撰文:Nancy,PANews

随着 Pump.fun 发币的消息再次传出,Solana 链上本就脆弱的流动性防线被击穿,也撕裂了尚处恢复期的市场信心,链上避险情绪迅速升温。

链上「老虎机」,仅 3.6% 用户获利超 500 美元

近日,围绕 Pump.fun 即将发币的传闻再度搅动市场风云。据 Blockworks 援引多位知情人士报道,Pump.fun 计划通过代币销售融资 10 亿美元,估值达 40 亿美元,代币将面向公众和私募投资者出售。尽管官方尚未确认发售时间,平台社交账号暗示或在两周内上线。

事实上,这并非首次传出发币计划。早在今年 2 月,据吴说区块链报道,Pump.fun 计划在 CEX 内部通过荷兰式拍卖发行代币,并且向 CEX 提供了详细发币准备文件。然而,当时市场流动性被特朗普及其夫人梅拉尼娅发行的个人 MEME 币大幅吸走,该计划最终未能落地。如今,市场环境略有回暖,Pump.fun 的发币计划似乎再度提上日程。

然而,这台链上「印钞机」 正面临市场热度大幅消退的局面。

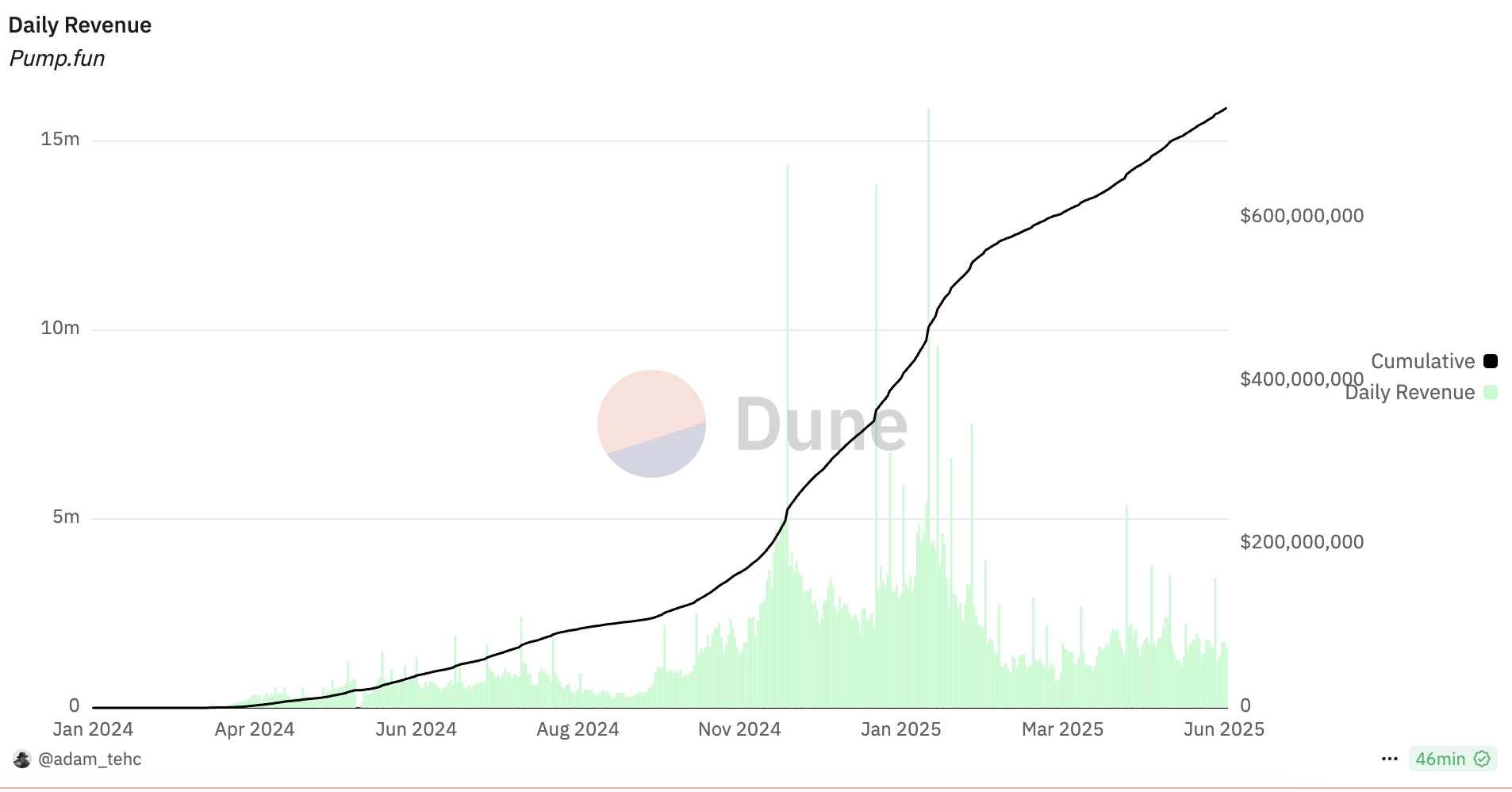

根据 Dune 数据显示,截至 6 月 4 日,平台累计收入已突破 7.3 亿美元,单日收入峰值曾逼近 1500 万美元。但自 2025 年 2 月起,平台营收增长显著放缓,当前多数日收入稳定在数百万美元区间。

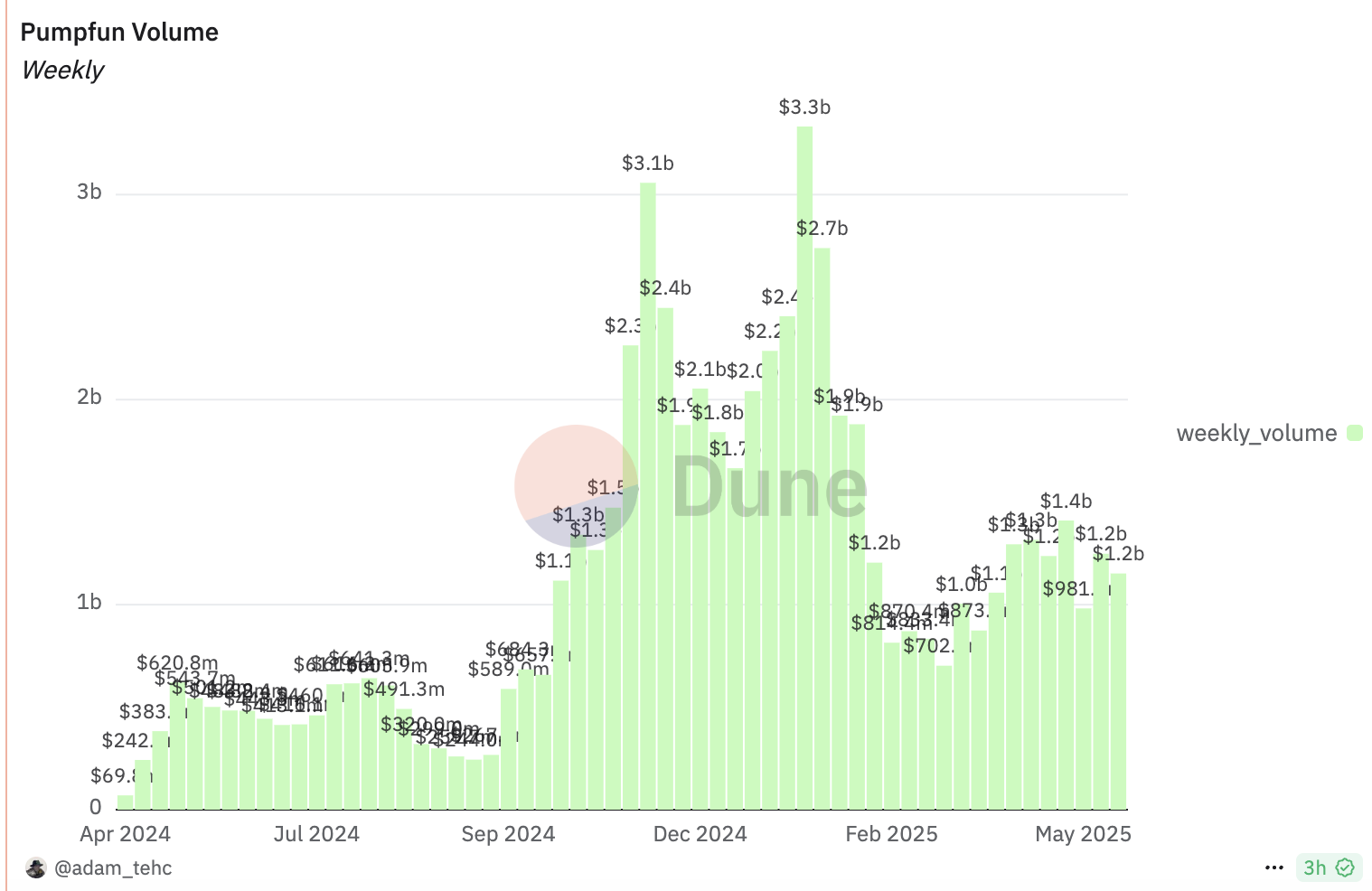

交易量方面,Pump.fun 在 2024 年末创下单周 33 亿美元的历史纪录,随后虽有数次反弹至 10 亿美元级别,但难以重回巅峰。流动性走弱的趋势,在一定程度上削弱了平台热度与用户参与意愿。

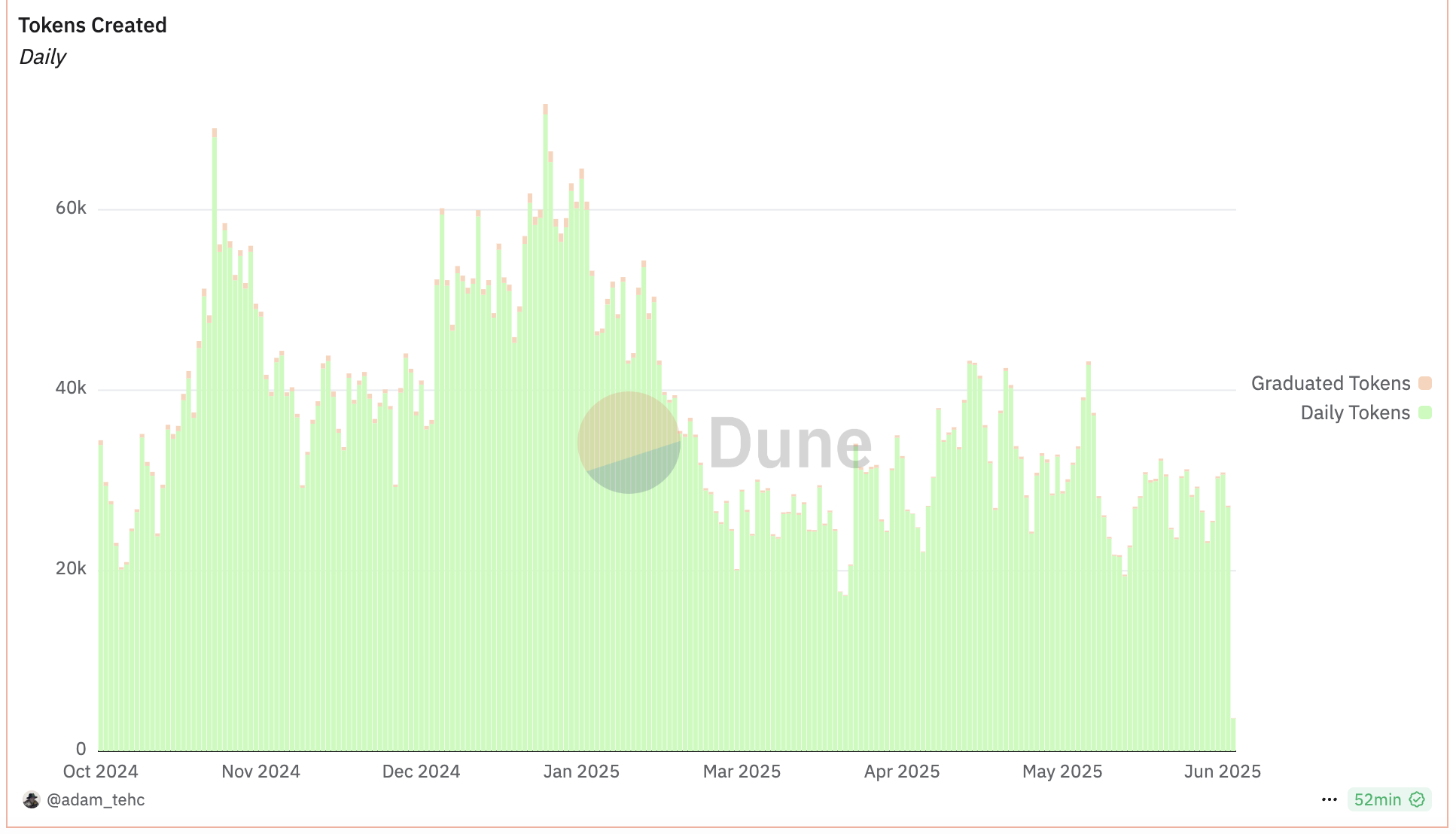

从代币创建量来看,Pump.fun 迄今已累计创建了超过 1102 万个代币,单日代币创建峰值一度达 7 万个(2025 年 1 月)。但目前该数据已降至日均 3 万个左右,显示用户参与热情有所降温。

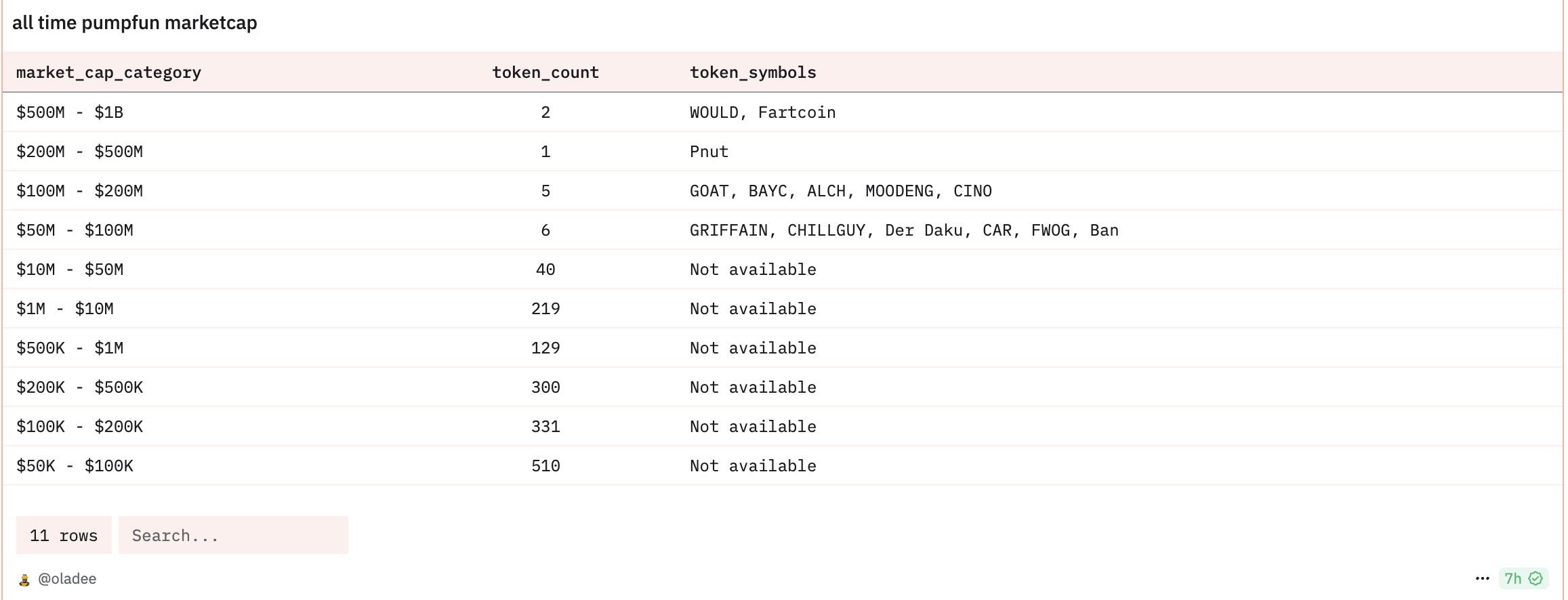

值得注意的是,在海量 MEME 币背后,真正具有一定市值体量的项目寥寥无几。据 Dune 统计,目前仅有 14 个代币市值超过 5000 万美元,市值在 100 万美元到 5000 万美元之间的也仅有 259 个,其余约 1.4 万个代币均处于微小市值阶段。这也说明绝大多数代币停留在内盘自嗨阶段,缺乏外部资金承接能力。

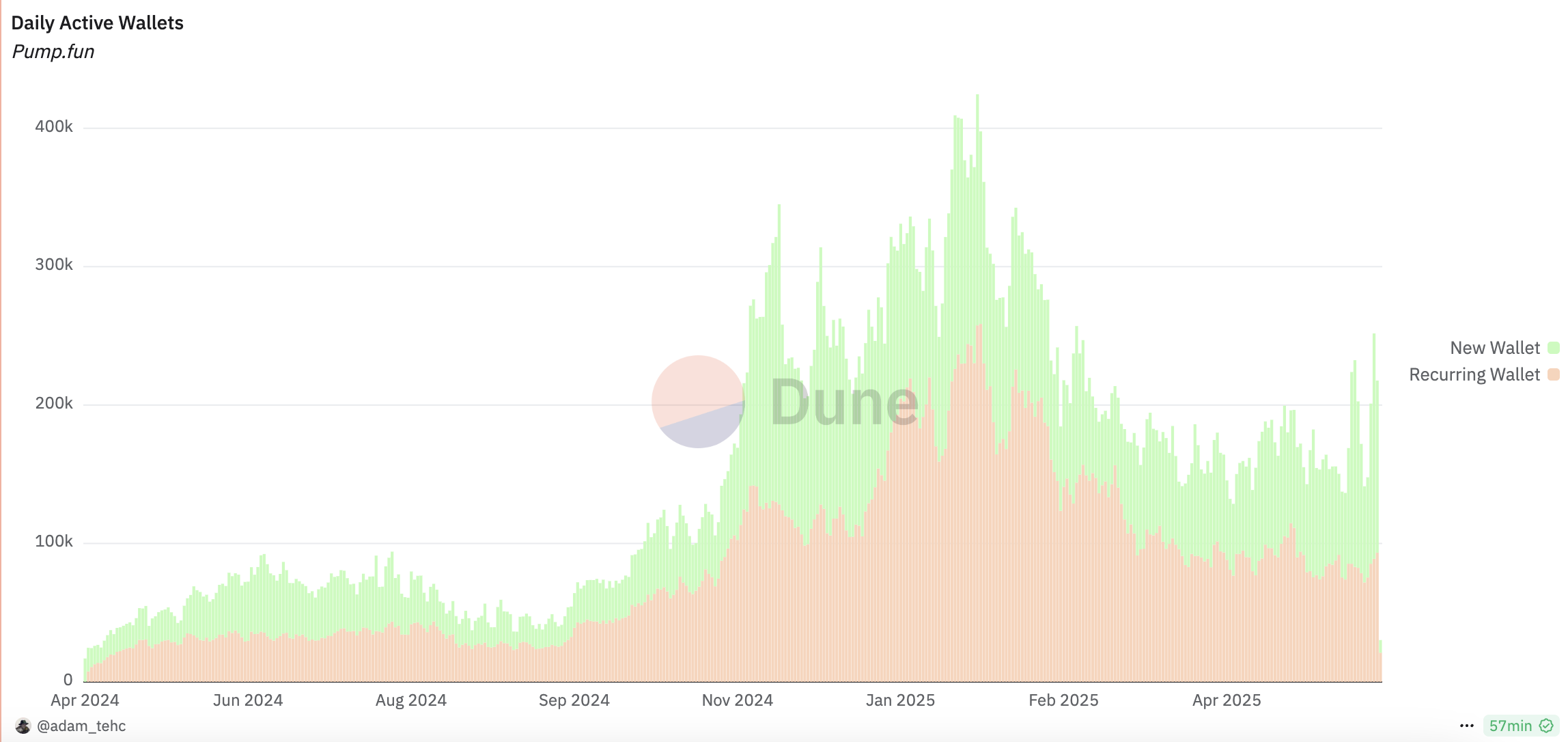

而在用户层面,Pump.fun 也面临新流量断崖,老用户苦撑的局面。Dune 数据显示,Pump.fun 在 2025 年 1 月底迎来高光时刻,单日活跃钱包数量一度突破 40 万个,彼时新用户涌入是推动用户数暴涨的关键。然而随着市场情绪冷却,活跃钱包数随之下滑,平台活跃度主要靠老用户复用维系,新用户贡献大幅下滑。这一趋势也佐证了,大量 Pump.fun 用户频繁尝试创建和炒作 MEME 币,但真正能建立持续性价值的项目极少,导致用户周期短、沉淀弱。

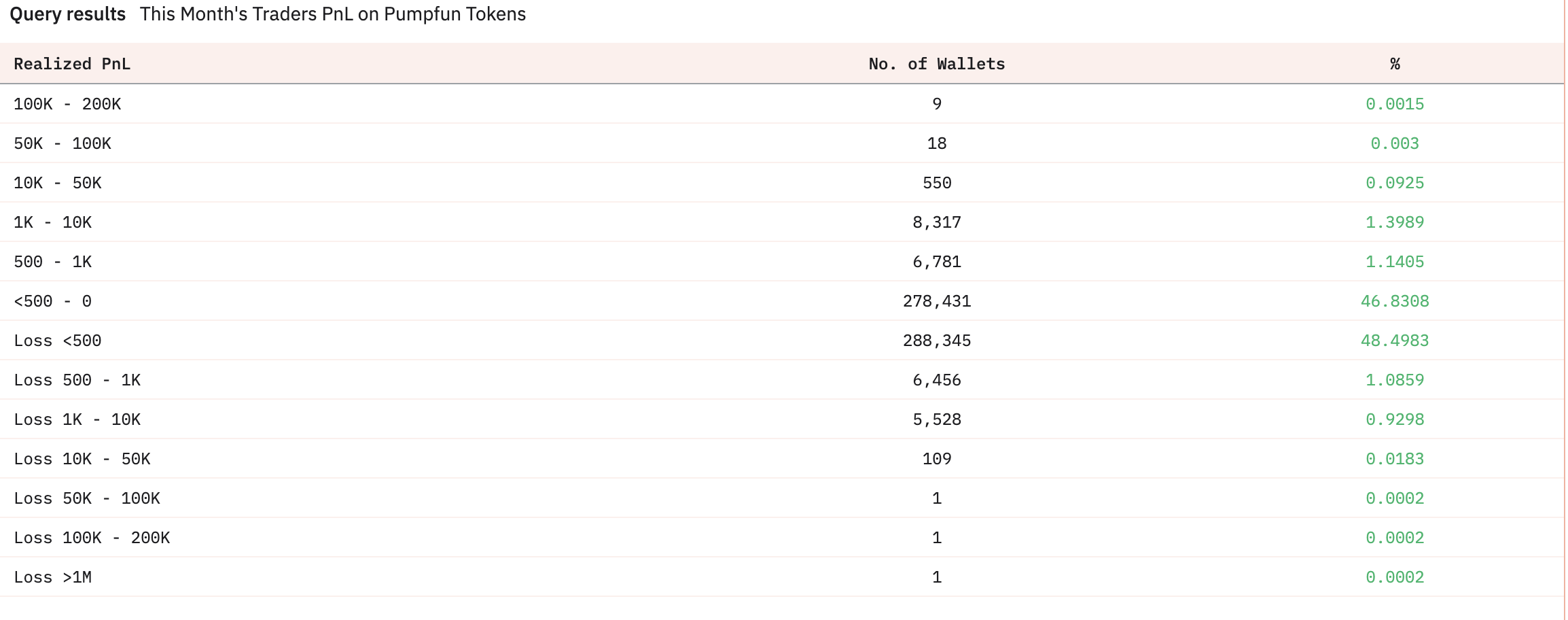

不仅如此,在 Pump.fun 的暴富叙事背后,是赤裸裸的幸存者偏差。Dune 数据显示,本月参与交易的钱包数约为 59.4 万个,其中仅 3.6% 的用户实现了超过 500 美元的实质性盈利。更为惊人的是,仅有 27 个钱包盈利超 10 万美元,仅占总交易者的 0.0045%;而实现超过 1 万美元盈利的钱包为 577 个,占比也仅为 0.1%。相对而言,亏损比例则更高,高达 52.5%,其中不乏亏损百万美元级别的极端个案。这些数据清楚地表明,极少数庄家赚走了绝大部分利润,而绝大多数散户只是充当流动性燃料。

在用户增长触顶、代币质量堪忧、流动性透支的当下,Pump.fun 发币能否撬动市场情绪,撑起高达 40 亿美元的估值,可谓是存在不小变数。

Solana 避险情绪升温,高估值发币引发争议

Pump.fun 高估值发币消息,让不少投资者担忧是否会重演当年 APE 币发布时的最后一波狂欢。

「上一个 40 亿估值的天王级,还是发了 APE 的 Yuga Labs,号称当年牛市的最后一波辉煌,之后市场山寨就全部腰斩了。现在 Pump.fun 同样 40 亿估值,但募资额是 APE 当年的 2 倍多。这几天各所再提速上币频率,估计也是有意避开两周后 PUMP 的大吸血。」加密 KOL@AB 发文表示。

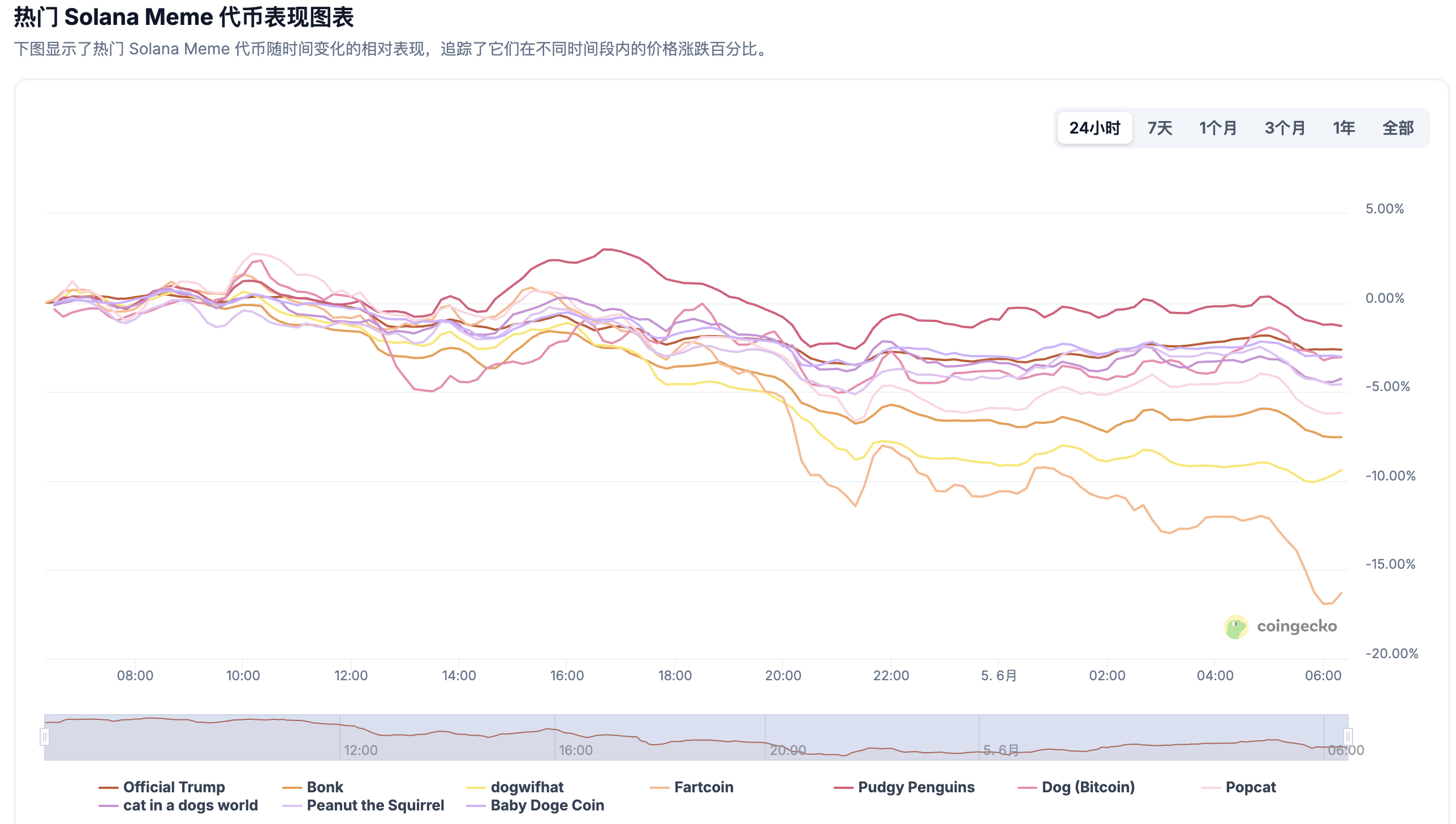

而从 Solana 链上资金流向来看,避险情绪正在升温,MEME 币集体下挫。据 CoinGecko 数据显示,过去 24 小时,Solana 生态中的热门 MEME 币普遍出现不同程度的回调。与此同时,Artemis 数据显示,Solana 成为过去 24 小时内资金净流出第三高的区块链网络。

独立研究员@Haotian 直言不讳地指出,Pump.fun 当前的估值水平「极度泡沫化」,一个 MEME 发射平台的估值竟然超越了大部分 DeFi 蓝筹协议,并提出以下四点核心批评:(1)虚高泡沫化的市场估值颇为不合理:Pump.fun 的注意力经济生意经是依赖市场 MEME 币的短期高度 Fomo 的非理性产物。说白了就是靠「赌性」驱动的流量变现。这意味着,Pump.fun 的商业模式变现能力完全是短期市场聚光灯效应下的产物,而非可持续的常态化盈利逻辑;(2)脆弱的商业护城河容易被反超:Pump.fun 抓住了 Solana 高性能 + 低成本的技术红利,以及 MEME 文化从小众走向大众的时代红利。这种建立在他人基础设施之上的商业模式,本质上就是「寄人篱下」的生意。一旦 Solana 生态出现重大变化,其商业模式的脆弱性会暴露无遗;(3)Launchpad 工具化属性很难自成生态:目前再「赚钱」也只是个「发币工具」,要想从纯 Launchpad 蜕变成一个复杂的 MEME 经济生态,本身就存在悖论:MEME 文化的核心恰恰是简单、直接、病毒式传播,过度的功能叠加只会让平台失去原有的「野性」;(4)超高估值会颠覆原本的价值创新体系:Pump.fun 的超高估值,正向整个行业发出危险信号:在当前的 Crypto 生态中,「流量聚合 + 投机变现」的价值可能超过了「技术创新 + 基础设施」。他认为,关键在于,Pump.fun 能否在获得巨额资本后,真正构建出可持续的商业护城河,要不然这种畸形的估值会给整个行业带来莫大的创新灾难,预示着一个更加功利、更加短视、更加远离技术极客本源的 Crypto 未来。

KOL@xingpt 从估值角度补充道,Pump.fun 过去 30 天年化收入为 7798 万美元,对应 FDV 5B 的话,其 FDV/ 年化收入的比率为 64;属于比较偏高的水平。如果长期来看,Pump 肯定是不值这个估值的,收益确定性不如 DeFi 龙头如 Ray/Cake;但如果行情好,团队会制造 fomo,也可能翻个倍说不定。现在这个估值,结合 X 上的情绪,我是觉得没必要过分看空甚至开盘去空。持有现金,静观其变即可。

不过,加密 KOL@加密韋馱则表示,抛开历史进程谈功过就是耍流氓。Solana 能有今天的链上主战场地位,直接原因就是因为 Pump.fun,它解决了从零流动性到 AMM 再到 CEX 的一条龙流动性方案,让链上安全标准化(撤池子、合约藏毒),搭建起 PVP 链上文化,并形成真正大量 SOL 锁仓。Pump.fun 的出现相当于链上的 iphone 时刻,也是首个认识到年轻一代注意力时长极短,并且唾弃传统价值,乐于 PVP 的。从价值投资的角度,Pump 是全网最大的消费者应用程序,市盈率却只有 5,是名副其实的价投标的。他认为目前币圈只有两个护城河:流动性和屏幕时长。

「不要再幻想 Pump.fun 会发空投了。」针对市场对 Pump.fun 空投的幻想,Weirdo Ghost Gang 创始人 sleepy 指出,Pump.fun 已经靠产品完成冷启动,没有发空投的动机。其实,现在的空投已经越来越变成一种短期注意力捕获的工具。看似在「激励用户」,本质上却很少能真正留下忠实的使用者。空投 ≠ 用户忠诚。空投只是一种流量释放器,用于短时间集中放大项目的影响力。但 Pump.fun 已经拥有稳定而庞大的用户群,它不需要再去用空投补充关注度,也不需要空投来制造话题。

总的来说,Pump.fun 的发币消息虽然再次点燃了市场的热议,但这场热度背后,隐藏的却是市场结构性流动性的脆弱、用户参与情绪的退潮、以及 MEME 叙事的巨大泡沫。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。