作者:李中贞、宋泽廷

什么是 RWA?

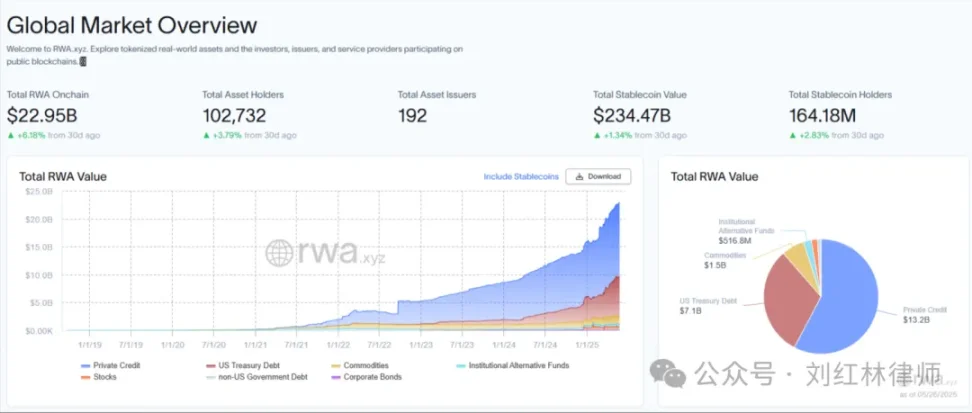

RWA(Real World Assets,真实世界资产代币化)是指通过区块链技术将现实中的实物资产(如房地产、黄金、艺术品等)或财产权益(如债权、收益权、基金份额等)转化为可在链上流通的数字代币。实现资产分割、公开账本、自由流通及自动化管理的创新模式。其技术底层依赖区块链的不可篡改性、智能合约的自动执行能力,并需要通过法律确保链上权益与底层资产的权属一致性。通俗来说,RWA 非常类似于传统金融中的资产证券化,但更新颖、更灵活。

举个例子,假设你拥有一套价值 300 万元的房子,在现实中想将其卖掉,你可能需要把房子挂在房产中介以及安居客等渠道,在一段时间里需要接待多位潜在买家来看房、沟通价格,在好不容易找好买家后,你将这套房子整套出售给买家,买家需要全额付款,这个过程交易周期长,手续也很复杂。但假如你通过区块链技术将这套房子转化为可在链上流通的数字代币——house,你将这套 300 万的房子的所有权划分成 3 万个 house 代币,每个 house 代币价值 100 元,即每个 house 代币代表房子的三万分之一的所有权,这样,任何人可以只花 100 元就能买到该房产的三万分之一的所有权,并且随时可以自由买卖这些代币——这就是 RWA。

但是,我们都知道在中国大陆,不动产产权变更需要去不动产登记中心办理过户。如果真的如上例所述,将房产上链发行 house 代币,你买了这个 house 代币就能拥有对应产权(物权)了吗?显然不是,这明显与我国法律相冲突。

其实,RWA 的核心不是把资产本身搬到链上(房子搬不动,股权搬不了),而是把「证明你拥有资产的权益凭证」代币化——比如把股票、债券、产权证明等法律认可的权益凭证,转化为链上的 Token。即资产的本质是「权利」,权利的载体是「法律认可的凭证」。RWA 要做的,就是把这些「受法律保护的凭证」用区块链技术重新包装,让凭证的流转更高效、透明,但前提是:先有法律框架下的权利,再有链上的 Token。

当然,从这里可以看出,RWA 的第一步是代币化——发行 RWA 项目代币。

RWA 代币的证券化

(一)代币的分类

提到 RWA 代币的证券化,就必须得先了解加密货币的分类,但由于全球各国、各地区以及各组织并没有达成统一的分类标准,所以目前加密货币的分类还处于混乱状态,以下列举目前全球各地区对加密货币的大概分类:

1.中国香港

香港证监会(Securities and Futures Commission,证券及期货事务监察委员会,简称证监会或 SFC)。联合香港金融管理局(Hong Kong Monetary Authority),将代币分为证券型代币和非证券型代币。其中,证券型代币受《证券及期货条例》规制,非证券型代币纳入《打击洗钱条例》监管。

2.新加坡

新加坡金融管理局(Monetary Authority of Singapore,简称「MAS」)将加密货币分为三类,分别是实用型代币、证券型代币以及支付型代币。但是,2025 年 3 月 27 日,新加坡金融管理局发布了《Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks》(有关审慎处理加密资产风险及银行额外一级和二级资本工具要求的咨询文件),拟将加密资产分类与巴塞尔标准保持一致。

3、美国

美国将代币分为商品和证券,尚未对加密货币进行更详细划分。美国商品期货交易委员会 (CFTC) 已明确将比特币和以太坊归类为商品,美国证券交易委员会 (SEC) 通过「豪威测试」(Howey Test) 来判断某种资产是否为证券。但是,在加密货币究竟是「证券」还是「商品」这一争议焦点上,SEC 和 CFTC 存在监管冲突。

豪威测试是 SEC 和法院用来判断某项交易是否构成「证券」(特别是「投资合同」)的法律标准。

根据豪威测试,如果一项交易满足以下四个条件,则它被视为「证券」,需遵守美国证券法:

a) 一方投资

b) 该投资针对特定事业

c) 该投资期待获利

d) 利益的产生源自发行人或第三人的努力

2019 年,美国证券交易委员会裁定比特币未通过豪威测试。根据裁决,比特币仅符合该框架的第一项,即必须有资金投入。然而,由于没有中央公司控制比特币,SEC 裁定比特币不符合豪威测试的其他要求:投资者并非将资金集中到「联合企业」中,并且比特币的价值不依赖于第三方(即产品开发者)。

4、欧盟

欧盟《加密资产市场 (MiCA) 法规》将加密资产分为电子货币代币、资产参考代币、其他加密资产。值得一提的是,欧盟将我们常说的稳定币划分成两类,分别是电子货币代币与资产参考代币。

5、巴塞尔委员会

巴塞尔银行监管委员会(BCBS)是银行审慎监管的主要全球标准制定者,并为银行监管事务的定期合作提供平台。其 45 名成员包括来自 28 个司法管辖区的中央银行和银行监管机构。其发布的巴塞尔框架是巴塞尔银行监管委员会(BCBS)的全套标准,BCBS 的成员已同意全面实施这些标准,并将其应用于其管辖范围内的国际活跃银行。其发布的 SCO60- 加密资产敞口将加密资产分为以下几类:

(二)为什么要将 RWA 代币证券化?

如前所述,虽然全球主要地区对代币的分类尚未形成统一标准,但无论中国香港、新加坡还是美国都有证券型代币的分类。

那么问题就来了,RWA 代币属于哪一种类型?

其实,RWA 代币的分类应当依据其现实世界资产进行划分:

-

少部分 RWA 代币属于非证券型代币。例如占据稳定币主要市场的 USDT、USDC,都是将美元这一现实世界资产代币化的产物,可以说 USDT、USDC 也属于 RWA,但它们肯定不属于证券型代币。

-

大部分 RWA 代币属于证券型代币。例如贝莱德代币化基金 BUIDL,如果将 1000 美元投入 BUIDL 基金,那么该基金承诺提供每个代币 1 美元稳定价值的同时,能够帮持有者理财让持有者获得投资的收益。

既然大部分 RWA 代币可能属于证券型代币,那就必须对其进行证券化(将代币认定为证券),这也就意味着这些 RWA 代币必须符合其流通地区对证券的监管政策,否则一旦被认定为不合规,轻则面临巨额罚款,重则存在刑事风险。

RWA 代币全球监管图景

现阶段还没有专门针对 RWA 代币的细分监管政策,RWA 代币本质上属于加密资产,对其进行监管依然适用各地区对加密资产的监管政策及法规。

(一)中国香港

香港对 RWA 稳定代币监管草案在 2025 年 5 月 21 号正式通过,并从 8 项要点深入讨论了 RWA 稳定代币合规框架与监管可能性。分别为:

1. 发牌制度与准入门槛

2. 储备资产要求

3. 透明度以及信息透露

4. 反洗钱与反恐融资

5. 监管机构的法律执行权

6. 跨境协调与执行权

7. 投资者保护机制

8. 科技进展与可持续性监管

根据《穩定幣條例草案》,任何实体若要在香港从事法币稳定币发行、推广或相关活动,必须满足特定的条件。比如,香港金管局颁发的牌照,公司的资质,发币目的和面对群众审核与反洗钱措施,以及持牌后的持续监管。其中潜在的冲突点和需平衡,如创新与监管之间的自相矛盾。需要注意的是,监管发牌要求如果过高,可能阻碍市场创新。

储备资产要求主要关注于持牌人是否拥有「优质且高流动性资产」。比如,现金,短期政府债券,回购协议和其他接近现金的资产。这些资产具备两大核心特征——低波动性和高变现能力,能够在市场波动或大规模赎回时迅速转换为现金,维持稳定币与锚定资产的固定汇率。根据储值支付工具牌照(SVF),持牌机构需缴纳 2500 万港元或资产规模 5% 的保证金。对于稳定币持牌标准,我们也可以由此参考。列如,若要发行 100 亿港元稳定币,储备资产就必须≥100 亿港元法币。以确保稳定币可随时按面值赎回,以及挤兑风险。

稳定币透明度以及信息透露是市场安全以及建立市场信心的重要方面。根据传统金融来看,投资者对一个交易市场的信心决定了一个市场的效率以及容量。这就是为什么股市中的上市公司必须每个季度,年季度都要强制披露一些公司的营收(比如 SEC 需求披露的 10K,10Q,8K,13F...),运营信息。好以让投资者们对市场更加信赖,以及确保钱的确定性和安全性。

另一个比较明显的问题在草案中提出了,稳定币因其匿名性和跨境流动性也可能被不法分子利用,成为洗钱和恐怖融资的工具。为此,制定一套针对性规则,旨在确保稳定币交易合法且透明,身份核验(KYC),资金追溯和记录保存是这个问题的三大关键。草案中,香港计划进一步对标国际标准(如 FATF《虚拟资产指南》)。只要资金的透明度以及合理范围的私密性得到保障,那么这个问题就可以得到解决。

另外,《稳定币条例草案》赋予金融管理专员(金管局)强大的法律执行权,确保稳定币市场合规运行。例如,若怀疑某稳定币发行人挪用储备资产,可直接调取其财务记录和交易数据。必要时可委派第三方机构(如会计师事务所)协助调查,甚至聘请国际专家团队破解跨境洗钱链条。

在全球化背景下,香港《稳定币条例草案》通过跨境协调机制与强力执行权,构建了覆盖全球的监管网络,确保稳定币发行与交易合法合规。例如,若某境外稳定币发行人涉嫌洗钱,香港金管局可要求当地监管机构协助调查(俗称远洋捕捞)。通过获得境外实体监管权,紧急处置权,以及刑事与民事制裁跨境适用权,为稳定币的合规全球化铺平道路。

总之,在此草案通过之后,根据规范化的准入筛选、风险隔离、透明披露、分级销售、快速赔付及严惩违规六大机制,构建了投资者保护「防火墙」。其核心逻辑是:

-

事前:严控发行人资质,杜绝「空手套白狼」;

-

事中:强制透明化运作,防止暗箱操作;

-

事后:提供救济渠道,降低维权成本。

这一框架不仅为香港稳定币市场奠定合规基础,更为全球投资者保护树立了标杆——在拥抱创新的同时,确保「散户钱包」不被金融冒险行为侵蚀。搭建起严重违规惩罚与执行框架,如无牌发行或虚假宣传,或有欺诈行为,会进行罚款 500 万及监禁 7 年徒刑,最高可罚 1000 万港元及 10 年监禁。

未来,香港或进一步探索智能合约嵌入合规规则,利用区块链技术实现自动化监管,在保护用户隐私的前提下满足监管需求。以「风险可控、创新有序」为核心,既为香港虚拟资产生态注入合规基因,也为全球金融治理贡献了东方智慧。在守住安全底线的同时,香港正以开放姿态迎接金融科技的未来,致力于成为虚拟资产监管与创新的「超级联络人」。

(二)美国 GENIUS 法案

在 2025 年 5 月 19 日,美国参议院以 66 票赞成和 32 票反对的投票表决,通过了《指导与建立美国稳定币国家创新法案》(Guiding and Establishing National Innovation for U.S.)的程序性投票。法案里提到了对稳定币精准的定义,谁可发币,以及发币要求。其中最受关注的一点是稳定币的资金储备需求。

法案中提出,美国合法稳定币必须要 100% 储备已发行的稳定币数量,并且都必须达到现金或等同于现金或短期 Bills,CDs 流动性。以及定期对此储备进行审计以及披露。并且每一个稳定币发行人将有 18 个月进行流动性调配,来适应新的法律法规。目前为止,在交易平台上交易名为 USD1 的稳定币属于完全合规状态。

GENIUS 法案还提到,算法稳定币会慢慢的淡出,且部分会被禁用。由于 2022 年 Terra/Luna 币的死亡螺旋事件,暴露了算法稳定币的致命短板和其不稳定的本质,所以在法律上需要进行更严格的管控,以确保不会再次发生类似事件。法案还强化了反洗钱(AML),处理利益等一系列疑虑,并且禁止了美国政府官员发行稳定币。确保了 Web3.0 在法律上的背书,以及以后持续性的普及教育。从而降低诈骗,洗钱,网络安全隐患等一系列犯罪行为。

(三)新加坡

2019 年 1 月 14 日,新加坡通过了《2019 支付服务法》(PSA) ,并不断修订,作为「监管新加坡支付系统和支付服务商的前瞻性和灵活框架」,该法案取代了之前的《支付系统监督法》和《兑换与汇款业务法》。此外,新加坡金融管理局 (MAS) 根据 PSA 发布了通知 PSN01(预防洗钱和打击恐怖主义融资——指定支付服务),对受监管的支付服务商引入了有关反洗钱 (AML) 和打击恐怖主义融资 (CFT) 的要求。这意味着支付服务商必须做到以下措施以实现监管合规:

-

风险评估和风险缓解

-

客户尽职调查

-

依赖第三方

-

代理账户和电汇

-

保存记录

-

可疑交易报告

-

内部政策、合规性、审计和培训

2025 年 3 月 27 日,新加坡金融管理局发布了《Consultation Paper on the Prudential Treatment of Cryptoasset Exposures and Requirements for Additional Tier 1 and Tier 2 Capital Instruments for Banks》(有关审慎处理加密资产风险及银行额外一级和二级资本工具要求的咨询文件),旨在实施巴塞尔银行监管委员会(BCBS)更新的有关加密资产风险的审慎处理和披露标准。其中提到,通过所有分类条件的加密资产被归类为第 1a 组加密资产(传统资产的代币化版本)或第 1b 组加密资产(旨在兑换挂钩价值的加密资产,该挂钩价值是预定义的参考资产或资产的价值,并具有有效的稳定机制)。

对于被归类为 1b 组加密资产的加密资产,BCBS 对加密资产风险敞口的审慎处理规定了赎回风险测试,其目标是确保储备资产足以让加密资产在任何时候都可以赎回挂钩价值。要通过赎回风险测试,银行必须确保加密资产的储备资产符合与储备资产的价值和构成以及储备资产管理相关的条件。

(四)欧盟

2023 年 6 月,欧盟正式发布《加密资产市场监管法案》(MiCA),MiCA 的监管对象分为两类:

1)第一类是加密资产发行商,包括稳定币发行商和其他加密货币发行商。

MiCA 对稳定币发行商主要有以下要求:

-

发行前获得授权

-

履行披露义务

-

持有一定规模的自有资金和储备资产

MiCA 对其他加密资产发行商要求较为宽松:

-

发行商必须在欧盟境内设立法人实体

-

发布白皮书

2)第二类监管对象是加密资产服务提供商。MiCA 对加密资产服务提供商的要求主要包括四个方面:

-

获得授权

-

治理结构完善

-

最低资本要求

-

消费者保护和透明度要求

法律之外,RWA 实践的潜在问题

香港稳定币草案,美国 GENIUS,和欧洲的 MiCA 以及东南亚法案的通过,无疑是对 RWA 应用层面的一大进步。但是除了法律法规之外,还有一些潜在问题不仅仅是监管就可以得到解决的。比如,RWA 在各大中心交易平台的流动性,以及 RWA Web3.0 防诈骗普法教育等。这些问题并不是 RWA 的弱点,更多是其中存在的不确定性以及只有时间才能去推动的事情。

当人们将目光聚焦于法律框架的完善时,RWA 在实践层面仍面临多重隐性挑战,其发展轨迹或许更接近一场「马拉松」而非「短跑冲刺」。

(一)流动性困局:中心化平台的「伪命题」

目前 RWA 在中心化交易平台(CEX)和与其绑定的资产在传统金融交易所的流动性呈现明显的两极分化。以香港为例,尽管合规牌照发放加速了机构资金入场,但一些基金,比如贝莱德的 BUIDL 的美债代币,每日流动性明显不足。这种理论与实际的割裂源于 RWA 资产本身的异质性:证券化代币需要一个相对新兴且复杂的托管清算体系。更关键的是,传统金融市场的流动性溢价机制尚未完全迁移至链上,同一商业地产的链上通证可能在多个平台重复抵押,而链下登记系统与公链数据的延迟同步,导致套利者难以弥合价差。

(二)教育鸿沟:Web3 原住民与现实世界的认知错位

防诈骗教育的复杂性远超简单的风险提示。在很多已经合法化的地区的 Web3 用户,例如新加坡某些投资者,将「RWA」误解为某种新型稳定币,而欧洲退休基金投资者更把 RWA 代币化债券与传统 ABS 产品的收益率做对比。这种认知偏差催生了新型诈骗形态。比如,某项目通过伪造政府数字签名,将其债券包装成「央行背书」的 RWA 通证,在去中心化论坛非法募资。监管机构要求的信息披露模板,难以覆盖此类针对技术认知差异的定向欺诈。

(三)技术债:被低估的链下 - 链上协同成本

现有 RWA 解决方案普遍陷入「预言机悖论」。比如,当某某信托通过 Chainlink 预言机同步租金收益时,节点运营商却要求其给出线下线上双重审计报告。这种混合架构导致边际成本递增。某欧洲铁路资产代币化项目因 Polkadot 与 Cosmos 跨链桥的安全争议,被迫推迟价值 8 亿欧元的资产迁移计划。这些无疑都超过了原先在传统金融体系下不会有的磨损和风险。既然架构如此复杂,且现阶段的问题多于传统架构,有什么解决方案,或者诱因,让人们更愿意使用 RWA 代币系统呢?

解决这些深层矛盾需要超越单纯的技术或监管维度:在流动性层面,可讨论用「托管 + 预言机」双轨制,允许传统托管机构在链上发行数字所有权凭证,如 Ondo finance 及其一系列产品方案。普及教育方面,香港数码港推出的 RWA 沙盒模拟器已开始用游戏化界面展示资产通证化的全流程风险节点。RWA 的真正成熟,或将催生介于传统金融与加密主义之间的「第三种基础设施」。当市场热切讨论 RWA 市值突破 500 亿美元的里程碑时,或许更应关注那些未被计入财报的隐性成本。这些暗流涌动的细节提醒我们,RWA 的进化速度最终取决于现实世界与数字原生生态的磨合效率,而这注定是一场需要耐心与智慧的长周期博弈。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。