As Israel–Iran war tensions rise, Bitcoin and Ethereum plummet.

Israel launched a "preemptive strike" on the night of June 13 with the intention of destroying Iran's military installations and nuclear programme. In an effort to destroy Iran's nuclear capacity, the Israeli Air Force attacked several Iranian military and nuclear installations overnight.

Cryptocurrency markets fell sharply late last night following allegations of Israeli airstrikes on Iran, which heightened Middle Eastern tensions and triggered a widespread risk-off mentality. Within 60 minutes of Israel striking Iran and Iran firing missiles back at Israel, over $100,000,000 was liquidated from the cryptocurrency market.

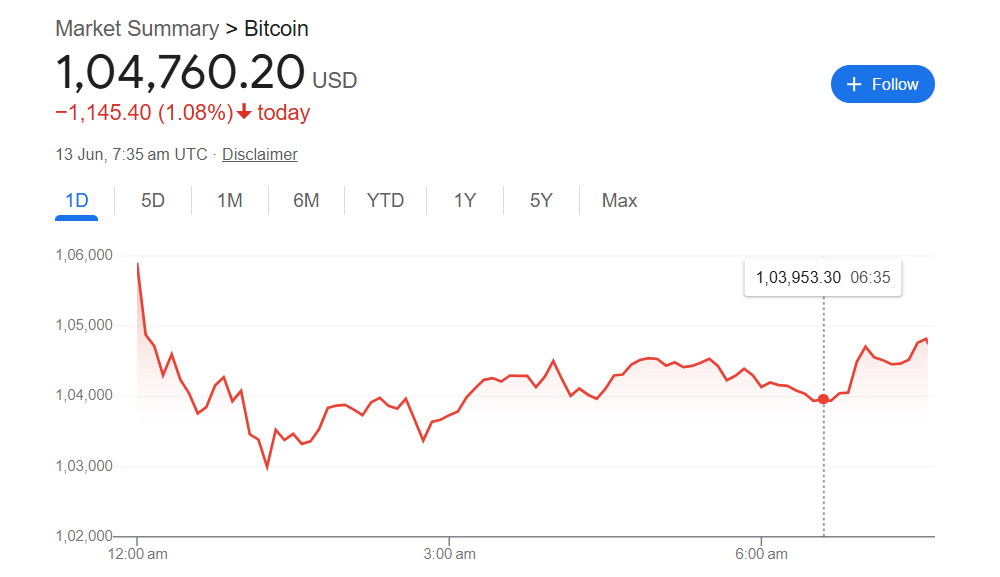

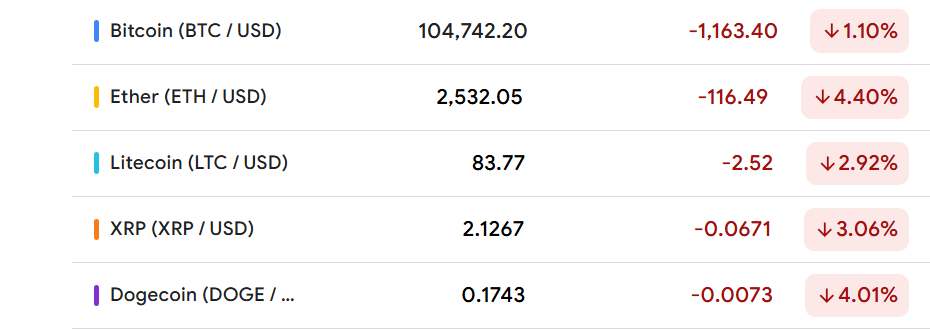

The largest cryptocurrency in the world, BTC, fell more than 4% to $104,000 in Friday morning trading, despite the fact that cryptocurrency markets saw a sharp drop late last night in response to reports of Israeli airstrikes on Iran, which escalated Middle East tensions and created a generalised risk-off mood. Ethereum fell 9.6% as well.

Other crypto currency prices dropped by 9.62%, 5.42%, and 2.65%, respectively, for Solana, XRP, and BNB.

Following Israel's massive attacks on Iranian nuclear and military installations, rising Middle East tensions caused a widespread flight from risky assets, which caused bitcoin values to plummet on Friday. The biggest digital currency in the world dropped 3.6% to $104,070.20.

Ethereum continued to decline, falling below $2,500, while XRP pulled back to $2.10, which increased pressure on the market as a whole. Amid tensions, BTC struggles to hold $104K.

These days, war is more than simply a story in the news. We're seeing that on our charts as well. Following Israel's attack on Iran, more than $1 billion was liquidated across cryptocurrency. Altcoins are suffering, and Bitcoin is down.

What Causes Bitcoin's High Volatility?

A number of reasons have contributed to the extreme volatility of the price of BTC since its inception. First off, big trades can have a big impact on price swings because the cryptocurrency market is still small and less liquid than traditional financial markets. Second, the value of Bitcoin fluctuates in the short term due to speculation and public opinion. The uncertainty is a result of media coverage, powerful viewpoints, and legislative changes, which impact supply and demand dynamics and fuel price swings. The fixed supply of Bitcoin is another important consideration. Since there will only ever be 21 million bitcoins produced, fluctuations in demand could cause dramatic price swings. This is made worse by "whales," or big Bitcoin holders, whose substantial transactions have the power to significantly affect the market, it continued.

As the world's most popular cryptocurrency reaches all-time highs, President Donald Trump's media firm just revealed a proposal to fund $2.5 billion to purchase bitcoin, joining an increasing number of so-called " bitcoin treasury companies ." The President's action and statements are directly proportional to the crypto market surge.

Market volatility is expected until geopolitical risk subsides

Geopolitical shocks cause investor behavior shifts, leading to crypto selloffs. High volatility expected until Middle East conflict resolves, with potential rebound once risk appetite returns. To navigate volatility, use pullbacks wisely, monitor geopolitical updates, and diversify your portfolio. Maintain a balanced portfolio with clear re-entry/exit plans and seek help with charts or technical setups.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。