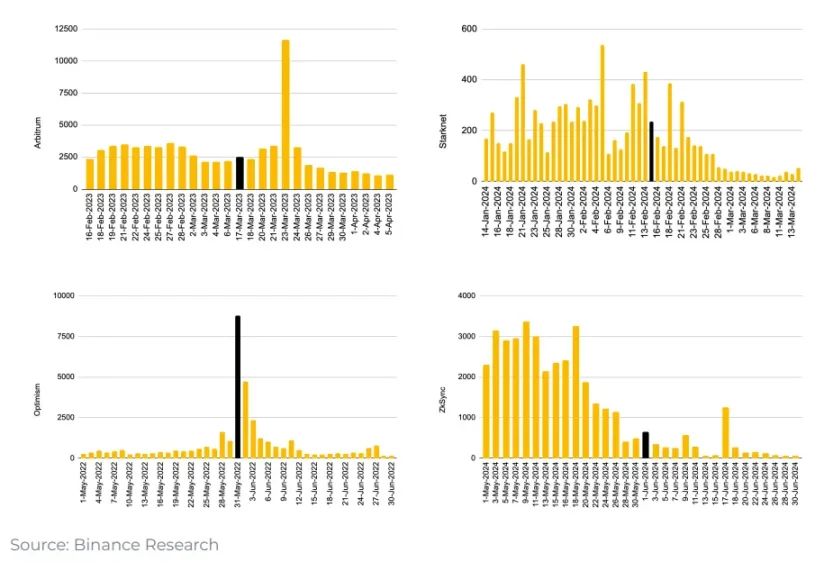

6. After L2 platform airdrop snapshots, bridging activities decline

However, after the airdrop ends, a decline in protocol metrics (see below) and market valuations is typically observed. This has led to a negative perception of the "low circulation, high FDV" issuance model that has been common over the past two to three years.

All well-known L2 platforms see a decline in bridging activities after announcing the completion of snapshots.

7. Tokens with higher circulation and lower FDV perform better after listing

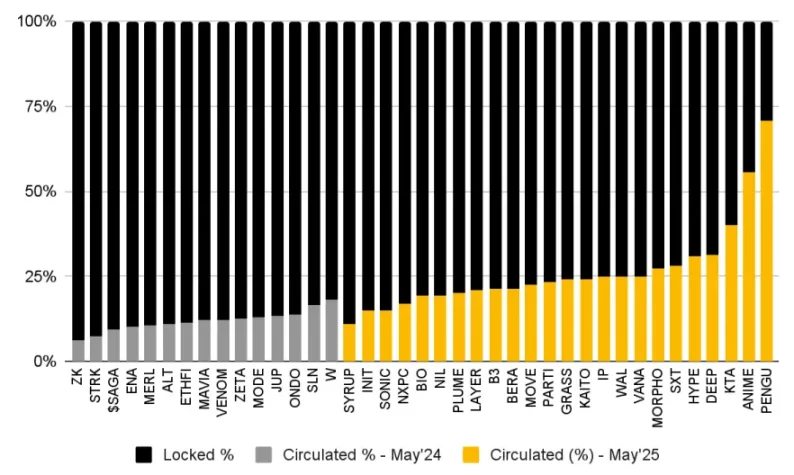

Compared to the analysis conducted in May 2024 (in gray), the circulation of recently issued tokens (in yellow) has steadily increased. This means users can "vote with their wallets," choosing to abandon tokens with unfavorable token economics. Therefore, projects must adapt to community needs, seeing healthier circulation across all projects.

Recent tokens show an upward trend in circulation compared to last year.

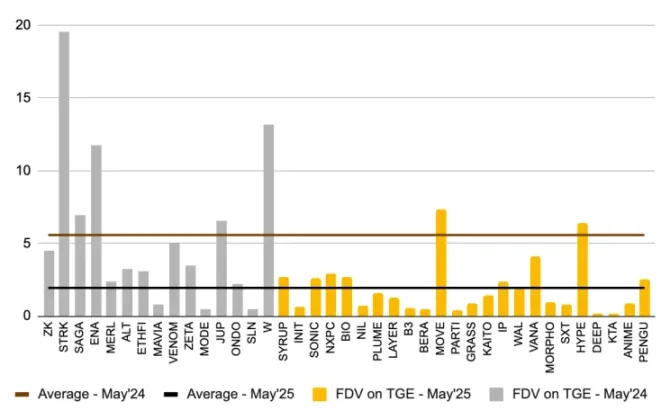

Similarly, comparing recent tokens with previous analyses shows that the fully diluted valuation at issuance has decreased. The average FDV of recently issued tokens is $1.94 billion, while the previous analysis averaged $5.5 billion.

The average FDV of recent TGEs has decreased by over 50% compared to a year ago.

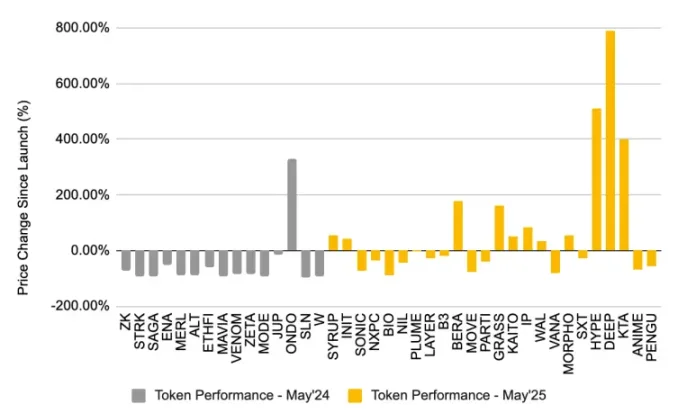

Compared to tokens analyzed in May 2024, recently issued tokens with higher circulation and lower FDV have shown stronger price performance (see below).

8. Token buybacks are on the rise

In 2025, token buybacks are trending upward, with projects like Aave, dYdX, Jupiter, and Hyperliquid implementing such plans to buy and burn tokens from the market using protocol revenue.

Projects that can successfully conduct token buybacks should be viewed positively, as only financially strong projects can do so. The reality is that many crypto projects have failed to find product-market fit, and those that have found it still need to discover the best ways to promote organic demand for tokens. Buybacks may serve as a transitional measure, allowing projects to focus on growth while avoiding interference from token prices.

9. Hyperliquid leads the token buyback trend

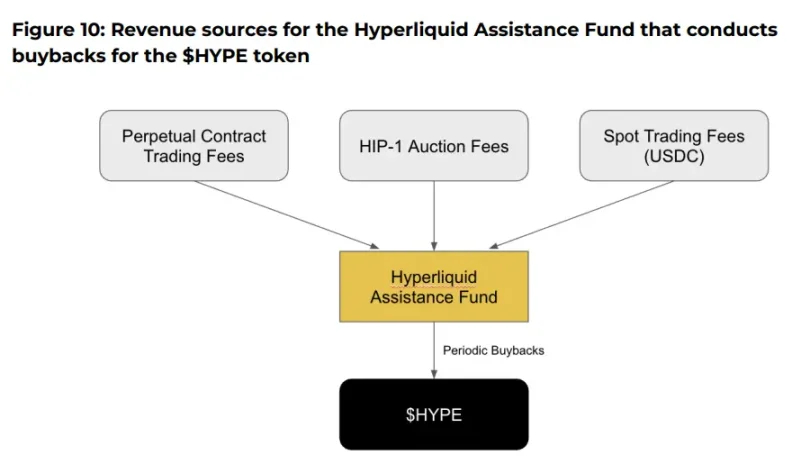

Hyperliquid currently leads the token buyback trend, having burned over $8 million worth of $HYPE tokens. What sets Hyperliquid apart is that buybacks are an integral part of its economic model. 54% of perpetual trading fees, spot trading fees, and HIP-1 auction fees are all used to buy back tokens. As of May 28, 2025, the Hyperliquid Assistance Fund holds 23,635,530.65 $HYPE tokens, valued at approximately $786 million.

However, with no revenue flowing to token holders, buybacks merely support the price. Critics argue that these funds could be better utilized beyond artificially creating scarcity. For example, Hyperliquid could consider distributing USDC fees generated from trading to reward $HYPE stakers. In this case, there would be a closer connection between the $HYPE token and protocol growth (as well as fees). Tokens with revenue can better align incentive mechanisms.

10. ICM remains speculative, with most issued tokens resembling memecoins

Believe is an emerging participant in the ICM movement, allowing users to easily create tokens on the Solana blockchain by posting a specific format (e.g., "$TICKER + @launchcoin") on X, thereby triggering automatic token deployment through a bonding curve model.

This simplified process enables creators and founders to issue tokens without the need for technical expertise or traditional financing barriers. The platform then shares transaction fees equally between the creators and itself, with tokens reaching a market cap of $100,000 being transferred to deeper liquidity pools on platforms like Meteora.

Since then, Launchcoin has experienced rapid growth, having issued over 27,495 tokens and achieving a total trading volume of $3.4 billion as of May 29, 2025. Although the sample size is still relatively small, the potential of transaction fees as direct income for creators is significant, allowing founders to fund development without diluting equity. At its peak, Believe's daily transaction fees exceeded $7 million, with 50% going to the creators. In contrast, Virtuals had daily transaction fees of $350,000 at its peak.

However, today, ICM remains speculative, with most issued tokens resembling memecoins. Given the permissionless nature of such platforms, over 27,000 tokens have been issued solely on Believe, leading to market saturation, diluted liquidity, and distracted investor attention from legitimate startups. Other issues include sniper bots, highlighting the technical challenges that could undermine the success of legitimate startups.

Overall, the ICM movement shares many similarities with the ICO investment era. It upholds the same principle of making funding accessible to everyone but provides greater accessibility for founders.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。