Accelerating the speed of currency circulation is the core application of cryptocurrency, and putting RWA on-chain perfectly aligns with this trend.

Author: Sumanth Neppalli

Compiled & Edited by: Deep Tide TechFlow

Stablecoins have recently become a hot topic in the cryptocurrency field. Some believe it is the best invention since sliced bread, while others (like me) think it is merely a clever way to export dollars. In the face of the transformation brought by tokenization, we have been pondering how financial markets will evolve accordingly. This article will first review the historical background of stablecoins, followed by an in-depth analysis of the potential impact of tokenization on the market.

In July 1944, representatives from 44 allied nations gathered in a ski resort in Bretton Woods, New Hampshire, to replan the global monetary system. They decided to peg national currencies to the dollar, which in turn was pegged to gold. This system, designed by British economist John Maynard Keynes, ushered in a new era of stable exchange rates and smooth trade.

If we liken this summit to a GitHub project, the White House created a branch, the Treasury Secretary submitted a pull request, and the finance ministers of various countries approved these changes, effectively "hard coding" the dollar into every future trade transaction. In today's digital age, stablecoins are like the merged result of this code, while other countries are striving to adjust their "codebases" in preparation for a future that may not rely on the dollar.

Within 72 hours of returning to the Oval Office, President Trump signed an executive order that sounded more like a fantasy novel for cryptocurrency enthusiasts than traditional fiscal policy: “Promote and protect the sovereignty of the dollar, including through legally backed stablecoins globally.”

Shortly thereafter, Congress introduced legislation called the GENIUS Act, “Guiding and Establishing National Innovation for U.S. Stablecoins.” This is the first bill to establish basic rules for stablecoins while encouraging their use for payments globally.

Currently, the bill is being debated in the Senate, with a vote expected this month. Staff members have revealed that the latest draft has incorporated several suggestions from the Democratic coalition, making the bill's passage likely.

So, why is Washington showing such strong interest in stablecoins? Is it merely political posturing, or is there a deeper strategic layout behind it?

Why Foreign Demand Remains Important

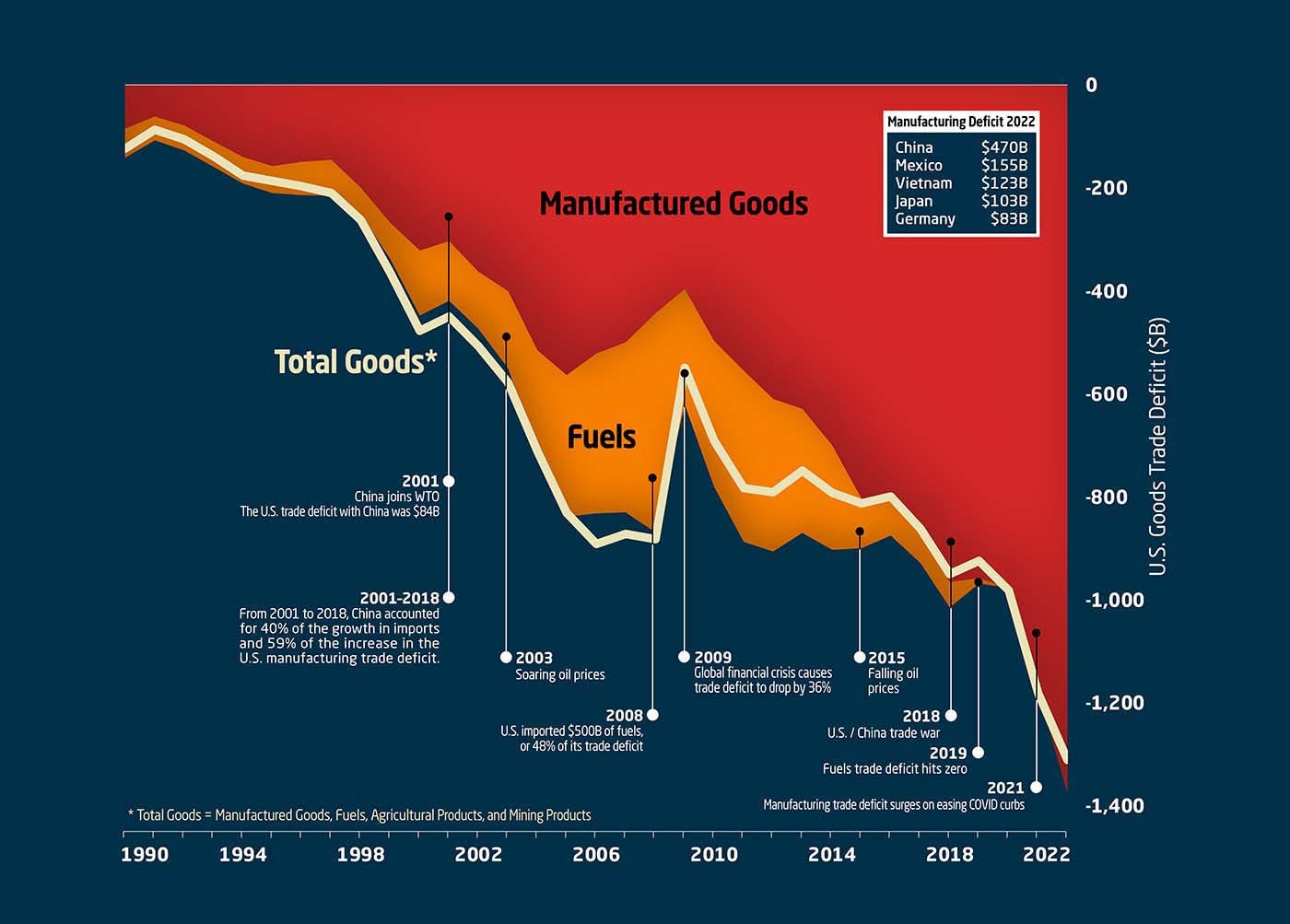

Since the 1990s, the U.S. has outsourced a significant amount of production to China, Japan, Germany, and Gulf countries, paying for these imports with newly printed dollars. Due to imports far exceeding exports, the U.S. has long faced a massive trade deficit. A trade deficit refers to the gap between the total value of goods a country purchases from the world and the total value of its exports.

Source: Visual Capitalist

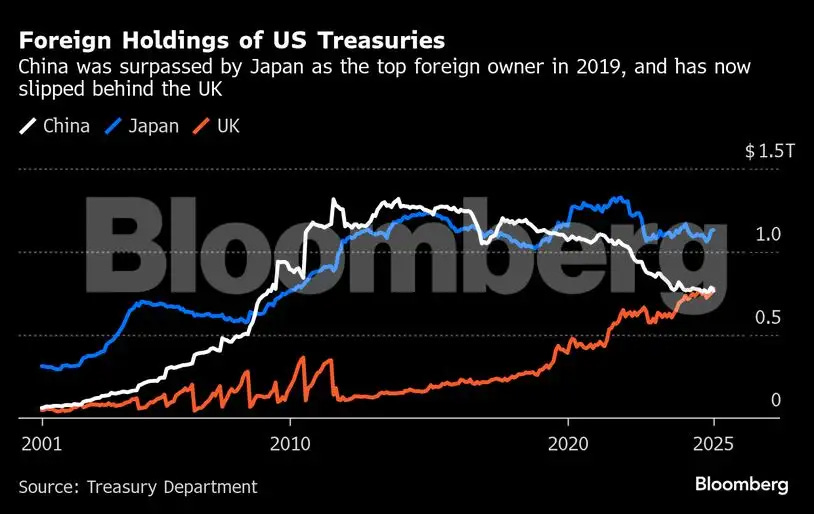

Exporting countries face a dilemma: if they convert the dollars earned back into their local currency, it will lead to an appreciation of their currency, thereby weakening the competitiveness of their goods and affecting exports. Therefore, the central banks of these countries typically choose to purchase dollars and invest them in U.S. Treasury bonds. This approach avoids fluctuations in the foreign exchange market while earning interest through bond yields, with credit risk nearly as low as directly holding dollars.

This model creates a self-reinforcing cycle: exporting goods to the U.S., earning dollar income, and then investing those dollars in U.S. Treasury bonds to earn interest. To maintain this cycle, exporting countries deliberately keep their local currency exchange rates low to promote more exports.

This "export financing cycle" has helped the U.S. address part of its debt issues. Currently, about a quarter of the 36 trillion dollars in U.S. debt is financed through this method. However, if a prolonged trade war disrupts this cycle, the U.S.'s cheapest source of financing may gradually dry up.

Financing the deficit: The U.S. government has long spent more than it earns, relying on budget deficits to operate. By selling Treasury bonds to foreigners, the U.S. can share the burden of its deficit. Short-term Treasury bills (T-bills) typically mature within a year, while long-term Treasury bonds mature in 20 to 30 years.

Maintaining low interest rates: High demand for U.S. Treasury bonds keeps their yields (i.e., interest rates) low. When buyers like China push up bond prices, yields fall, reducing borrowing costs for the government, businesses, and consumers. This low-cost borrowing supports economic growth and funds expansionary fiscal policies.

The global status of the dollar: The dollar's status as the global reserve currency depends on the international community's trust in the U.S. economy and assets. Foreign-held U.S. Treasury bonds symbolize this trust, ensuring that the dollar continues to be widely used in international trade, oil pricing, and foreign exchange reserves. This privilege allows the U.S. to borrow at a lower cost while maintaining economic influence globally.

However, if this demand decreases, the U.S. will face higher borrowing costs, a weaker dollar, and diminished geopolitical influence. In fact, warning signs have already emerged. Upon leaving office, Warren Buffett expressed that his greatest concern was an impending dollar crisis. Today, the U.S. has lost its AAA credit rating from all major rating agencies for the first time. The AAA rating is seen as the "gold standard" in the bond market, indicating that this debt is nearly risk-free. Following the downgrade, the U.S. Treasury had to offer higher yields to attract buyers, which will undoubtedly increase the nation's interest expenses, while the U.S. debt continues to grow.

If traditional Treasury bond buyers begin to exit the market, who will take on the next round of newly issued trillions of dollars in debt? Washington's strategy is to open new funding channels through a wave of regulated, fully dollar-backed stablecoins. The GENIUS Act stipulates that stablecoin issuers must purchase U.S. Treasury bonds. This is why the government is taking a tough stance on trade issues while actively promoting a digital dollar.

The Historical Impact of Eurodollars

Deep Tide Techflow Note: Eurodollars refer to dollar deposits held in banks outside the United States, particularly in European banks. These dollar deposits are not subject to U.S. regulation, so their interest rates and operational methods may differ from those of the domestic banking system.

Detailed Explanation

Financial innovation is not new to the U.S. The Eurodollar system, with a scale of up to 1.7 trillion dollars, has also gone through a process of being completely denied to gradually being accepted. Eurodollars are dollar-denominated deposits held in overseas banks, primarily distributed in Europe. These deposits are not subject to the regulatory restrictions of U.S. banks.

The Eurodollar system was born in the 1950s. At that time, to evade U.S. jurisdiction during the Cold War, the Soviet Union chose to deposit dollars in European banks. This system rapidly developed, and by 1970, its market size had grown from initially a few billion dollars to 50 billion dollars, achieving a fifty-fold expansion in just ten years.

Initially, the U.S. was skeptical of this system. French Finance Minister Valéry Giscard d'Estaing vividly likened it to a “monster of speculation”, alluding to its complexity and potential risks. However, the oil crisis of 1973 temporarily alleviated these concerns. At that time, the Organization of the Petroleum Exporting Countries (OPEC) took action to quadruple the global value of oil trade in just a few months. In this upheaval, the world urgently needed a stable currency as a medium of trade settlement, and the dollar became the preferred choice.

The Eurodollar system significantly enhanced the U.S.'s ability to influence the world through non-military means. As international trade continued to develop, and the Bretton Woods system further solidified the dollar's dominance, this system gradually expanded. Although Eurodollars are primarily used for payments between foreign entities, these transactions must go through a global network of correspondent banks, ultimately involving U.S. banks.

This arrangement places the U.S. in a key position within the global financial system, providing strong leverage for its national security objectives. The U.S. can not only block transactions directly involving itself but also exclude "bad actors" from the entire global dollar system. As a clearing center, the U.S. can track the flow of funds and implement financial sanctions against nations.

A New Era for Stablecoins

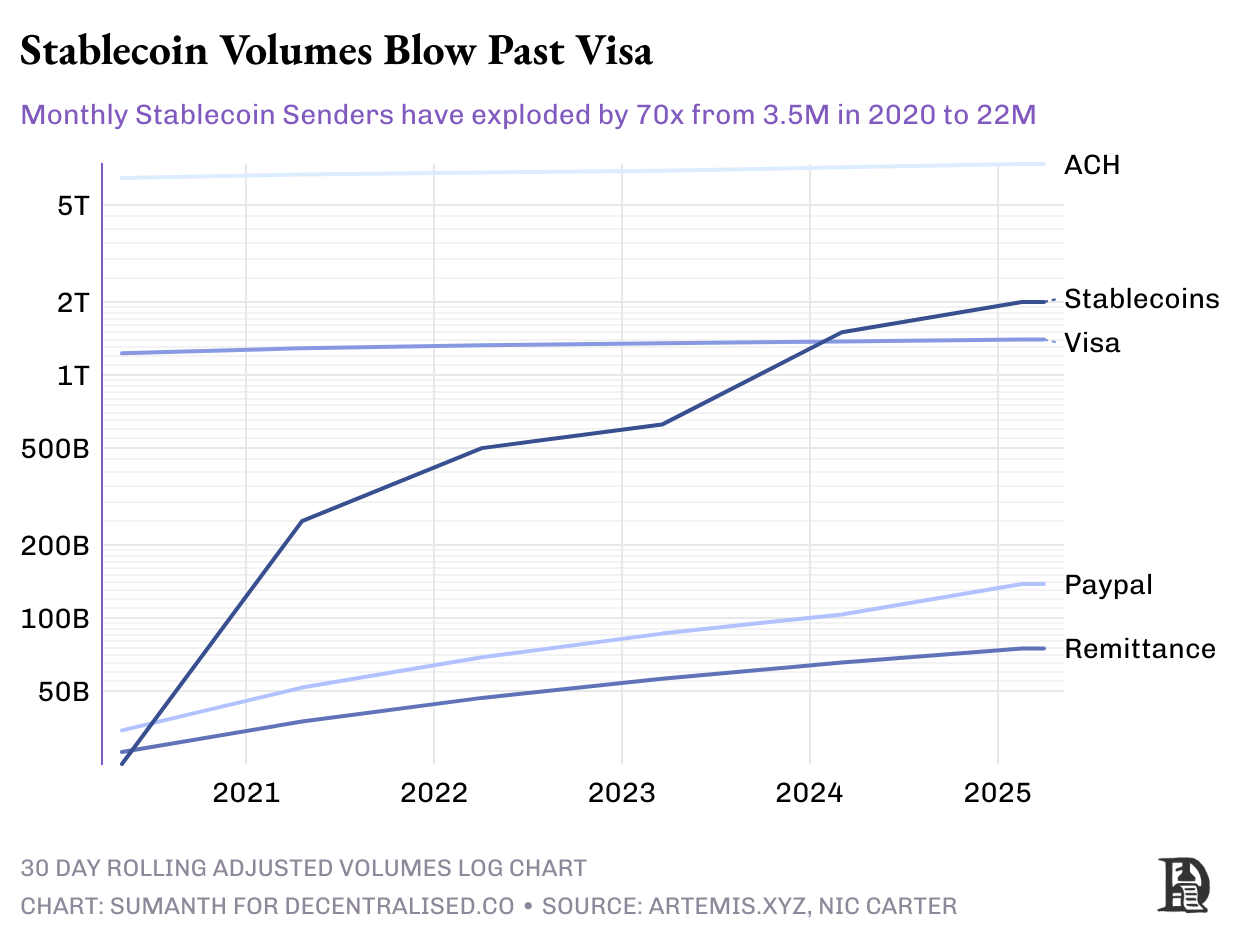

Stablecoins can be seen as a modern version of "Eurodollars," characterized by a publicly transparent blockchain explorer. Unlike the traditional model of storing dollars in London vaults, dollars are now "tokenized" and circulated through blockchain technology. This innovation has brought significant economies of scale: by 2024, the on-chain settlement amount of dollar-denominated stablecoins reached approximately 15 trillion dollars, slightly exceeding the scale of the Visa payment network. Currently, the total amount of circulating stablecoins has reached 245 billion dollars, with 90% being fully collateralized and dollar-denominated.

Over time, the demand for stablecoins has continued to grow. Investors seek to convert their earnings into stable assets to hedge against the cyclical fluctuations of the market. Unlike the extreme volatility of the cryptocurrency market, the use cases for stablecoins are expanding, indicating that their function is no longer limited to simple trading tools but is gradually becoming an important financial infrastructure.

The demand for stablecoins can be traced back to 2014. At that time, Chinese cryptocurrency exchanges needed a way to transfer dollars between their order books without relying on banks. They chose Realcoin, a dollar token based on the Bitcoin network and using the Omni protocol.

Realcoin (later renamed Tether) completed the inflow and outflow of funds through Taiwan's banking network. This method worked well until Wells Fargo terminated its correspondent banking relationship with these banks due to concerns about the regulatory risks posed by Tether's rapid growth. Ultimately, in 2021, the U.S. Commodity Futures Trading Commission (CFTC) fined Tether 41 million dollars, accusing it of misreporting reserves and claiming that its tokens were not fully backed by assets.

Tether's operating model is very similar to that of traditional banks: it accepts deposits, invests the float, and earns interest from it. Tether invests about 80% of the funds from its token issuance in U.S. Treasury bonds. Based on the current yield of 5% on short-term Treasury bonds, its holdings of 120 billion dollars can generate approximately 6 billion dollars in annual income. Through this method, Tether achieved a net profit of 13 billion dollars in 2024. In the same period, Goldman Sachs reported a net income of 14.28 billion dollars. Notably, Tether has only about 100 employees, while Goldman Sachs has around 46,000 employees. On a per capita basis, Tether generates profits of up to 130 million dollars per employee, while Goldman Sachs generates 310,000 dollars.

To gain market trust, some competitors choose to establish an advantage through transparency. For example, Circle publishes monthly audit reports for USDC, detailing each token's minting and redemption records. However, the entire industry still relies on the credit commitments of the issuers. In March 2023, the collapse of Silicon Valley Bank (SVB) temporarily froze Circle's 3.3 billion dollars in reserves, causing USDC's price to drop to 88 cents until the Federal Reserve intervened to cover SVB depositors' losses.

The U.S. government is currently planning to establish a clear regulatory framework. The GENIUS Act proposes the following core rules:

Reserves must be 100% backed by high-quality liquid assets (HQLA), such as U.S. Treasury bonds and reverse repurchase agreements.

Real-time audits through licensed oracles.

Introduction of regulatory tools: including issuer freeze functions and compliance with FATF (Financial Action Task Force) rules.

Compliant stablecoins will gain access to Federal Reserve master accounts and can obtain liquidity support through reverse repurchase channels.

Based on this, a graphic designer living in Berlin no longer needs a bank account in the U.S. or Germany, nor does he need to deal with cumbersome SWIFT procedures to hold dollars. He only needs a Gmail account and to complete a quick identity verification (KYC), provided that Europe has not mandated the promotion of its euro CBDC (Central Bank Digital Currency). Currently, funds are shifting from traditional bank ledgers to applications based on digital wallets, and the operating companies of these applications will resemble global banks without branches.

If this regulatory framework becomes law, existing stablecoin issuers will face important choices: either register in the U.S., accept quarterly audits, anti-money laundering checks, and reserve proofs; or watch as U.S. trading platforms turn to compliant stablecoins. Circle has already stored most of its USDC collateral assets in money market funds regulated by the U.S. Securities and Exchange Commission (SEC), making it more competitive in this context.

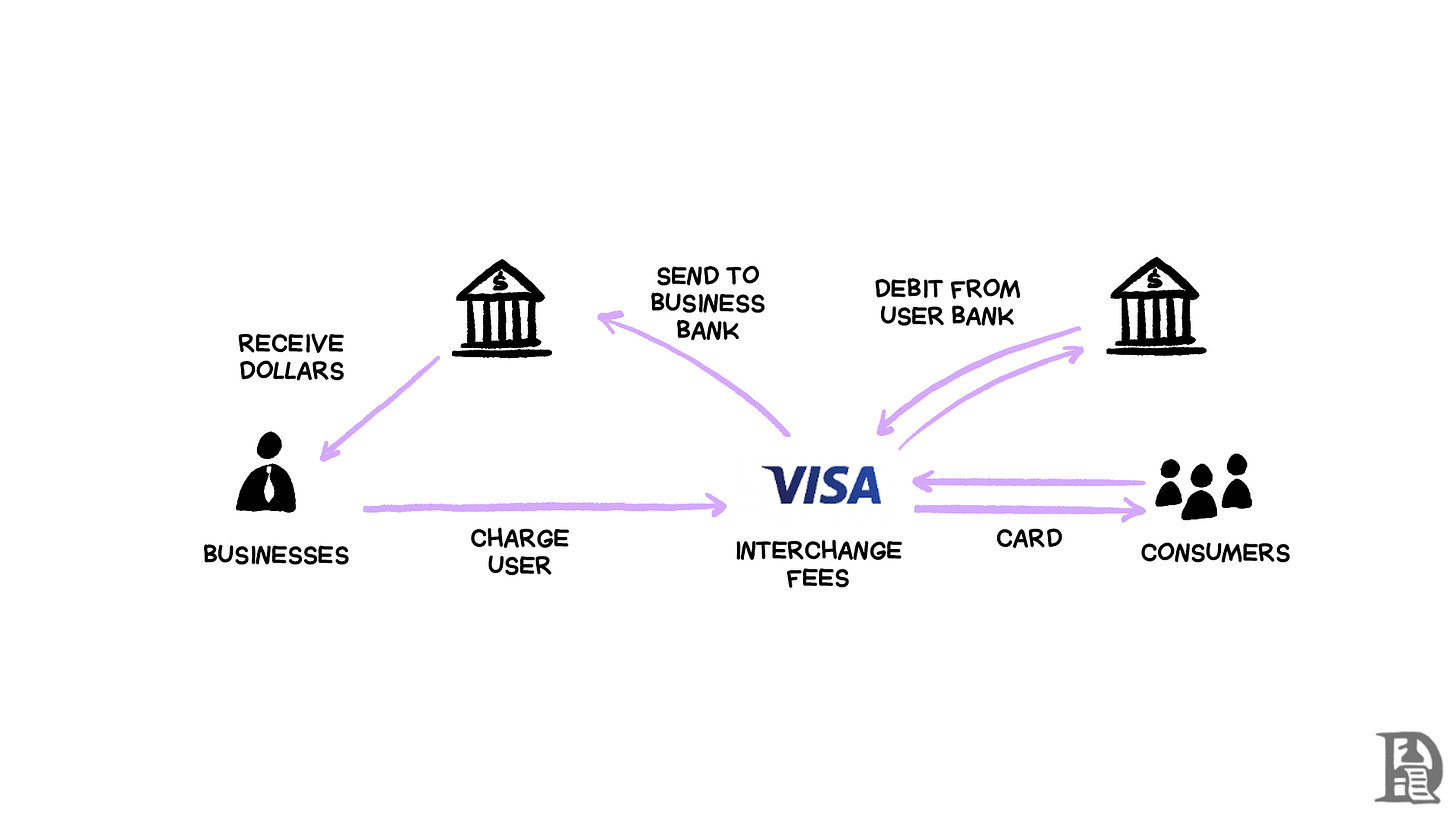

Tech giants and Wall Street are actively entering the stablecoin space. Imagine if Apple Pay launched "iDollars": users deposit 1,000 dollars, earning rewards and being able to use it anywhere that supports contactless payments. The core appeal of this model lies in the interest income from idle cash balances far exceeding current card transaction fees, while also reducing the involvement of traditional financial intermediaries. This may also be one of the reasons Apple decided to end its credit card partnership with Goldman Sachs. When payments are completed through "on-chain dollars" (i.e., blockchain-based dollar tokens), the traditional 3% transaction fee will be compressed to just a few cents in fixed blockchain fees.

Major banks in the U.S. are also accelerating their layouts. For example, Bank of America, Citibank, JP Morgan, and Wells Fargo are jointly exploring the possibility of issuing stablecoins. Notably, the GENIUS Act explicitly states that stablecoin issuers cannot distribute interest income to users, a provision that may reassure banking lobby groups. This stablecoin can be viewed as a brand new "super cheap checking account": operationally instant, globally covered, and available 24/7.

In the face of this trend, traditional financial giants are also rapidly adjusting their strategies. Mastercard (Mastercard) and Visa have launched dedicated stablecoin settlement networks. PayPal has issued its own stablecoin, while Stripe completed its acquisition of Bridge this year, marking the largest cryptocurrency transaction to date. These companies have clearly recognized the important position of stablecoins in the future financial system.

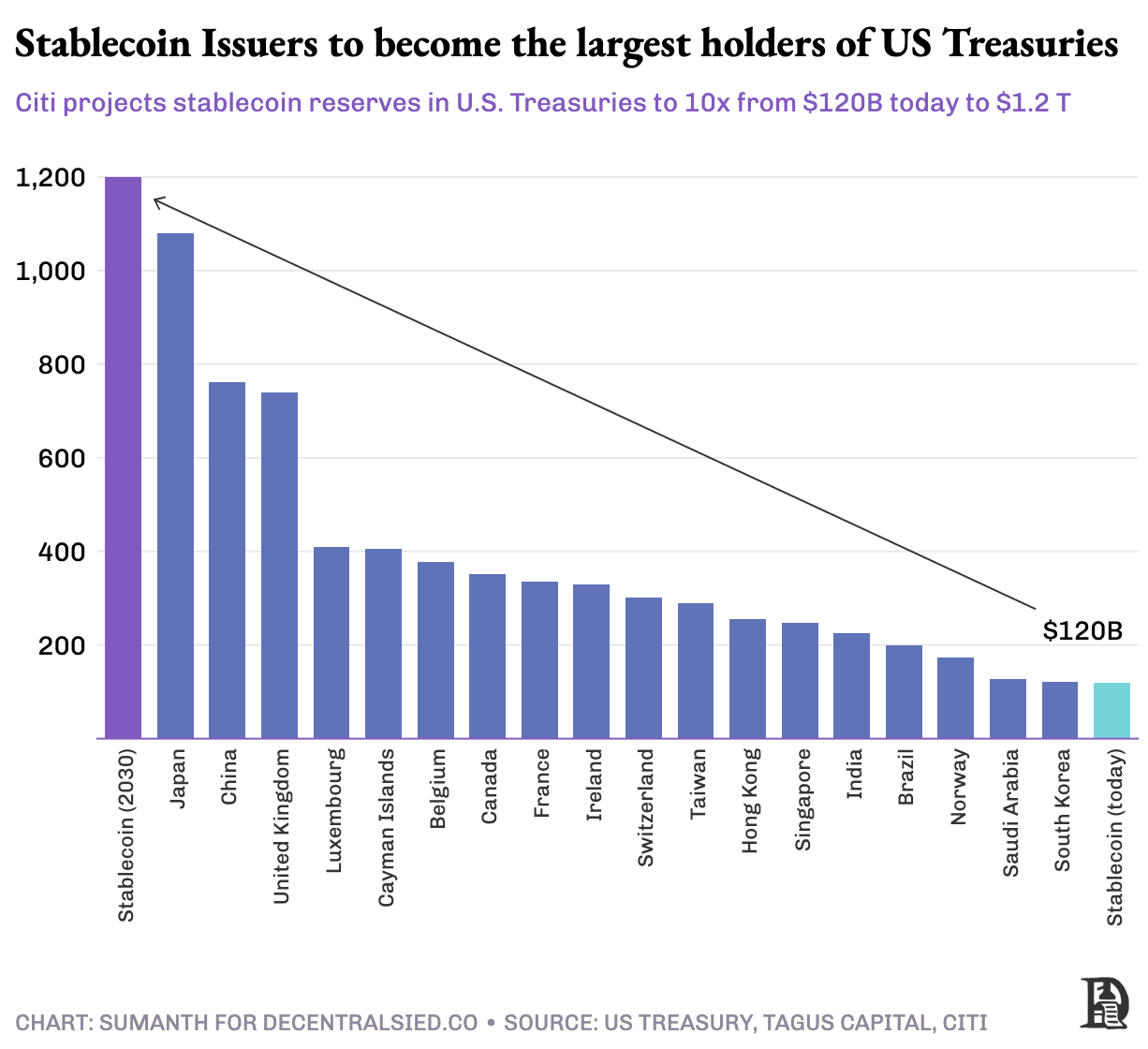

At the same time, Washington is closely monitoring this field. Citibank's forecast indicates that under the baseline scenario, the stablecoin market size will grow sixfold by 2030, reaching 1.6 trillion dollars. The U.S. Treasury's research data is even more optimistic, predicting it will reach 2 trillion dollars by 2028. If the GENIUS Act requires stablecoin issuers to invest 80% of their reserves in U.S. Treasury bonds, stablecoins will replace China and Japan as the largest holders of U.S. debt. This change will not only further consolidate the dollar's global position but may also profoundly impact the global financial landscape.

Applications and Advantages of Tokenized Assets

With the rise of "stable dollars," they are gradually becoming the core funding driving the entire token economy. Once cash is tokenized, people treat it like traditional funds: storing, lending, or using it as collateral. However, all of this is done at internet speed rather than the processing speed of traditional banks. This rapid flow of funds will further drive more "real-world assets" (RWAs) into the blockchain system, enjoying the following advantages:

24/7 Settlement - The traditional T+2 settlement cycle will be eliminated, as blockchain validators can complete transaction confirmations within minutes. For example, a trader in Singapore can purchase a tokenized apartment in New York in the evening and complete ownership confirmation before dinner.

Programmability - Smart contracts can embed complex financial logic directly into assets, such as automated coupon payments, yield distribution rules, and built-in compliance parameters.

Composability - Tokenized assets can be flexibly combined. For instance, a tokenized government bond can serve as collateral for a loan while distributing interest payments to multiple holders. An expensive beachfront villa can be divided into 50 shares, jointly held by multiple investors, and leased to hotel service providers for management through Airbnb.

Transparency - The transparent nature of blockchain can help regulators monitor on-chain collateral rates, systemic risks, and market dynamics in real-time, thereby avoiding risks similar to those triggered by the opacity of the derivatives market during the 2008 financial crisis.

As BlackRock CEO Larry Fink stated: "Every stock, every bond, every fund—every asset—can be tokenized."

The main obstacle lies in the clarity of regulation. Investors know what to expect in traditional exchanges because the rules of these exchanges have been built on painful lessons.

Take the example of the 1987 "Black Monday" stock market crash, when the Dow Jones Industrial Average plummeted 22% in a single day due to automated programs selling stocks as prices fell, triggering a series of sell-offs. The U.S. Securities and Exchange Commission (SEC) responded by introducing circuit breakers, which pause trading to allow investors to reassess the situation. Today, if the New York Stock Exchange (NYSE) experiences a 7% drop, trading is paused for 15 minutes.

Tokenizing assets is the relatively simple part, where issuers guarantee the rights to the real-world assets corresponding to the tokens. The difficult part is ensuring that all rules are adhered to both on-chain and off-chain. This means embedding wallet-level whitelists, national identity information flows, cross-border KYC/AML (Know Your Customer/Anti-Money Laundering) requirements, citizen holding limits, and real-time sanctions screening into the code.

Europe's Markets in Crypto-Assets (MiCA) provides a complete operational manual for digital assets in Europe, while Singapore's Payment Services Act serves as a starting point for Asia, but the global regulatory landscape remains insufficiently developed.

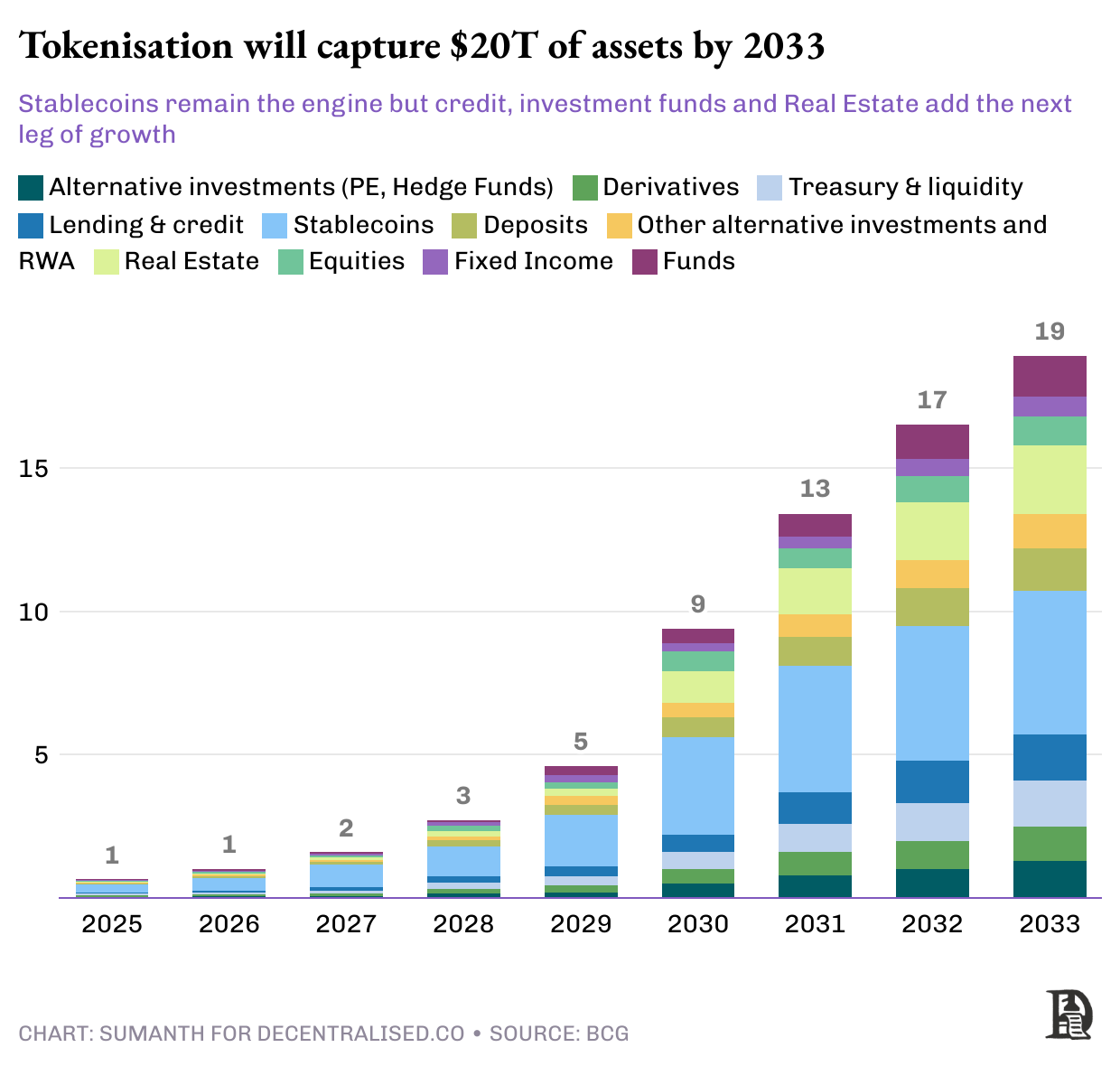

It is almost certain that the promotion process will be phased.

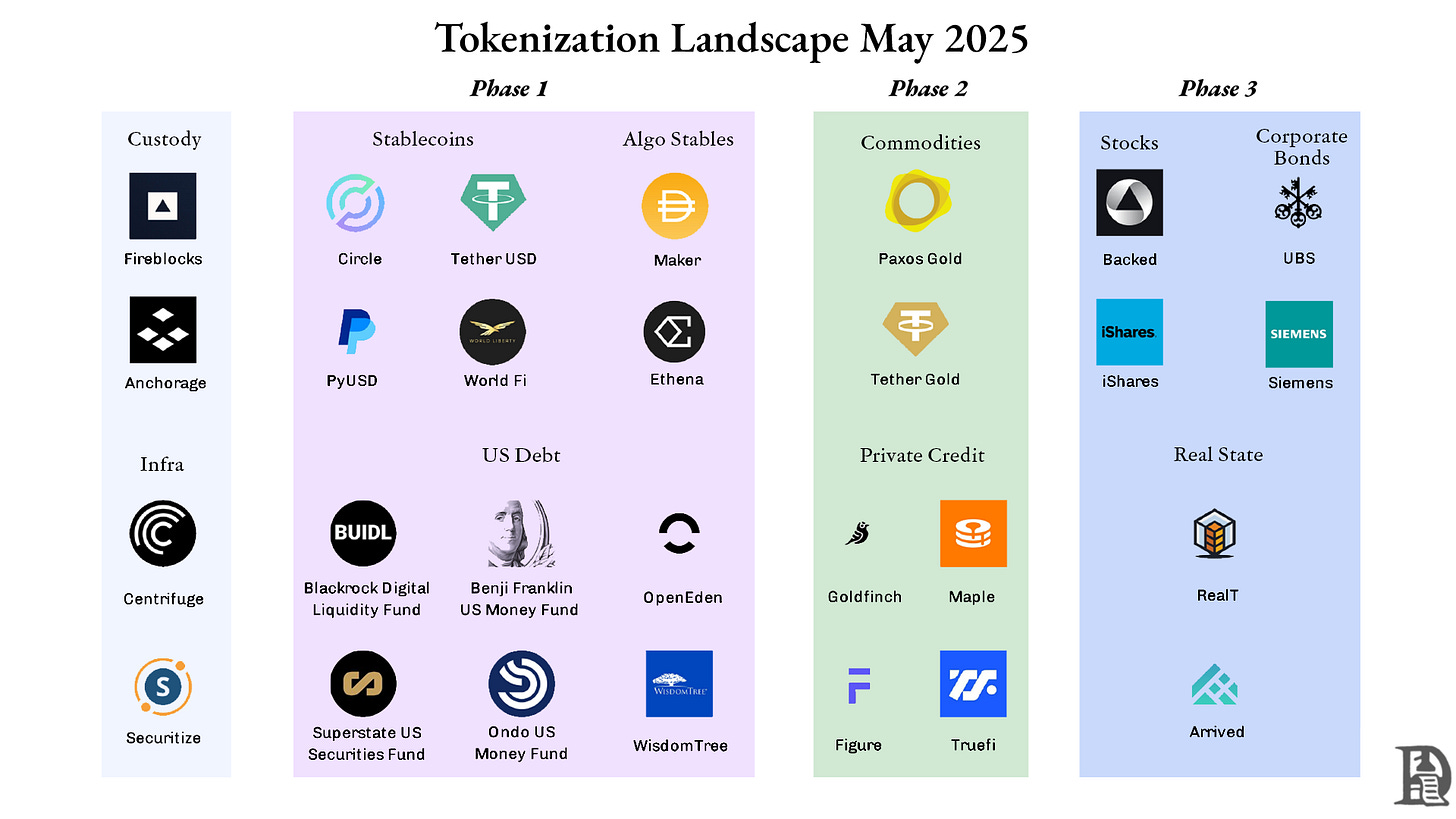

Phase One: The first to be introduced on-chain will be the most liquid and lowest-risk instruments, such as money market funds and short-term corporate bonds. The operational benefits of this phase are immediate, as settlement cycles can be shortened instantly, and compliance handling is relatively simple.

Phase Two: The risk curve will rise, involving higher-yield products such as private credit, structured financial products, and long-term bonds. In this phase, the goal is not only to enhance efficiency but also to release liquidity and achieve asset composability.

Phase Three: This will expand to lower liquidity asset classes, such as private equity, hedge funds, infrastructure, and real estate-backed debt. Achieving this phase requires widespread acceptance of tokenized assets as collateral and a cross-industry tech stack capable of servicing these assets. Banks and financial institutions need to custody these real-world assets (RWAs) as collateral while providing credit support.

Although the timelines for different asset classes may vary, the direction of development is clear. Each new batch of stable dollars will push the token economy forward by one phase.

Stablecoins

The token market pegged to the dollar is currently dominated by two giants, Tether (USDT) and Circle (USDC), which together control 82% of the market share. Both are fiat-collateralized stablecoins: for example, euro-denominated stablecoins support each circulating token by depositing euros in banks.

In addition to the fiat model, developers are exploring two decentralized experimental methods to maintain price stability without off-chain custodians:

Cryptocurrency-Collateralized Stablecoins: These stablecoins are supported by other cryptocurrencies as reserves, typically using over-collateralization to cope with market volatility. For example, MakerDAO’s DAI is a representative in this field, with a supply reaching 6 billion dollars. After the bear market in 2022, MakerDAO converted more than half of its collateral into tokenized government bonds and short-term bonds to reduce the impact of ETH volatility on the system while obtaining stable returns. Currently, this portion of assets contributes about 50% of the protocol's revenue.

Algorithmic Stablecoins: These stablecoins do not rely on any collateral but maintain price stability through an algorithm-controlled minting and burning mechanism. Terra’s UST once reached a market cap of 20 billion dollars, but due to price decoupling, market confidence collapsed, leading to massive sell-offs. Although emerging projects like Ethena have achieved growth through improved models, reaching a market cap of 5 billion dollars, this area still needs time to gain broader recognition.

If the U.S. government only allows fully fiat-backed stablecoins to use the "qualified stablecoin" label, other types of stablecoins may be forced to drop the "USD" from their names to comply with regulations. The future of algorithmic stablecoins remains uncertain, as the GENIUS Act requires the Treasury to conduct research on these protocols within a year before making a final decision.

Money Market

The money market includes highly liquid, short-term assets such as government bonds, cash, and repurchase agreements. On-chain funds "tokenize" these assets by packaging ownership into ERC-20 or SPL tokens. These tools enable 24/7 redemptions, automated yield distributions, seamless payment integrations, and convenient collateral management.

Asset management companies retain traditional compliance processes (such as AML/KYC, accredited investor restrictions), but settlement times have been reduced from days to minutes.

BlackRock's USD Institutional Digital Liquidity Fund (BUIDL) is the market leader in this field. The company has designated Securitize, a SEC-registered transfer agent, to handle KYC onboarding, token minting and burning, tax compliance FATCA/CRS reporting, and shareholder registry management. Investors must have at least 5 million dollars in investable assets to qualify, but once whitelisted, they can subscribe, redeem, or transfer tokens 24/7, which traditional money market funds cannot offer.

BUIDL has grown to manage approximately 2.5 billion dollars in assets, distributed among over 70 whitelisted holders across five chains. About 80% of the funds are invested in government bonds (mainly 1 to 3 months), 10% in long-term government bonds, and the remaining funds are held in cash.

Platforms like Ondo(OUSG) act as investment management pools, allocating funds to a group of tokenized money market funds, such as BlackRock, Franklin Templeton, and WisdomTree, providing free stablecoin entry and exit channels.

Although the 10 billion dollar scale seems insignificant compared to the 26 trillion dollar government bond market, this trend is significant: the largest asset management companies on Wall Street are choosing public chains as distribution channels.

Commodities

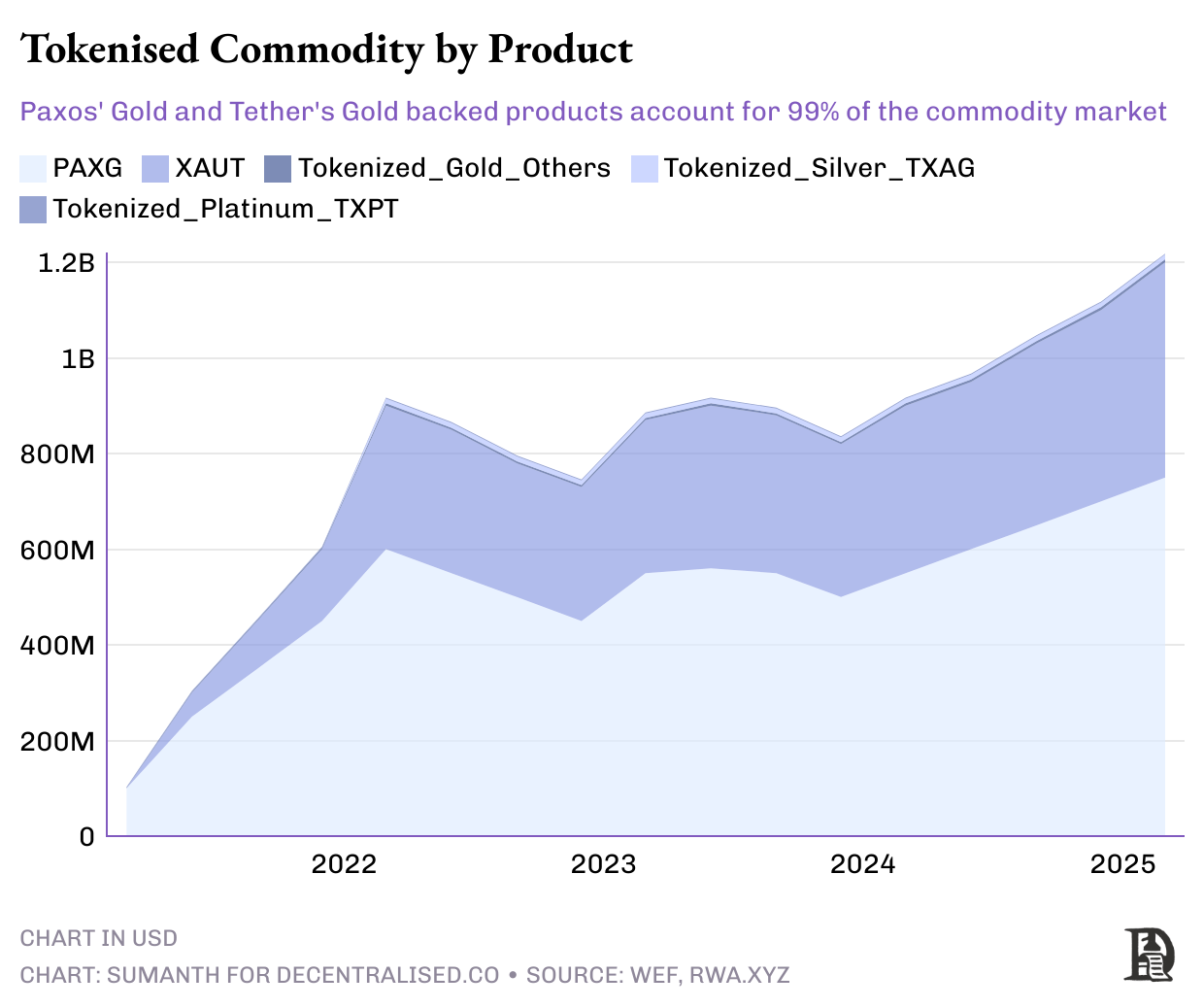

Tokenizing hard assets is pushing these markets toward 24/7, click-to-trade platforms. Paxos Gold (PAXG) and Tether Gold (XAUT) allow anyone to purchase a small portion of tokenized gold bars. Venezuela's PETRO experiment involved packaging oil into barrels; some smaller pilot projects link token supply to soybeans, corn, or even carbon credits.

The current operating model still relies on traditional infrastructure: for example, gold bars are stored in vaults, oil is stored in tanks, and auditors review reserves monthly. This custodial model introduces centralized risks, and physical redemptions are not always feasible.

The advantage of tokenization lies in enabling fractional ownership of assets, making traditionally illiquid physical assets easier to use as collateral. This market has grown to 14.5 billion dollars, almost entirely backed by gold. Compared to the 5 trillion dollar physical gold market, tokenized assets still have significant room for growth.

Lending and Credit: New Opportunities in DeFi

Decentralized finance (DeFi) lending was initially achieved through over-collateralized cryptocurrency loans. Users can borrow $100 by locking up $150 worth of ETH or BTC. This model is similar to gold-backed loans. Holders wish to retain their digital assets because they believe in their appreciation, but they also need liquidity to pay bills or make new investments. Currently, the total lending on the Aave platform is approximately $17 billion, accounting for nearly 65% of the entire DeFi lending market.

In traditional credit markets, banks dominate the lending market through long-validated risk models and strict capital requirements. Private credit, as an emerging asset class, has reached a global asset management scale of $3 trillion, keeping pace with the traditional credit market. Companies raise funds by issuing high-risk, high-yield loans, attracting institutional investors seeking higher returns, such as private equity funds and asset management companies.

Bringing credit on-chain can expand the range of lenders and increase transparency. Smart contracts can automate the entire loan process, including fund disbursement, interest payment collection, and ensuring that liquidation conditions are transparently visible on-chain.

Two On-Chain Private Credit Models

- "Retail-Oriented" Direct Lending

Platforms like Figure tokenize home improvement loans and sell the split notes to retail investors worldwide. This model is similar to a debt version of crowdfunding. Homeowners can obtain cheaper financing by splitting the loan into smaller shares, while retail investors can receive monthly returns, all managed automatically by the protocol.

Pyse and Glow tokenize power purchase agreements (PPAs) by integrating solar projects and handle all related operations, including solar panel installation and meter readings. Investors can participate in the investment and earn an annualized return (APY) of 15–20% from monthly electricity revenue.

- Institutional Liquidity Pools: On-Chain Transparent Private Credit

- On-chain private credit pools provide investors with a transparent operating environment. Protocols like Maple, Goldfinch, and Centrifuge consolidate borrowers' funding needs into on-chain credit pools managed by professional underwriters. The depositors in these credit pools mainly include accredited investors, decentralized autonomous organizations (DAOs), and family offices. They track investment performance through public ledgers while earning floating returns of 7–12%.

- On-Chain Credit Protocols Reducing Operational Costs

- These protocols effectively reduce operational costs by introducing on-chain underwriters to conduct due diligence and complete loan disbursement within 24 hours. For example, the Qiro platform relies on a network of underwriters, each with its own credit assessment model, and rewards them based on their analysis results. However, due to higher default risks, the growth rate of such loans is slower than that of mortgages. When defaults occur, these protocols cannot pursue recovery through legal means like traditional finance but must rely on traditional collection agencies, which inadvertently increases costs.

As underwriters, auditors, and collection agents gradually move on-chain, the operational costs of the credit market will further decrease, attracting more lenders to participate.

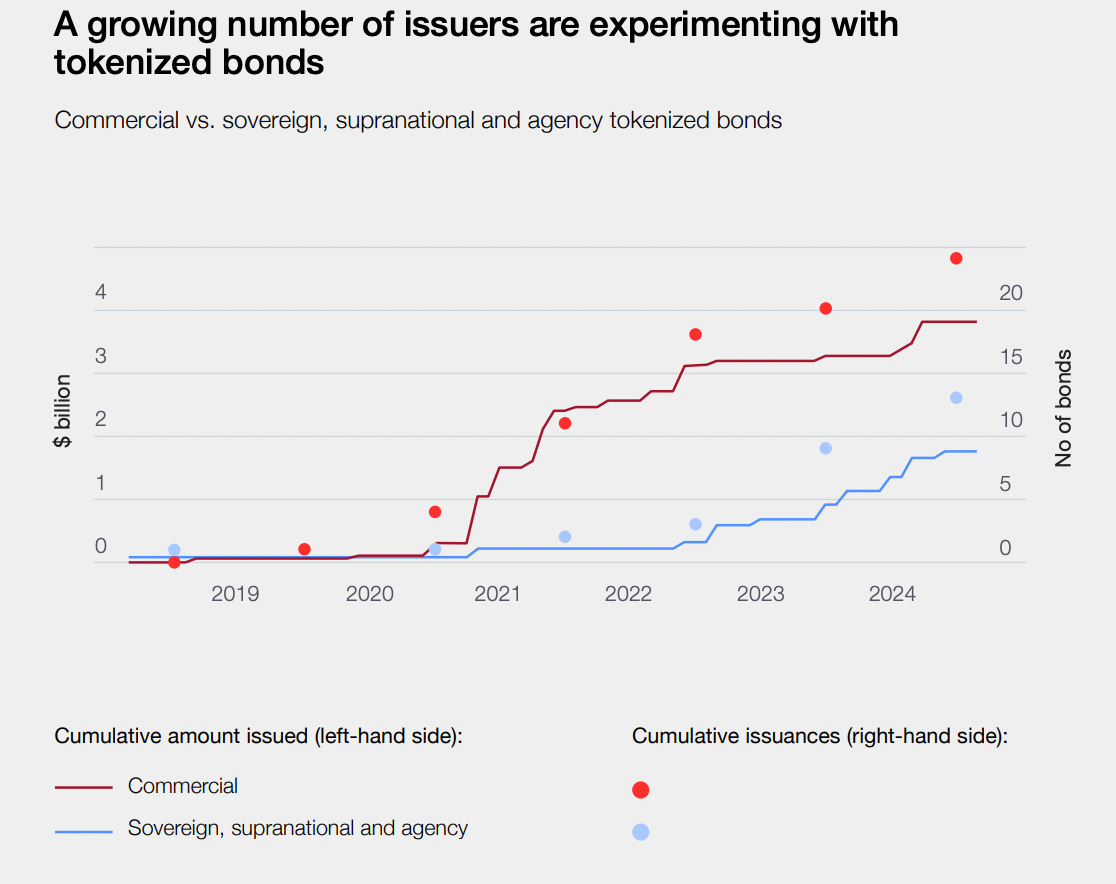

Tokenized Bonds: The Future of the Debt Market

Although bonds and loans are both debt instruments, they differ significantly in structure, standardization, and methods of issuance and trading. Loans are typically "one-to-one" agreements, while bonds are "one-to-many" financing tools that follow a fixed format. For example, a 10-year bond with a 5% annual coupon is easier to rate and trade in the secondary market. Bonds, as public financial instruments, are subject to market regulation and are typically rated by agencies like Moody's.

Bonds are primarily used to meet large-scale, long-term capital needs. Governments, utility companies, and blue-chip corporations usually raise funds by issuing bonds for budgets, factory construction, or short-term financing. Investors receive periodic coupon payments and recover their principal at maturity. This market is enormous; as of 2023, the nominal value of the global bond market has reached $140 trillion, approximately 1.5 times the global stock market value.

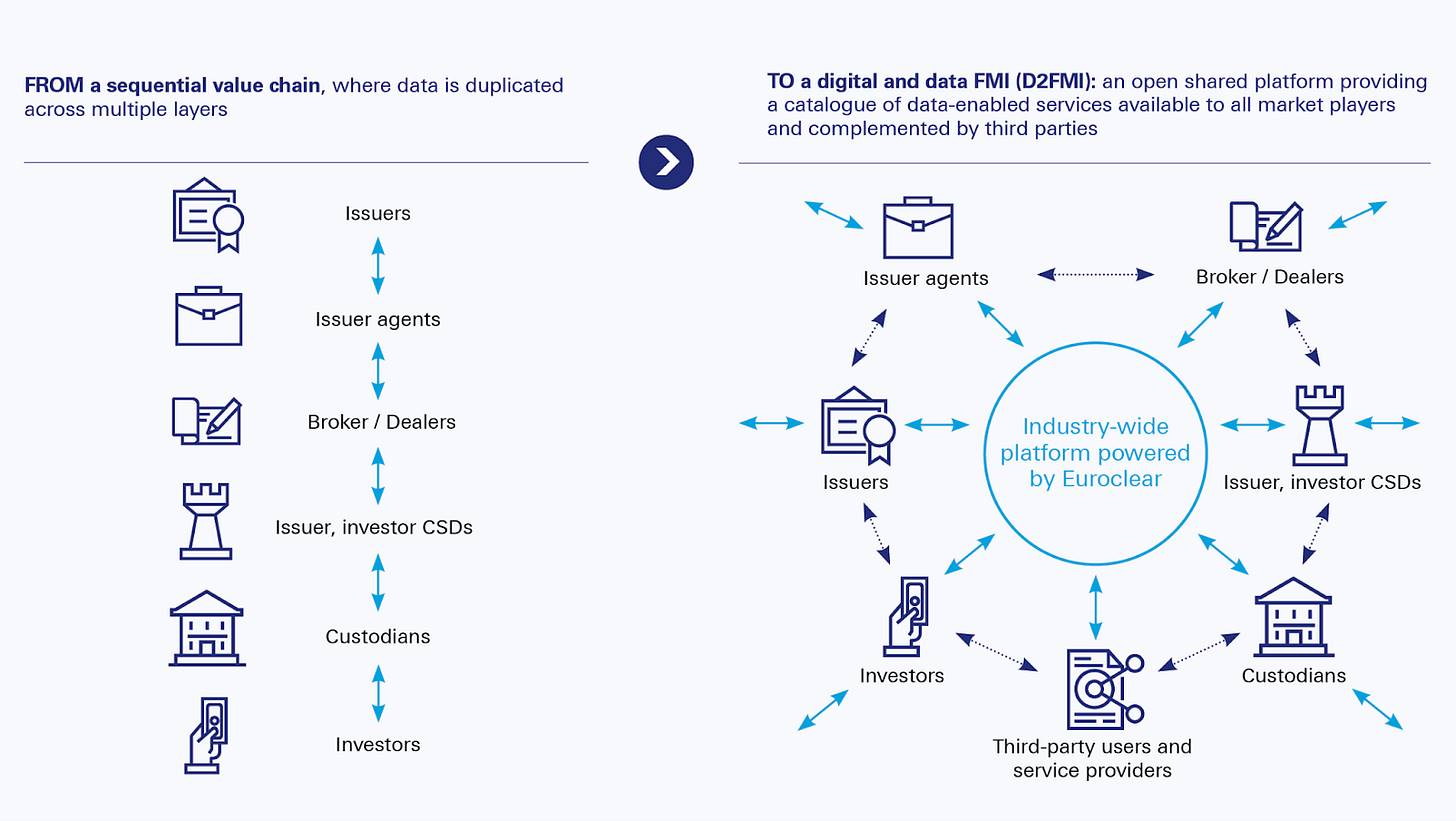

However, the current bond market still relies on traditional clearing systems designed in the 1970s. Clearing companies like Euroclear and DTCC need to process transactions through multiple custodians, increasing transaction delays and resulting in a T+2 settlement time. In contrast, smart contract bonds can achieve atomic settlement in seconds while automatically distributing coupons to thousands of wallets. These bonds can also embed compliance logic and connect to global liquidity pools.

The operational costs of smart contract bonds can save 40–60 basis points per issuance. Additionally, financial officers can access a 24/7 secondary market without paying exchange listing fees. Euroclear, as Europe's core settlement and custody network, manages €40 trillion in assets and connects over 2,000 participants across 50 markets. They are currently developing a blockchain-based settlement platform aimed at covering issuers, brokers, and custodians to eliminate redundant operations, reduce risks, and provide clients with real-time digital workflows.

Source: Euroclear

Companies like Siemens and UBS have issued on-chain bonds in ECB trials. The Japanese government is also testing the market in collaboration with Nomura to tokenize bonds.

Source: WEF Insights

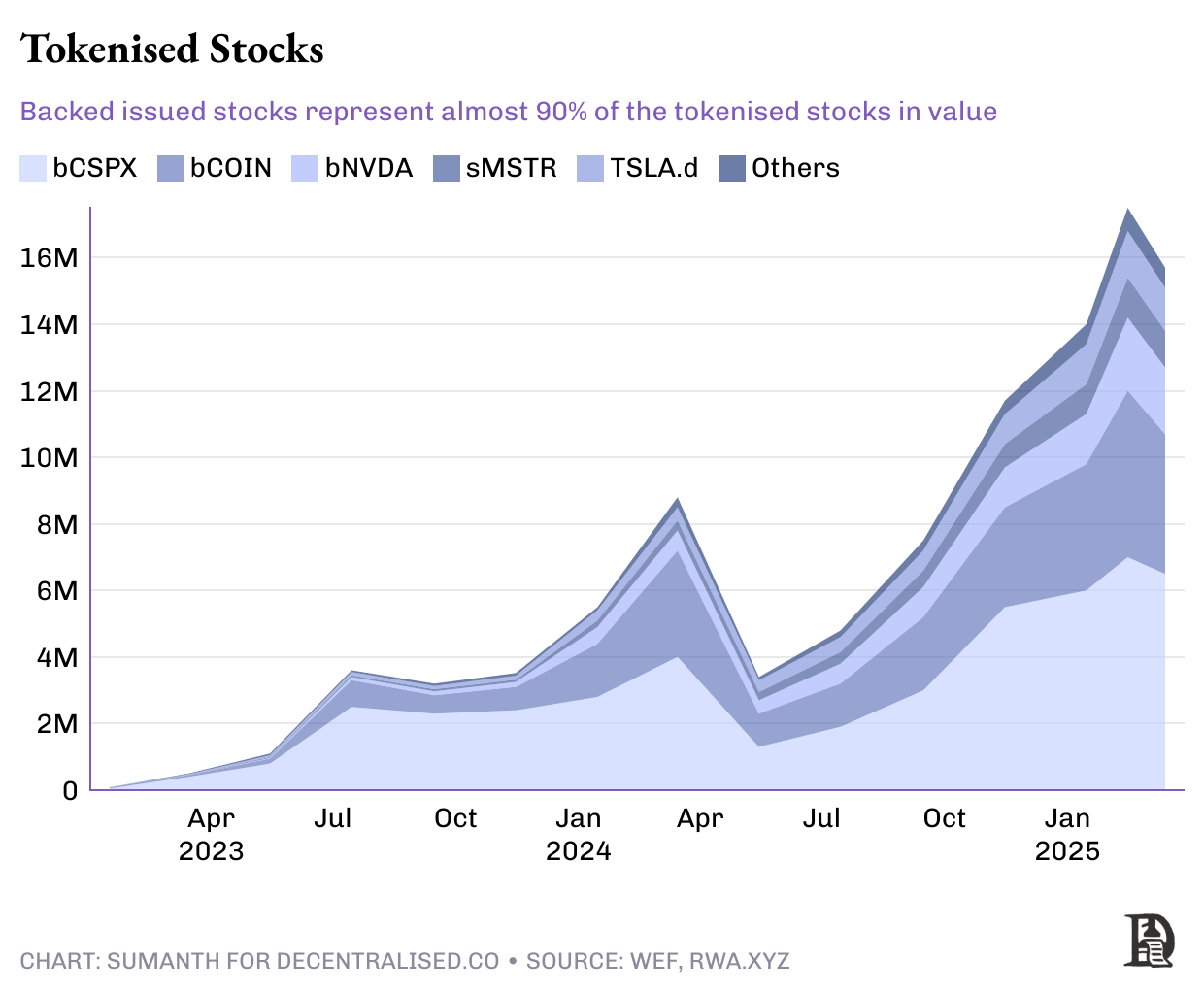

Stock Market

This field naturally appears promising, as it has attracted a large number of retail investors, and tokenization can enable a 24/7 "internet capital market."

The current obstacle lies in regulation. The U.S. Securities and Exchange Commission (SEC) custody and settlement rules were established before the emergence of blockchain, requiring intermediary participation and a T+2 settlement cycle.

However, this situation is changing. Solana has applied to the SEC for approval to conduct on-chain stock issuance, providing a full suite of services including identity verification (KYC), educational guidance, broker custody requirements, and instant settlement.

Robinhood has also submitted a similar application, requesting that tokens representing U.S. Treasury strips or Tesla stocks be treated as securities themselves, rather than synthetic derivatives.

Outside the U.S., market demand is even stronger. With no strict restrictions, foreign investors hold approximately $19 trillion in U.S. stocks. The traditional investment method is through local brokers like eTrade, which collaborate with U.S. financial institutions but incur high foreign exchange spreads.

Startups like Backed offer an alternative in the form of synthetic assets. Backed purchases an equivalent amount of underlying stocks in the U.S. market and has completed $16 million in transactions. Kraken has just partnered with Backed to provide U.S. stock trading services for non-U.S. traders.

Real Estate and Alternative Assets

Real estate is one of the asset classes most reliant on paper documents. Every property deed needs to be recorded in government registries, and every mortgage is kept in bank vaults. Unless these registries accept hashes as legal proof of ownership, large-scale tokenization is difficult to achieve. This is why only about 20 billion dollars of the global $400 trillion real estate market has been tokenized.

The UAE is one of the regions leading this transformation, with property deeds worth 3 billion dollars registered on-chain. In the U.S., real estate startups like RealT and Lofty AI have tokenized over $100 million in residential properties, with rental income flowing directly into investors' wallets.

Currency also hopes to flow

Cypherpunks view "stable dollars" as a regression, signifying a return to traditional models of bank custody and permissioned whitelists. Meanwhile, regulators are uneasy about permissionless blockchain systems, as these systems can transfer billions of dollars within a block. In reality, the proliferation of blockchain occurs precisely at the intersection of these two extreme discomforts.

Cryptocurrency purists may continue to complain, just as early internet supporters opposed the issuance of TLS certificates by central authorities. However, it is precisely because of HTTPS that our parents can safely use online banking today. Similarly, while stable dollars and tokenized government bonds may seem "not pure enough," they are the way billions of people first encounter blockchain through an application that never mentions the word "crypto."

The Bretton Woods system once bound the global economy within a single currency framework, while blockchain technology breaks this limitation by enhancing the efficiency of currency operations. Every time we push an asset onto the chain, we save settlement time, release collateral that was previously idle in clearinghouses, and allow the same dollar to support three transactions before lunch.

At Decentralised.co, we maintain one viewpoint: accelerating the velocity of money is the core application of cryptocurrency, and putting real-world assets (RWA) on-chain aligns perfectly with this trend. The faster the speed of value settlement, the more frequently funds can be reinvested, thereby further expanding the overall economic scale. When dollars, debt, and data can flow at network speed, business models will no longer rely on charging for the "liquidity" process but will create new revenue sources through the "momentum" effect.**

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。