If revenue continues to grow, there will be significant room for valuation increases, making the $4 billion valuation seem reasonable or even undervalued.

Author: tomas

Compiled by: Deep Tide TechFlow

On Twitter, discussions about @pumpdotfun's plan to conduct an ICO are filled with various complex emotions, but there is almost no solid evidence to support these views. Therefore, it is worth delving into its fundamentals to assess the following two questions: 1) Is the $4 billion ICO valuation reasonable? 2) What are the potential returns or risks of this investment?

This article is not a comprehensive analysis but rather a series of key observations that I believe are necessary to form a complete judgment. It should also be stated that I have no vested interest in @pumpdotfun, and this analysis will help me decide how to trade this ICO.

To answer the two questions I raised, I believe it is necessary to further explore the following points:

How does @pumpdotfun respond to competition in the memecoin space?

How does @pumpdotfun perform within the entire ecosystem?

Is the user appeal and growth momentum of @pumpdotfun rising or declining?

Let’s analyze them one by one.

How does @pumpdotfun respond to competition in the memecoin space?

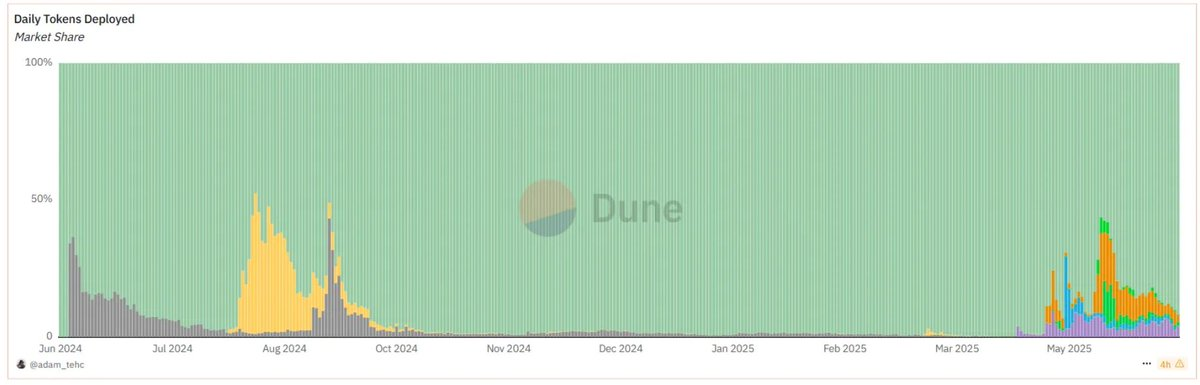

From the chart above, it is clear that while competitors continue to emerge and briefly capture market share, they quickly disappear. The recent wave of competition comes from @bonk_fun, @RaydiumProtocol's LaunchLab, and @believeapp, marking the second round of competition since Pump's inception. However, from the first wave of competition (Justin's pump[.]sun), it can be seen that these competitors did not last, and users typically return to @pumpdotfun within weeks.

How does @pumpdotfun perform within the entire ecosystem?

Clearly, Pump performs well in the memecoin space, but I also want to understand its significance in the broader ecosystem.

https://dune.com/hashed_official/pumpdotfun

https://dune.com/ilemi/solana-dex-metrics

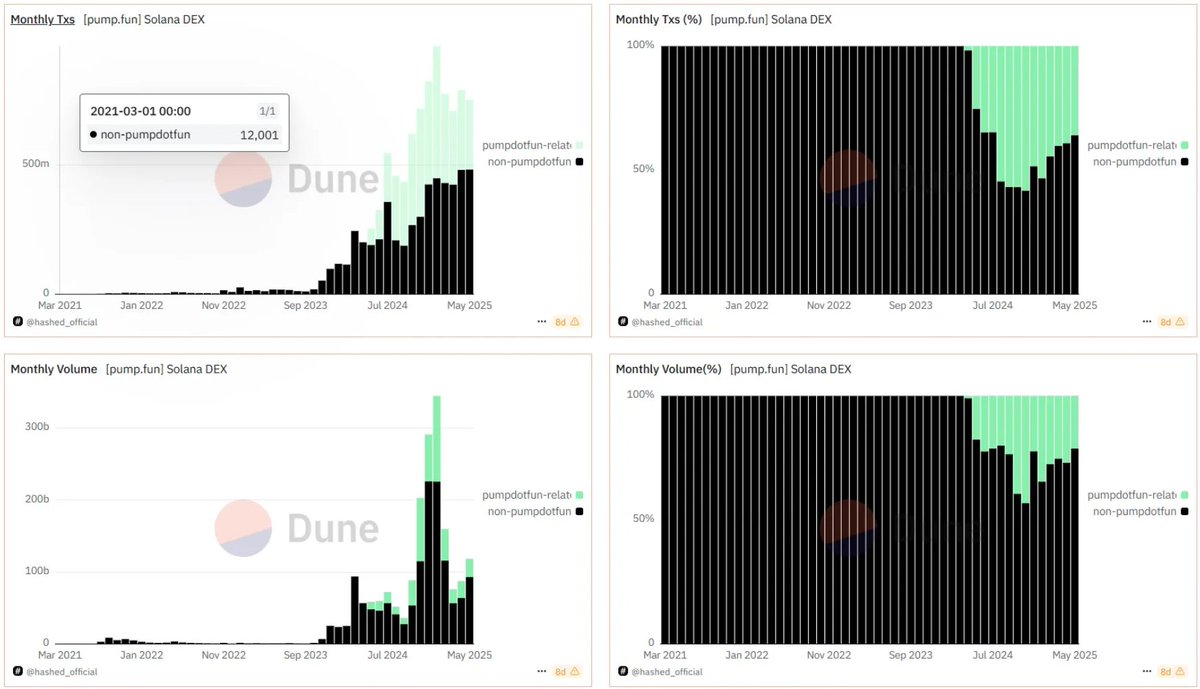

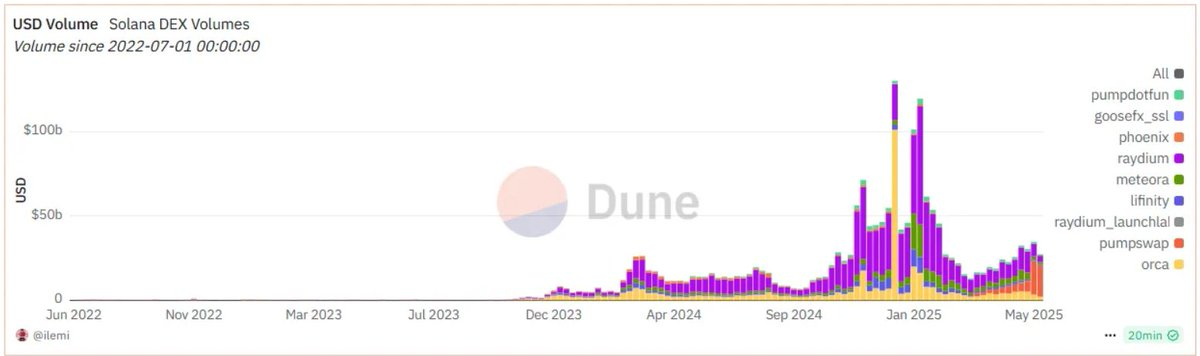

From the charts above, it can be seen that the market dominance of memecoins is declining, with their share of the total ecosystem trading volume dropping from 45% at the end of the year to about 25% currently. Meanwhile, from the lower chart, it can be observed that pump.swap has shown significant growth compared to other decentralized exchanges (DEX) on @solana.

It is worth noting that the decline in the share of memecoin trading has returned to levels seen before the Q4 2024 bull market peak with @virtuals_io and $TRUMP, so this decline is natural and expected. I am pleased to see that the share of memecoin trading in overall trading activity may have found a sustainable, normalized level.

Is the user appeal and growth momentum of @pumpdotfun rising or declining?

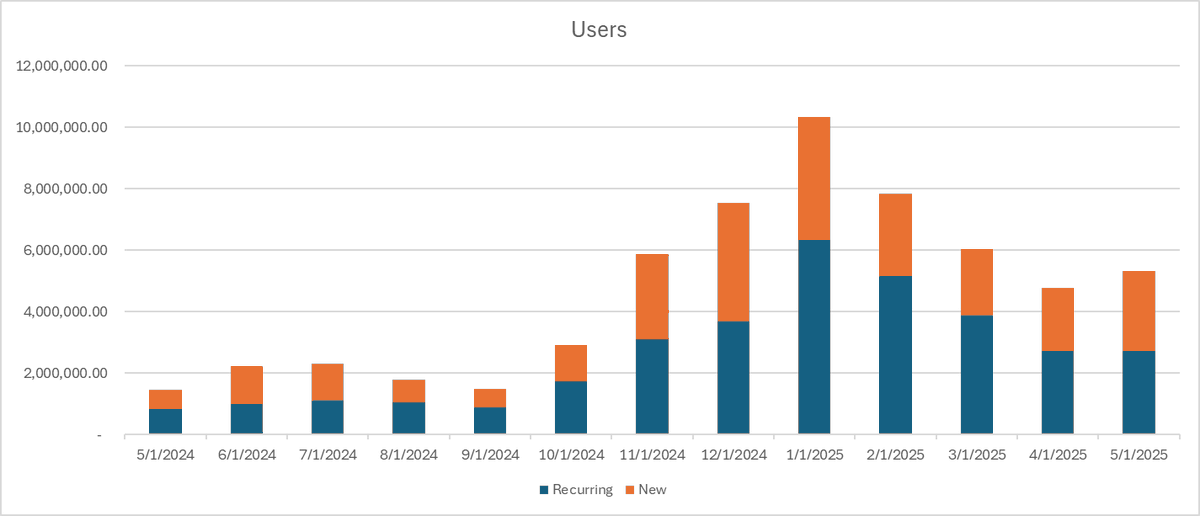

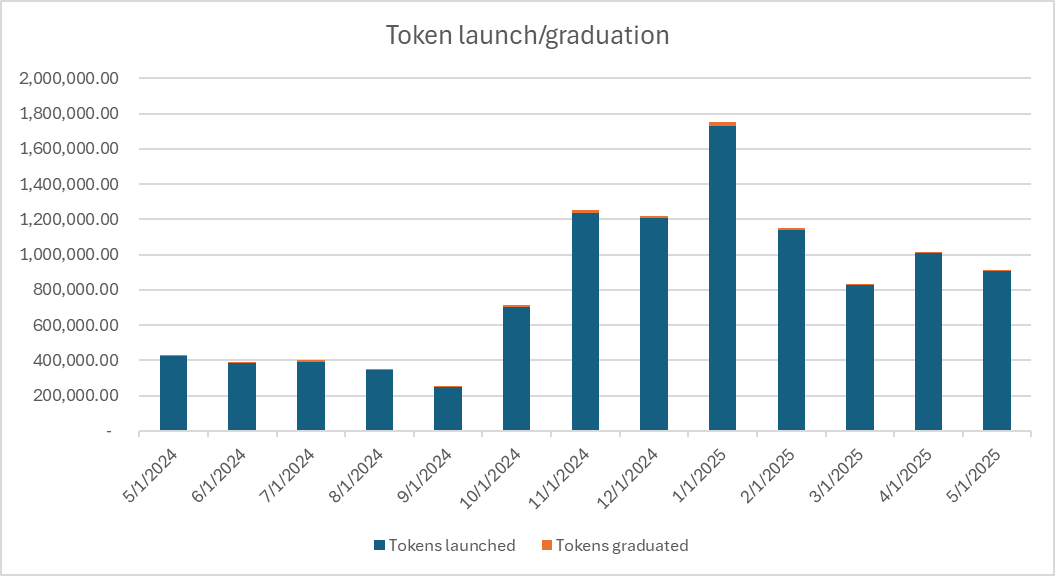

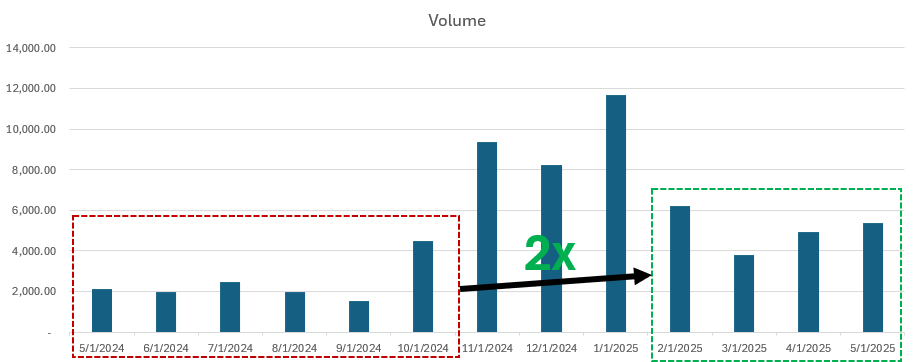

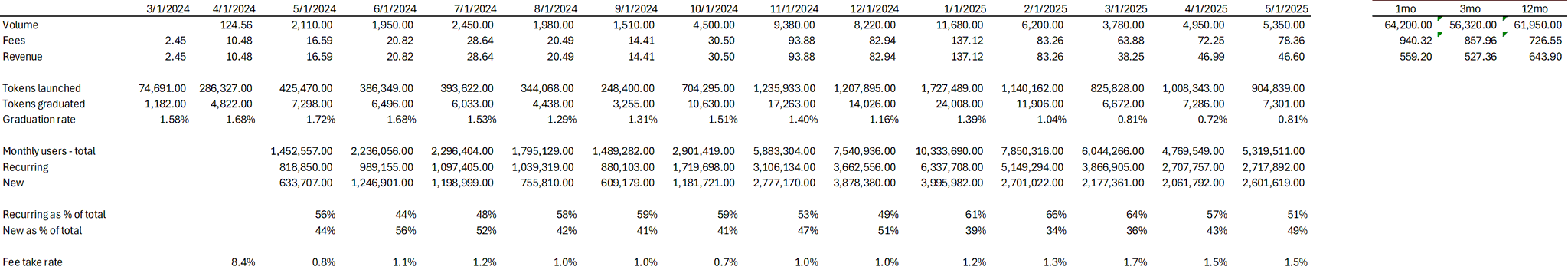

A good picture is worth a thousand words, so the following shows three charts of @pumpdotfun's trading volume, user base, and token issuance/graduation rate.

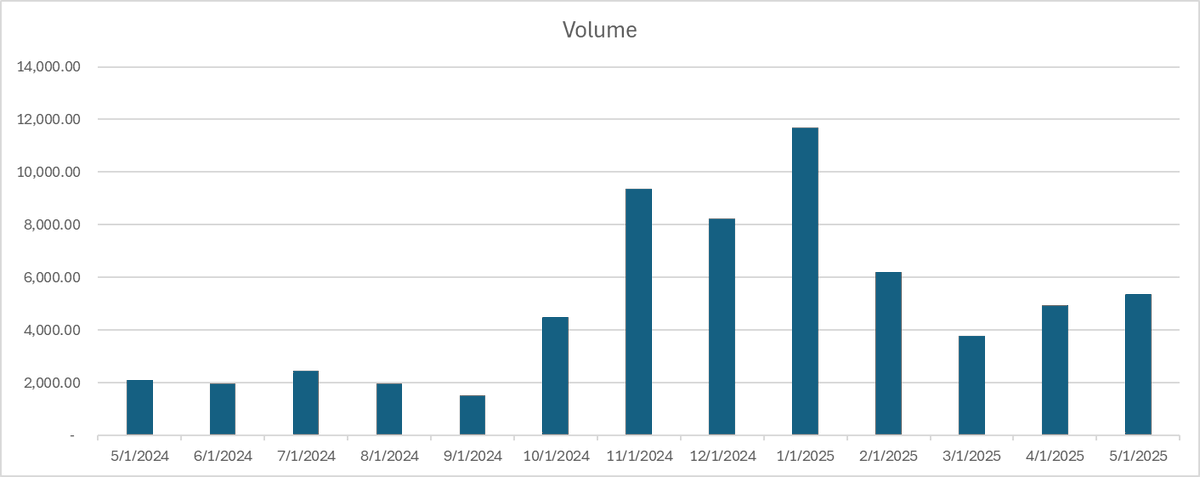

Overall, when viewed in context, these metrics are positive for me. Excluding the "frenzy" bull market period from November to January, all metrics have doubled, and the user return rate is high (an average of 56% of monthly users are returning users), although the graduation rate is relatively stable but slightly declining.

Valuation Analysis

In my view, @pumpdotfun continues to maintain a healthy growth rate, with almost no sustainable competitors, and broader market conditions indicate that memecoins are far from over. Therefore, the notion that @pumpdotfun's ICO is its "last squeeze" is unfounded.

Since Pump's value is clearly not zero (it does not appear to be disappearing in the short term), we can further explore its reasonable valuation.

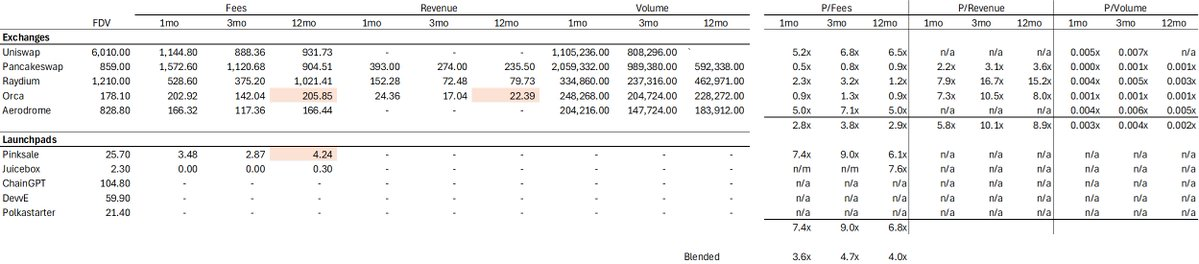

Rather than relying on a bunch of subjective input data for discounted cash flow (DCF) analysis, I chose a comparative analysis method. I first collected two sets of data:

Group A

Group B

For @pumpdotfun, I used the following data in my analysis:

pump.fun data

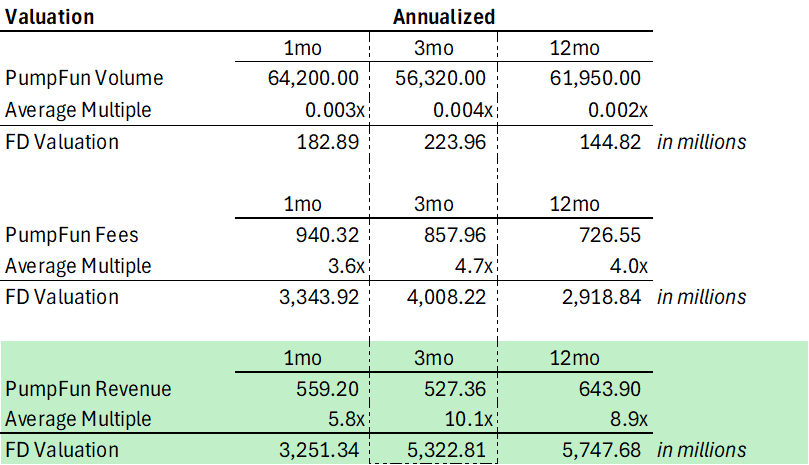

When estimating using different metrics from dataset A, we can see that @pumpdotfun's fully diluted valuation (FDV) ranges from $183 million to $5.7 billion. Clearly, this range does not provide a definitive answer. However, as a fundamental-focused investor, considering that Pump.fun's business model differs significantly from traditional decentralized exchanges (DEX) or launch platforms, I tend to view revenue as the appropriate metric for evaluating the company.

The trading volume of DEX does not accurately reflect its monetization capability, and transaction fees do not accurately represent the ability to buy back tokens. I believe that the ability to buy back tokens will become a major driving factor in analyzing any token in the future. Therefore, when valuing @pumpdotfun, revenue is clearly the most suitable metric.

Another point to add is which annualized metric is more appropriate?

In my view, the 3-month metric is the optimal choice in this case. The 1-month data is too volatile (for example, @HyperliquidX's annualized revenue fluctuates between $300 million and $1 billion), while the 12-month revenue does not reflect @pumpdotfun's recent adjustments to its business model, which include introducing creator revenue sharing, potentially overestimating @pumpdotfun's current revenue run rate.

Based on DEX multiples estimation, Pump's fully diluted valuation (FDV) is approximately $5.3 billion.

But can we do better? The current valuation method does not accurately reflect the Pump team's buyback decisions, as it assumes a 100% buyback ratio, which is clearly unrealistic. Additionally, the current valuation does not fully consider that Pump is more like a company rather than a protocol, making it inappropriate to use DeFi multiples to evaluate a company.

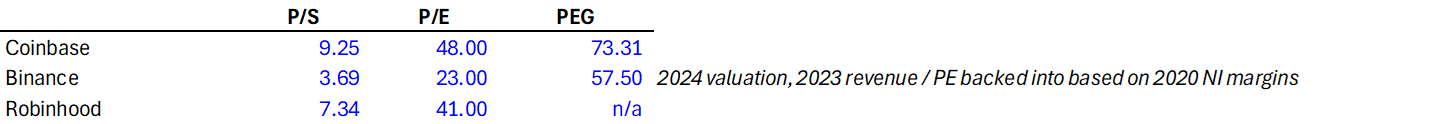

Therefore, we can turn to the key players in centralized finance (CeFi) — Coinbase, Binance, and Robinhood's price-to-earnings (P/E) ratios as a representative dataset for valuation.

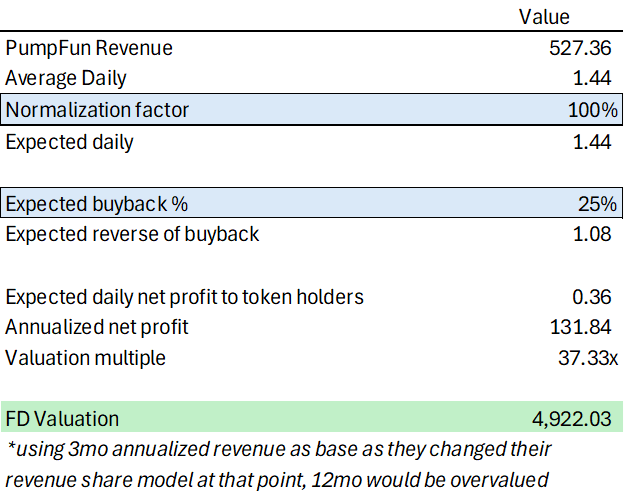

Valuation based on dataset B

Interestingly, assuming a 25% buyback plan, the FDV is approximately $5 billion, which is very close to the results from the DEX multiples method.

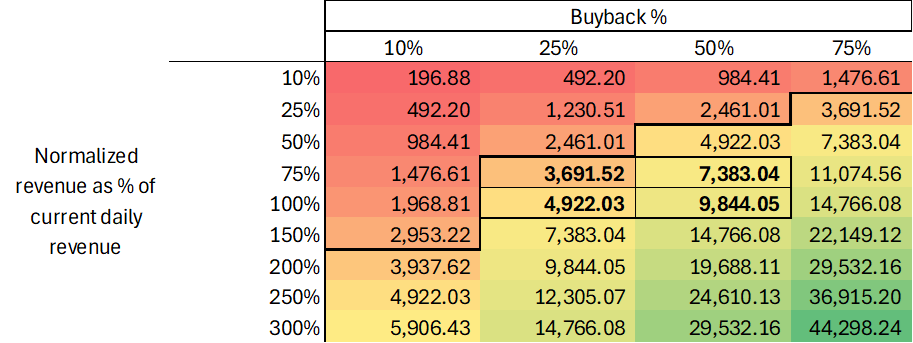

But there is a problem! In these scenarios, I assumed specific buyback plans and sustainable user appeal. So what if we conduct a sensitivity analysis on these assumptions?

The results of the sensitivity analysis based on "valuation from dataset B" are as follows:

My base assumption is that Pump.fun can maintain 75%-100% of its current revenue (daily revenue of $1.5 million) and use 25%-50% of that revenue for buybacks. This would place its valuation between $3.7 billion and $9.8 billion. If revenue continues to grow, there will be significant room for valuation increases, making the $4 billion valuation seem reasonable or even undervalued.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。