"For Circle, becoming a publicly listed company on the New York Stock Exchange is a continuation of our desire to operate with maximum transparency and accountability."

Author: Lei Jianping

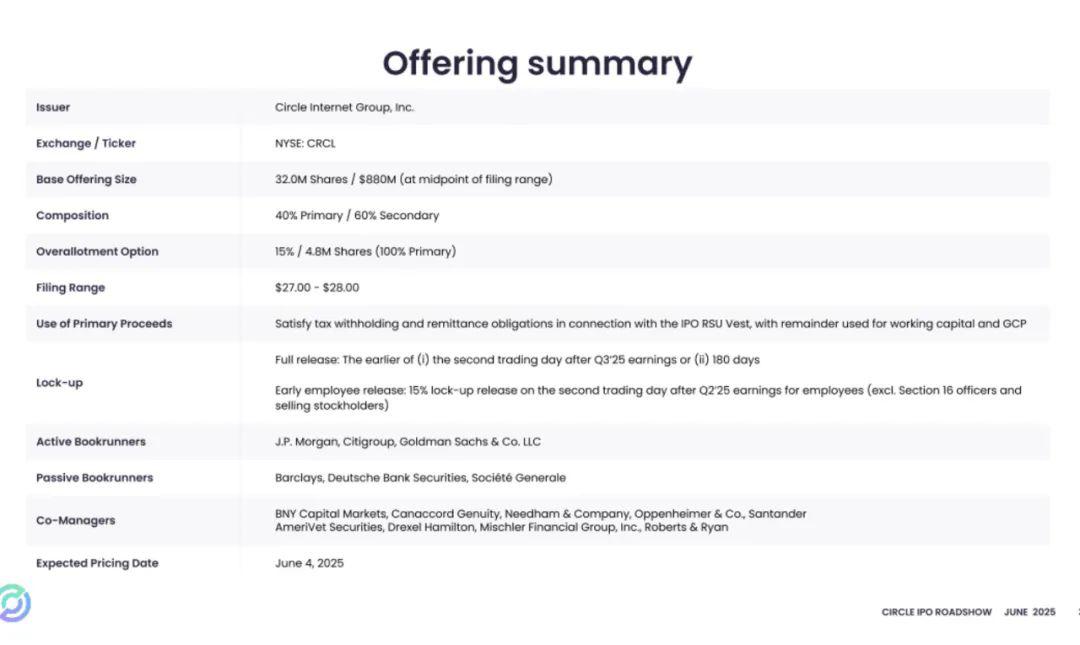

USDC stablecoin issuer Circle (stock code: "CRCL") has recently launched its IPO, preparing to list on the NYSE this week. Circle's offering range is between $27 and $28, issuing 32 million shares, with a maximum fundraising of $896 million.

Of this, Circle will issue 12.8 million shares, raising up to $358 million; existing shareholders will sell 19.2 million shares, cashing out $538 million.

ARK Investment Management, LLC and its affiliates have expressed interest in subscribing for up to $150 million of Class A common stock at the IPO price, with terms identical to those of other purchasers in this offering.

Circle's target valuation has been raised from $5.65 billion to $7.2 billion.

Circle CEO Jeremy Allaire stated, "For Circle, becoming a publicly listed company on the New York Stock Exchange is a continuation of our desire to operate with maximum transparency and accountability."

Previously Planned to Go Public via SPAC: Company Valued at $9 Billion

Circle's Push for the NYSE

Founded in 2013 in Boston, Circle offers a product called Circle Pay, which provides fiat currency transfer services and is also known as "the American Alipay."

Circle previously collaborated with Coinbase, and in 2018, the two established the Centre Consortium to create USDC.

In August 2023, the Centre Consortium was dissolved, and Circle acquired the remaining 50% stake from Coinbase for a total price of $209.9 million, acquiring approximately 8.4 million shares measured at fair value, with Coinbase receiving equity in Circle.

After the acquisition, Centre became Circle's indirect wholly-owned subsidiary, giving Circle complete control over the USDC ecosystem. In December 2023, Circle dissolved Centre, with its net assets distributed to another wholly-owned subsidiary of the company.

Circle announced a $60 million Series D funding round in June 2016, led by IDG Capital, which also led the Series C round. Breyer Capital and General Catalyst Partners continued to participate in the investment.

Circle's Series D funding also attracted several strategic investors from China, including Baidu, CICC, Everbright Holdings, Wanxiang, and Yixin, as well as two significant individual investors: former IBM Chairman and CEO Sam Palmisano and Glenn Hutchins, co-founder of SilverLake.

In May 2018, Circle announced the completion of a $110 million Series E funding round, led by Bitmain. IDG Capital continued to follow on as a co-investor and as the lead investor in the Series C and D rounds, with other participants including Breyer Capital, Accel, and new entrants Blockchain Capital and Tusk Ventures.

On May 31, 2021, Circle announced it raised $440 million, with participants including Digital Currency Group, Fidelity Management and Research Company, and cryptocurrency exchange FTX.

Circle was previously valued at $9 billion in a transaction to go public through a special purpose acquisition company (SPAC), which concluded in December 2022. At that time, Jeremy Allaire expressed disappointment over the "overdue" proposed transaction but stated that the company still intended to go public.

Annual Revenue of $1.676 Billion

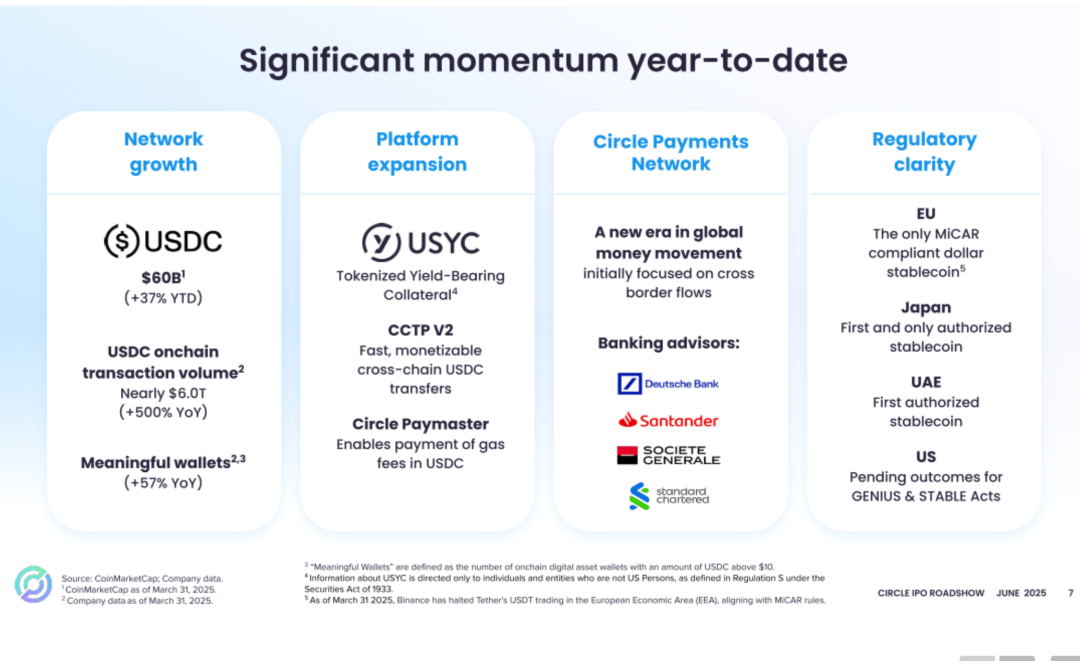

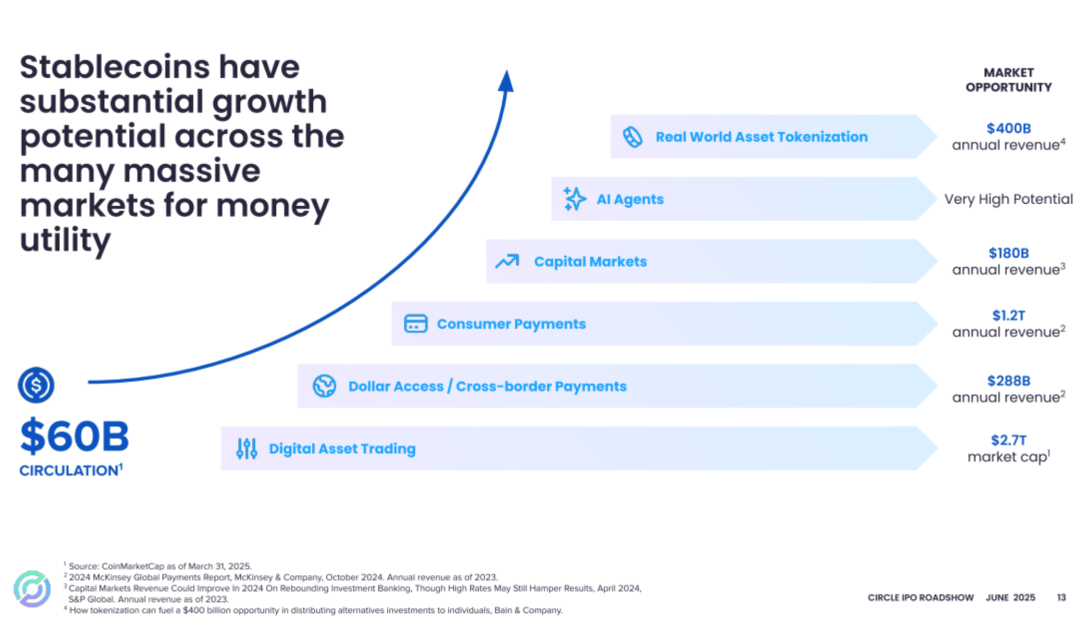

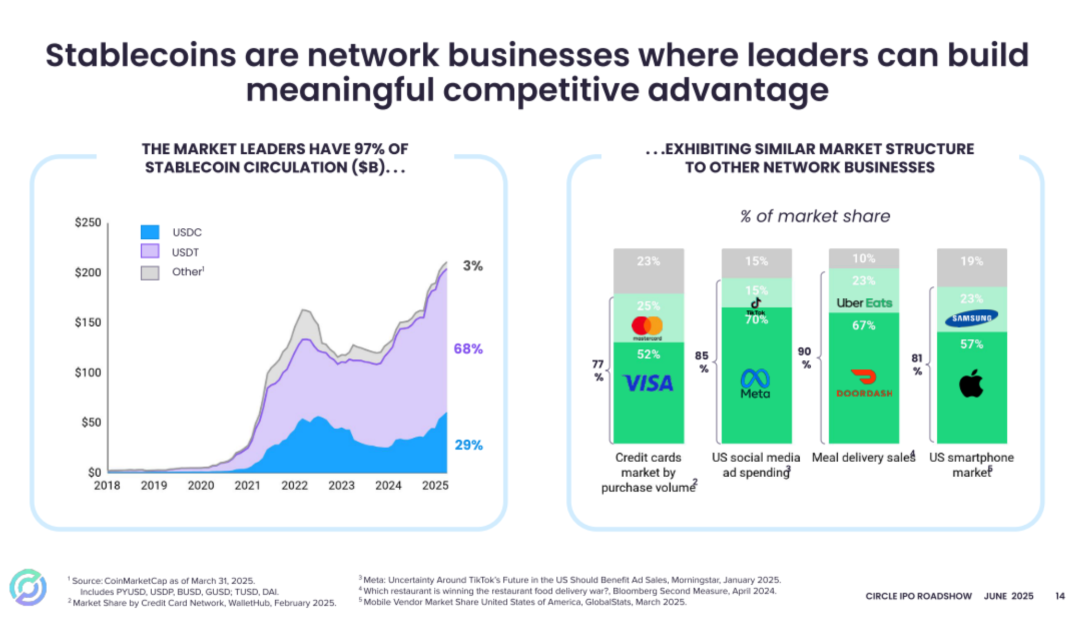

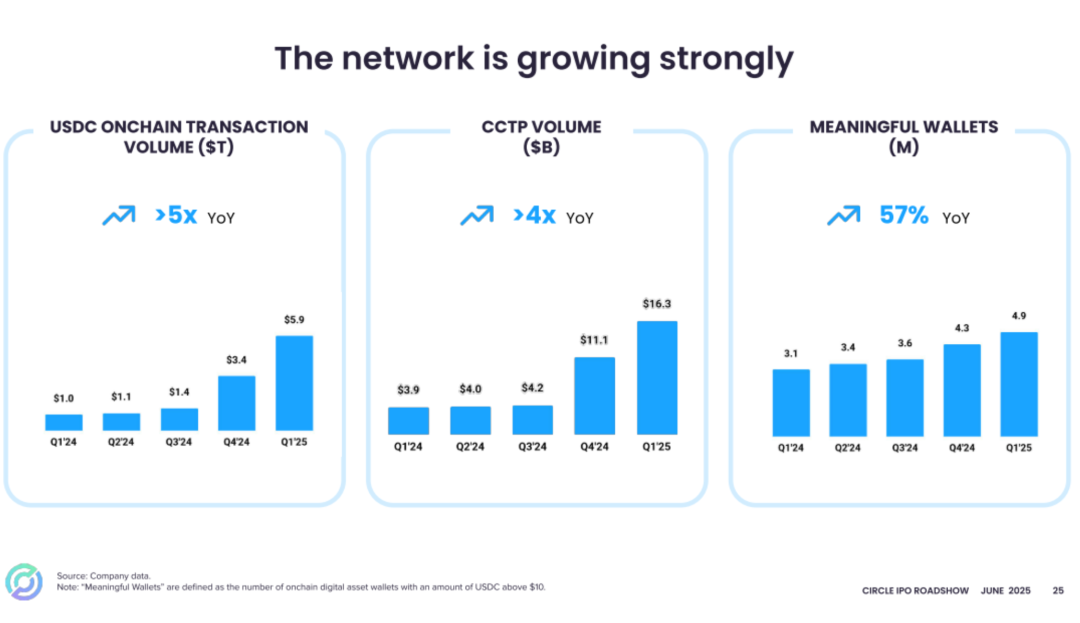

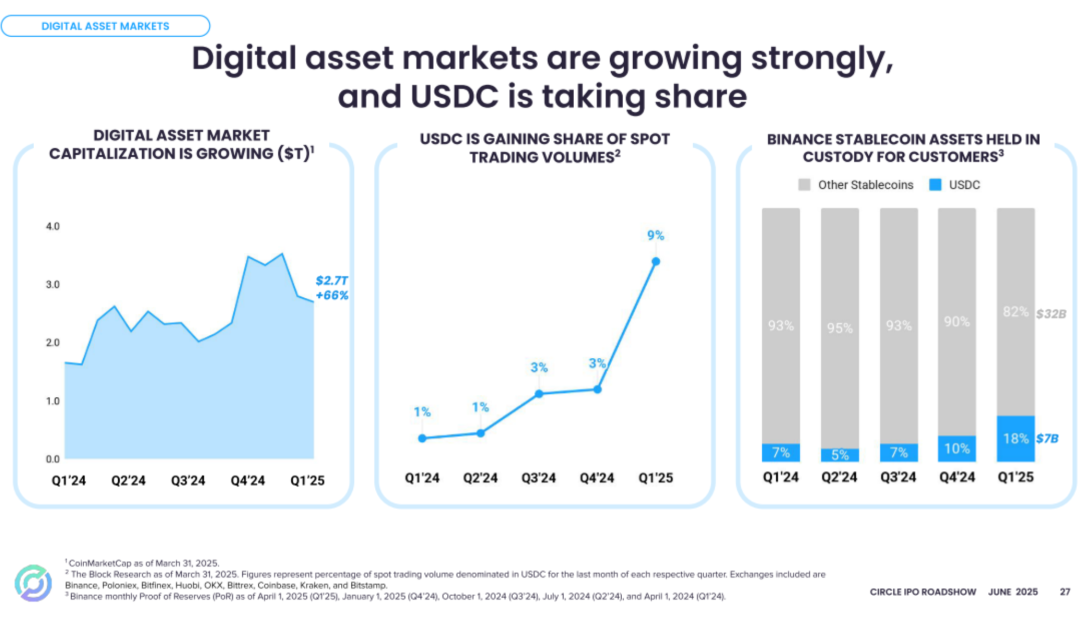

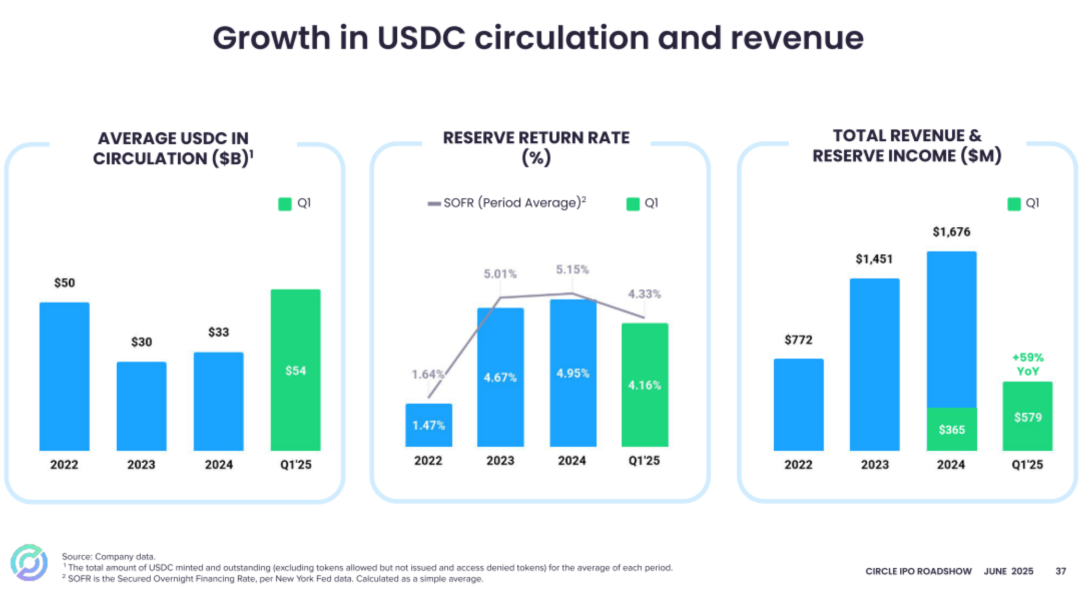

As of March 31, 2025, Circle held USDC valued at $59.976 billion, with an average USDC value of $54.136 billion.

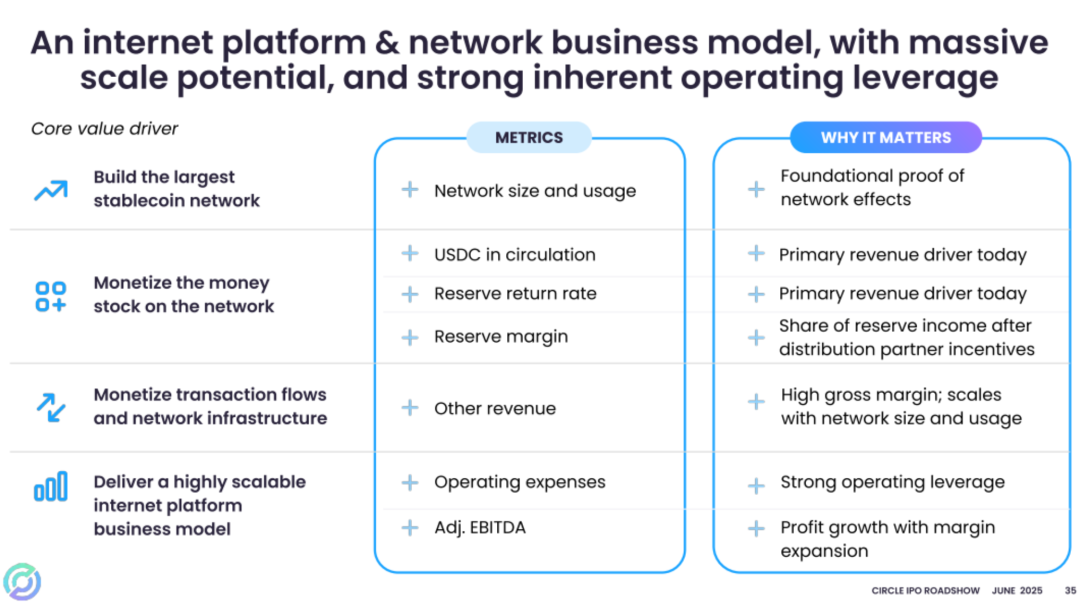

The prospectus shows that Circle's revenues for 2022, 2023, and 2024 were $772 million, $1.45 billion, and $1.676 billion, respectively; operating profits were -$38.12 million, $269 million, and $167 million.

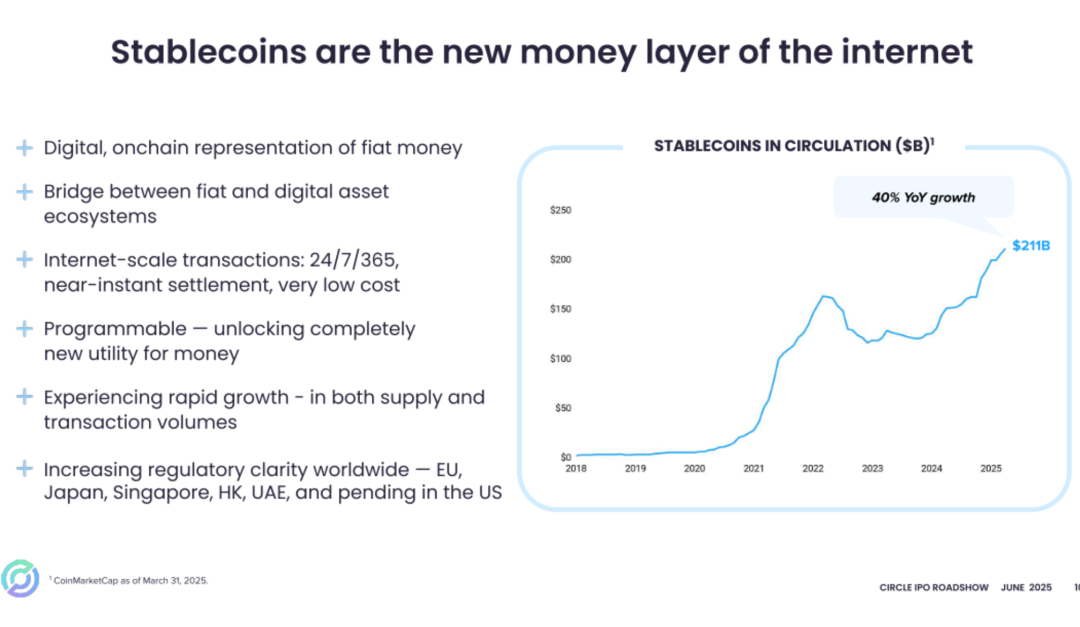

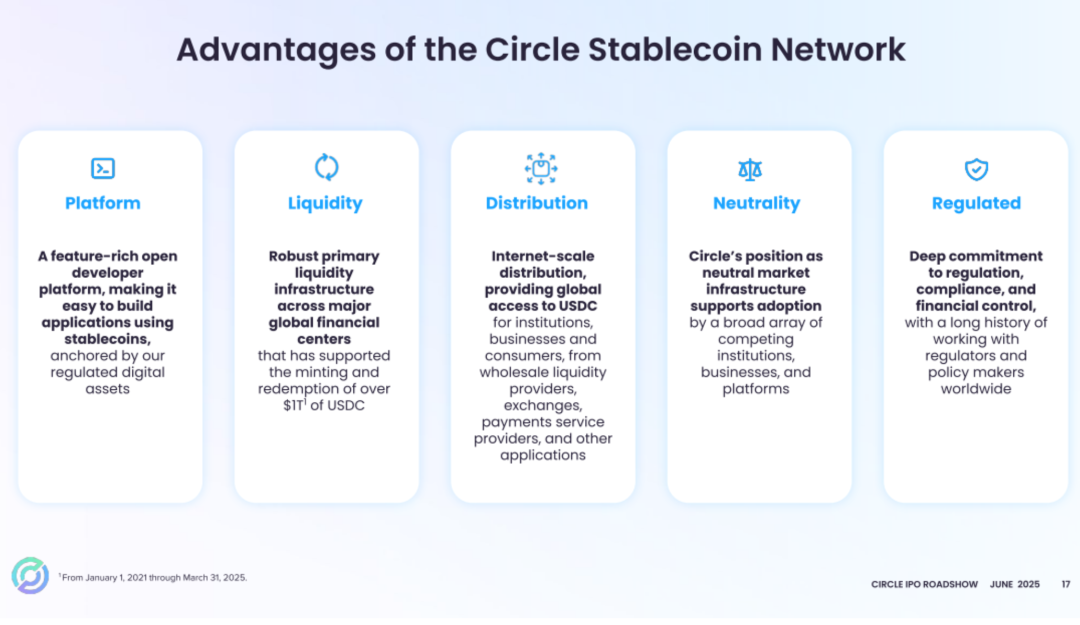

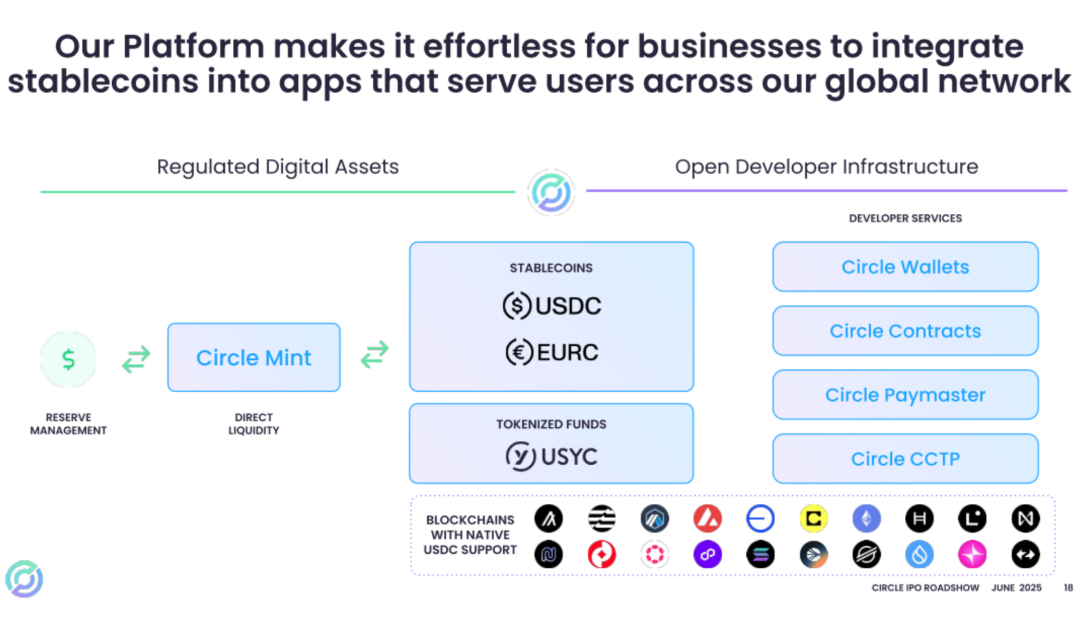

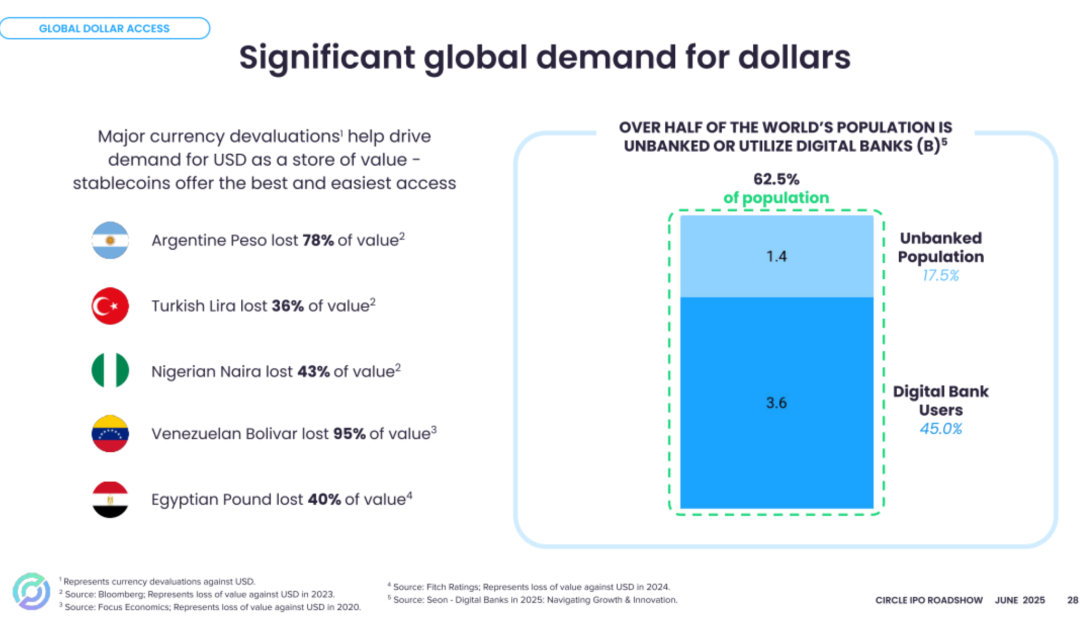

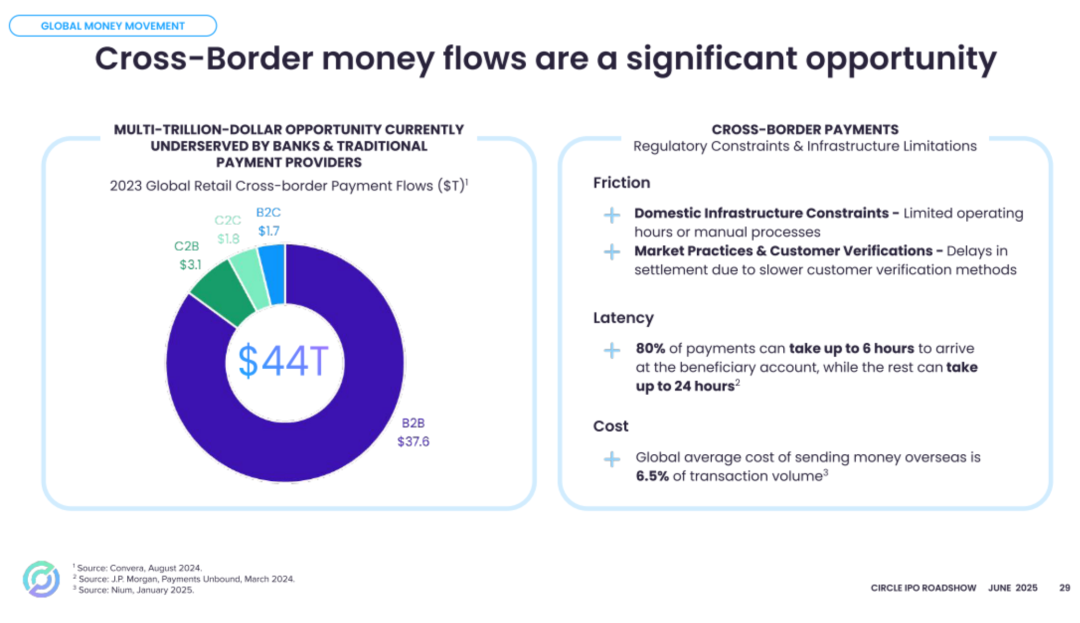

Circle's business model is straightforward: the company issues USDC stablecoins pegged 1:1 to the US dollar and invests the $60 billion deposited by users in short-term U.S. Treasury bonds to earn risk-free returns.

Circle primarily invests in U.S. Treasury bonds and cash, generating approximately $1.6 billion in interest income ("reserve income") in 2024, accounting for 99% of Circle's total revenue.

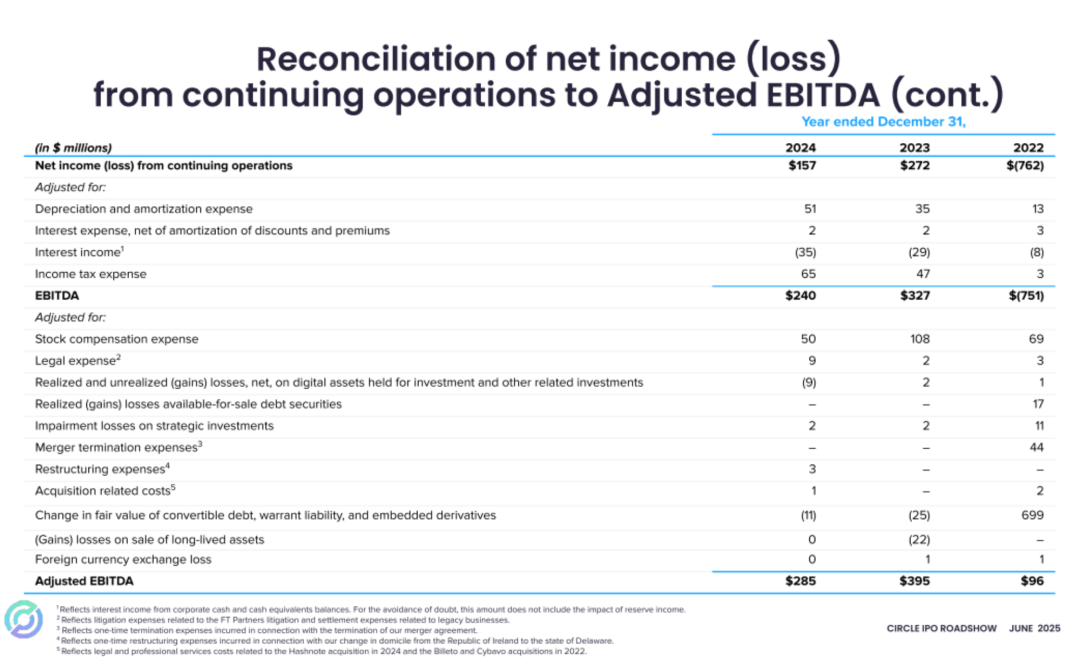

Circle's net income from continuing operations for 2022, 2023, and 2024 was -$760 million, $271 million, and $157 million, respectively.

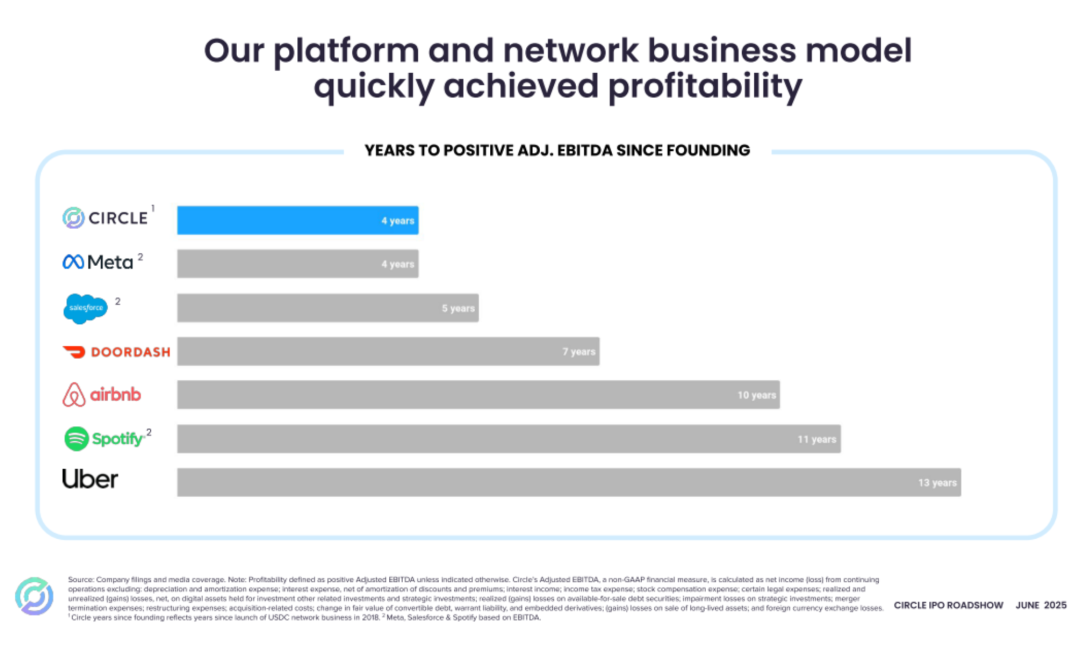

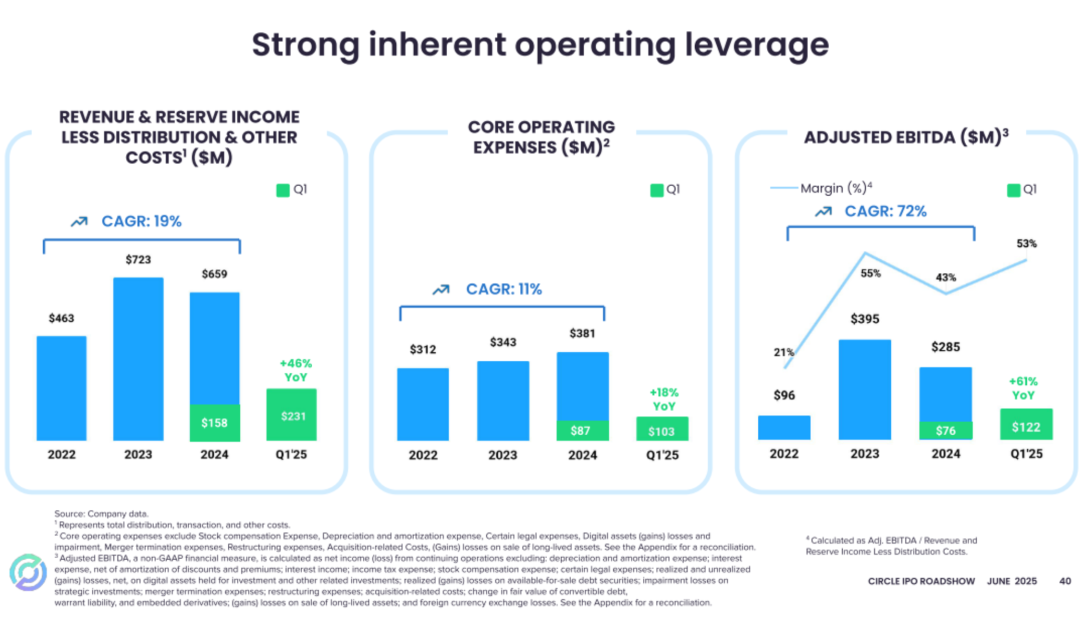

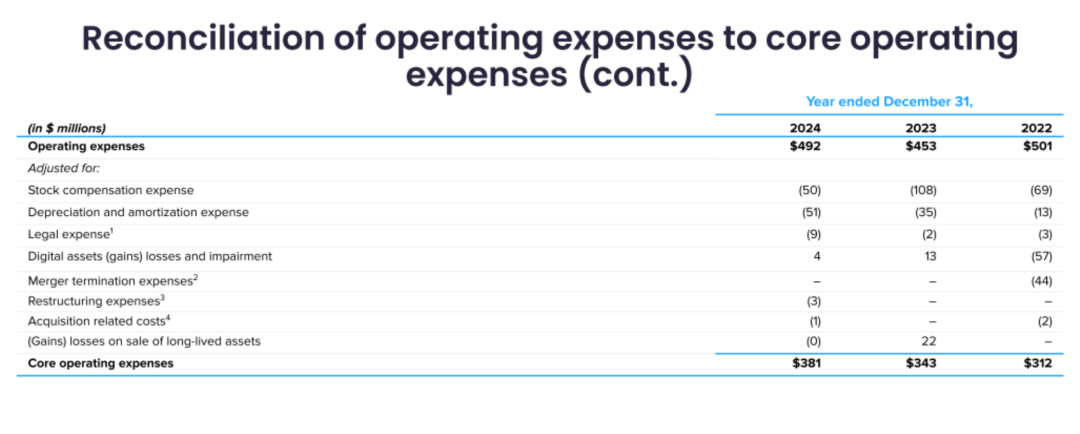

Circle's Adjusted EBITDA for 2022, 2023, and 2024 was $96 million, $395 million, and $285 million, respectively.

In the first quarter of 2025, Circle reported revenue of $579 million, a 58.6% increase from $365 million in the same period last year;

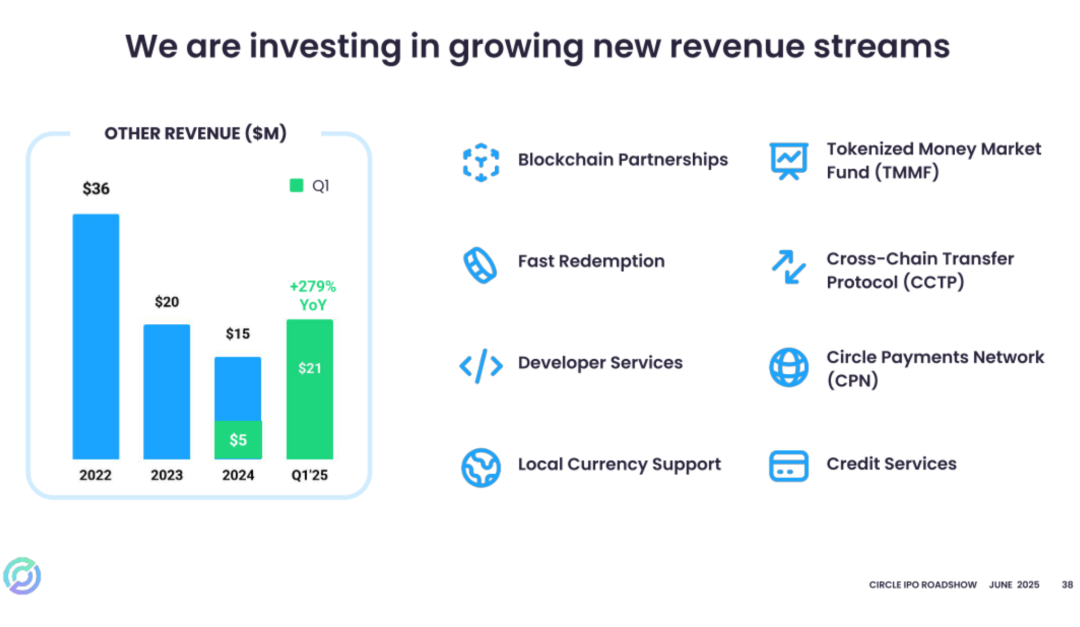

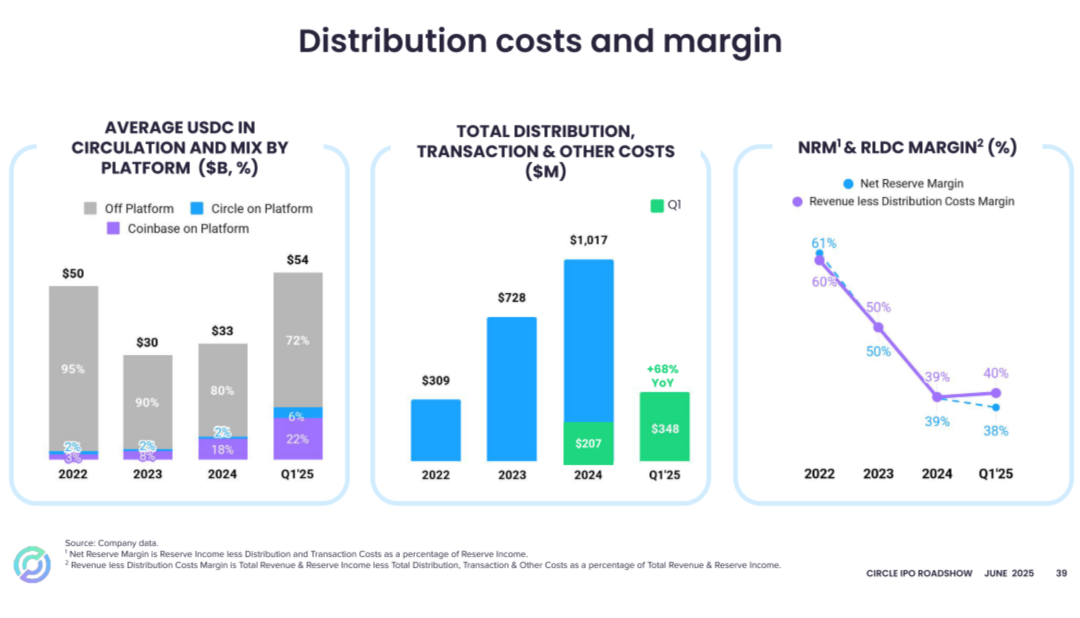

Circle's distribution and trading costs in the first quarter of 2025 increased by $144.6 million compared to the same period in 2024, a rise of 71.3%, primarily due to an increase of $101.8 million in distribution costs paid to Coinbase, attributed to increased reserve income and platform balances, as well as an additional $42.5 million in distribution costs related to new strategic distribution partnerships.

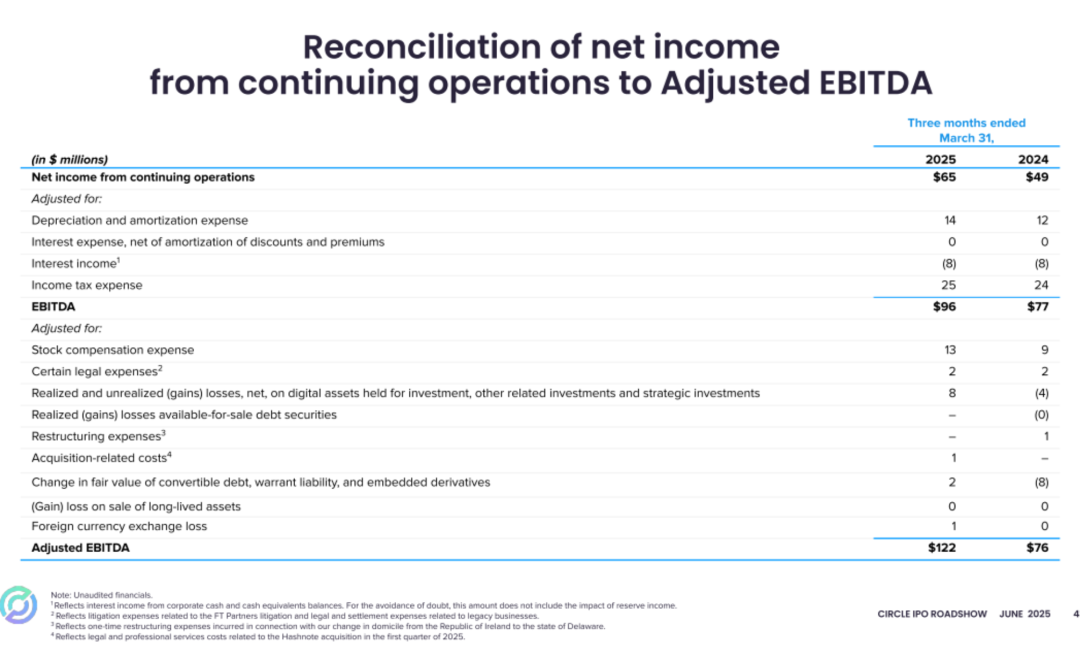

Circle's profit from continuing operations in the first quarter of 2025 was $92.94 million, a 77.6% increase from $52.32 million in the same period last year; net income from continuing operations was $64.79 million, a 33.2% increase from $48.63 million in the same period last year.

Circle's Adjusted EBITDA for 2022, 2023, and 2024 was $96.28 million, $395 million, and $285 million, respectively; the Adjusted EBITDA for the first quarter of 2025 was $122 million, compared to $76.26 million in the same period last year.

IDG Capital and Accel are Shareholders

Circle's Chairman and CEO is Jeremy Allaire, CFO is Jeremy Fox-Geen, and President is Heath Tarbert.

Before the IPO, Jeremy Allaire held 77.1% of Class B shares, with 23.1% voting rights; Nikhil Chandhok held 1% of Class A shares; Accel held 6.9% of Class A shares, with 4.8% voting rights; Breyer held 9% of Class A shares, with 6.3% voting rights;

General Catalyst held 12.8% of Class A shares, with 8.9% voting rights; P. Sean Neville held 22.9% of Class B shares, with 6.9% voting rights.

IDG Capital held 12.6% of Class A shares, with 8.8% voting rights; Oak Investment held 7.5% of Class A shares, with 5.3% voting rights; FMR held 7.2% of Class A shares, with 5.1% voting rights; Elisabeth Carpenter held 2.8% of Class A shares, with 2% voting rights.

After the IPO, Jeremy Allaire held 78.9% of Class B shares, with 23.7% voting rights; P. Sean Neville held 21.1% of Class B shares, with 6.3% voting rights.

Accel held 5.4% of Class A shares, with 3.8% voting rights; Breyer held 6.7% of Class A shares, with 4.7% voting rights; General Catalyst held 10% of Class A shares, with 7% voting rights.

IDG Capital held 10.4% of Class A shares, with 7.3% voting rights; Oak Investment held 5.9% of Class A shares, with 4.1% voting rights; FMR held 6.7% of Class A shares, with 4.7% voting rights; Elisabeth Carpenter held 2.1% of Class A shares, with 1.5% voting rights.

Here is Circle's roadshow PPT:

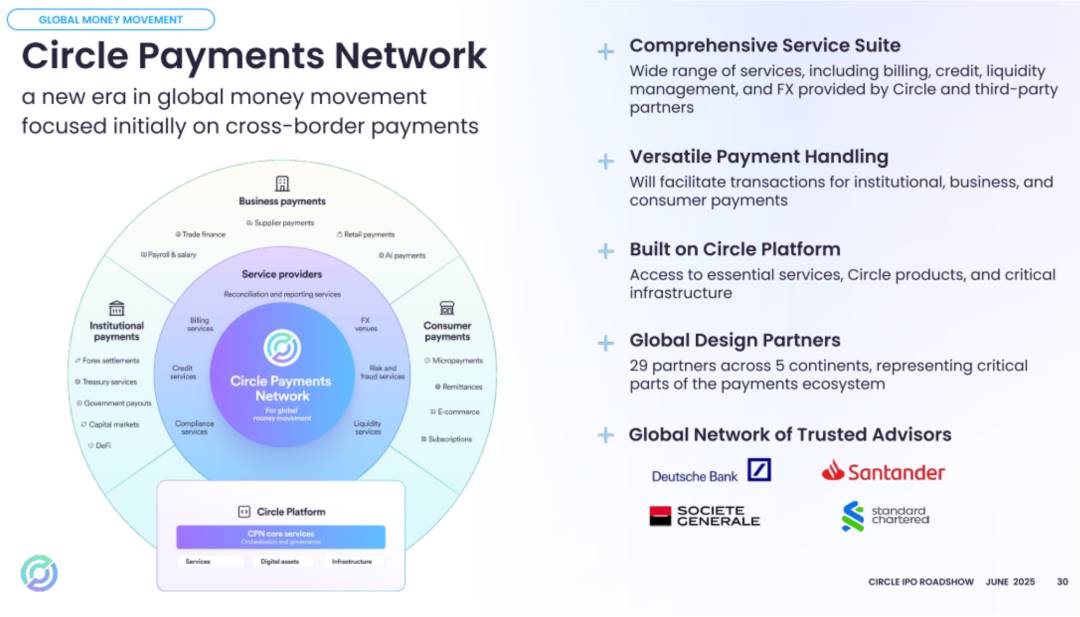

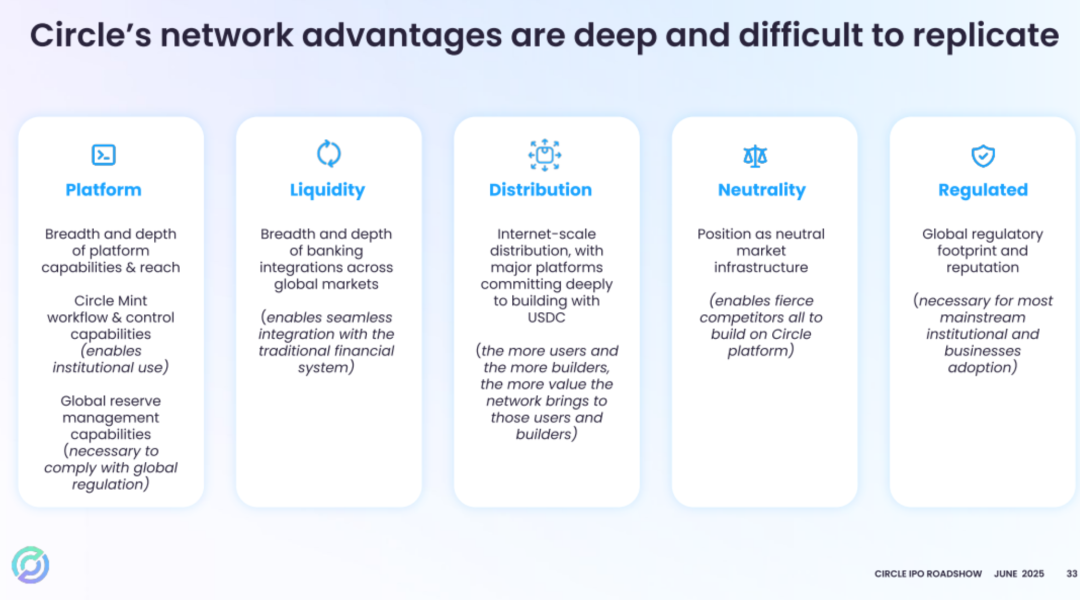

Circle Roadshow PPT Content

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。