Article: Jasper De Maere, Outlier Ventures

Translation: Peng SUN, Foresight News

The battle for crypto users is taking on new forms. We see that as exchanges adopt Web3 wallets, build EVM L2, and adopt the Lightning Network and other existing infrastructure, they are transitioning from closed systems to open systems. We are excited about these developments and believe that they represent the differentiated value proposition of existing open-source Web3 networks. As proven in previous technology cycles, companies entering open-source networks need to have a different playbook. We believe that community and innovation are the keys to success, and these factors will determine the degree of success of exchanges and financial institutions participating in open source.

Open Source

"Open source" is a broad term used in software, simply meaning that anyone can inspect, modify, and enhance the source code. There are different types of open source, such as libraries, networks, and infrastructure. We focus on open-source Web3 networks and infrastructure, such as blockchain and wallet solutions.

Innovation is Key

In this article, we emphasize the importance of innovation in open-source networks. This is a key factor for the long-term success of networks and serves as a mechanism to counterbalance networks that are overly focused on economic value.

Exchanges on the Open Source Path

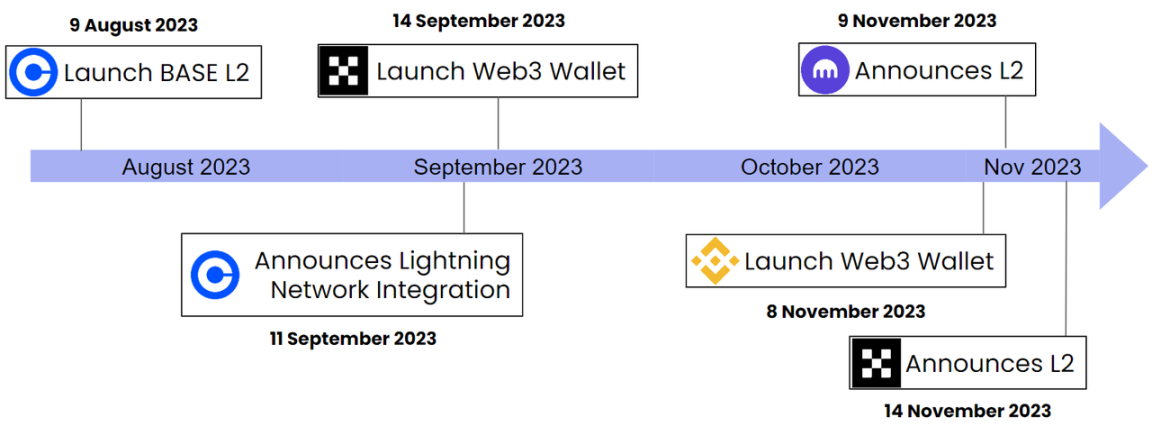

In the past two months, we have seen centralized crypto exchanges make a series of announcements, declaring their transition from closed systems to open systems, including the upcoming launch of Layer2 and Layer3 wallets.

Exchange Announcement Timeline

Convergence

Since 2022, we have seen DEX and CEX converge in functionality, which is evident in the transition from CEX to open-source exchanges. We believe that there are two key driving factors behind the development of CEX:

- Products: People want to develop new and exciting DeFi products that require innovation, such as EVM compatibility, zero-knowledge proofs, and multi-party computation, which can only be achieved through blockchain technology.

- Liquidity: Although CEX liquidity is still far higher than DEX (CEX at $3 trillion per month, while DEX at $310 billion per month), CEX is still seeking to increase DeFi liquidity. Liquidity on CEX is usually concentrated in blue-chip assets such as BTC and ETH. Users will benefit from being able to access the long-tail low-market-cap tokens in DEX liquidity pools, as CEX is increasingly finding it difficult to maintain and manage the liquidity of these tokens.

As CEX continues to embed open-source infrastructure in its products, the boundary between CEX and DEX will become increasingly blurred. We are excited about this development because it indicates that decentralized open-source networks (Web3) not only provide an alternative to centralized solutions for users but also directly impact centralized institutions, leading them towards a more inclusive and efficient ecosystem.

We believe that cryptocurrency exchanges are the first in a multitude of financial services to transition to open-source systems. While we have not yet seen banks or asset management companies adopt open-source systems, we know that they are attempting to use permissioned blockchains and Web2.5 wallets.

Open Source Economic Moat

Many believe that entities (protocols, companies, etc.) cannot capture value in open-source systems. The ability to fork networks or replicate code leads many to believe that entities will be eliminated if they become too commercialized.

They would be right if not for network effects. The economic moats commonly used by Web2 platforms also have some relevance to open-source systems. The difference is that in Web3 open-source networks, users control and participate in the value they create for the network.

Closed networks and open networks generate and maintain network effects in very different ways. The generation of network effects in open-source networks depends on the successful execution of two things:

- Community

"Open-source networks are the accumulation of community efforts"

The existence of open-source networks is inseparable from the community. The Web3 community plays a crucial role in driving the development, acceptance, and adoption of blockchain projects. Traditional enterprises strive to plan internal product development, and the same applies in the open-source field. Exchanges operating in an open-source manner need to make the same effort to prioritize and build their L2 community. A strong community will generate network effects among different users, who will increasingly benefit from the scale and quality of the community.

- Innovation

"Innovation ensures the relevance and competitiveness of open-source networks"

Innovation plays a crucial role in strengthening and expanding network effects. When innovative features, services, or technologies are introduced into the network, more users will participate. Through innovation, the network can maintain relevance, not only attracting existing users but also achieving user growth. Innovation also brings a sense of achievement and progress to the community built on the open-source network.

In conclusion, we believe that exchanges entering the open-source domain with their L2 need to continue to stimulate community interest in their products through innovation and community building.

Web3 Network Effects

We see increasing evidence that Web3 protocols are successfully capturing value. By creating network effects, Web3 protocols are more valuable to each user, which can generate network effects. Users can switch to new applications simply by forking the code, but this is not without cost. Leaving the protocol and its users entails switching costs.

Without affecting community voting, we believe that the recent debate within the Uniswap community regarding its proposal for fee switch is an example of how network effects create an economic moat, even in open-source networks. In short, Uniswap Labs proposed a new plan to introduce a 0.15% transaction fee in its frontend and wallet.

We believe that there are currently no cases of open-source networks excessively pursuing commercial value. But if this trend continues, innovation is the key to balance. Due to network effects, simply forking networks and rebuilding networks using open-source code is not a real solution. We need innovation to create new value propositions and add differentiated practical features for users.

"Neutral" and "Company" Open Source

Exchanges are launching their own L2, attempting to expand their product suite and leverage DeFi liquidity. Now that these L2s supported by centralized institutions are live, we can see two types of L2 with different strategies:

- Neutral L2 - L2 without a pre-existing customer base or support from large centralized institutions

- Company L2 - L2 as an extension of product services for large centralized institutions, expanding into the open-source domain.

The success of these two approaches depends on different strategies, from seamless access for existing users to attracting successful DApps in the L2 ecosystem. While there are subtle differences in strategy, innovation is a priority for both sides. Actively promoting innovation within the open network is crucial to ensuring its long-term success. As we encourage the community to create and innovate, the open system will thrive. We believe that there will be a close correlation between future innovation and the success of different L2s.

Conclusion

At Outlier Ventures, we are excited to discover and confirm the new trend of open-source systems. Certain inefficiencies observed in closed systems will no longer exist in open-source systems. This is why we hope to see CEX's L2 strategy shift towards a focus on innovation and community. We believe that successful innovation and community building will play a more important role in determining the overall success of these institutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。