Author: THOR

Translator: LlamaC

"Recommended message: EVM has always been a pioneer in blockchain virtual machines and has become the most commonly used virtual machine over the years. It has witnessed the innovation of well-known projects such as Curve, Uniswap, and Maker. Although EVM dominates, the rise of AltVM (alternative virtual machine) is due to its limited programming languages, the complexity of Solidity, and sequential processing. Among AltVM, Monad, apart from MonadDb bringing 10,000 TPS per second to the mainnet, has built a huge community culture, which sets it apart from other AltVM projects. We always liken L1 to a city and view the core operators of L1 as a service-oriented government. We evaluate based on the ability to attract investment (developers) and the atmosphere for citizens to live in (culture)/the efficiency of citizen services (convenience). Currently, Monad has shown its competitiveness, and we look forward to witnessing and participating in the development and growth of Monad in the future. Gmonad!"

Monad is a Layer 1 (L1) blockchain set to launch later this year. Despite not being live yet, Monad has already amassed a large community, reaching a nearly cult-like status, with members even creating their own pets and releasing mixtapes on Soundcloud. Monad stands out for its goal of becoming a highly scalable single large-scale L1 blockchain, compatible with EVM and capable of processing over 10,000 transactions per second with a block time of 1 second. This scalable performance is achieved through parallel execution, Monad DB, and other technologies. Achieving security and decentralization, Monad raised $19 million in its seed round, led by Dragonfly, with participation from Placeholder, Shima Capital, Lemniscap, Cobie, and others.

The Origin Story of Monad

Monad has been in development for about two years, founded by Keone Hon, James Hunsaker, and Eunice Giarta. Keone and James are co-founders with technical backgrounds who worked together at Jump Trading for eight years. Sitting at the same high-frequency trading desk, competing with 20 other teams within Jump, Keone and James consistently ranked at the top for multiple years, facilitating over $10 trillion in nominal trading volume annually and processing thousands of transactions per second. At this level of trading volume, Keone and James experienced firsthand the differences in execution at the microsecond level. After entering the crypto space, Keone worked on Solana DeFi, while James worked on building Pyth. Realizing the potential for fundamental optimizations to be implemented on EVM, they began building Monad in 2022, optimizations that have become standard in high-performance computer science over the past 20 years but have not yet been applied to EVM. By introducing these components, a higher-performance EVM can be created to address many current scalability bottlenecks.

"They are the first to push parallel EVM. Their understanding of it is better than anyone else in the crypto space right now. Without a doubt, I think what other chains are claiming to have with parallel EVM, Monad had already completed a year and a half ago. Through full-fledged engineering, Monad is very close to having the first product. I dare say, within a month, we will have the first internal private testnet online and operational."

Monad's Technical Stack

It turns out that parallelization is far more than just a buzzword/narrative; it can achieve scalability and efficient execution. What makes Monad scalable and capable of processing over 10,000 transactions per second is not just the parallel execution engine.

I think many people believe that parallel execution is a natural byproduct of insertion, i.e., "if you can add parallel execution to EVM, suddenly its performance will greatly improve." But in reality, this is not the case. Parallel execution alone does not have much impact on creating a higher-performance EVM. Monad truly achieves parallel execution, combined with some other optimizations, unlocking a significant amount of performance. Let's break it down separately:

Parallel Execution

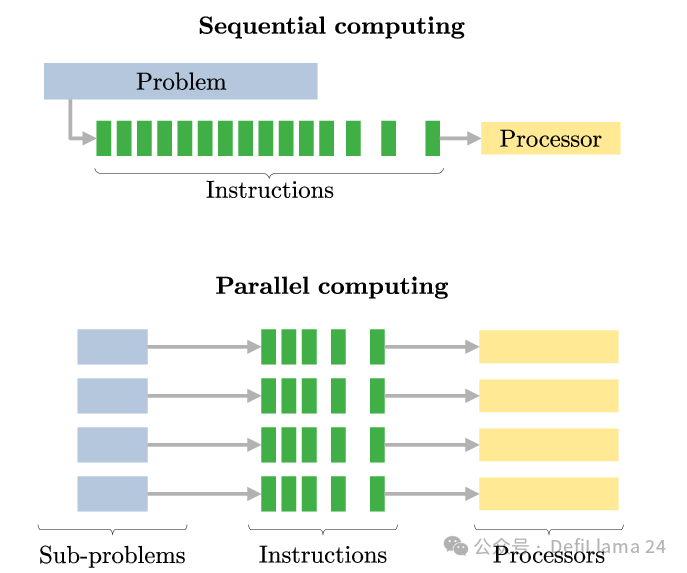

Refers to the ability to execute multiple tasks simultaneously, rather than one after another (sequentially). While parallel processing may be more complex, it can significantly reduce processing time and improve efficiency by distributing workloads among multiple processors:

Sequential execution vs. parallel execution

Sequential execution vs. parallel execution

Monad utilizes parallel execution, allowing for the simultaneous processing of multiple transactions. It is worth noting that Monad blocks are still linearly ordered sets of transactions, similar to Ethereum.

Monad uses optimistic execution, meaning the chain begins executing transactions before early transactions in the block are completed. To avoid errors and incorrect execution, the states of transactions are sequentially merged in the block to ensure correctness.

MonadDb

Without a state database allowing for parallel read and write to disk, the impact of the parallel execution engine on blockchain performance is limited. Let's consider an example:

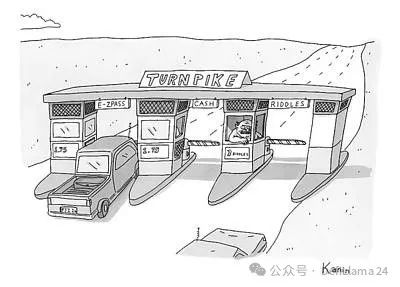

Sequential execution (Ethereum): Imagine a single-lane highway with a single toll booth allowing one car to pay the toll and pass through at a time.

Parallel execution: Now there are 20 lanes on the highway and 20 toll booths, but still only one car can pass through at a time. So if a car is passing through toll booth 1, cars at toll booths 2 or 3 will have to wait.

Parallel execution with parallel database: All 20 toll booths can be used simultaneously, and 20 cars on different lanes can pass through simultaneously.

Monad DB (Monad database) is crucial for unlocking parallel processing and rapid finality/high TPS for the chain.

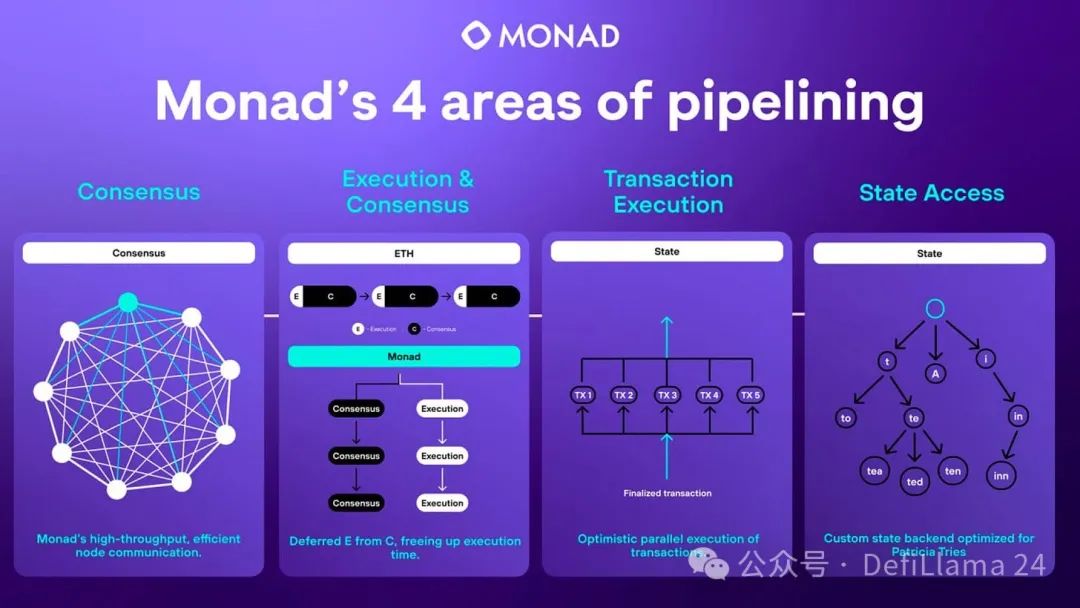

Asynchronous Execution and Consensus

Currently, in Ethereum blocks, execution occurs in about 1/10 of a second, and the next 11.9 seconds are spent on consensus. What Monad does is separate these, so instead of having 12 seconds for a block and 1/10 of a second for execution, you now have two independent lanes, allowing you to use the entire block budget for execution. Imagine if Ethereum had 12 seconds of execution time per block instead of 1/10 of a second. This is a 100-fold increase. This is a very standard thing that has been implemented in computer science for a long time, but it does not currently exist in EVM. So this is another major unlock."

"All of these combined are the key to truly achieving performance. This is what enables it to actually operate and achieve a throughput of 10,000 transactions per second."

All of this, combined with full EVM compatibility, sets Monad apart in the competition. Any EVM protocol can easily be deployed on Monad and take advantage of an efficient execution environment.

What Applications Can Be Built on Monad?

List of projects committed to launching on Monad

List of projects committed to launching on Monad

The technical stack has been introduced, so let's explore the upcoming Monad ecosystem. Generally, all protocols will benefit from improved execution, such as faster finality and more TPS. However, there are specific applications that can experience transformative progress unlocked by a fast chain like Monad.

One of the most obvious use cases is trading protocols. Particularly for on-chain order book DEX (spot and futures), building on Monad will be attractive. Historically, order book exchanges have been centralized (Bybit, Binance, Coinbase, etc.), providing deep liquidity but with relatively high fees and risks related to lack of self-custody. The AMM model, widely adopted by GMX, Gains, Synthetix, allows for on-chain self-custody, but liquidity may be limited, leading to poor trader execution and slippage. Therefore, on-chain decentralized order book exchanges are considered by many to offer the best of both worlds. However, rather than having to launch a custom application chain for efficient execution, order book DEX can seamlessly deploy on Monad, which is EVM-compatible throughout the stack.

One of the early builders on Monad is the Elixir protocol, a delegated proof-of-stake network providing liquidity for various order book trading. With Elixir, users can deposit liquidity into various treasuries acting as market makers for order book trading markets. Elixir is currently active on Vertex and RabbitX, with plans to launch on platforms such as Injective, dYdX, Bluefin, and Monad.

Additionally, the native Monad content platform, The Pipeline, recently conducted a podcast interview with Pike Finance, expressing early excitement for launching on Monad later this year. Pike Finance is a cross-chain currency market powered by wormhole, Circle, and Pyth, and they recently launched their beta on various EVM chains a few days ago.

Another use case is large-scale on-chain games that require high throughput to function properly. "I think games sound great on paper. You have this complete virtual economy and world, but you really need the underlying base layer performance to allow it to have a million active users every day. An example is playing 'Fortnite' with your friends. If only 500 people can play at a time, it's not as fun. You need a million people, right? That's where it really becomes interesting and competitive. In terms of gaming, we allow games to scale from a few hundred active users at any given time to millions."

Monad seems to be in discussions with game studios about building and enabling truly high-throughput games on-chain.

Roadmap

Monad is expected to launch on the mainnet at some point later this year, possibly in the third quarter. Therefore, while it is still early stages for the chain, an internal testnet (an internal test network) is about to go live.

There is already a lot of interest from existing EVM protocols looking to bridge to Monad, leveraging its high scalability and EVM compatibility, but there are also teams looking to build native applications on the Monad blockchain. Additionally, Monad recently announced a partnership with Layerzero, which will make bridging liquidity into the ecosystem even easier.

Given the tremendous interest from the community and developers, the hype surrounding Monad may continue to grow until the public testnet and mainnet launch later this year.

Conclusion

In a world where new L1 and L2 chains are launching almost every day, Monad stands out with its scalable technology, highly capable team, and cult-like community. As a single chain, I believe its closest competitors are Solana and perhaps Sui. However, there are many different scaling approaches attempting to gain adoption (rollups app-chains, modular stacks, etc.). Therefore, it's interesting to see if Monad can attract liquidity, users, and developers in this highly competitive infrastructure environment, but given the high expectations, it seems possible. While Monad is still in the early stages, staying updated on the latest developments within its ecosystem will make things even more interesting.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。