Who will laugh last in this "Three Cities Chronicle"?

Written by: Deep Tide TechFlow

Singapore, Hong Kong, Dubai.

In the grand chess game of the global cryptocurrency industry, these three cities are vying for industry discourse power and talent resources in different ways.

Singapore's strict regulations have stripped the former utopia of its luster, Hong Kong's policy openness has sparked a wave of return, while Dubai has become an emerging crypto oasis with its "zero tax + open regulation" model.

These three crypto strongholds, once the dream habitats of the crypto industry, now stand at a crossroads of fate. With regulatory iron fists, capital flows, and Web3 ambitions, who will emerge victorious in this "Three Cities Chronicle"?

Singapore: Once Glamorous

Singapore, the small island known as the "Lion City," was once a utopia in the eyes of countless crypto dreamers.

Now, the crypto scene in Singapore is shrouded in a "compliance fog."

In June 2025, the Monetary Authority of Singapore (MAS) issued a final interpretation, requiring unlicensed digital token service providers (DTSP) to cease services to overseas clients by June 30, and even core teams of overseas projects based in Singapore must undergo MAS regulatory review.

With policies still unclear, anxiety has spread among the people.

Subsequently, Singapore's MAS has taken a dual approach, being both reassuring and tough on offshore exchanges.

MAS released the latest explanation stating that the main regulatory targets are tokens, specifically digital payment tokens and tokens of capital market products, meaning payment tokens or equity tokens. Service providers of governance tokens and utility tokens are not affected by the regulations and do not need to apply for licenses.

Additionally, according to Bloomberg, Singapore's regulatory authorities issued a final warning, urging major cryptocurrency trading platforms operating in the country without local licenses to exit swiftly.

According to Deep Tide TechFlow, many crypto exchanges based in Singapore have begun evacuation plans, gradually relocating core personnel to Hong Kong, Malaysia, and other places.

However, even before the policy panic, the trend of crypto practitioners fleeing Singapore had already begun.

"It's too expensive to stay," said XIN, a seasoned crypto professional, who feels that the cost of living in Singapore is excessively high.

"A decent apartment on Orchard Road costs about 5,000 SGD (25,000 RMB), and just this cost has caused headaches for many, but more importantly, it's much harder to make money this year."

For Adam, a crypto practitioner, Singapore used to attract a large number of professionals due to its safety and institutional guarantees, and everyone could make money to cover costs, whether they were project parties, exchanges, or VCs, all could share in the bull market. However, this cycle seems to belong only to Bitcoin, with many altcoin projects failing, and crypto VCs losing their investments. It seems more effective to hoard Bitcoin and lie flat; staying in Singapore only increases costs and loses its meaning.

Qin, who has lived in Singapore for several years, has also observed that the number of industry people leaving Singapore has increased significantly in the past year. A noticeable phenomenon is that many previously active walking groups in Singapore have fallen silent.

With the impact of this policy, many more practitioners will leave, so who will continue to stay in Singapore?

Practitioners from licensed crypto companies. According to the MAS official website, 24 companies, including COBO, ANTALPHA, CEFFU, and MATRIXPORT, are on the exemption list, while 33 companies, including BITGO, CIRCLE, COINBASE, GSR, Hashkey, and OKX SG, have already obtained DTSP licenses.

Non-licensed practitioners, such as crypto VCs, KOLs, and non-securities and payment token project parties… However, most of these individuals are founders and executives or have already obtained Singapore PR, settling in Singapore.

In summary, Singapore has implemented its talent strategy, attracting a sufficient number of compliant and high-net-worth individuals.

Hong Kong: A Surge of Activity

Where is the new crypto hot land after leaving Singapore?

Hong Kong and Dubai may be the two current answers.

After the final interpretation of DTSP was announced in Singapore, Hong Kong Legislative Council member Wu Jiezhuang immediately released a bilingual statement on social media, stating: "If you cannot continue your operations in Singapore and intend to move to Hong Kong, please contact me to understand the relevant situation. We are willing to provide assistance and welcome you to develop in Hong Kong!"

The night view of Victoria Harbour remains dazzling, but Hong Kong's financial story is entering a new chapter.

With Circle's listing, Hong Kong's push for stablecoin regulation has drawn the attention of various capital flows back to Lion Rock.

On May 21, 2025, Hong Kong's "Stablecoin Issuers Ordinance" was officially passed, requiring stablecoin issuers to be licensed and ensuring that reserve assets are 100% backed by highly liquid assets. The Hong Kong Monetary Authority (HKMA) even holds extraterritorial jurisdiction to regulate globally pegged stablecoins.

On June 12, Bloomberg reported that Ant Group's international department is planning to apply for a stablecoin license in Hong Kong.

In addition to increasingly clear and explicit crypto policies, compared to the past few years when it was once ridiculed as a "financial ruin," Hong Kong's macro environment is now experiencing unprecedented improvement.

Well-known financial media Gelonghui shared several sets of data:

Hong Kong's residential rental levels have reached new highs;

The number of Americans in Hong Kong (a representative data of foreigners in Hong Kong) has reached a new high. Before the pandemic, it was 85,000; after the pandemic in 2023, it dropped to 70,000, but the latest data has exceeded 85,000;

The application fee collected by Hong Kong universities in a year (not admission, just the application fee) has reached 800 million.

LD CAPITAL founder Yi Lihua has lived and worked in both Singapore and Hong Kong for a long time, but he admits he prefers Hong Kong and plans to base himself there long-term.

"Hong Kong has many advantages, such as diverse food, better climate, and closer proximity to the mainland, with more friendly policies. Additionally, it's much easier to obtain residency in Hong Kong than in Singapore; once you meet the duration, you get it, while Singapore requires repeated applications. Staying in the land of China forever, I think it's a better choice for future generations to continue being Chinese." Yi Lihua stated.

An increasing number of crypto practitioners are choosing to relocate from Singapore to Hong Kong. According to insiders, TRON founder Justin Sun also moved to Hong Kong early on for long-term residency.

A clear indicator of the rise and fall of popularity between the two cities is the rental levels.

According to Midland Realty data, in May 2024, Hong Kong's residential rents rose for three consecutive months, reaching the highest level since 2019.

The Hong Kong Central Realty Index (CRI) reported 125.38 in May this year, soaring 1.32% month-on-month, the largest increase in nine months, just 2.05% below the historical high.

In contrast, in the first half of 2024, Singapore's premium private residential rents fell by 4.5%, the largest drop among 30 cities worldwide.

Dubai: The "Shenzhen" of the Middle East

In addition to East Asia's Singapore and Hong Kong, Dubai, this "on-chain desert oasis," is rapidly reshaping the crypto power landscape.

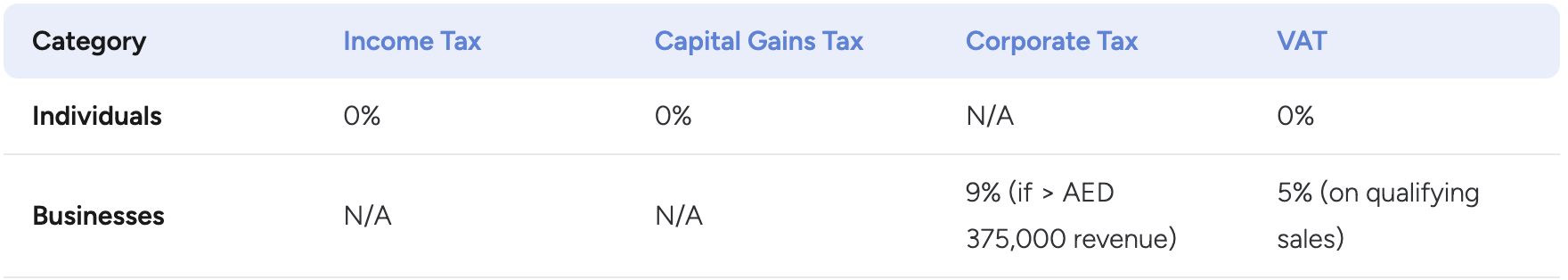

"Zero personal income tax, corporate tax as low as 0-9%, relatively reasonable living costs, and more internationalization," said a practitioner who has lived and worked in Dubai for two years, listing the city's attractions. "More importantly, the regulatory authorities here truly understand and embrace crypto innovation."

In 2025, Dubai's Virtual Assets Regulatory Authority (VARA) further optimized regulatory rules, adopting a "sandbox-adapt-expand" model, providing clearer legal protections for virtual asset service providers (VASPs).

As early as 2024, Dubai had gathered over 1,400 blockchain startups, with a total valuation of $24.5 billion, forming a complete ecosystem that includes over 90 investment funds and 12 incubators.

According to Chainalysis data, Dubai's crypto industry contributes approximately 100 billion dirhams ($27.25 billion) in output, accounting for 4.3% of the UAE's GDP.

In May 2025, the UAE's state-owned investment company MGX invested $2 billion in Binance, the world's largest cryptocurrency exchange, signaling a clear message.

Veteran crypto investor Snow, who has lived in Dubai for a long time, stated that "opportunities abound" is the core reason for her choice of Dubai. In her view, various aspects of the Middle East are not as well-developed as Singapore or Hong Kong, whether in legal systems or infrastructure, many are lacking, but the less developed a place is, the more opportunities there are.

Dubai is like Shenzhen in the early 20th century, with people flocking from all over the world, all for the initial dream—to make money.

"Besides local Middle Easterners, the majority of people in Dubai are Europeans, Russians, Indians, and Chinese… everyone is here to do business and make money, and once they make enough, they buy property in Dubai or return home."

Nancy, who resides in Dubai and was once a real estate agent, has witnessed the crazy rise of Dubai's housing market. According to a recent report by global commercial real estate services firm CBRE, residential prices in Dubai rose by an average of 18% in 2024, reaching 20% in the first quarter of 2025.

The new crypto elite have become an important force supporting Dubai's housing market.

"In recent years, many crypto billionaires from China have purchased a large number of properties in Dubai," Nancy stated.

Previously, Dubai's largest private real estate developer, Damac Properties, announced that it would accept payments in Bitcoin and other cryptocurrencies for property sales.

Today, Dubai is also the most important testing ground for real-world assets (RWA) in real estate.

On May 1, Dubai's MultiBank Group, real estate giant MAG, and blockchain provider Mavryk signed a $3 billion RWA agreement, which will allow MAG's luxury real estate projects to enter the blockchain through a regulated RWA market.

On May 25, the Dubai Land Department (DLD), the Central Bank of the UAE, and the Dubai Future Foundation launched a tokenized real estate project in the MENA region. These government agencies introduced a platform that allows investors to purchase tokenized shares of "Dubai ready-to-own properties."

Due to its regulatory friendliness, Dubai is currently the base for many exchanges, with Binance being the largest cryptocurrency trading platform.

In Dubai and the entire Middle East, Binance holds a relatively special status.

"Binance is a very useful identity label in Dubai; former employees, companies invested by Binance, Binance partners… all serve as high-quality identity endorsements. Even if they don't have it, many people will claim to know some Binance executives," Nancy explained. Perhaps it is also the gathering effect brought by Binance that has led Dubai to become an important center for information and project resource trading in the crypto market, with many crypto projects' shell resources and other market-making activities taking place in Dubai.

In addition to exchange personnel, Dubai has also gathered many well-known crypto KOLs, such as the Coin Bureau studio, which has 2.68 million followers on YouTube, based in Dubai.

However, Dubai also faces its own challenges.

Extreme summer heat, cultural differences, limitations in banking services, and geopolitical uncertainties are all potential concerns. "Dubai is great, but it's not everyone's ideal choice," Nancy admitted. "Many people simply want to make money in Dubai, and once they have enough, they leave. Dubai is not suitable for living; in contrast, Abu Dhabi has a more vibrant atmosphere."

Moreover, the cultural and time zone differences in Dubai may also become obstacles to expanding into the Asian market. Dubai serves as a bridge connecting Europe, Asia, and Africa, while Hong Kong is the gateway to Asia, especially the Chinese market.

With Singapore tightening regulations, Hong Kong reviving its policies, and Dubai rising rapidly, the three crypto cities are forming a unique pattern: Hong Kong as the gateway to Asia, especially the Chinese market; Dubai as the intersection connecting Europe, Asia, and Africa; while Singapore may reposition itself as a more compliant and institutionalized crypto asset management center.

Whether it's the dazzling night view of Victoria Harbour, the magnificent skyline of the Burj Khalifa, or the modern architecture of Marina Bay in Singapore, the skylines of these cities witness the arrival of a new era of crypto finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。