作者:Frank,PANews

美国监管的寒冬似乎正悄然退去,一缕“创新豁免”的曙光照进了DeFi领域。6月9日,SEC高层释放的积极信号,预示着DeFi平台或将迎来更友好的发展土壤。

然而,在这政策春风的吹拂下,DeFi市场内部却呈现出一番耐人寻味的景象:一方面,以Aave为代表的头部协议TVL屡创新高,基本面数据强劲;另一方面,不少头部DeFi协议的TVL却增长乏力,且代币价格仍不及年初,市场的“价值发现”之路似乎依旧漫长。虽然DeFi代币在近两天内迎来了快速反弹,但这背后究竟是短期市场情绪的扰动,还是深层价值逻辑的驱使?PANews聚焦DeFi头部玩家们的最新动态与数据表现,剖析其中的机遇与挑战。

SEC释放积极信号:DeFi监管迎“创新豁免”框架

美国证券交易委员会(SEC)近期对DeFi监管释放出显著积极信号。在6月9日举行的“DeFi与美国精神”加密圆桌会议上,SEC主席Paul Atkins表示,DeFi的基本原则与美国经济自由及私有财产权等核心价值观相符,并支持加密资产的自我托管。他强调,区块链技术实现了无需中介的金融交易,SEC不应阻碍此类创新。

此外,Atkins主席首次透露已指示工作人员研究制定针对DeFi平台的“创新豁免”(innovation exemption)政策框架。该框架旨在“迅速允许受SEC管辖的实体和非管辖实体将链上产品和服务推向市场”。他还明确,构建自我托管或注重隐私软件的开发者不应仅因发布代码而承担联邦证券法下的责任,并提及SEC公司金融部已澄清PoW挖矿和PoS质押本身不构成证券交易。

SEC加密任务组负责人Hester Peirce委员亦表达支持,强调不应因他人使用代码而追究代码发布者的责任,但也警示中心化实体不得借“去中心化”标签规避监管。

在SEC共和党委员推动更友好加密政策的背景下,这些表态被市场视为重大利好,一度引发DeFi代币价格飙升。若“创新豁免”得以实施,有望为美国DeFi项目发展营造更宽松明确的监管环境。

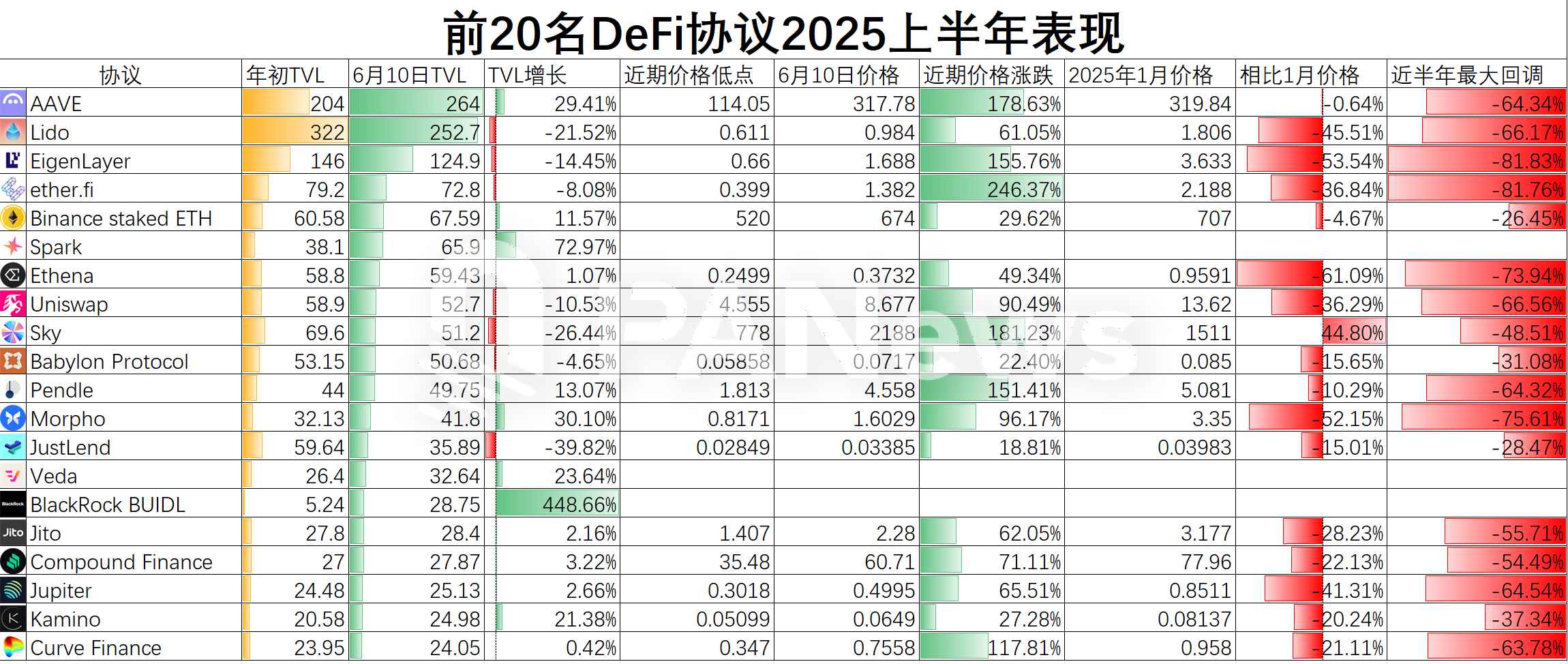

数据复盘:TVL增长乏力,代币反弹强劲

在会议释放监管利好之后,沉寂的DeFi类代币迎来了普涨行情。尤其是Aave、LDO、UNI、COMP等头部项目普遍出现了20%~40%大幅上涨。但这究竟是一次单纯的消息面引导市场的昙花一现还是DeFi行业的自然增长结果?PANews对头部的前20名DeFi协议的近半年数据进行了复盘。

从总体上来看,这些头部DeFi协议在2025年上半年的TVL量增长并不明显,其中有7个协议的TVL在上半年还出现了下滑。而在上涨的协议当中,有5个的增长不超过5%,基本属于原地踏步。增长最快的是贝莱德推出的BUIDL,这个协议与传统意义的DeFi协议并不相同,严格意义上属于RWA的范畴。其他的协议当中,增长较为明显的是Aave,TVL突破260亿美元,达到了历史新高,且上半年增长了超过60亿美元。Sky系的Spark则迎来了72.97%的增长。

波场生态虽然在今年的稳定币实现了持续增长,但其生态的头部DeFi协议JustLend TVL数据却在上半年下降了39.82%,成为降幅最大的头部协议。此外,像市场关注度比较高的Sky、Lido、EigenLayer、Uniswap等热门协议在上半年也出现了不同程度的下滑。

代币价格似乎也在放大这种下滑态势,前20名的DeFi协议的代币价格在2025年上半年平均的最大回撤达到了57%,即便是最近市场回暖,各个协议的代币有了大幅反弹的情况下,绝大多数的协议代币仍没能回到2025年1月1日的价格水平。其中,只有SKY的治理代币MKR相比1月1日时上涨了44.8%,AAVE则是勉强回到了1月1日相似的价格。总体上,这些代币平均较1月1日价格还是下跌了24%。

不过,这些DeFi项目的代币价格普遍都迎来了大幅反弹,平均低点的反弹涨幅约为95.59%。其中ether.fi、Sky、Aave、EigenLayer、Pendle等几个代币的反弹幅度都在150%以上。从走势上来看,这些代币的近期低点都集中在4月7日,与加密市场的走势相似。但反弹的力度普遍要优于其他类型的代币。不过,无论是从价格反弹的角度还是近半年的整体走势来看,代币价格的走势似乎与这些DeFi协议TVL的表现没有直接关联。

Aave稳进,Uni升级,Sky蜕变,EigenLayer再起

在这些项目当中,有一些DeFi项目的表现值得重点关注。

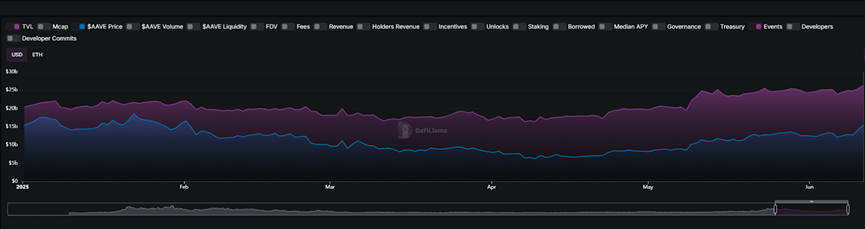

Aave:作为DeFi协议的龙头项目,在上半年数据表现亮眼,多次突破历史新高。且拓展了Aptos、Soneium等多个公链,目前支持18条公链。此外,为了提振AAVE代币价格,Aave社区推出名为了“Aavenomics”的提案,包括每周100万美元的代币回购和针对Aave与原生稳定币GHO的收入再分配,根据提案,Anti-GHO奖励的80%将分配给Aave质押者。

从产品的利率等方面来看,Aave的借贷利率都不算高,但有着更雄厚的深度,这也使其获得了不少大户的偏爱。6月10日,特朗普家族支持的World Liberty Financial从Aave借入了价值 750万美元的USDT。总体来看,2025年上半年,Aave在基本面(TVL等数据)和市场表现方面都实现了上涨趋势,仍是DeFi协议发展的标准模板。

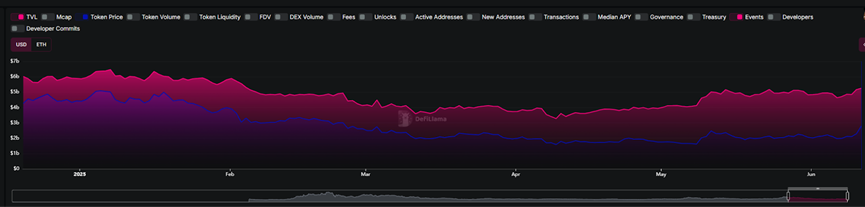

Uniswap:Uniswap在2025年正式上线了V4版本,在技术上引入了hooks、singleton机制等更多灵活的自定义逻辑并显著降低了Gas费用。此外,Unichain的上线也进一步扩展力Uniswap在DeFi生态的竞争力。

虽然上半年Uniswap的TVL量有所下滑,但仔细观察可以发现这种下滑主要是以太坊价格的下跌导致,从ETH的质押量来看,相较1月份还是有所上升。此外,Unichain上线后快速占领了一定的市场,已经成为Uniswap上TVL排名第二的公链,截至6月11日TVL约为5.46亿美元。

Sky:从2024年开始由MakerDAO改为Sky后,Sky迎来了一次全面的品牌升级之路。虽然在升级后,Sky的TVL开始走向下滑,但生态内的另一个协议Spark在RWA方向也发挥出了新的潜力,这两个协议相加的TVL量将超过110亿美元,能够排到前三的水平。另外,其代币MKR的价格在2025年表现也较为亮眼,从最低的800美元左右一路上涨至2100美元,涨幅超过170%。不过,MakerDAO的升级计划“终局之战”,显然是一次相对复杂的重组,从治理机制、代币经济学到产品组合均有涉及,这也让市场对其很难形成一个简单的认知,并不利于市场的传播。

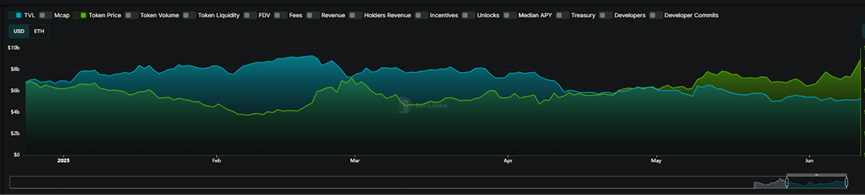

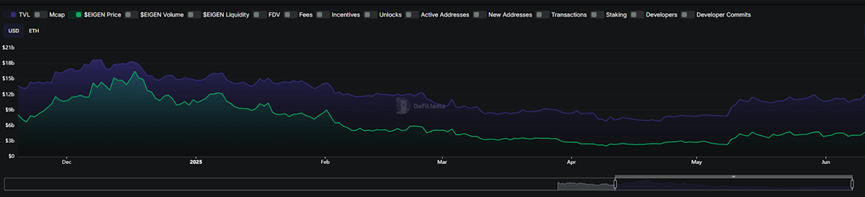

EigenLayer:EigenLayer开创了“再质押”(restaking)这一新概念,自推出以来,EigenLayer的TVL实现了爆炸式增长达到124亿美元,目前已成为排名第三的DeFi协议。虽然2024年再质押的概念在火爆一阵后开始熄火,EigenLayer的TVL也一度进入下滑,不过从4月份以来,EigenLayer的TVL数据明显进入了新的增长周期,不到2个月的时间从70亿美元增长至124亿美元,增幅达到77%。褪去概念的外衣,或许再质押的真实价值正在重新被市场定义。

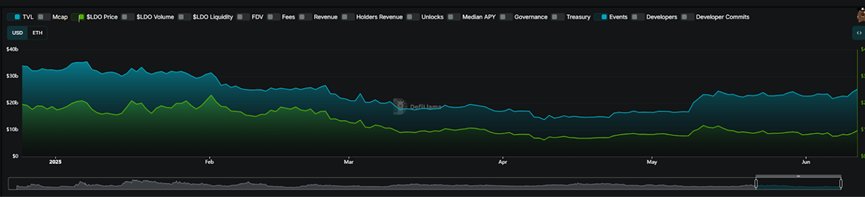

Lido:作为流动性质押领域的龙头项目,Lido凭借stETH曾占据市场的主导,TVL量在2024年曾一度达到近400亿美元。不过自2024年下半年以来,随着以太坊L2的快速增长,过度集中于以太坊主网的Lido(以太坊主网占比超过99%)呈现出颓势,TVL也一路下滑。其代币在近期的反弹当中也不算明显,从低点到6月10日61%的最大涨幅远低于前20名DeFi代币的平均值。目前Lido的TVL总量扔排在第二仅次于Aave,对Lido来说,规模效果仍在。只是如何快速转型适用于更多市场,可能是保持领先地位的首要任务。

SEC的监管转向,无疑为美国DeFi市场注入了一剂强心针。 困扰项目方已久的监管不确定性有望缓解,像Uniswap费用开关这类悬而未决的创新或许能真正落地。数据揭示的趋势同样值得深思:尽管以太坊仍是TVL的主要承载地,但DeFi的发展动能已日益显现其独立性,甚至开始反哺底层公链的价值,正如Bitwise分析师Danny Nelson所言,“DeFi生态正成为ETH上涨的引擎”。未来,监管的明确化将吸引更多传统金融资本以更低风险偏好进入DeFi领域,带来宝贵的新鲜血液;同时,贝莱德等巨头推出独特DeFi产品的尝试,既预示着更广阔的融合前景,也意味着增量市场的争夺将更为激烈。这场由监管松绑开启的“终局之战”,或许正是DeFi走向成熟、与传统金融深度交融的新起点。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。