In general, there are far more reasons to be bullish on ETH than bearish.

Author: ElonMoney

Translator: Deep Tide TechFlow

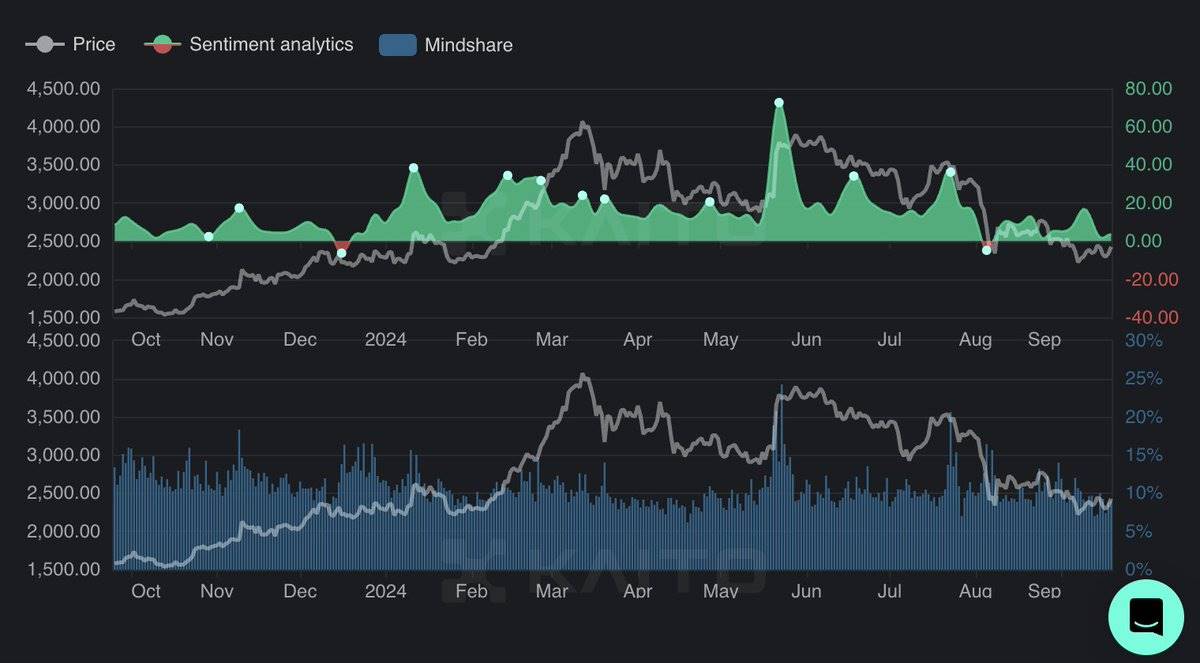

What is the market sentiment for ETH? Let's take a look!

Recently, there has been a divergence of opinions on $ETH. Many traders and analysts remain bullish, but some have turned to a more pessimistic attitude. I have collected some respected voices on Crypto Twitter (CT) to understand why these viewpoints have changed.

First, let's look at the reasons for and against ETH, and then delve into the opinions of some important cryptocurrency opinion leaders.

Bullish Reasons

Ethereum 2.0 Upgrade: The shift from Proof of Work (PoW) to Proof of Stake (PoS) in the Ethereum 2.0 upgrade is the main driving force behind the bullish sentiment. This upgrade is expected to enhance the network's transaction capabilities, attracting more users and developers.

Growth of DeFi: Ethereum is the core of the decentralized finance (DeFi) ecosystem, hosting the majority of related projects. As DeFi platforms offering lending, trading, and other services continue to develop, the demand for ETH will also increase, thereby increasing its value.

NFTs: Ethereum is the primary platform for NFTs, and with the surge in popularity of NFTs, the minting, purchasing, and selling of NFTs require the use of ETH, thus increasing its demand.

Smart Contract Functionality: Ethereum supports smart contracts, making it the preferred choice for developers to build decentralized applications. This flexibility enhances its market value, leading to positive market sentiment.

Institutional Recognition: An increasing number of institutions are beginning to recognize Ethereum's potential, viewing it as a valuable asset and an innovative platform, adding trust and stability to its market position.

Bearish Reasons

Scalability Issues: Despite the upgrade to Ethereum 2.0 and the shift to PoS, Ethereum still faces serious scalability challenges. The network performs poorly when handling a large number of transactions, leading to congestion and high fees during peak periods, which is very frustrating for users and developers.

Competition from Other Blockchains: Ethereum is facing fierce competition from other blockchains that offer faster transaction speeds and lower fees. Platforms such as Solana, Binance Smart Chain, and Cardano are rapidly rising, attracting developers and projects that might have chosen Ethereum previously.

Update Delays and Development Challenges: Ethereum's development plans have experienced delays in the past, and any further delays in critical upgrades could trigger bearish sentiment in the market. If Ethereum makes slow progress in addressing existing issues or introducing new features, investors may lose patience.

So, what is the mainstream market sentiment for ETH?

Let's take a look at the opinions of top traders and analysts:

@sassal0x believes that ETH is the core asset of the decentralized Ethereum economy, emphasizing its decentralization, liquidity, and growth potential. As the ecosystem expands, these characteristics make it a strong investment.

@0xQuit emphasizes the unique value of Ethereum as an innovative and creative platform, contrasting it with Bitcoin's reputation as a stable store of value.

@llamaonthebrink believes that Ethereum's value lies in its unique innovative features and the potential to create new narratives, requiring forward-thinking beyond traditional financial concepts.

@0xENAS sees ETH as a potential long-term investment opportunity, as the current support levels and prevailing negative sentiment may indicate a contrarian buying opportunity.

@deltaxbt humorously links the 25% drop of ETH relative to BTC to Vitalik Buterin's emotional state, suggesting the founder remain single to avoid similar market fluctuations.

@rektmando expresses a bearish view, suggesting that ETH holders feel uncertain about Ethereum's future after seeing @VitalikButerin sing.

@MoonOverlord believes that first-layer transactions are no longer viable, viewing Ethereum as a "missed opportunity," and pointing out that Solana's low fees and fast transaction confirmation speed are evidence of this shift.

@crypto_bitlord7 holds a bearish view, stating that Ethereum is "done for," and plans to sell the tokens purchased during the ICO era.

@gametheorizing believes that Ethereum's value primarily depends on the strength of its community, and warns that if narrative splits or competition from second-layer solutions weaken the community, its value may decline.

@GwartyGwart is frustrated with Ethereum's transaction system, especially the negative experience when users attempt to send the maximum amount of ETH.

In general, there are far more reasons to be bullish on $ETH. Developers continue to favor Ethereum, the number of decentralized applications (dApps) is steadily increasing, and institutions are gradually adopting it. Bearish sentiment is usually due to price declines or sales by Vitalik and the Ethereum Foundation, but these actions are often explained as donations or operational costs.

Successful individuals, how do you view ETH?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。