原创|Odaily星球日报(@OdailyChina)

作者|Wenser(@wenser2010)

随着美国突袭伊朗核设施基地一事的逐渐扩散,加密市场再度迎来猛烈下跌,BTC 一度失守10万美元大关,ETH 价格则下跌至2300美元下方,由此,一场属于空军的牛市或许已然拉开了帷幕。

近几日,无论是做空的个人交易者还是机构,几乎都处于盈利状态,不少交易员甚至扬眉吐气一般对外发声,堪称“打了个翻身仗”。

目前来看,市场仍处于地缘政治冲突下的恐慌性下跌与小幅回弹之间左右横跳的状态,Odaily星球日报将于本文探讨“空军牛市”的后续持续时间及关键性影响因素,供读者参考。注:本人仅为观点视角分享,不构成投资建议。

空军大牛市 VS 震荡型陷阱:只要你开空,就能赚钱?

在伊以局势越发紧张的当下,曾经作为避险资产的 BTC 如今已经成为全球经济体中的一部分,“伊以冲突,钱包买单”已成为不少加密人群无奈的自嘲。而在这样的市场形势下,做空群体却是赚得盆满钵满的那一小撮人。

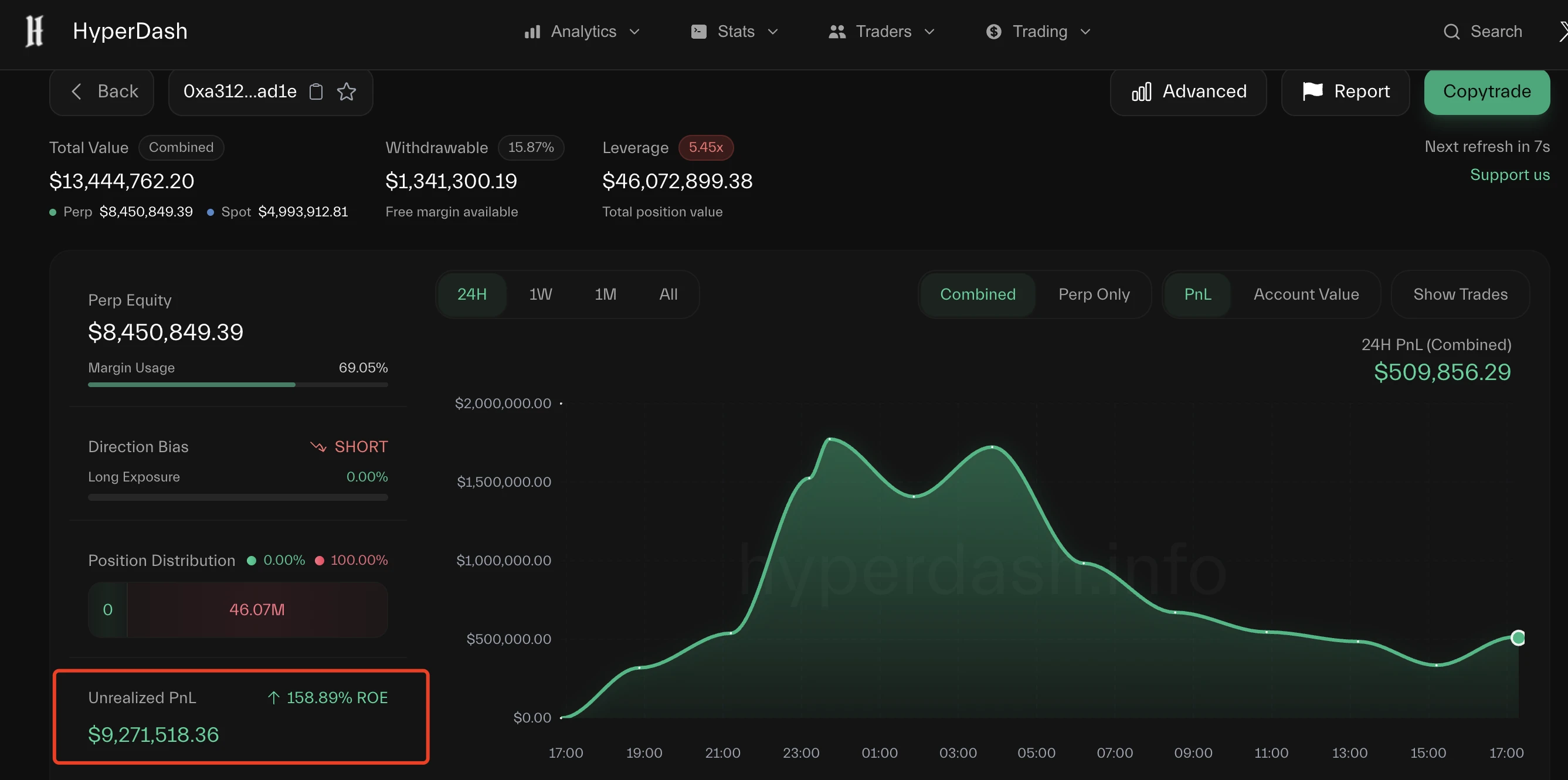

“空军头子”发威:做空16种代币,浮盈近1000万美元

6月20日,Hyperliquid 上一位做空 16 个山寨币的“空军头子”累计盈利暂报 968 万美元,远高于上周的 356 万美元,彼时,其 16 个持仓中有 15 个为浮盈状态,唯一浮亏的 HYPE 亏损已缩窄至 192 万美元,整体仓位价值约为 5330 万美元。

值得一提的是,该巨鲸于6月17日已部分平仓了 ETH、PEPE、INIT、XRP 在内的多个标的,锁定了部分利润。

https://hyperdash.info/zh-CN/trader/0xa312114b5795dff9b8db50474dd57701aa78ad1e

目前,该地址已提出134万美元资金,账户下浮盈利润仍然高达 927万美元。值得一提的是,造成其唯一损失的代币是 HYPE,目前浮亏约 170万美元。

无独有偶的是,“空军头子”不止一个。

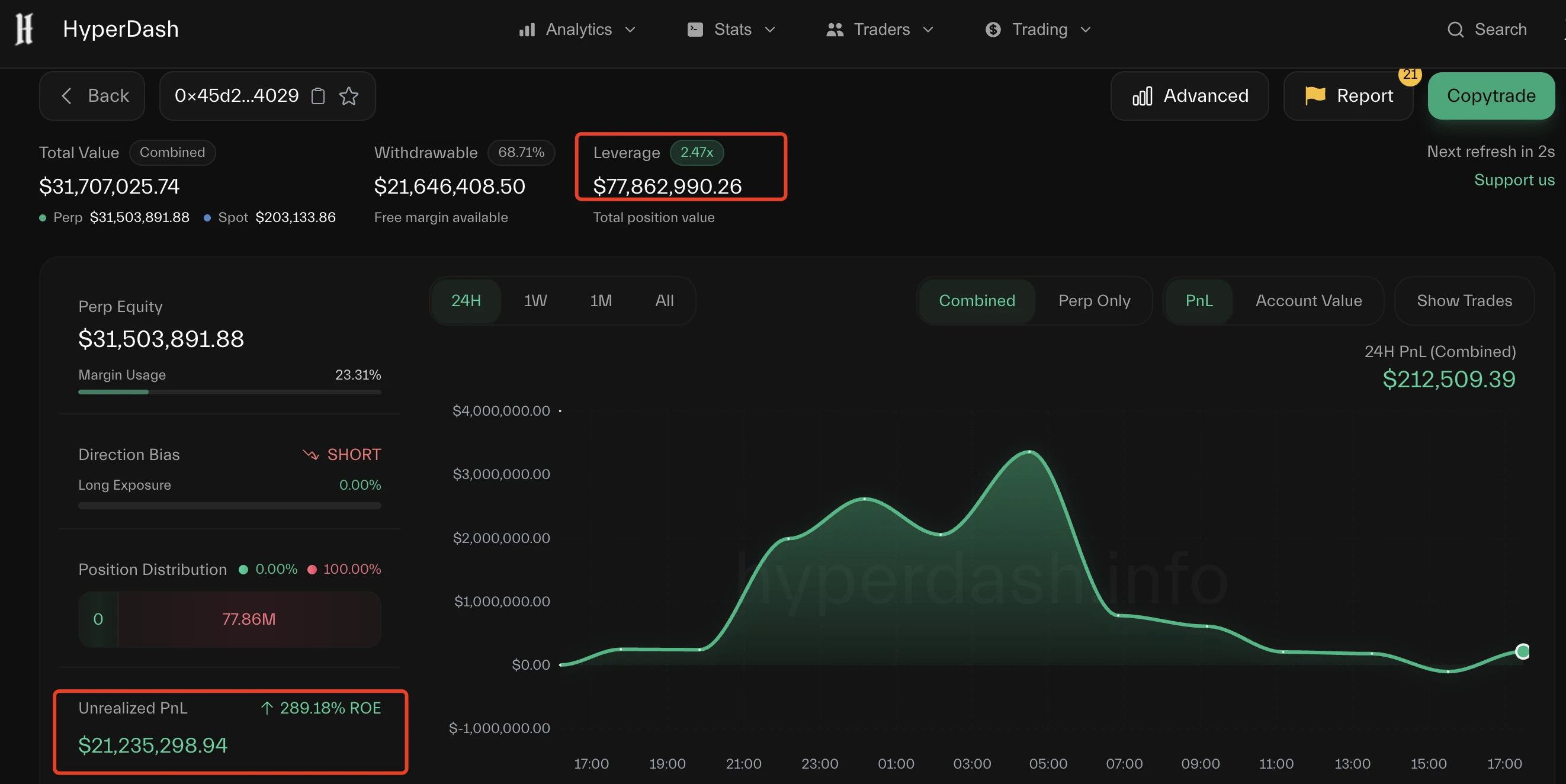

“空军巨鲸/机构”:做空58个代币,浮盈超2000万美元

6 月 16 日起,某巨鲸/机构开启了自己的“空军之旅”——其在 Hyperliquid 上开空 58 个币种,包括 BTC、ETH、SOL、XRP、PEPE、FARTCOIN、DOGE、AAVE、HYPE等。目前,该地址浮盈 2134 万美元,其仓位规模达到 7779 万美元,58 个空单中只有两个为浮亏状态,为 HYPE(浮亏约 428 万美元)、 AAVE(浮亏约 1.6万美元);战绩最好的则是 ETH, 浮盈 443.8 万美元。

https://hyperdash.info/zh-CN/trader/0x45d26f28196d226497130c4bac709d808fed4029

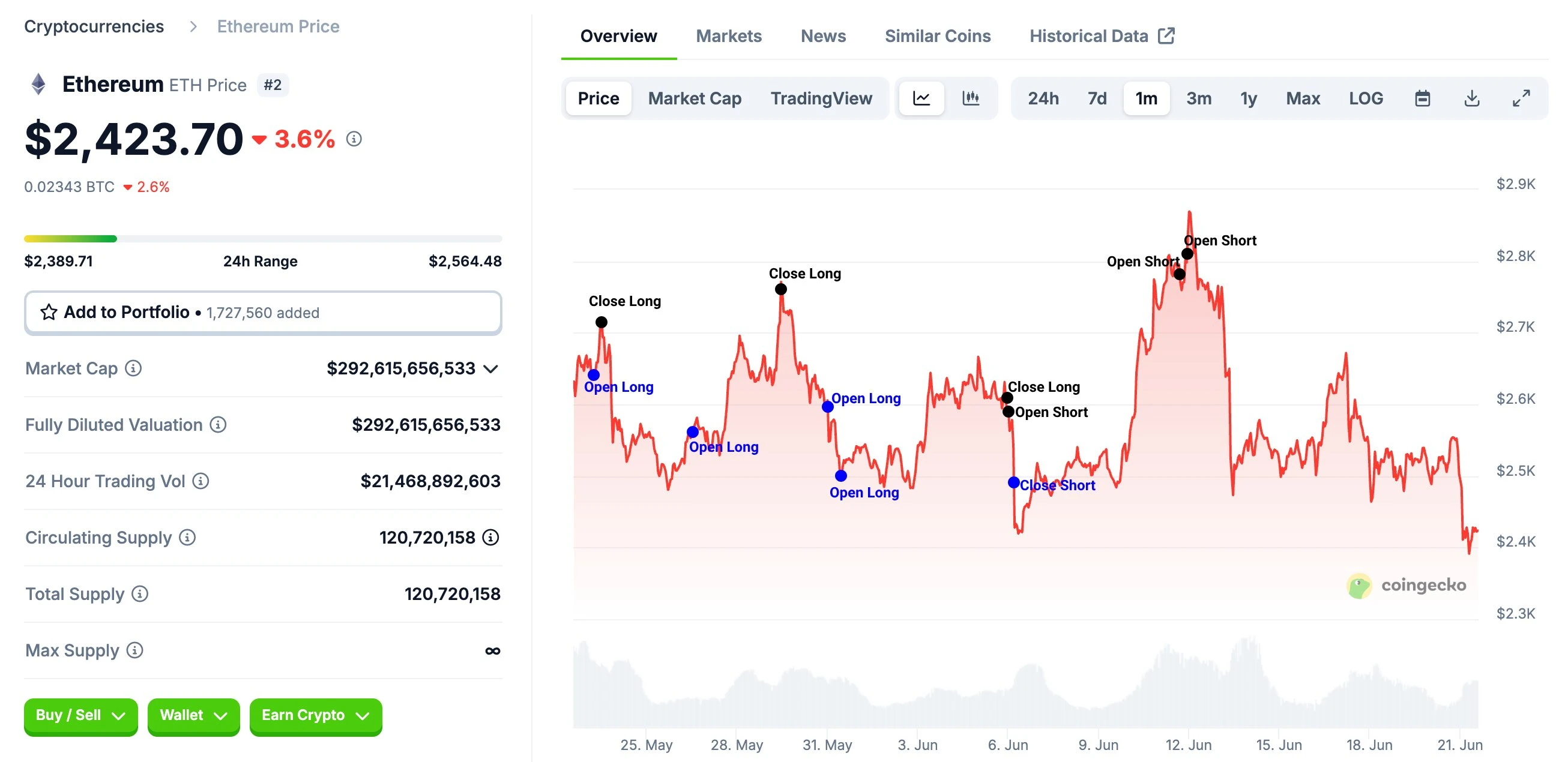

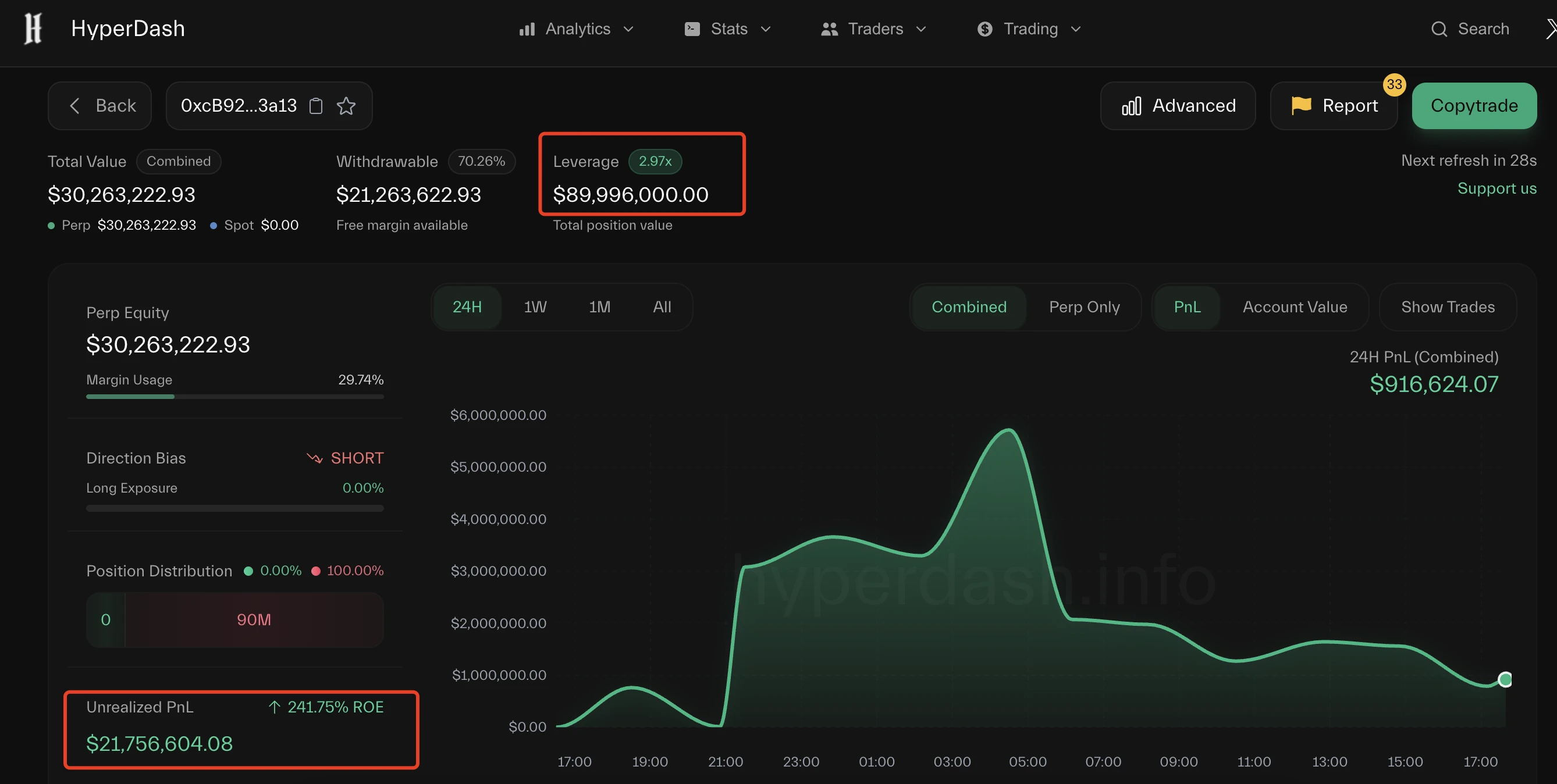

ETH 聪明钱:顶部做空,浮盈超2000万美元

除了“无脑做空”的空军头子,此次做空热潮中还包括了“ETH 聪明钱玩家”。

据 LookonChain 监测,某底部做多 ETH 聪明钱过去一个月操作几乎完美无缺,每次都能在 ETH 大幅下跌之前平仓,在顶部做空,此前一个月曾狂赚2000万美元。目前,该地址累计浮盈超2175万美元,仓位价值高达约 9000万美元。

https://hyperdash.info/trader/0xcB92C5988b1D4f145a7B481690051F03EaD23a13

业内人士观点一览:数据党统计、交易员观点、美股山寨牛市、特朗普等“不稳定因素”

身处当下市场,针对目前下跌震荡的局势,业内人士也纷纷给出了自己的观点看法,有人从数据方面出发,有人则更多基于宏观层面风险给出自身观点,也有人认为此前 Circle 上市及美股山寨牛市一定程度上影响了加密市场的流动性,结合美国总统特朗普“冒天下之大不韪”做出的种种骚操作,共同构成了加密市场的“不稳定因素”。

数据统计:半年内新低代币数量达294个

据加密 KOL @zxw018018 发文统计,前1000交易量币种中:半年新高标的代币仅有 9个;半年新低标的代币数量则高达 294 个。他个人认为,这是“山寨持续归零中”的一大表现。

交易员James Wynn:增持空单,BTC短期目标为 9.3到9.5万美元

此前因做多 BTC 而声名鹊起、最终又因高频开单的交易员 James Wynn 近日发文表示,已“加大仓位做空”,并将比特币短期目标价定在 93,000 至 95,000 美元。

他指出,在更多国家可能加入战局的背景下,市场仍未充分反映现实风险。此外,美国并无降息预期,所谓的多头逻辑仅依赖全球流动性扩张,但这并非来自美元体系。此外,其进一步提出阴谋论,认为美国政府可能希望通过某种“黑天鹅事件”迫使比特币下跌,从而为其自身创造低位建仓的机会。(当然,这纯属主观个人臆想。)

而美国突袭伊朗核设施一事确实在某种程度上加剧了外界对伊以冲突扩大化的猜测与市场“用脚投票”的下跌走势。

美股山寨牛市:BTC储备阵营壮大,Circle引领稳定币板块

对加密市场产生重大影响的另一重因素,则在于 BTC ETF、ETH ETF 通过之后的美股市场。

一方面,Strategy 的“囤币策略”被 Metaplanet 等上市公司成功验证,成为不少上市公司储备资金、拉升股价的拿手好戏,这进一步影响了圈外资金流入加密市场的可能性和规模;另外一方面,携“稳定币第一股”概念强势登陆美股的 Circle 以及波场TRON反向合并的 SRM 公司成为美股市场的“山寨王者”,稳定币板块由此引领了近期的美股山寨牛市。

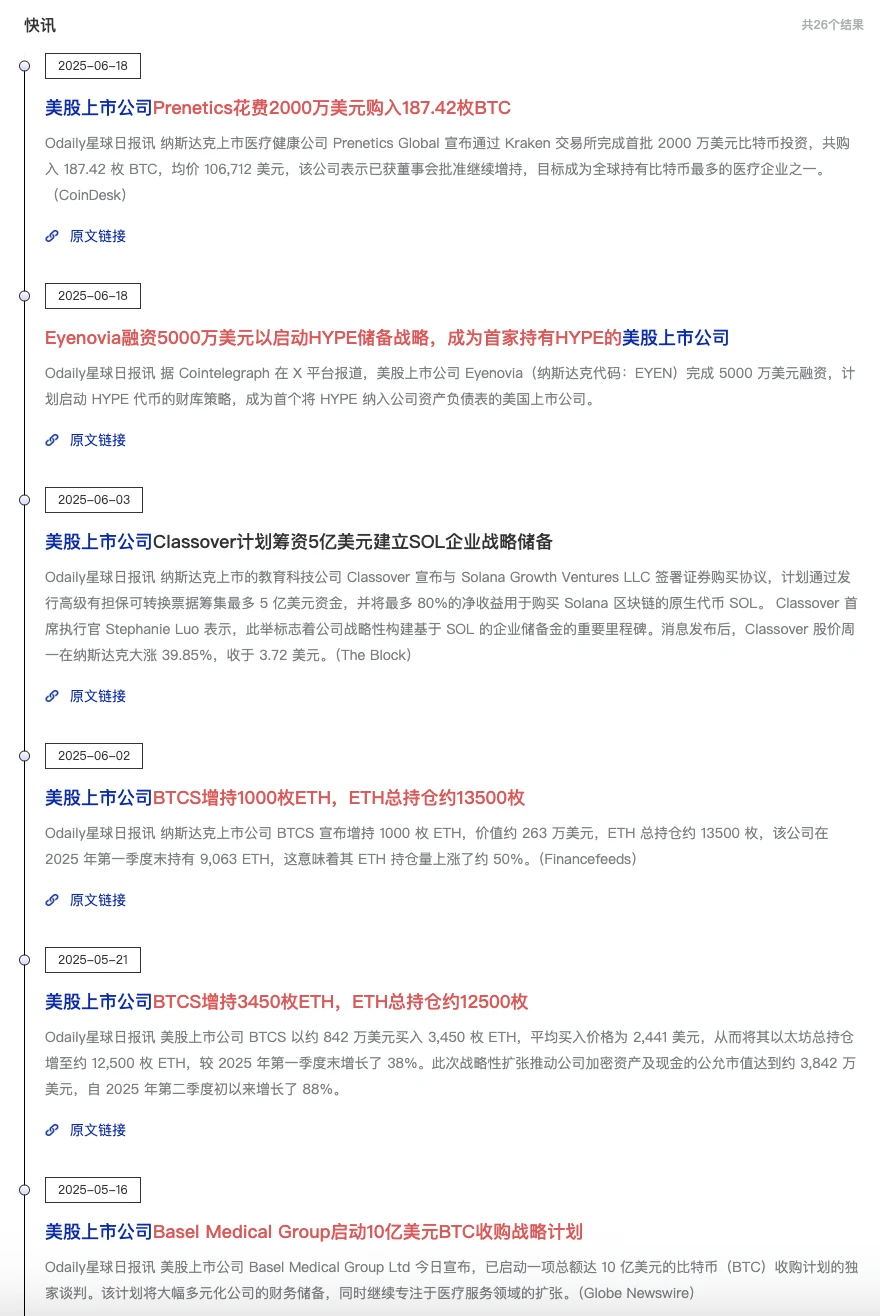

美股上市公司囤币近况

出乎不少加密人群意料的是,Circle 股价居然一路飙升至如今的接近260美元,这在一定程度上也对山寨币市场产生了“虹吸效应”,资金流动性进一步萎缩。

特朗普促使局部地区热战进一步白热化,美国处于战争泥潭边缘

至于特朗普,对于现在的伊以冲突而言,毫无疑问是个十足的搅屎棍。

6月20日,美国白宫就伊朗问题给出的态度是:美国总统特朗普将在两周内决定是否对伊朗采取军事行动。

而就在短短的2天后,特朗普则耀武扬威般对外界表示,美军已完成对伊朗福尔多、纳坦兹和伊斯法罕三处核设施的打击行动,其中福尔多为主要目标并已实施全弹量投掷。

如此反复多变的政治态度与雷厉风行的军事打击,进一步加剧了中东地区伊以局势的紧张程度,最新消息显示,伊朗方面计划关闭石油运输咽喉管道——霍尔木兹海峡,此举已得到伊朗议会批准,但仍需等待最高安全机构最终决定。

甚至,特朗普还喊出了“MIGA”(Make Iran Great Again)的口号,暗示伊朗当局应考虑政权更迭。

不得不说,商人出身的特朗普对于发动战争的心理压力远远小于拜登等政客,而其造成的严重后果,或许需要加密市场连同全世界的经济体系买单。

结语:短期市场修复仍看美方态度,目前处悲观态势

综合来看,加密市场的“山寨G”早有端倪,而伊以冲突以及美国的直接下车无疑是这一结果的催化剂。而短期内的市场修复,仍然主要依赖于美方的后续表态及跟进,尤其是特朗普的发言与动作。

交易员 Eugene Ng Ah Sio 此前发文表示,已开启比特币和一些山寨币的多单,认为“美国的轰炸行动,加上霍尔木兹海峡的关闭”是一次对早期多头的连续打击,已经足够洗盘,现在正是“逢低买入”的时候。

但特朗普能否如图4月时那般“先发起关税贸易战,后发利好言论救市”,目前仍是个未知数。

或许,对于大多数人来说,有限做空是比无脑做多更具性价比的选择。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。