Author: 1912212.eth, Foresight News

The long-awaited surge has finally occurred. On the evening of May 8, BTC broke through the $100,000 mark and continued to rise, standing above $102,000, achieving five consecutive weekly gains. However, the most impressive performance came from Ethereum, which rose over 20% in 24 hours, breaking through the $2,000 mark and reaching $2,200. ETH/BTC returned above 0.02, rebounding over 14% from its low.

Ethereum's explosion also led to a surge in the altcoin market, with staking token EUGEN rising over 40% in 24 hours, ETHFI rising over 28%, and both OP and ARB rising over 15%. In the public chain sector, SOL rose nearly 10%, while SUI and BERA both rose over 19%. In the stablecoin sector, ENA rose over 28%, and LQTY rose over 39%.

The crypto market has been quiet for several months since January this year. What are the influencing factors behind this rise? How will the subsequent market unfold?

Bitcoin Spot ETF Continues to See Net Inflows Since Mid-April

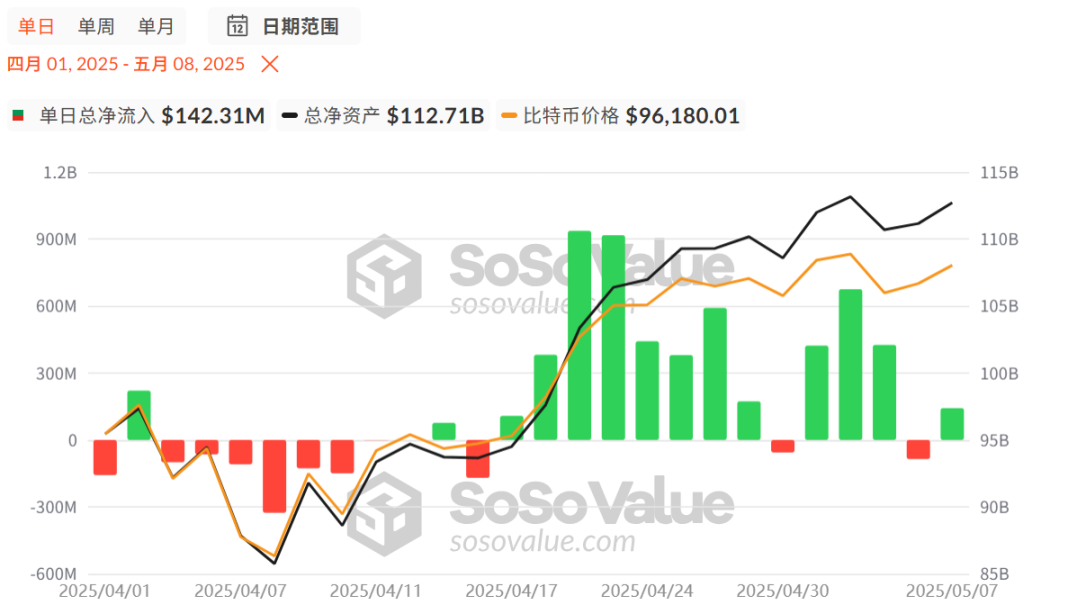

As an indicator of market capital inflow, ETF data shows that Bitcoin spot ETFs have seen continuous net inflows since April 15.

The chart shows that the net inflow on the 2nd exceeded $900 million, the net inflow on the 1st exceeded $600 million, and the net inflow on the 5th exceeded $300 million, while there was only one day of net outflow on the 3rd, and it was far less than the net inflows.

Currently, the total net inflow of Bitcoin spot ETFs has reached $40.77 billion, with strong capital inflows laying a solid foundation for BTC's price surge.

Strategy and Other Listed Companies Continue to Buy

Data shows that Strategy spent $555.8 million to increase its holdings by 6,556 BTC between April 14 and 20, with an average price of $84,785. Subsequently, it invested another $180.3 million to increase its holdings by 1,895 BTC, with an average price of $95,167. Additionally, Strategy launched an ambitious "42/42 plan," aiming to raise $84 billion over two years to purchase Bitcoin, following last year's implementation of the $42 billion "21/21 plan."

Japanese listed company Metaplanet increased its holdings by 145 BTC on April 24 and then invested $53.4 million to acquire 555 BTC on May 7. Furthermore, it issued $25 million in ordinary bonds on the same day to fund additional Bitcoin purchases. The CEO of Metaplanet stated in a shareholder letter that the company will continue to firmly advance its Bitcoin strategy, aiming to hold a total of 10,000 BTC by the end of the year.

Indian listed company Jetking, NASDAQ-listed Thumzup, and US-listed medical technology company Semler Scientific are also purchasing or planning to purchase more Bitcoin.

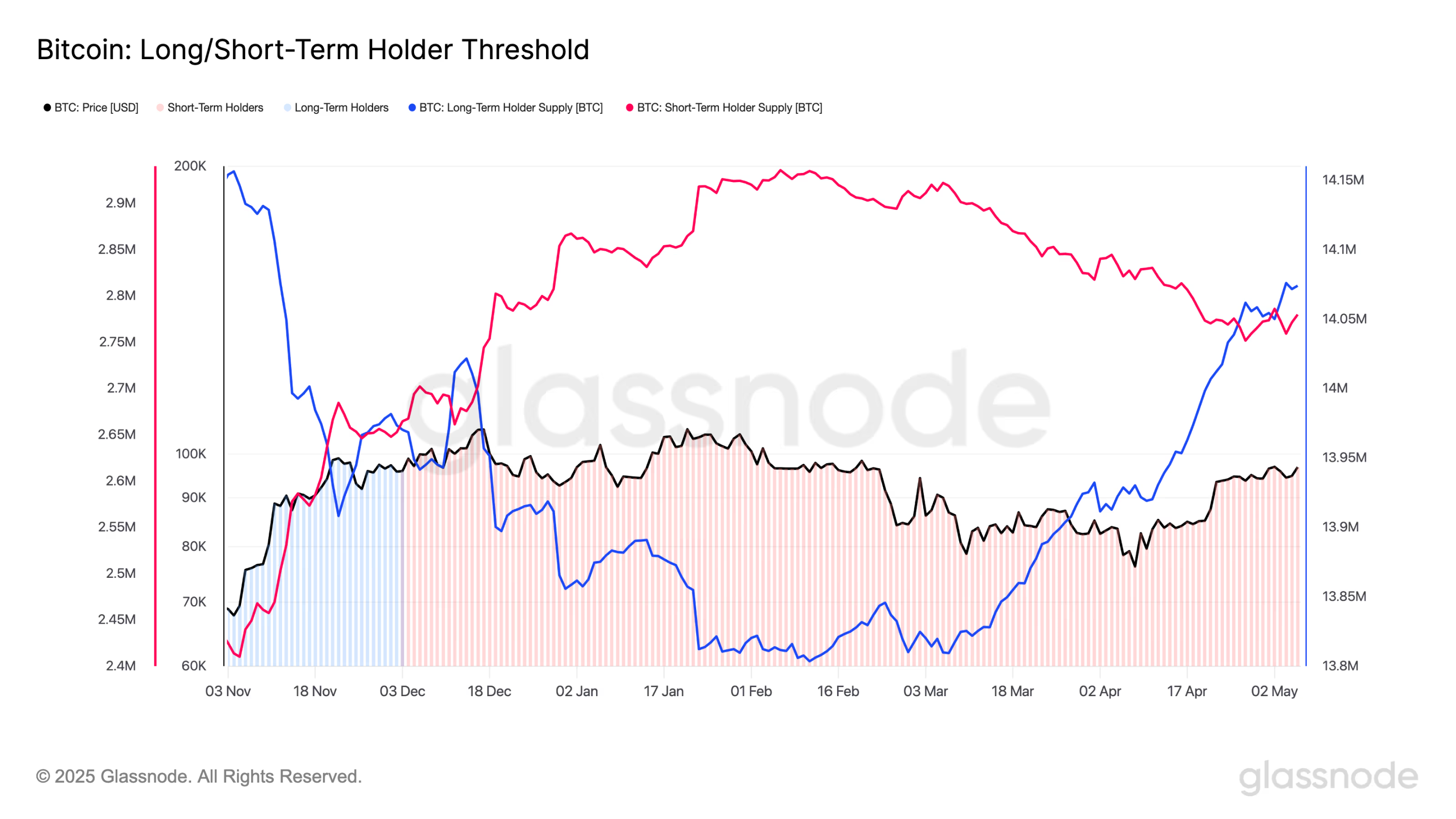

Both Long-term and Short-term Bitcoin Holders Are Increasing Holdings

Glassnode data shows that both short-term holders (STH) and long-term holders (LTH) of Bitcoin are increasing their holdings. LTH has been continuously accumulating since early March, while STH has also started to increase holdings in the past week. Glassnode defines LTH as investors holding BTC for more than 155 days, while STH are those holding for less than 155 days. According to its latest weekly report, LTH has increased its holdings by over 250,000 BTC since early March, bringing the total holdings of this group to over 14 million BTC.

This indicates that market confidence is recovering, and the accumulation momentum has surpassed investors' tendency to sell for safety.

When BTC was near the local low of $74,000, over 5 million BTC were in a state of loss. However, as the market recovers, this number has dropped to around 1.9 million BTC, indicating that over 3 million BTC have returned to a profitable state.

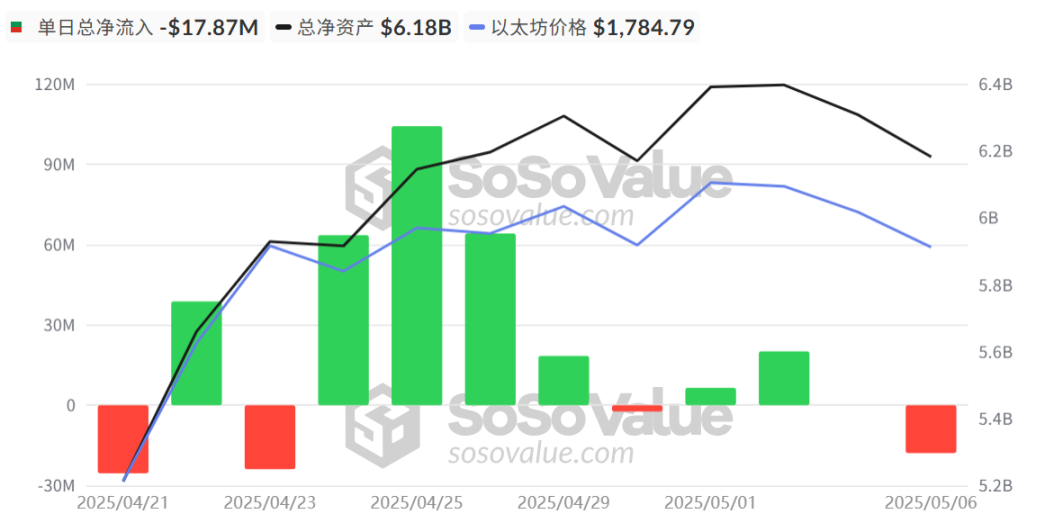

Ethereum Spot ETF Sees Continuous Net Inflows Along with Positive Pectra Upgrade

The data for Ethereum spot ETFs also shows optimism. Since the end of April, there have been net inflows over 7 days, with net inflows exceeding $60 million on 3 days, and the maximum single-day net outflow did not exceed $30 million.

Additionally, Ethereum has completed the Pectra upgrade, marking the first upgrade of the Ethereum mainnet since the Cancun upgrade in March last year. This includes two coordinated updates: the Prague execution layer hard fork and the Electra consensus layer upgrade, with plans to incorporate 11 Ethereum Improvement Proposals (EIPs). Key EIPs in this upgrade include EIP-7251 (increasing the maximum effective balance of validators), EIP-7691 (improving blob throughput), and EIP-7623 (increasing calldata fees).

This upgrade brings significant technical improvements to the Ethereum mainnet and its ecosystem projects, with market capital and sentiment directly reflected in ETH prices and ecosystem projects.

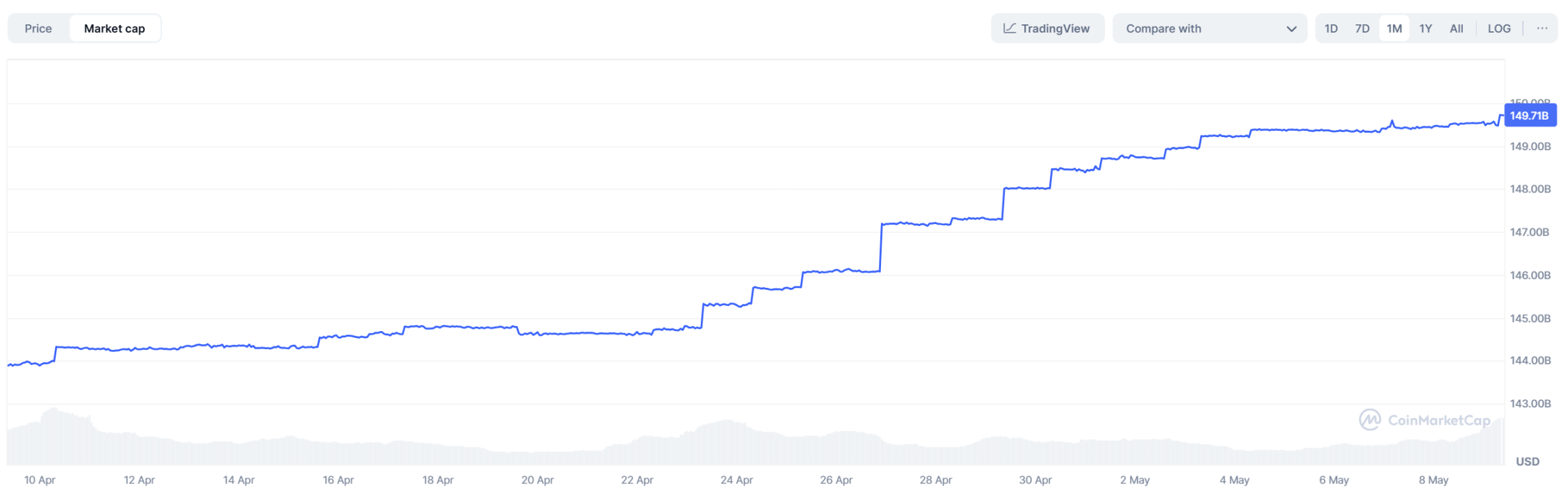

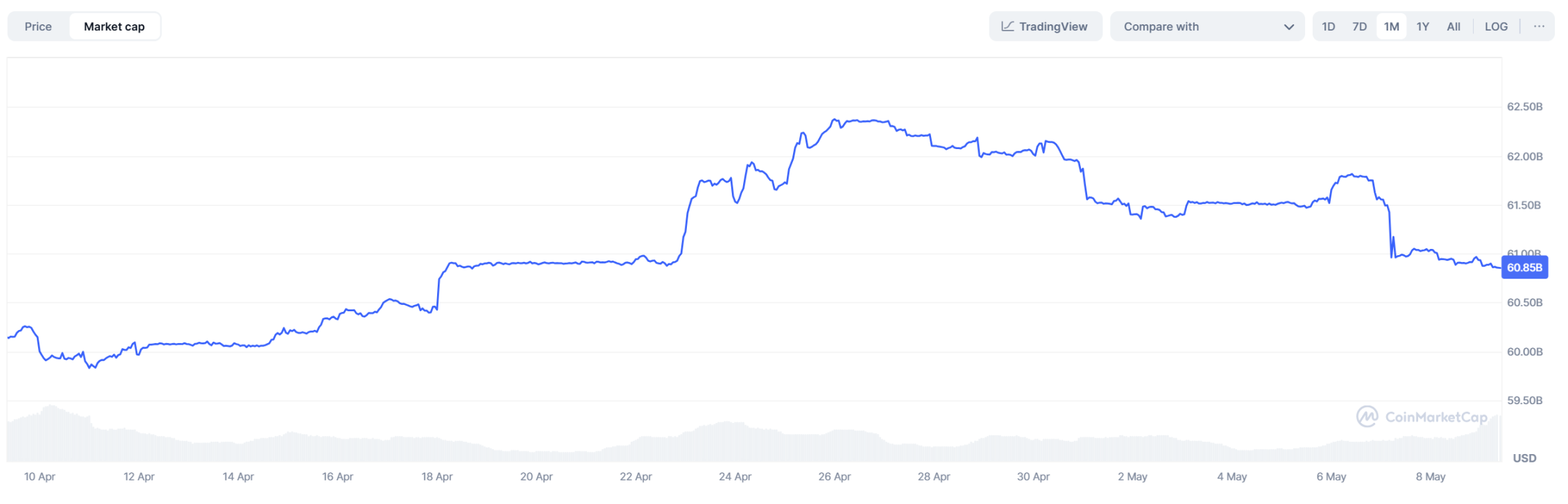

USDT and USDC Market Capitalization Increased Over 4% in a Month

The total market capitalization of stablecoins continues to reach new highs. According to DefiLlama data, the current total market capitalization of stablecoins has reached $242.226 billion, with a 7-day increase of over $16.078 million. USDT's monthly increase is 3.75%, with a market capitalization of $150.179 billion, while USDC's monthly increase is 1.18%, with a market capitalization of $60.904 billion, having retreated somewhat since reaching a peak at the end of April.

(USDT Market Capitalization Chart)

The market capitalizations of the two major stablecoins have not decreased but rather increased, indicating that capital is still flowing into the crypto market.

(USDC Market Capitalization Chart)

Federal Reserve Rate Cuts Expected in June-July, US-China Tariff War May Soon Resolve

In the early hours of May 8, the Federal Reserve announced after a two-day meeting that it would maintain the federal funds rate in the range of 4.25% to 4.5%. This marks the third consecutive time the Fed has not cut rates since the meetings in January and March this year. Powell stated, "The monetary policy outlook may include lowering short-term rates." He mentioned in a press conference that the outlook "may include" rate cuts or maintaining rates, depending on economic conditions. The fluctuations in GDP data will not significantly change our situation. This has further intensified the tension between the Federal Reserve and the White House. Trump has repeatedly criticized the Fed, stating that talking to Powell is like "talking to a wall," as Powell is always too late.

Current pricing indicates a 30% chance that the Fed will cut rates by 25 basis points as early as June, slightly higher than the earlier 27%. According to futures prices, the likelihood of a rate cut by July is about 75%. Recently, the Bank of England and the People's Bank of China have both cut rates, and global liquidity M2 continues to rise. Expectations of Fed rate cuts may promote capital inflows into crypto assets.

Regarding tariffs, Trump has wielded the tariff stick, causing global capital markets to tremble. Under pressure from the market and domestic public opinion, Trump has finally become restless, frequently expressing intentions for talks with China. On May 7, the Chinese Ministry of Foreign Affairs announced that Vice Premier He Lifeng would visit Switzerland from May 9 to 12, during which he would hold formal talks with US Treasury Secretary Yellen and Trade Representative Tai. This marks the first face-to-face discussions on economic and trade issues between high-level officials from China and the US since the 2024 G20 summit, interpreted by the market as a clear signal from both sides to "pause tariff escalations."

Future Market Trends

Raoul Pal, former Goldman Sachs executive and founder of Real Vision, tweeted, "I believe BTC's dominance has peaked today. Daily, weekly, and monthly DeMark top signals have appeared, and the top levels are lower than the 2021 peak, which in turn was lower than the 2017 peak. If this judgment holds, it will mark the arrival of the next phase of the 'Banana Zone' (referring to the altcoin season). Let's wait and see."

Chris Burniske, a partner at Placeholder who has been vocal about the bull market not being over, tweeted again, "When the blockchain economy is thriving, it has the fastest economic feedback loop of any trillion-dollar system in the world: activity—on-chain capital inflow—price—activity. When we fall into despair, we always forget this and are then surprised by how quickly wealth changes."

Jack Tan, co-founder of WOO X, stated, "Bitcoin breaking through $100,000 again is not just a price confidence restoration, but a strong vote of confidence in the future vision of decentralized finance globally. As the impact of trade war-related news gradually diminishes, the gold market has also entered a wait-and-see period, with risk appetite returning to dominance."

The most optimistic "call king," Arthur Hayes, co-founder of BitMEX, stated that Bitcoin will reach $150,000 by the end of May.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。