近期,TRX可谓在加密领域风光无限!根据TRONSCAN最新数据显示,5月波场TRON协议总收入超3.43亿美元,创下历史新高,平均每日收益高达1100万美元。就在昨日(6月4日),TRON官方表示,“TRX减产”提案也将于6月10日正式开启投票,若提案通过,TRX链上供应量将直接减少。

过去3个月,TRX币价一路狂飙,从0.21美元最高冲到0.28美元,涨幅轻松突破30%。5月先是美国SEC正式受理了Staked TRX ETF的申请。倘若该申请能够顺利获批,TRX的币价极有可能迎来一波大暴涨,其未来走势令人充满遐想。

现在,越来越多的加密社区用户已敏锐地捕捉到了这一潜在机遇,纷纷开始行动,积极买入并坚定持有TRX代币,静静等待ETF申请获批时能捕获那波丰厚的潜在涨幅,期待着在这场财富盛宴中分得一杯羹。

然而,仅仅买入TRX并持有,在不少投资者眼中,似乎有些“守着金山却不知如何开采”的遗憾,未能充分发挥其潜在价值。如何使手中持有的TRX实现收益最大化?寻找靠谱的收益渠道,积极参与稳健的生息策略,已然成为广大TRX持有者的首要。

在TRON生态的原生DeFi应用——JustLend DAO平台上,有一个堪称TRX“生息神器”的组合神矿“sTRX +USDD”。经过实际测试验证,通过质押TRX参与该组合,年化收益轻松突破20%,这无疑为TRX持有者提供了一条极具吸引力的财富增值路径。而且,操作过程极为简便,只需简单几步,投资者便能在JustLendDAO平台上开启“躺赚”模式,让手中的TRX实现“一鱼多吃”,将多重收益轻松收入囊中,真正实现财富的稳健增长。

JustLend DAO金矿“sTRX+USDD”:解锁TRX“一鱼多吃”的财富密码

在加密货币的世界里,追求高收益始终是投资者们不懈的目标。JustLendDAO平台上的“sTRX + USDD”金矿组合,为TRX持有者提供了一条实现财富稳健增值的最佳路径,让TRX能够“一鱼多吃”,带来多重收益。

TRX在链上质押能获得近20%的年化高收益,这一诱人的回报主要通过JustLendDAO平台上的“sTRX + USDD”两个矿池得以实现。

在深入探究其具体运作流程之前,让我们先来了解一下JustLend DAO、sTRX、USDD这三个关键产品的主要功能以及它们之间的紧密联系。

- Justlend DAO原本基于波场TRON网络上的去中心化借贷协议,如今已成长为TRON生态中至关重要的DeFi生态系统中心。它能丰富多样,涵盖了抵押借贷、质押TRX(即Staked TRX质押TRX以换取sTRX质押凭证代币)、能量租赁(Energy Rental),以及支持用户探索使用各种DeFi应用程序等。根据DeFiLlama数据,截至6月5日,该平台锁仓的加密资产价值高达34亿美元,稳坐TRON网络上TVL最高的DeFi协议宝座,其实力与影响力可见一斑。

- sTRX也就是Staked TRX,是Justlend DAO推出的TRX流动质押产品。用户只需将TRX质押就可获得sTRX质押凭证代币。sTRX作为一种生息资产代币,可自动捕获TRON网络上的节点投票奖励和能量租赁收益。正因如此,sTRX在市场上备受青睐,热度居高不下。截止到6月5日,JustLendDAO上质押的TRX数量约81亿枚,价值约21.9亿美元,参与地址数高达4360,足见其受欢迎程度。

- USDD2.0是运行在TRON网络上的去中心化稳定币,与美元保持1:1挂钩。用户可以通过质押TRX、sTRX、USDT等多种优质加密资产进行超额抵押铸造。6月5日USDD发行量已超4.2亿美元,实力不容小觑。

那么,JustLend DAO上的“sTRX + USDD”金矿组合究竟是如何运作的呢?

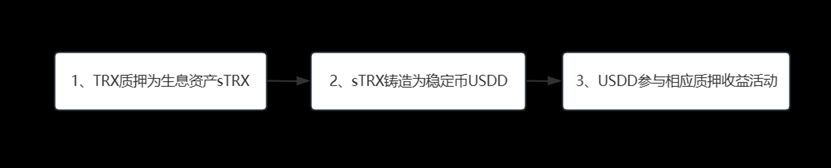

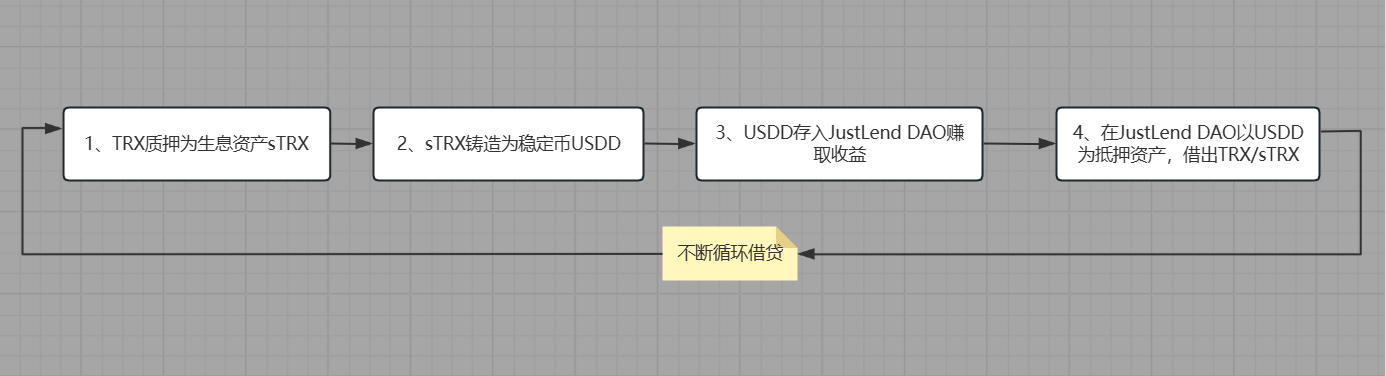

具体而言,用户在JustLend DAO平台将TRX质押,使其转化为生息资产sTRX;随后,利用sTRX进行抵押,铸造出稳定币USDD;完成这一系列铸造操作后,用户获得的USDD参与JustLend DAO平台质押或存入赚取收益活动,便能够同时享有JustLend DAO sTRX质押收益以及USDD存入收益的双重丰厚回报。

整个流程可以简洁地概括为:TRX质押为生息资产sTRX → 使用sTRX铸造为稳定币USDD → USDD参与JustLend DAO质押赚取利息。

通过这样的操作,TRX实现了“一鱼多吃”,其收益主要分为两部分:一部分是质押为sTRX所带来的底层收益,包括节点投票奖励和能量租赁收益;另一部分则是sTRX铸造USDD后产生的收益,涵盖了USDD质押或存入收益以及参与各种DeFi活动所带来的收益等。

在加密货币市场风云变幻的当下,JustLendDAO的“sTRX + USDD”金矿组合为TRX持有者提供了一个稳健且高效的收益增长途径,让投资者能够在复杂的市场环境中,轻松实现资产的增值与保值。

TRX质押核心玩法大揭秘:超简单3步,轻松躺赚20%+收益

寻找高收益且操作简便的链上投资策略一直是加密社区用户的核心诉求。JustLendDAO平台上的“sTRX + USDD”金矿组合玩法,仅需三步,就能让TRX实现“一鱼多吃”,收获多重丰厚回报。

第一步:质押TRX获取sTRX,开启基础收益之旅

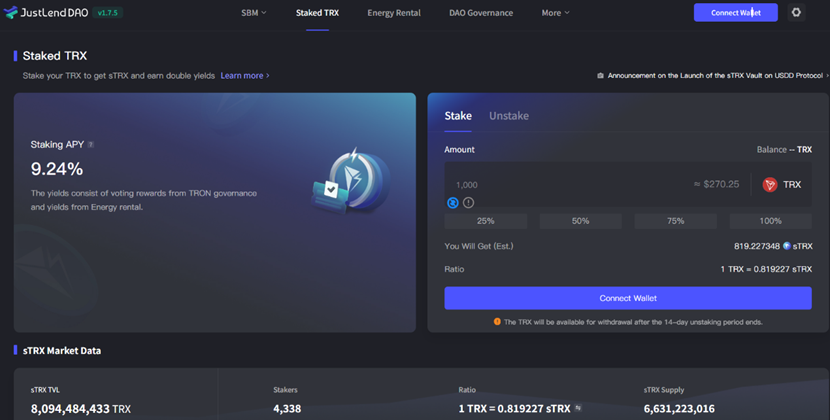

在JustLend DAO平台的Staked TRX板块,用户只需将手中的TRX进行质押,就可轻松获取流动质押凭证代币—sTRX。sTRX像是一个会自动“生钱”的魔法代币,能够自动赚取TRON网络的质押收益,包括投票奖励和能量租赁收益。不过,sTRX具体收益情况并非一成不变,它会随着网络上质押的TRX数量而动态波动。过去7日sTRX质押收益为9.24%。

网站链接(https://app.justlend.org/strx?lang=en-US)

这里还有一个小贴士要分享给大家:关于TRON链上的交易费,如果投资者交易次数较多,不妨在JustlendDAO上的能量租赁中心(Energy Rental)租赁能量。通过这种方式,每笔支付的链上交易费用可以从几美元大幅降低到零点几美元,可节省不少成本。

第二步:使用sTRX铸造稳定币USDD,拓展收益渠道

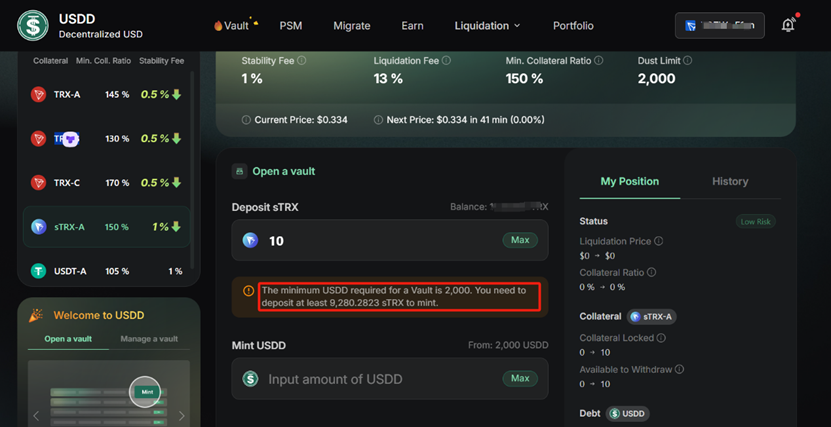

获取sTRX后,接下来就可以在USDD平台上,利用sTRX资金库进行超额抵押铸造USDD了。

(网站链接:https://app.usdd.io/vault?token=STRX-A)

不过,这里有几个关键要点需要注意:USDD每次最小铸造量为2000USDD,而且采用的是超额抵押模式,当前抵押率约为150%。6月5日显示,每铸造2000USDD至少需要抵押9280sTRX。为了避免由于持有sTRX数量不足而无法生成USDD的情况,在质押TRX时,最好一次性质押足够量。按照当前1TRX=0.81sTRX的兑换比例,每次质押数量约在12000TRX左右比较稳妥。

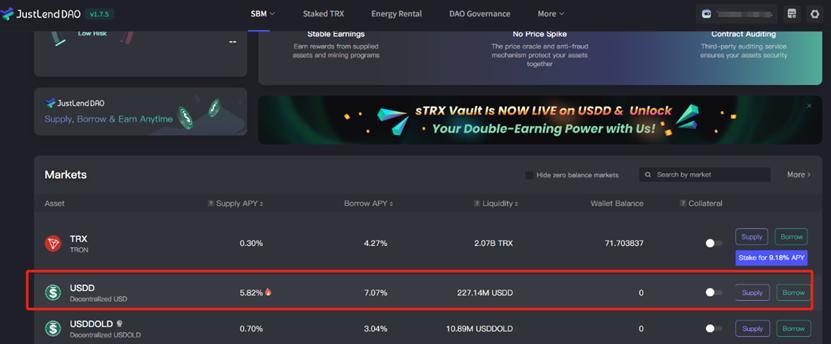

第三步:质押USDD,赚取高收益,实现财富增值

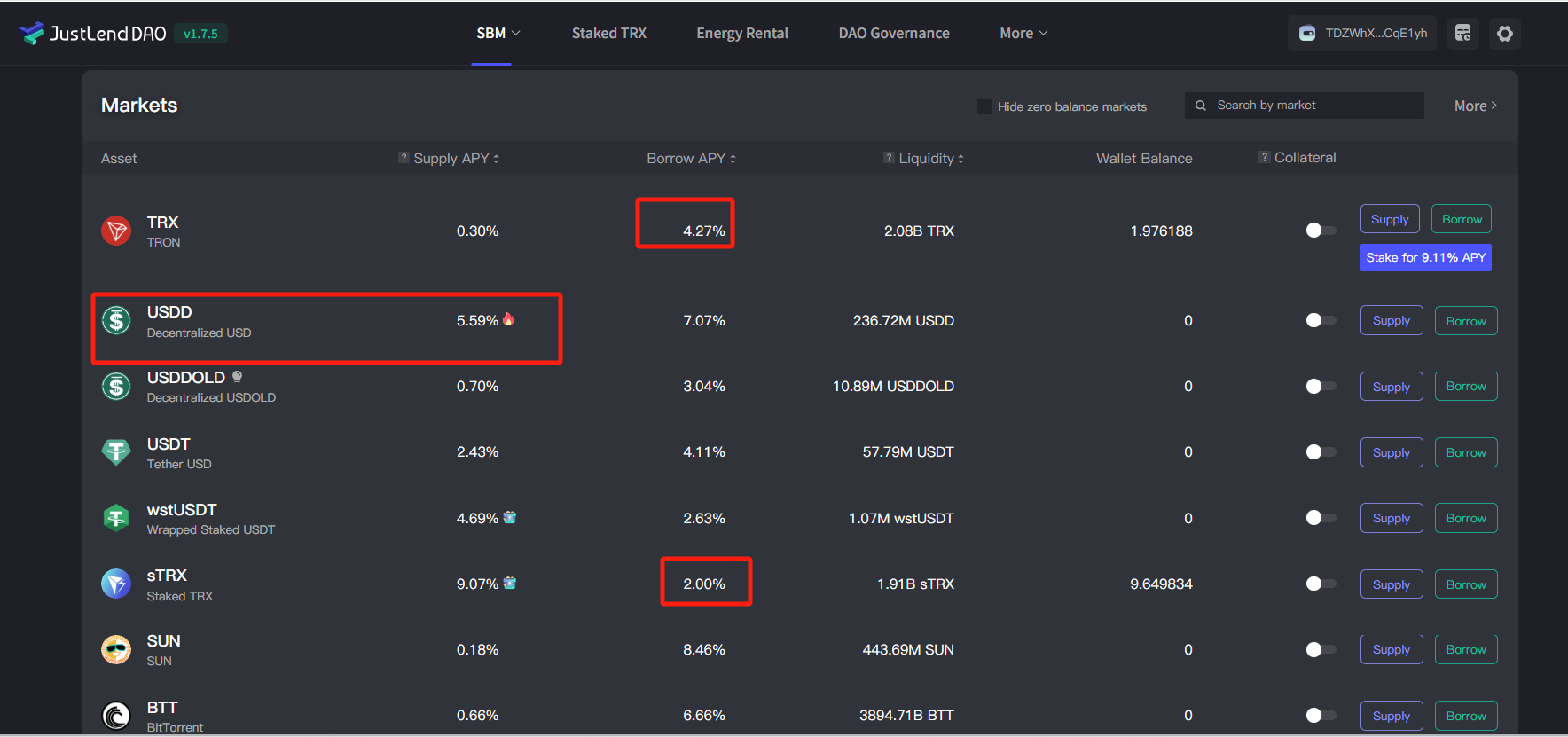

成功铸造出USDD后,就可以直接参与JustLend DAO上对应的USDD高收益存入活动了。当前在JustLend DAO,USDD存入年化收益为5.8%,这样的收益水平在稳定币投资领域中颇具吸引力。

(网站链接:https://app.justlend.org/homeNew)

通过以上简单的三步操作,TRX持有者能够轻松获得多重收益:

- 收益1:在JustLend DAO中质押TRX获取sTRX,赚取基础质押收益。近7日质押年化收益约9.24%,为投资者的资产增值奠定了坚实基础。

- 收益2:持有的sTRX可以在USDD官方进行超额抵押铸造为USDD,获得的USDD再去参与JustLend DAO平台的质押活动。6月5日,JustLend DAO平台存入USDD可享受5.82%的年化收益,进一步拓宽了收益渠道。

“TRX质押收益(收益1)+USDD质押或存入收益(收益2)”这两项收益是同时、独立产生的,互不干扰。

6月5日实测数据显示,质押TRX币本位综合年化轻松站上15% +(TRX质押收益9.24%+USDD存入收益5.82%)。而且,sTRX质押收益率和USDD的资金池利率并非固定不变,而是处于浮动变化状态,会根据质押或存入资产的数量而随时调整。在市场活跃时期,sTRX质押收益率可高达30%。这样一来,综合年化收益率也会随之波动,多数时候综合年化远超20%+,为投资者带来了极为可观的财富增长机会。

高阶玩家秘籍:借循环借贷操作,捕获“sTRX+USDD”超额收益

通过JustLend DAO平台上的“sTRX+USDD”金矿组合,初级玩家仅用TRX底层资产,便能轻松赚取sTRX质押收益与USDD存款利息的双重回报。然而,对于那些纵经验丰富的高阶链上玩家而言,这套组合拳的收益潜力远不止于此,还有着更为广阔的掘金空间,还能从中捕获更高收益的可能。

高阶玩家可以巧妙高效利用JustLend DAO借贷资金池功能,存入USDD借出TRX和sTRX,开启高收益循环套娃的金钥匙。将USDD存入JustLend DAO平台可以将其作为抵押品,直接借出TRX或sTRX,然后再继续铸造USDD,这一步看似简单,实则蕴含着巨大的收益潜力。

借出的TRX后,玩家们会迅速将其质押,以获取sTRX质押凭证代币。紧接着,再利用手中的sTRX进行超额抵押,铸造出更多的USDD。新铸造的USDD再次被存入生息平台,等待利息的累积。而当资金积累到一定程度,又可以重复上述操作,再次借出TRX/sTRX,开启新一轮的循环,如此不断循环。

这种循环借贷的操作模式,就像是一个不断滚动的雪球,随着每一次的循环,收益也在不断累积和放大。与基础的“sTRX质押收益+USDD存入利息收入”相比,综合收益可呈现出几何级数的增长,轻松远超20%的常规年化收益水平。

“金铲子”TRX利好不断

JustLend DAO平台的“sTRX + USDD”金矿组合拳,宛如一台精密运转的自动赚钱机器,为TRX打开了从质押、铸造稳定币到稳定币生息的增值新通道,开辟了一条清晰的收益链条:TRX→sTRX→USDD→再到TRX/sTRX,真正实现了“钱生钱,再生钱”的财富增值模式,让TRX成为当之无愧的“金铲子”资产。

对于持有TRX的用户而言,不仅能够享受到TRX币本位上涨带来的收益,还能通过“sTRX + USDD”这一组合捕获超额链上收益。

对于TRX囤币党来说,这种模式具有独特的优势。在不影响资产流动性的前提下,用户能够实现收益的最大化和资产的最大幅度增值。sTRX和USDD均无锁定期要求,用户可以随时赎回 sTRX 或 USDD 资产,也可以在DEX平台随时将其兑换为所需的其他资产种类,为用户的资金管理提供了极大的便利性和灵活性。且sTRX+USDD的收益模型也非常清晰具有可持续性,sTRX质押收益来自治理投票奖励和能量租赁收益;USDD收益则来自官方系统补贴。

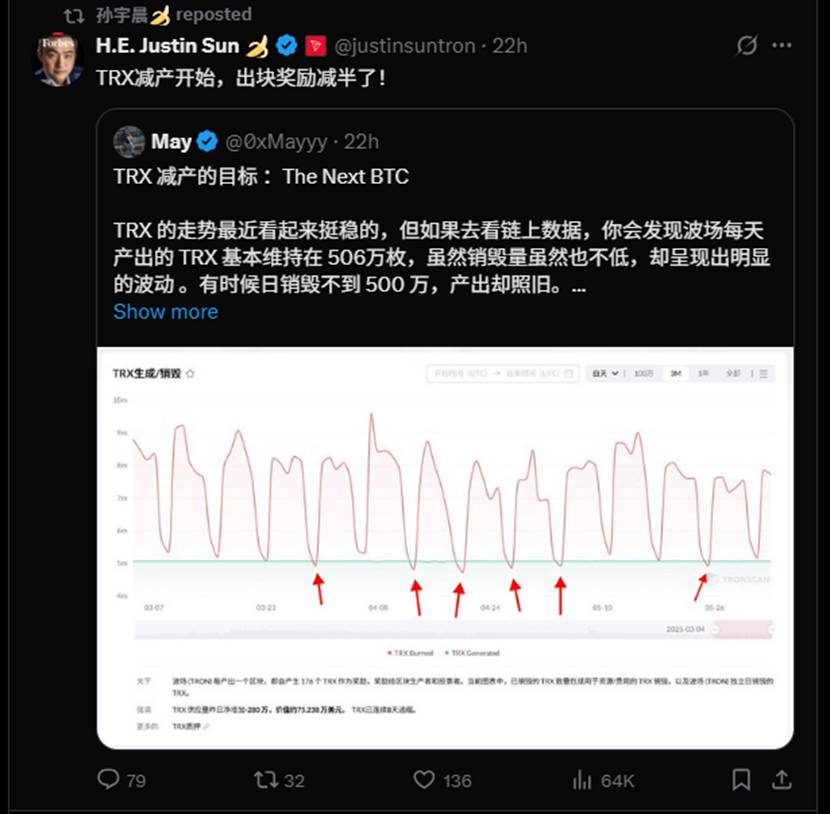

另外,有关底层基础资产TRX更是利好不断。先是5月,TRX ETF申请已获美SEC受理;接着5月TRON网络协议收入创下3.43亿美元新高;然而就在昨日(6月4日),TRON官方表示:TRX减产提案(TIP-738)预计将于新加坡时间2025年6月10日开启投票流程,再次引起了加密社区广泛关注和讨论。

“TRX减产提案”旨在降低TRX区块奖励,该提案提议,将区块奖励从16 TRX砍半至为8TRX,同时将投票奖励从160TRX减为128TRX。若该提案通过,奖励下调意味着每天链上产出的TRX将大幅减少,直接压缩了TRX链上新增供给,显著降低TRX通胀速度,这可以增加TRX的稀缺性,有利于提升TRX的长期价格。

由此来看,基础资产TRX在RX ETF叙事的潜在预期,协议收入不断刷新历史记录,及近期TRX的减产提案赋能等多重利好的推动,或将成为加密资产领域中最具潜力的加密资产之一。同时,借助JustLend DAO 的“sTRX + USDD”多重收益策略,TRX又可作为金铲子,不仅能够享受到未来币本位上涨带来的收益,还能一键开启财富增值之旅,实现资产的稳健增长和财富的积累。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。