Standard Chartered lowered its digital asset price forecasts across major cryptocurrencies, signaling further downside before a potential rebound. The banking giant released research on Feb. 12, cutting targets for several crypto tokens — including bitcoin, ethereum, XRP, and solana — reflecting expectations of near-term capitulation across the broader asset class.

“I think we are going to see more pain and a final capitulation period for digital asset prices in the next few months,” Global Head of Digital Assets Research Geoffrey Kendrick stated. “The macro backdrop is unlikely to provide support until we near Warsh taking over at the Fed.” He added:

“On the downside, I think this will see BTC to USD 50,000 or just below, ETH to USD 1,400.”

Kendrick described those levels as potential entry points, noting: “They will be buy levels, for end year forecasts of USD 100,000 ( BTC) and USD 4,000 ( ETH).” He also wrote, “We expect further declines near-term and we lower our forecasts across the asset class.” Expanding on the outlook, Kendrick explained, “Near-term, we see potential for further price downside in the coming months.”

Kevin Warsh’s anticipated arrival follows President Donald Trump’s nomination of him on Jan. 30 to succeed Jerome Powell as Federal Reserve chair, with Warsh expected to assume the role in May pending Senate confirmation. A former Fed governor from 2006 to 2011, Warsh has expressed support for forward-looking economic models over lagging data, indicated that artificial intelligence-driven productivity gains could warrant interest rate cuts, and promoted a leaner central bank balance sheet alongside broader institutional restructuring.

He further detailed: “We think ETF holders are more likely to sell, rather than buy the dip, for now. We therefore see potential for bitcoin to fall to (or just below) a low of USD 50,000 over the next few months. This would still be smaller than previous sell-offs. We would expect a BTC low of USD 50,000 to see ethereum ( ETH) bottom out at around USD 1,400.”

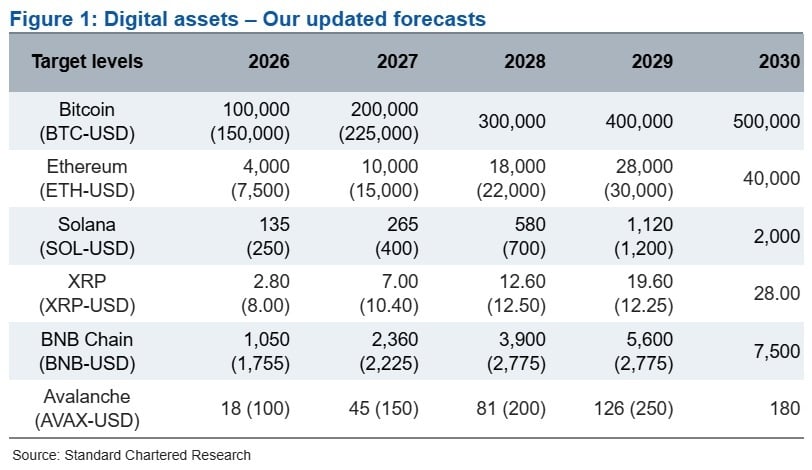

The revised projections show broad downward adjustments across major tokens compared with prior estimates. For 2026, bitcoin was reduced to $100,000 from $150,000 previously, ethereum to $4,000 from $7,500, XRP to $2.80 from $8.00, and solana to $135 from $250. In 2027, bitcoin was lowered to $200K from $225K, ether to $10K from $15K. XRP is forecast to be at $7 from $10.40, and solana to $265 from $400. Ethereum’s 2028 forecast was trimmed to $18K from $22K and its 2029 projection to $28K from $30K, while bitcoin’s 2028 and 2029 targets remain unchanged at $300K and $400K. Long-term 2030 forecasts were maintained at $500K for bitcoin, $40K for ethereum, $28 for XRP, and $2K for solana, underscoring a constructive multi-year outlook despite near-term reductions.

Kendrick stated:

“Once the lows have been reached, we expect the asset class to recover for the rest of 2026. This takes our year-end BTC forecast to USD 100,000 (from USD 150,000 previously) and our ETH forecast to USD 4,000 (from USD 7,500).”

He added, “Other digital assets are likely to broadly follow the majors; we adjust our forecasts for them accordingly.”

- What is Standard Chartered’s new bitcoin price forecast?

Standard Chartered lowered its year-end bitcoin forecast to $100,000, with a potential near-term drop to around $50,000. - How low could ethereum fall according to the revised outlook?

The bank sees ethereum potentially bottoming near $1,400 before recovering later in the year. - Why does Geoffrey Kendrick expect further digital asset downside?

Kendrick cited macro weakness and potential ETF selling pressure as drivers of additional near-term declines. - What are Standard Chartered’s long-term bitcoin and ethereum targets for 2030?

The bank maintained its 2030 projections of $500,000 for bitcoin and $40,000 for ethereum.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。