撰文:深潮 TechFlow

本周四,继 CoinBase 之后,加密市场最重要的 IPO 来临。

Cirlce,美元稳定币 USDC 的发行商,将在纽交所上市交易,预计最高募资 8.96 亿美元,股票代码为 CRCL。

然而,上市前夕,一家港股公司中国光大控股股价却连续上涨,5 天上涨 44%,牵扯出一段隐秘的 Circle 中国往事。

光大控股早在 2016 年与 IDG 资本联合投 Circle,成为其股东。

甚至在 2018 年,有国内媒体报道,Cicle 可能被注入国内某 A 股上市公司,引得深交所发函询问,最后该上市公司不得不出面辟谣。

Circle 频繁与中国公司产生联系,也是其历史发展历程的见证与缩影,从加密钱包到交易所到稳定币,Circle 的青葱岁月充满艰辛与曲折。

本文带你回顾 Circle 的历史进程与中国情缘。

最初的梦想:美国支付宝

2013 年,杰瑞米·阿莱尔(Jeremy Allaire)和 Adobe 首席科学家肖恩·内维尔(Sean Neville)共同创立了 Circle,总部设在波士顿,这是他第三次正式创业。

在此之前,他分别于 1995 年和 2012 年缔造了两家上市公司,软件公司 Allaire 和在线视频平台 Brightcove,并积累了深厚的人脉资源。

Circle 成立之初,便获得 900 万美元 A 轮融资,创下了当时加密货币公司有史以来的最高融资额。

投资者包括 Jim Breyer、Accel Partners 和 General Catalyst,他们都是阿莱尔上一家公司 Brightcove 的投资者,与其说是投资 Circle 这家公司,不如说,他们就是投资杰瑞米·阿莱尔这个人。

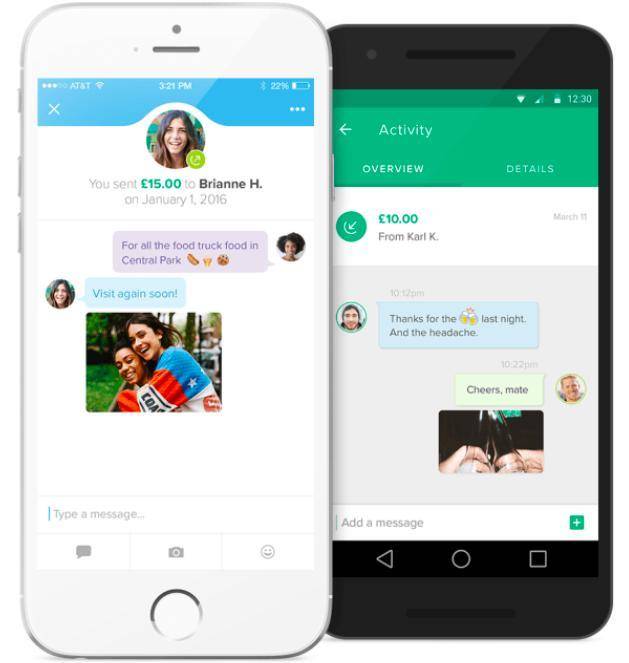

Circle 最初并没有涉足稳定币,而是立志打造「美国版支付宝」。

Circle 最初的产品形态就是一个数字货币钱包,主要提供加密货币(比特币)的储存及法币兑换服务,利用比特币实现资金的快速转移。

比如,国际间转账使用 SWIFT 需要 3-5 个工作日的确认,但使用 Circle,可以依靠「现金——比特币——现金」的路径快速转账,这个过程中,比特币成为了中间通道。

此时的阿莱尔是一个坚定的比特币信徒,认为实现跨国界的支付系统只是时间问题。他想让用户像使用邮件,短消息一样,没有太多阻碍就能实现转账支付。

随后,Circle 一路高歌。

2015 年 8 月,Circle 获得高盛集团和 IDG 资本领投的 5000 万美元融资。

为什么 IDG 资本会参与领投 Circle?

这或许离不开 Circle 的早期投资者 Jim Breyer,以早期投资 FaceBook 闻名,他还有另外一个身份——IDG 在美国的投资合伙人。

IDG 的这笔投资也为日后 Circle 结缘中国埋下伏笔。

9 月,Circle 拿到了纽约金融服务局颁发的第一张数字货币许可证 BitLicense,这意味着 Circle 可在纽约州持证提供数字货币服务。

同样在这一年,中国的移动支付市场战火四起,微信依靠微信红包快速挤占支付宝的市场份额,大洋彼岸的 Circle 不止于观望,也在年底推出了社交支付。

当时来看,这是一次大胆的创新尝试,如今来看,这或许源自自身定位不清晰,为后来的多次转型埋下了伏笔。

中国情缘

2016 年,Circle 与众多中国 VC 结缘。

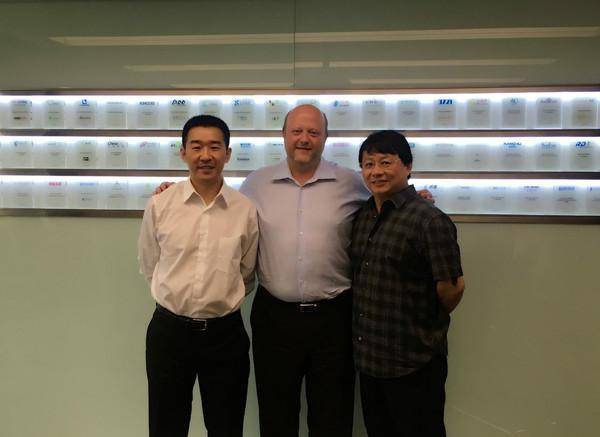

6 月,骄阳似火,Circle 成功牵手一众中国资本,宣布完成 6000 万美金 D 轮融资,由 C 轮的领投方 IDG 资本继续领投,此外,百度、光大、宜信、万向、中金甲子等中国企业纷纷跟投。

其中,IDG 资本连续领投 Circle C 轮和 D 轮,并进入其董事会,IDG 资本创始人合伙人熊晓鸽曾如此评价该笔投资:

现在国内投资互联网公司,基本都在投应用,而不是技术。很重要的一个原因是,目前国内看到在商业模式方面的创新比较多,而技术创新相对较少。IDG 资本所投资的美国技术,例如 Circle 的比特币区块链技术,基本都属于「美国能做,而中国目前做不了,或者说做得没有美国好」的类型。然而,技术虽然投在国外,IDG 资本的初衷还是有一天能够将前沿技术带到中国,并获得落地的长足发展,这是我们投资一家美国公司的「中国角度」。

不仅引入众多中国资本,Circle 更是有着“入华梦想”。

2016 年初,Circle 组建成立了独立运营的 Circle 中国公司——世可中国,主体为天津世可科技有限公司,意为「可以通行于全世界的支付」,公司 CEO 由 当时 IDG 资本的 EIR (入驻企业家)李彤担任,万向集团肖风任董事。

创始人阿莱尔表示,Circle 将在中国的监管框架下开展业务,在未取得政府许可情况下,不会贸然上线产品。

此外,Circle 一直在同中国的监管层、银行等机构进行沟通、分享信息。然而我国高度重视金融安全,在国内开展支付业务需要第三方支付牌照,因此,Circle 在华业务长时间处于停滞状态,有名无实。

据企查查信息显示,2020 年 8 月 15 日,天津世可科技有限公司申请简易注销,并于 9 月 7 日正式注销,退出中国。

Circle 入华,最终成为黄粱一梦。

艰难转型

2016 年,伴随着比特币分叉、扩容之争愈演愈烈,阿莱尔逐渐对比特币停滞发展不满,「三年过去了,比特币的发展速度放缓了很多」,阿莱尔此前接受采访时曾这样表示。

12 月 7 日,Circle 发布公告,宣布「放弃比特币业务」,保留比特币及美元等法币的转账业务,但用户无法进行比特币买卖,并表示,「Circle 会把业务重心转移到社交支付上」。

但事实上,Circle 的整体发展思路却是从支付转移到了交易,「阿莱尔淡化了比特币(支付)在 Circle 业务中所扮演的角色,开始做更多关于赚钱的工作」,Coindesk 曾如此报道。

在加密货币领域里,什么业务最赚钱?交易所。

2017 年,Circle 对外表示,尽管取消了 APP 中直接买卖比特币的功能,但其依旧为大型交易所做市,并推出为机构客户提供大额加密资产 OTC 服务的 Circle Trade。

2018 年 2 月,Circle 宣布以 4 亿美元收购加密资产交易所 Poloniex,正式进军加密货币交易所领域,此次并购的融资由其大股东 IDG 资本主导。

5 月,Circle 继续公布融资消息,宣布获得 1.1 亿美元融资,由比特大陆领投,IDG 资本、Breyer Capital 等继续老股东跟投。

值得注意的是,领投的比特大陆同样由 IDG 资本投资,据深潮 TechFlow 了解,正是 IDG 资本出面联姻,才促成比特大陆领投,此时,IDG 已是 Circle 最大的机构股东。

这笔投资对于 Circle 非同一般,一方面这是按照投后 30 亿美元的超高估值进行融资,不到一年之后,其估值下跌 75%。

其次,2018 年下半年,加密市场迎来惨烈的大熊市,无论是 Circle 还是比特大陆都将面临生死考验,有了这笔钱,一定程度上帮助了 Circle 度过难关。

有了资本注入,Circle 开始四处出击,试图全面开花。

2018 年 7 月,Circle 推出了锚定美元的稳定币 USDC,回头来看,这无疑是历史性的一刻,Circle 做出了对于其而言最重要的决定。

除了最核心的交易所和稳定币业务,Circle 的布局也开始向外延伸。

2018 年 10 月,Circle 收购股权众筹平台 SeedInvest,并建立 Circle Reseach 输出加密货币行业消息和报告。

至此,在资本的推动下,Circle 成为了以交易所为核心,稳定币、OTC 多元发展的综合加密货币集团:Poloniex 提供交易业务;Circle Pay 提供转账;SeedInvest 用于筹集资金;Circle Trade 提供场外交易服务;USDC 为美元稳定币。

一切看起来很美好,殊不知,寒冬已至,此般多元布局,危险至极。

2019 年,Circle 历史上最灰暗的一年。

2 月,Cointelegraph Japan 率先披露,在 SharesPost 的股票交易平台上,Circle 公司估值为 7.05 亿美元。9 个月前,Circle 获得比特大陆 1.1 亿美元投资后估值高达 30 亿美元,不到一年,估值大跌 75%。

5 月,Coindesk 报道,Circle 已裁员 30 人,约占员工总人数的 10%,后来接连又走了 3 位高管。

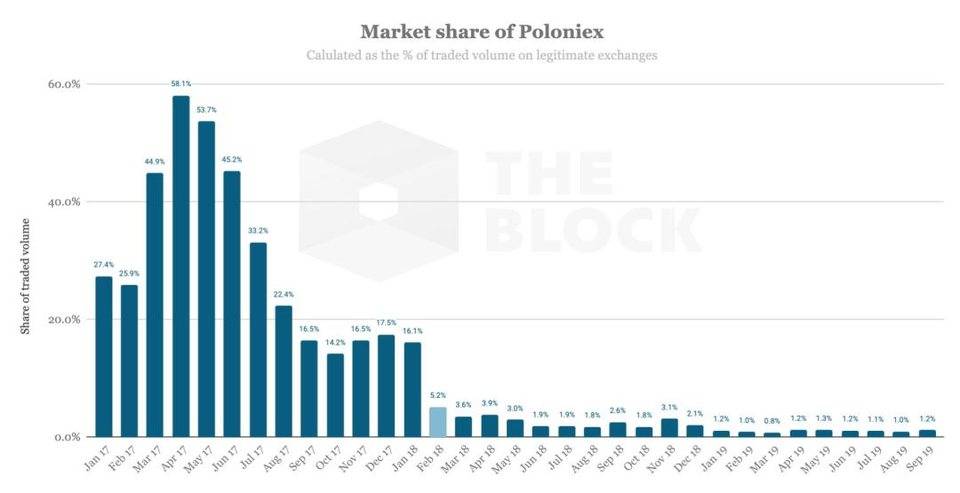

但最让阿莱尔头疼的或许还是重金收购的 Poloniex 遭遇滑铁卢。

2019 年 5 月 13 日,Poloniex 宣布将在美国用户的页面中下架 9 种加密货币。因为根据美国法律,这些代币已接近证券的概念,但它们却并未在 SEC 被注册,有违规风险。10 月,再次下架 6 种加密货币,损失大量利润。

为此,阿莱尔数次公开表示对美国监管机构的不满,却又无可奈何,只能将 Poloniex 的业务主体转移至监管环境更为宽松的百慕大。7 月 23 日,Circle 宣布 Poloniex (P 网)将获得百慕大数字资产业务许可执照。

但这依然无法阻止 Poloniex 不断丧失市场,从 2017 年一度接近 60% 的市场份额(合规交易所中),到 2019 年 9 月,市场占比仅有 1%。

估值大跌、核心业务受挫、人才流失……Circle 再次站在了命运的十字路口。

生死存亡时刻,Circle 选择断臂求生,从 2019 年下半年陆续剥离核心业务,并专注于稳定币 USDC。

2019 年 6 月,Circle 宣布从 7 月 8 日起,Circle Pay 服务将逐步取消对用户支付和收费的支持,并最终于 9 月 30 日完全取消对 Circle Pay 的所有支持。

9 月 25 日,Circle 在发布公告称暂停 Circle Research 项目。

10 月,在众人的惊愕声中,Circle 出售了交易所业务 Poloniex,接手方为一家亚洲投资公司运营的「Polo Digital Assets」,背后的实际控制人为波场创始人孙宇晨。

据后来披露的 SPAC 文件显示,Circle 在其收购并随后出售 Poloniex 的过程中损失了超过 1.56 亿美元。

12 月 17 日,Circle 向交易所 Kraken 出售其 OTC 服务台 Circle Trade。

到了 2020 年,Circle 旗下的加密投资交易应用 Circle Invest 以股权方式出售给 Voyager Digital。

至此,经过一系列瘦身,Circle 从一个多元化的加密货币集团变成了专注于美元稳定币 USDC 的稳定币发行商。

美元大使

Circle 发行稳定币的商业模式,简单又利润丰厚:公司发行与美元 1:1 锚定的 USDC 稳定币,将用户存入的资金主要投资于短期美国国债,从而赚取几乎无风险的收益。

目前,USDC 发行量超过 610 亿美元,相当于有超过 610 亿美元的储备,投资于美国国债 (85%由贝莱德的 CircleReserveFund 管理)和现金 (10-20%存于全球系统重要性银行)。

根据财务报表,2024 年,Circle 凭借投资美国国债产生了约 16 亿美元的利息收入,占到了 Circle 总收入的 99%。

然而,其净利润却从 2.68 亿美元下降至 1.56 亿美,其中一个隐藏的风险点在于合作伙伴 Coinbase 的吸血。

2018 年,Circle 与 CoinBase 共同创立 Centre 联盟推出 USDC。

2023 年,Centre 联盟解散,Coinbase 获得了 Circle 的股权,而 Circle 则完全控制了 USDC 生态系统,但是 Coinbase 依然保留了对部分收入的分红权。

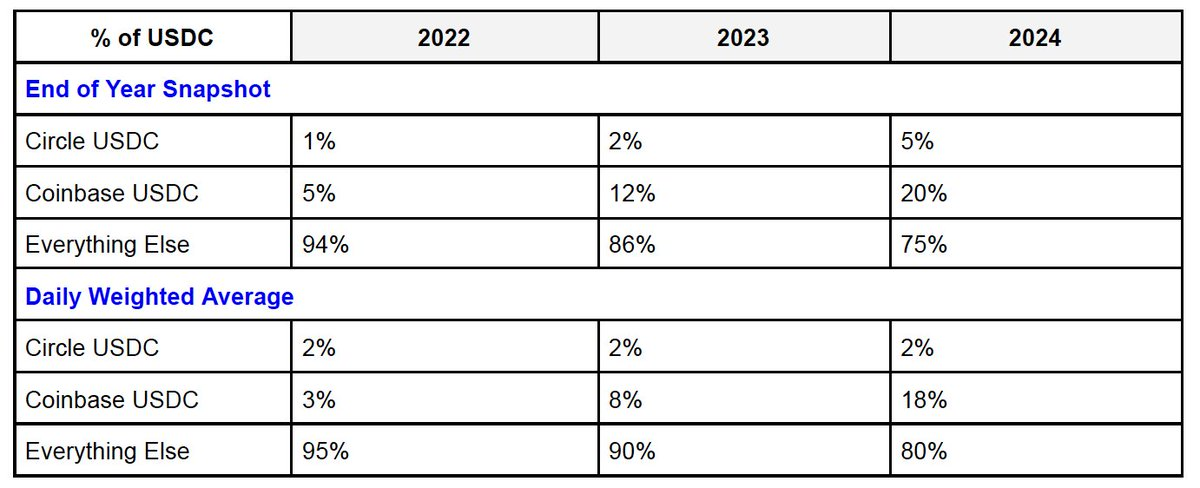

USDC 总供应量可以分为三部分:Coinbase 的 USDC、Circle 的 USDC 以及其他平台的 USDC。

· Coinbase:包括 Coinbase Prime 和交易所持有的 USDC。

· Circle:包括 Circle Mint 持有的 USDC。

· 其他平台:如 Uniswap、Morpho、Phantom 等去中心化平台持有的 USDC。

根据 Circle 的 S-1 备案文件,Circle 与 Coinbase 之间有以下收益分配协议:

Coinbase 平台上的 USDC:Coinbase 获得 100%的储备收益。

Cirle 平台上的 USDC:Coinbase 获得 100%的储备收益。

非 Coinbase 平台上的 USDC:Coinbase 和 Circle 各获得 50%的储备收益。

Coinbase 在 USDC 总供应量中的占比正在快速增长,2025 年第一季度已达到约 23%,并且目前 USDC 已经是 Coinbase 的第二大收入来源,占 2025 年第一季度收入的约 15%,超过了质押收入。

外有稳定币一哥 USDT 短期难以撼动,以及美联储降息预期的不利影响,内有 Coinbase 吸血利润,Circle 难言安稳,但是其 IPO 又“恰逢其时”。

美国稳定币法案(《GENIUS 法案》),已于 5 月 21 日在参议院获得通过,目前正在众议院审议,一旦正式通过,将为 Circle 带来显著的战略性利好。

《GENIUS 法案》的核心内容,恰好是 Circle 的优势:

第一,要求每发行一个稳定币,背后必须有等值的美元现金或美债支持;

第二,稳定币发行商必须向美国联邦政府注册,并且要每月公开储备情况,确保资金安全,还要遵守反洗钱反犯罪的法规;

第三,如果发行公司破产,稳定币持有人的兑付优先。

法案通过后,将使 Circle 这样的合规优先企业获得合法地位认证,从而增强机构投资者和普通用户对 USDC 的信任度。

过去,传统金融机构对监管不确定性的顾虑一直是阻碍其采用稳定币的主要障碍,而《GENIUS 法案》将消除这一障碍,为 Circle 打开与银行、支付服务提供商和大型企业合作的新机遇,扩大 USDC 的应用场景和市场份额。

而未来,Circle 未来也将肩负他的战略责任:成为美元全球化战略的重要执行者,同时为美国国债市场提供强有力的支撑。

这也是其 IPO 上市后的核心叙事,面向全球的美元大使。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。