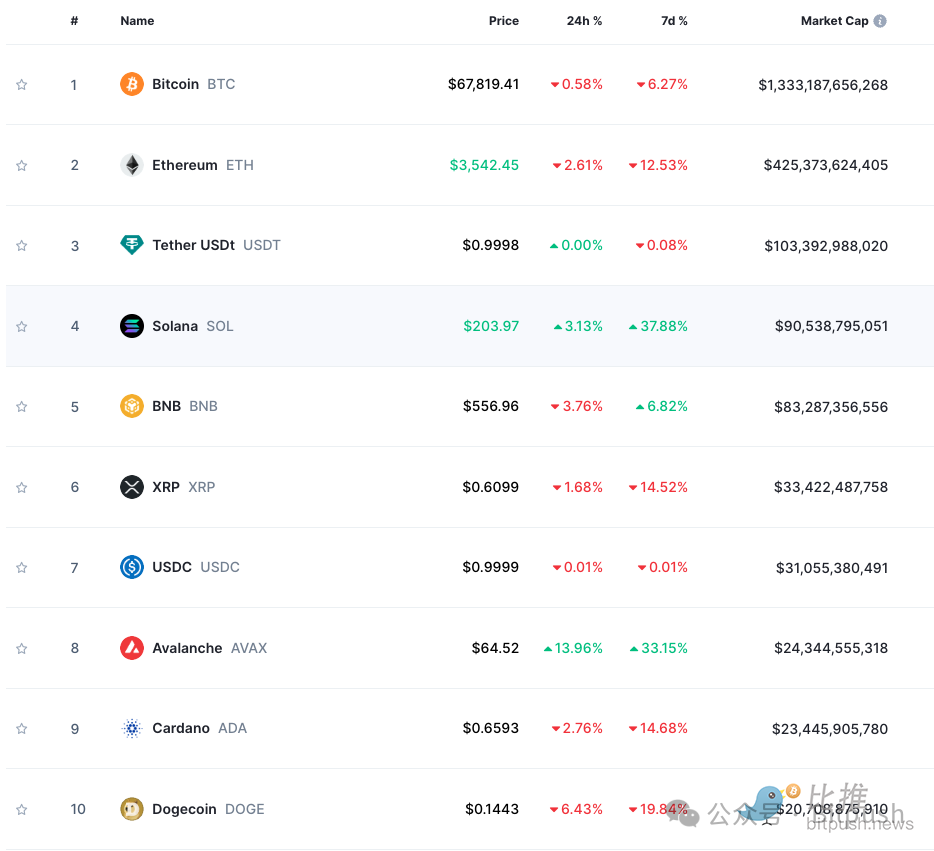

On Monday, the cryptocurrency market continued to decline. After a brief drop to around $65,000 over the weekend, Bitcoin rebounded slightly and consolidated around $67,000 to $68,000, with a drop of over 8% from its previous all-time high. Ethereum briefly dropped below $3,500 but recovered to above $3,500 by the close of the US stock market, with a 24-hour decline of nearly 3%.

Among the top 10 cryptocurrencies by market capitalization, only Solana (SOL) and Avalanche (AVAX) achieved positive returns in the past 24 hours. Dogecoin experienced the largest decline at 6%, while BNB, ADA, and others saw declines of around 3%.

Solana Ecosystem Continues to Gain Traction

Data tracked by Santiment shows that SOL and the meme token The Book of Meme (BOME) built on Solana have been the hottest tokens in the past two days.

SOL's price surged by 45% in 7 days, breaking $200 for the first time since December 2021, although it is still below the historical high of $259.96 in November 2021.

Cryptocurrency exchange Binance launched perpetual futures for BOME on March 16, and BOME has surged by 82% since its listing on March 10.

Santiment stated in its market report: "BOME and SOL are the two most popular assets on X, Reddit, Telegram, and 4Chan, as their recent performance has outperformed the market. People still believe that Solana and its meme tokens are viable alternatives to Ethereum's ecosystem."

According to Santiment, the mentions of "SOL" on social media have increased to 322 times. Meanwhile, Google Trends, used to measure interest in hot topics, briefly showed a value of 100 for global searches for "solana." A value of 100 represents the maximum number of searches observed for a term within a given time range. This indicates that more people are browsing information about Solana online.

The heat of the Solana ecosystem and its continuously rebounding token price will be echoed. Data from Top Ledger and OurNetwork shows that the trading volume of decentralized exchanges based on Solana has reached $30 billion this month, a tenfold increase from a year ago.

BTC in a Pre-Halving Pullback Period, Standard Chartered Bank Predicts a Rise to $150,000 by Year-End

Some analysts believe that based on historical trends, Bitcoin is currently in a pre-halving pullback period.

Cryptocurrency trader and independent analyst Rekt Capital posted on X, stating that the sustained price trend is part of the pre-halving pullback. During the halving cycles in 2016 and 2020, BTC dropped by 38% and 20%, respectively.

Lucas Kiely, Chief Investment Officer of YieldApp, also warned that Bitcoin is entering a "danger zone" before the halving.

Kiely stated: "The price trend of Bitcoin over the past week is a prelude to future turbulence and a clear signal to fasten our seat belts as we enter the 'danger zone' before the halving. In the days before the halving, BTC plummeted by 40% in 2016 and 20% in 2020. We are just preparing for the price trend before this halving cycle." Kiely predicted that Bitcoin may experience a 20% pullback and continue to fluctuate around $60,000.

However, Standard Chartered Bank has raised its year-end price prediction for Bitcoin from $100,000 to $150,000 and expects BTC to reach a peak of $250,000 in 2025, stabilizing at around $200,000.

Standard Chartered Bank has become one of the more Bitcoin-friendly traditional banks, with an active Bitcoin research team. Previously, the bank's analysts predicted that the price of Bitcoin would reach $100,000 by the end of 2024.

The bank's analysis is based on the comparison of the launch of a gold ETF in the US with the price of gold, as well as the correlation between ETF inflows and BTC prices. The report stated: "We believe the analogy with gold—both in terms of ETF impact and optimal portfolio—remains a good starting point for estimating the 'correct' mid-term price level of Bitcoin."

In another report, Standard Chartered Bank stated that the approval of a spot Ethereum ETF is expected on May 23, leading to inflows of up to $45 billion within the first 12 months. By the end of 2024, the price of Ethereum is expected to rise to $8,000.

The report stated: "By 2025, we expect the price ratio of ETH to BTC to return to the 7% level seen for most of 2021-22. Given our estimate of a year-end 2025 BTC price level of $200,000, this implies an ETH price of $14,000."

The pre-halving pullback coincides with the Federal Open Market Committee (FOMC) meeting, which will conclude on March 20. After last week's inflation data exceeded expectations, investors are paying attention to the possibility of a rate cut by the Federal Reserve.

Economists at Goldman Sachs have changed their forecast for Fed rate cuts, now expecting three cuts this year instead of the previously predicted four. The swap market has also reduced its bets on Fed rate cuts, with the probability of a 25 basis point cut in June now at less than 50%.

So far, the price of Bitcoin has continued to be directly affected by macroeconomic events, and further regulatory actions and Fed monetary policy may continue to impact the price of Bitcoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。