For investors, Hyperliquid is both a land of opportunity and a minefield of risks.

Written by: Lawrence, Mars Finance

Hyperliquid: The New Dominator of On-Chain Liquidity

In May 2025, the crypto market experienced a new round of breakthroughs, with Bitcoin surpassing the $110,000 mark and Ethereum stabilizing at $2,600. Amid this frenzy, an on-chain contract platform named Hyperliquid is redefining industry perceptions with astonishing data.

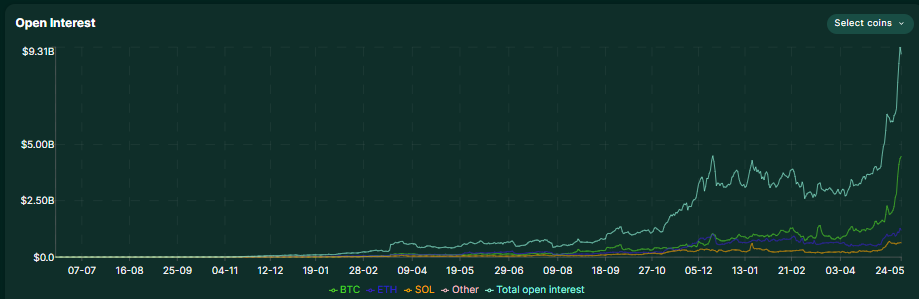

On May 26, Hyperliquid officially announced that its total open contracts reached $10.1 billion, with a 24-hour fee income of $5.6 million, and USDC locked volume exceeding $3.5 billion, all three metrics hitting historical highs.

This achievement not only signifies Hyperliquid's surpassing of traditional CEXs (like Binance and Bybit) to become the traffic center for on-chain contracts but also reveals a new trend: crypto whales are shifting the battlefield from centralized exchanges to on-chain platforms, with Hyperliquid becoming their "hunting ground."

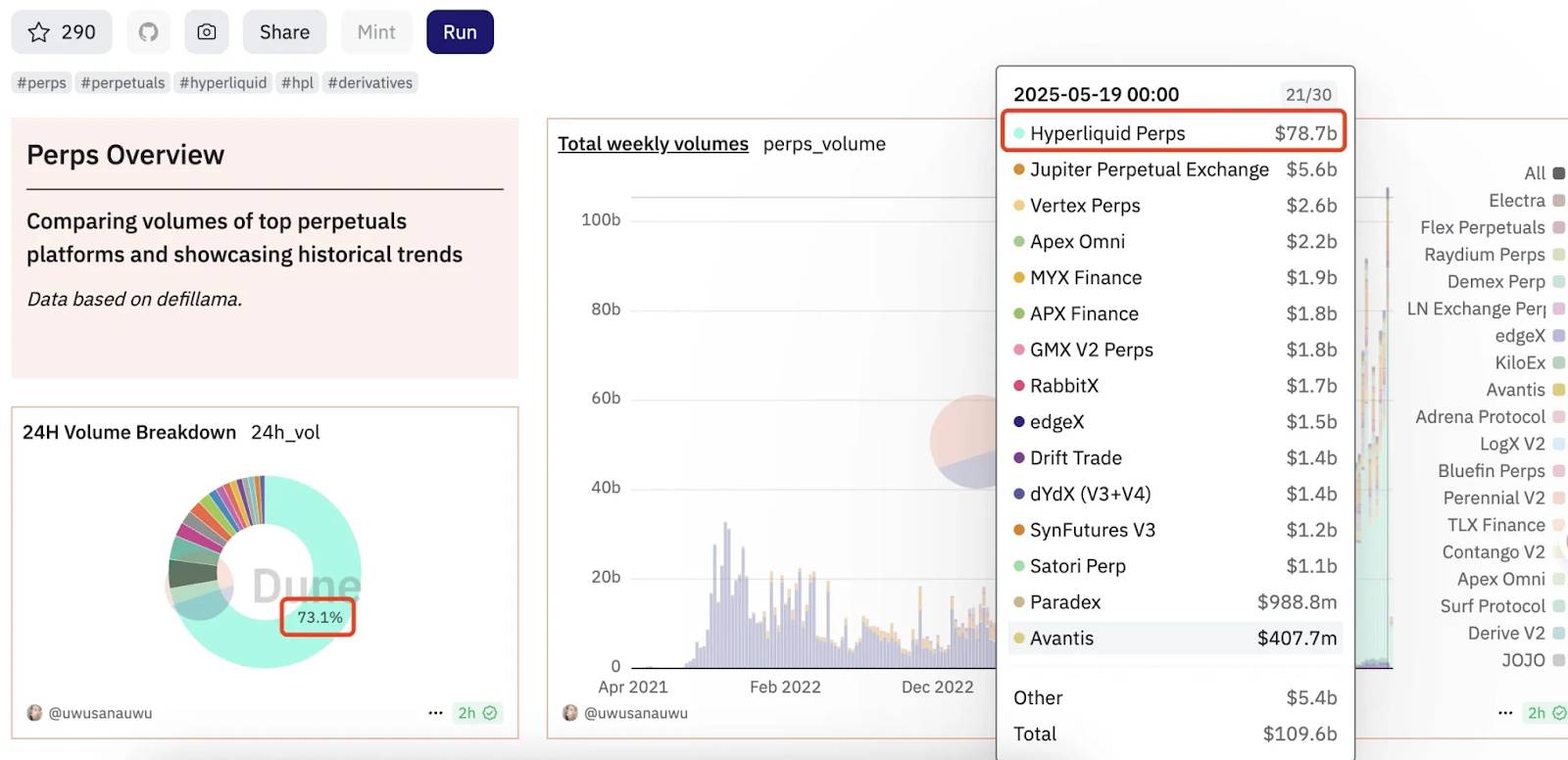

From the data, Hyperliquid's rise is not coincidental. Its average daily trading volume accounts for over 70%, with a 46% increase in trading volume over seven days, far exceeding similar platforms.

Behind this phenomenon is the whales' extreme pursuit of high leverage, low fees, and transparency. Take the well-known trader James Wynn as an example; he recently opened a $568 million Bitcoin long position on Hyperliquid with 40x leverage, directly pushing the BTC price past the psychological barrier of $100,000, a feat nearly impossible to achieve on traditional CEXs. Hyperliquid's "on-chain CEX" characteristic—combining the transparency of decentralization with the high leverage of centralization—makes it an excellent stage for whale games.

Whale Hunting Logic: From Position Games to Market Sentiment Manipulation

In Hyperliquid's ecosystem, the profit model for whales has transcended simple long and short trading, evolving into a combination of "attention economy" and "psychological warfare."

Using James Wynn as an example, his trading strategy exhibits three main characteristics: high leverage (40x), large positions (hundreds of millions of dollars), and clear public calls. By publicly disclosing his positions, he not only attracts follow-on funds to drive up the asset price but also amplifies market sentiment through social media, creating a positive feedback loop of "position—emotion—price." For instance, his continuous call for Bitcoin, stating "100,000 dollars is still undervalued," directly led to a large influx of retail investors, further solidifying the bullish trend.

This strategy is not an isolated case. Previously, another Hyperliquid whale, @qwatio, accurately bet on the Federal Reserve's interest rate decision with 50x leverage, earning over $9 million in a single day. His timing for opening positions closely aligned with policy announcements, raising suspicions of insider trading.

Although on-chain detective ZachXBT revealed his true identity as British fraudster William Parker, this did not diminish his market influence. Such cases expose a harsh reality: in the on-chain contract market, the "legitimacy" and "profitability" of whales are often decoupled, with the market focusing more on results than methods.

What is even more concerning is that the on-chain operations of whales have given rise to new forms of market manipulation. For example, by withdrawing unrealized profits to reduce margin, they induce the platform's liquidation mechanism to take over positions, thereby transferring risk to liquidity pools (like HLP Vault). In the Hyperliquid liquidation event in March 2025, a whale profited $1.86 million through this method, while the platform's liquidity pool suffered a loss of $4 million. This "arbitrage within the rules" exposes the risk management vulnerabilities of on-chain contracts and forced Hyperliquid to urgently lower leverage ratios (BTC to 40x, ETH to 25x) and improve the margin system.

Meme Coins and Leverage: The Whales' "Double-Edged Sword"

In Hyperliquid's ecosystem, the combination of meme coins and high-leverage contracts has become another tool for whales to harvest liquidity. James Wynn's rise is closely related to meme coins: in 2023, he bet $7,000 on PEPE, ultimately profiting over $25 million;

In 2025, his associated address transferred 38.918 billion PEPE to Binance, causing another price fluctuation. The core of this "Meme + Leverage" model lies in: using on-chain transparency to create FOMO sentiment, and then amplifying profits through high leverage.

Recently, a meme coin named moonpig became a typical case of this model. On May 22, moonpig's market cap skyrocketed from $30 million to $100 million, more than tripling, driven by James Wynn's public calls. However, when the price briefly plummeted by 30%, the market accused him of "pump and dump." Although he denied this and hinted at exiting the contract market, his subsequent deposit of $4 million USDC to increase his Bitcoin position once again confirmed the whales' control over market sentiment.

The essence of such operations is to combine the volatility of meme coins with the explosive power of leverage, creating short-term profit opportunities, but at the cost of increasing market fragility.

It is worth noting that Hyperliquid's low fees and high liquidity further amplify this risk. For example, in March, its absolute funding rates for BTC and ETH were far lower than those of Binance and Bybit, while the average daily liquidation amount reached $400 million, far exceeding traditional platforms.

This environment has attracted a large number of "gambler-type" whales. For instance, a user went long on ETH with 50x leverage, profiting $6.8 million on the day of a favorable Trump policy announcement, while his opening position was only $22 away from the liquidation price. Such "dancing on the edge of a knife" operations push on-chain contracts to the extremes of speculation and risk.

Controversies and Reflections: The Compliance Dilemma of On-Chain Contracts

Behind Hyperliquid's prosperity lies the inherent contradiction of decentralized finance (DeFi): the coexistence of transparency and manipulability. On one hand, the public nature of on-chain data makes whale positions visible, allowing retail investors to track the movements of "smart money"; on the other hand, whales exploit this transparency to manipulate the market in reverse, creating a distorted ecosystem of "public position games." Trader Eugene sharply criticizes this: "Publicizing large-scale positions does more harm than good, with negative externalities far outweighing positive effects."

This contradiction is even more pronounced at the regulatory level. Traditional CEXs can suppress manipulation through dynamic risk limits and position size controls, such as limiting large position leverage to 1.5x.

However, as a DEX (decentralized exchange), Hyperliquid must balance "permissionless" and "risk control." Although it has introduced margin improvement measures (such as requiring liquidation losses to exceed 18.3%), whales can still circumvent restrictions by diversifying positions across multiple accounts. This "cat-and-mouse game" reflects the governance challenges of DeFi: how to prevent systemic risks while maintaining decentralization principles?

The community is sharply divided on this issue. Some advocate for introducing CEX-style risk controls, such as adjusting margins based on position size; others believe this contradicts the spirit of DeFi, arguing that the real solution should be to attract more market makers to enhance liquidity, naturally raising manipulation costs. Hyperliquid's choice leans towards the latter, as its recent introduction of professional market makers and expansion of on-chain asset categories may be key to the future stability of its ecosystem.

Future Outlook: Opportunities and Challenges of Onchain Summer

The rise of Hyperliquid marks the entry of the crypto market into a new phase of "Onchain Summer." As CEXs like Binance and OKX embrace the on-chain ecosystem through wallet functions, and traditional institutions enter via ETFs, the liquidity barriers of on-chain contracts are gradually being broken down. With its positioning of "high-performance L1 public chain + on-chain CEX experience," Hyperliquid has become the biggest beneficiary of this trend.

However, can the whale-dominated ecosystem be sustained? The answer depends on three variables:

Regulatory pressure: If countries include on-chain contracts in derivative regulatory frameworks, Hyperliquid may face compliance requirements such as KYC and leverage limits, potentially weakening its competitive advantage.

Technological iteration: Currently, Hyperliquid's TPS (transactions per second) still lags behind public chains like Solana. If it cannot improve performance, large transactions by whales may lead to network congestion and increased slippage.

Retail participation: Currently, Hyperliquid has only 390,000 users, and the variety of spot trading options is limited. If it cannot attract more retail investors to hedge against whale volatility, the platform may become a "whale playground."

For investors, Hyperliquid is both a land of opportunity and a minefield of risks. Following whales requires vigilance against "survivorship bias"—James Wynn's success obscures the tragedies of countless liquidated traders; blindly replicating high-leverage strategies may become "fuel" for whales to harvest. Only by establishing an independent analytical framework can one navigate the turbulent waters of on-chain contracts with stability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。