撰文:Web3Mario

摘要:2024年8月23日,美联储主席鲍威尔在Jackson Hole全球央行年会上正式宣布“现在是政策调整的时候了。前进的方向是明确的,降息的时机和步伐将取决于即将到来的数据、不断变化的前景以及风险的平衡。”这也就意味着持续了将近3年的美联储紧缩周期迎来了转折。如果宏观数据不出意外的话,将在9月19日的议息会议时迎来首次降息。然而在进入降息周期初期时,并不意味着暴涨的马上来临,还是有些风险值得大家警惕,因此笔者于此总结一下当前最需要关注的一些问题,希望可以帮助大家规避掉一些风险。总的来说,在降息初期,我们还需要关注六个核心问题,包括美国的衰退风险、降息节奏、美联储的QT(量化紧缩)计划、通胀重燃风险、全球央行联动效率和美国政治风险。

降息并不一定意味着风险市场的即刻上涨,相反大部分情况下是下跌

美联储的货币政策调整对全球金融市场有着深远的影响。特别是在降息初期,尽管降息通常被视为刺激经济增长的措施,但它也伴随着一系列潜在风险,这就意味降息并不一定意味着风险市场的即刻上涨,相反大部分情况下是下跌。而造成这种情况的原因通常可以被归类为以下几点:

- 金融市场波动性增加

降息通常被认为是支持经济和市场的信号,但在降息初期,市场可能会出现不确定性和波动性上升的现象。投资者往往会对美联储的行动产生不同的解读,有些人可能会认为降息反映了对经济放缓的担忧。这种不确定性可以导致股市和债市出现较大的波动。例如,在2001年和2007-2008年金融危机期间,尽管美联储开始了降息周期,但股市仍然经历了显著的下跌。这是因为投资者担心经济放缓的严重性超出了降息的正面影响。

- 通胀风险

降息意味着借贷成本下降,鼓励消费和投资。然而,如果降息过度或持续时间过长,可能会导致通胀压力上升。当经济中充裕的流动性追逐有限的商品和服务时,价格水平可能会迅速上升,特别是在供应链受限或经济接近充分就业的情况下。历史上,如1970年代末期,美联储降息导致了通胀飙升的风险,这使得后续不得不采取更加激进的加息政策来控制通胀,从而引发经济衰退。

- 资本外流和货币贬值

美联储降息通常会降低美元的利率优势,导致资本从美国市场流向其他国家的更高收益资产。这种资本外流会对美元汇率产生压力,导致美元贬值。虽然美元贬值可以在一定程度上刺激出口,但也可能带来输入型通胀的风险,特别是在原材料和能源价格高企的情况下。此外,资本外流还可能导致新兴市场国家的金融不稳定,特别是那些依赖美元融资的国家。

- 金融系统的不稳定性

降息通常被用来减轻经济压力并支持金融系统,但它也可能鼓励过度的风险承担。当借贷成本低廉时,金融机构和投资者可能会寻求更高风险的投资来获得更高回报,导致资产价格泡沫的形成。比如,在2001年科技股泡沫破裂后,美联储大幅降息以支持经济复苏,但这种政策在一定程度上助长了随后房地产市场的泡沫,最终导致了2008年金融危机的爆发。

- 政策工具的有效性受限

在降息初期,如果经济已经接近零利率或处于低利率环境,美联储的政策工具可能受到限制。过度依赖降息可能无法有效刺激经济增长,尤其是在利率接近零的情况下,这就需要更多的非常规货币政策手段,如量化宽松(QE)等。在2008年和2020年,美联储在降息接近零后不得不采用其他政策工具来应对经济下滑,这表明在极端情况下,降息的效果是有限的。

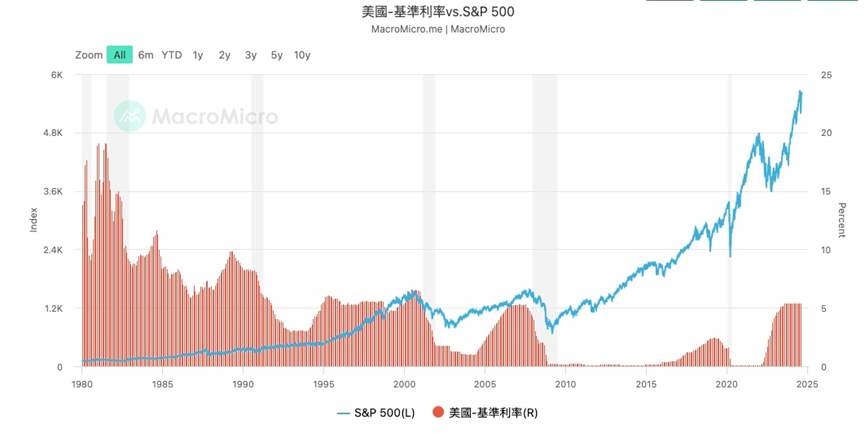

让我们从历史数据来看,随着1990年代,美苏冷战的结束,世界进入美国主导的全球化的政治格局后直到现在,美联储的货币政策反映出了一定程度的滞后性。而当前也正值中美对抗正酣的阶段,旧秩序的破碎无疑更加剧了政策的不确定性风险。

盘点当前市场的主要风险点

接下来让我们盘点一下当前市场中存在的主要风险点,重点包括美国的衰退风险、降息节奏、美联储的QT(量化紧缩)计划、通胀重燃风险和全球央行联动效率。

风险一:美国经济衰退风险

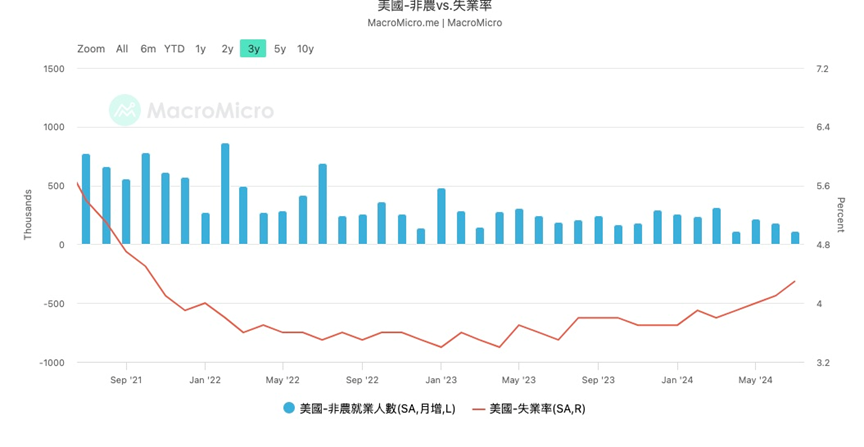

有很多人将9月份的潜在降息成为美联储的“防御性降息”。所谓防御性降息,指的是在经济数据没有出现明显恶化的情况下,为降低潜在的经济衰退风险而做的降息决策。在我之前的文章中已经分析过了美国失业率已经正式出发了“萨姆规则”对于衰退的警戒线。因此对9月份的降息是否能够遏制逐渐上升的失业率,从而起到稳定经济抵抗衰退的观察就显得极为重要。

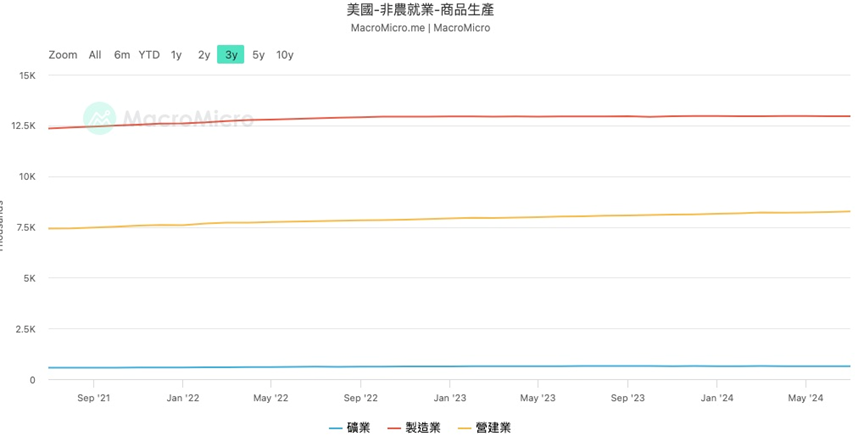

让我们从非农就业数据的细项上来观察一下具体发生了什么,可以看到在商品生产门类,制造业就业人数出现了较长时间的低波动震荡,对数据贡献更多的是营建业。而对于美国经济来说,高端制造业,以及与其搭配的技术及金融服务业是主要的驱动力,也就是说当这部分高收入精英阶层收入上升时,受财富效应影响增加消费,进而惠及其他中低端服务业,所以该部分人群的就业情况可以作为美国整体就业情况的领先指标。而制造业就业的疲软可能展现出一定的导火索风险。除此之外,我们来看下美国ISM制造业指数(PMI),可以看到PMI正处于快速下降的趋势,这也进一步佐证了美国制造业疲软的局面。

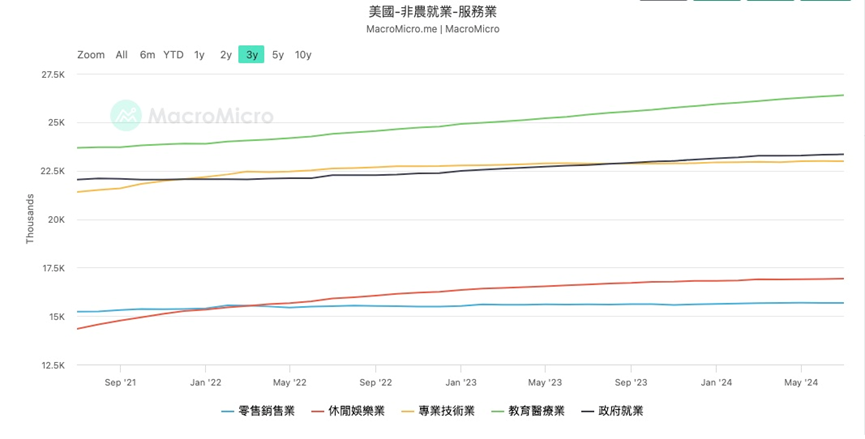

接下来来看下服务行业,专业技术业与零售业都呈现出了同样的冷冻局面。对指标作出正贡献的主要以教育医疗、休闲娱乐为主,主要原因我认为有两个,其一是最近新冠出现了一定的反复,并且受飓风影响,相关的医疗救护人员出现了一定程度的短缺。其二是由于7月大部分美国人处于度假期,由此带动的旅游等休闲娱乐行业增长,当假期结束后,该领域势必也收到一定的打击。

因此总的来说,美国当前衰退风险仍然存在,所以小伙伴还需要进一步通过宏观数据去观察相关风险,主要包括非农就业、初领失业金人数、PMI、消费者信心指数CCI、房价指数等。

风险二:降息节奏

第二个需要关注的是降息节奏的问题,虽然已经确认开始降息,但是降息的速度将影响风险资产市场的表现。历史上美联储的紧急降息是比较少见的,因此在议息会议之间的经济波动就需要市场自己的解读来影响价格走势,当某些经济数据预示着美联储加息过慢时,市场将率先开始反应,因此如何确定一个适合的降息节奏,并通过利率指引的方式引导市场按照美联储的目标来运行是至关重要的。

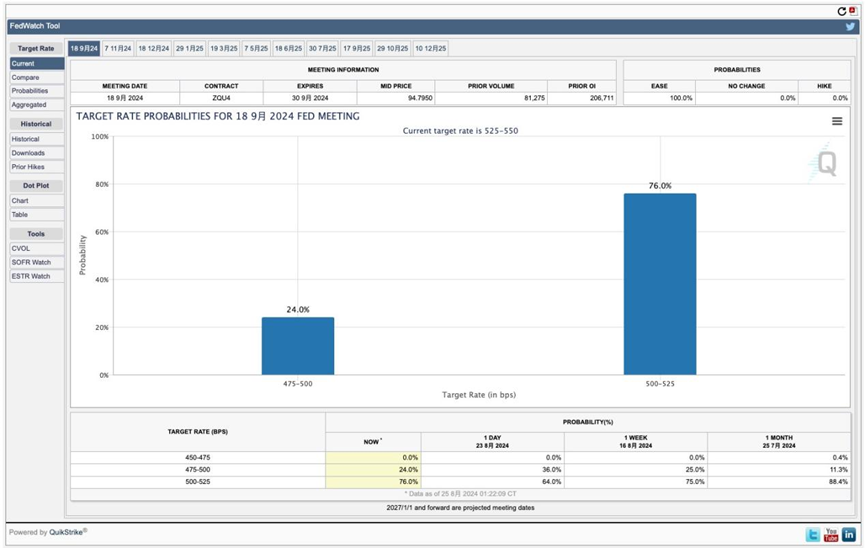

当前市场对9月利率决策的预估是将近75%的概率降25~50BP,25%的概率降50~75个BP,那么密切关注市场的判断,也可以较为明显的判断市场情绪。

风险三:QT计划

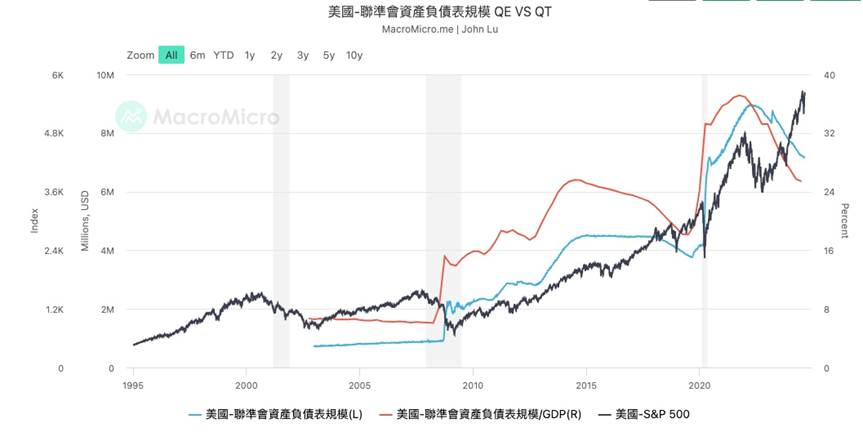

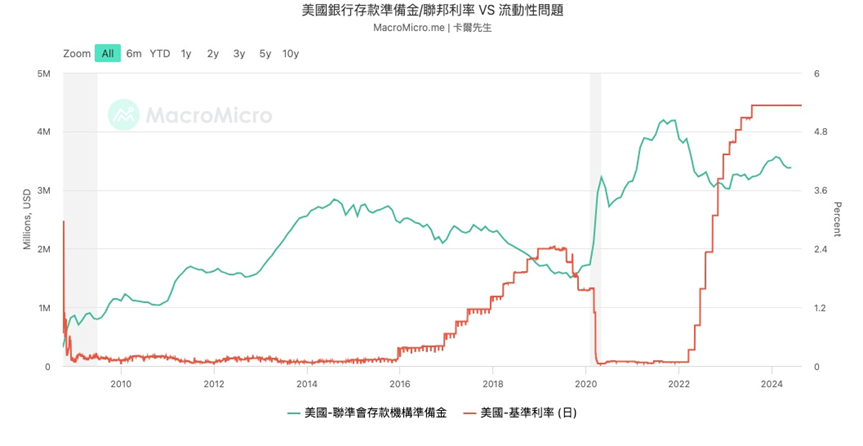

自从2008年金融风暴后,美联储快速将利率降低到0,但是仍然没有能够让经济出现复苏的现象,那时货币政策已经失效,因为无法继续降息,于是为了向市场进一步注入流动性,美联储创建了量化宽松QE工具,通过扩张美联储的资产负债表的方式向市场注入流动性,同时增加银行系统的准备金规模。这种方式其实是将市场风险转移到美联储身上,因此为了降低系统性风险,美联储需要通过量化紧缩QT,控制资产负债表规模。避免无序的宽松导致自身风险过大。

在鲍威尔的发言中并没有涉及到对当前QT计划的判断以及后续规划,因此仍需要我们对QT的进程,以及由此引发的银行准备金变化情况保持一定的关注。

风险四:通胀风险重燃

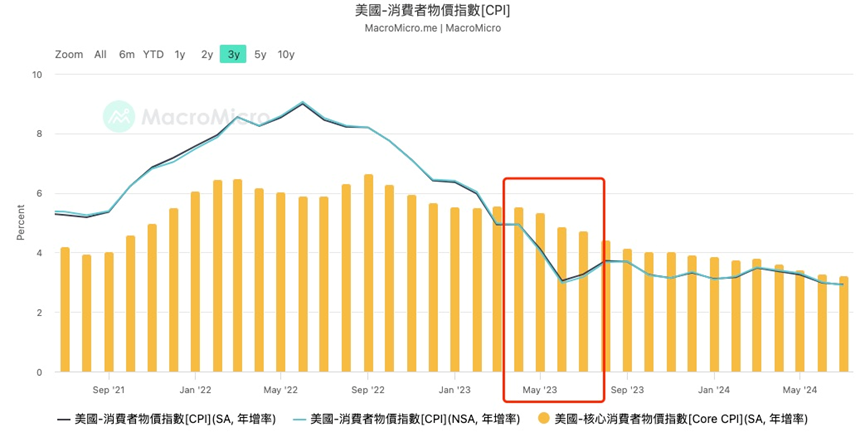

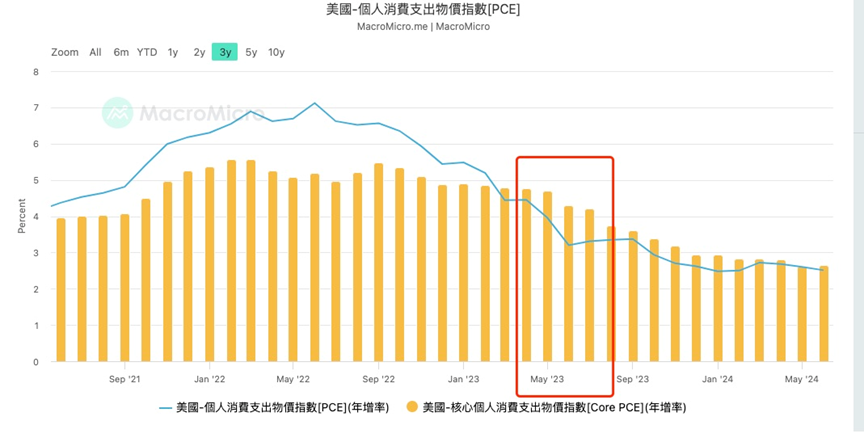

鲍威尔在周五的会议上对通胀风险保持乐观的态度,虽然没有达到预期的2%,但已经可以对控制通胀较为有信心。的确,从数据上确实可以反映出这个判断,而且已经有不少经济学家开始吹风,即在经历过疫情的洗礼后,目标通胀率仍然设置成2%是否过低。

但是这里仍然存在一些风险:

-

首先从宏观角度来看,美国再工业化受各种因素影响,并不顺利,而且又恰逢中美对抗背景下美国的逆全球化政策,供给端的问题在本质上并没有得到解决。任何地缘政治的风险,都会加剧通胀的重燃。

-

其次考虑到在本轮加息周期中,美国经济并没有进入实质的衰退周期中,随着降息的进行,风险资产市场将出现复苏,当财富效应再次产生时,随着需求側的扩张,服务业通胀也将再次重燃。

-

最后是数据统计上的问题,我们知道为了避免季节性因素对数据造成干扰,CPI与PCE数据通常会用年增率,也就是同比数据来反应真实情况,而到今年5月开始,2023年的高基期因素将被耗尽。届时相关数据的表现将容易收到增长的影响。

风险五:全球央行联动效率

我想大部分小伙伴对8月上旬的日美利差交易风险还记忆犹新,虽然日本央行马上出面安抚市场,但是我们仍然可以从前两天的植田和男国会听证上看得出其偏向鹰派的态度。而且在其讲话的过程中,日元也出现了明显的拉升并在听证会后官员的再次安抚而得到恢复。当然实际上,日本国内的宏观数据表现也的确需要加息,这在我之前的文章中也有过详细的分析,但作为很长一段时间全球杠杆资金的核心来源,日本央行的任何加息聚餐都将给风险市场带来极大的不确定性。因此对其政策保持高度关注也是有必要的。

风险六:美国大选风险

最后需要提一下的就是美国大选的风险,在我之前的文章中也已经对特朗普与哈里斯的经济政策有过详细的分析。随着大选的临近,将会有越来越多的对抗与不确定性事件发生,因此也需要时刻保持对大选相关事项的关注。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。