Analysts have referred to Trend Research's liquidation as "the largest level of surrender signal."

Written by: Kamina Bashir

Translated by: Chopper, Foresight News

The investment firm Trend Research, led by Jack Yi, founder of Yodel Capital, has liquidated all of its Ethereum holdings, reportedly incurring a total loss of nearly $750 million.

This large-scale sell-off occurred as Ethereum continued to weaken, with the token dropping over 30% in the past month. Its price performance has once again sparked market discussions about whether Ethereum has reached its bottom.

Trend Research Sells Ethereum Amid Market Volatility

BeInCrypto previously reported that Trend Research began transferring Ethereum to Binance earlier this month. On-chain analysis platform Lookonchain confirmed that the firm completed the sell-off yesterday.

Trend Research transferred a total of 651,757 ETH (approximately $1.34 billion) to Binance, with an average selling price of $2,055. After the transaction, the firm's ETH holdings were reduced to just 0.0344 ETH, worth about $72.

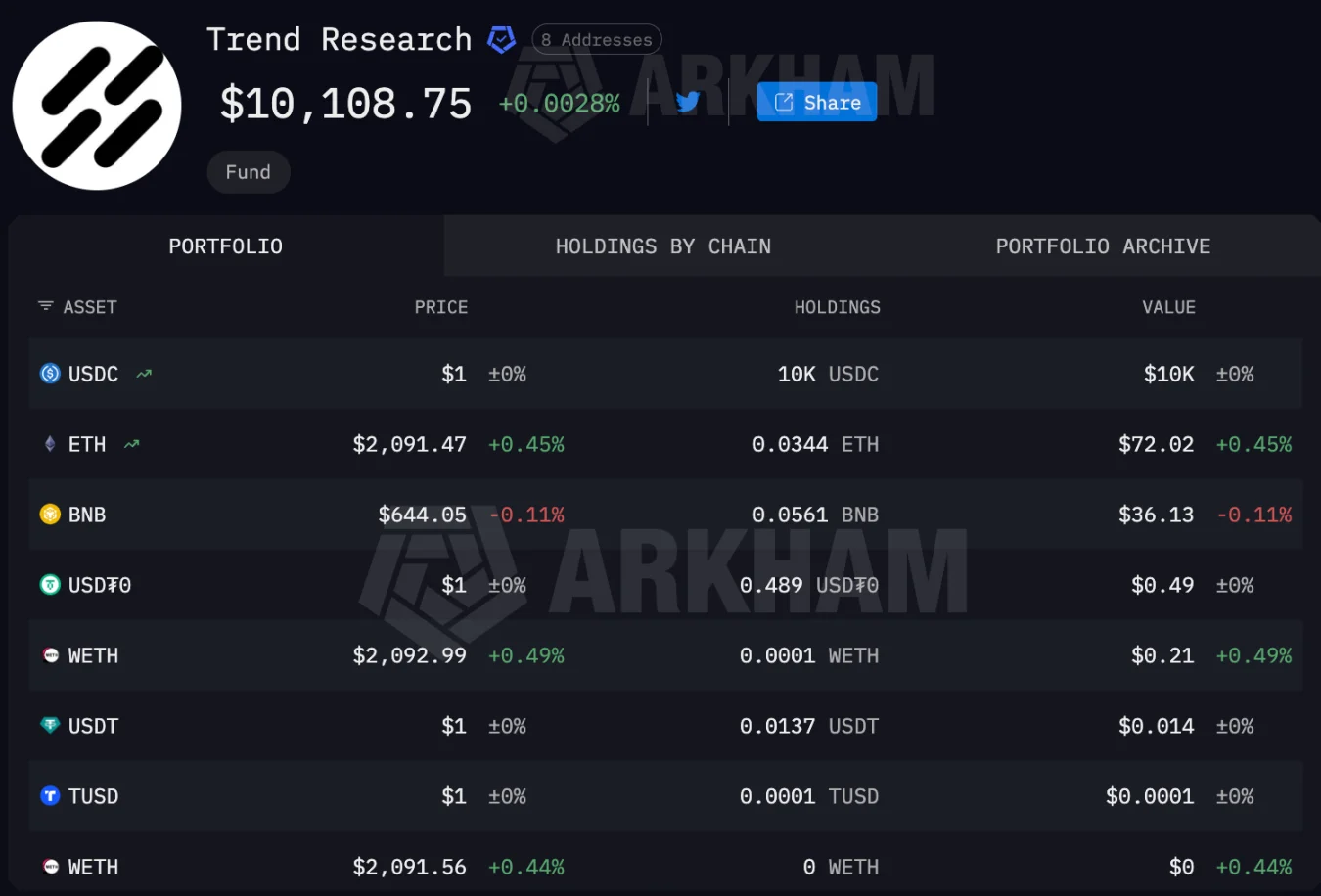

Data from Arkham Intelligence also corroborated its near-liquidation status, with the account holding only about $10,000 in USDC and a small amount of other tokens.

Lookonchain stated, "Total losses amount to approximately $747 million."

This liquidation stemmed from a leveraged strategy built on the DeFi lending protocol Aave. Analysts explained that Trend Research initially bought ETH on a centralized exchange and used it as collateral deposited in Aave.

Subsequently, the firm borrowed stablecoins against the collateral and repeatedly used the borrowed funds to buy more ETH, creating a cyclical leveraged position that significantly amplified exposure and liquidation risk.

As ETH prices continued to decline, its positions approached the liquidation line. To avoid a margin call, Trend Research chose to proactively liquidate all positions.

In stark contrast to Trend Research's sell-off, BitMine adopted the opposite strategy. Despite ongoing losses, the firm continued to increase its holdings, recently spending $42 million to buy Ethereum.

What Does Hitting Bottom Mean for BitMine and Trend Research?

These two completely opposite strategies emerged amid heightened volatility in the Ethereum market. BeInCrypto Markets data shows that the world's second-largest cryptocurrency has dropped 32.4% in the past month.

On February 5, ETH briefly fell below $2,000 before rebounding slightly. As of the time of writing, Ethereum is priced at $2,094.16, up about 0.98% in the last 24 hours.

During this downturn, some analysts believe that Ethereum may be nearing a market bottom. Some analysts have referred to Trend Research's liquidation as "the largest level of surrender signal."

Axel stated, "Such forced exits often occur near significant lows."

Joao Wedson, founder of Alphactal, also pointed out that Ethereum's price bottom typically appears a few months earlier than Bitcoin's, due to the faster liquidity cycles of altcoins.

Wedson noted that some chart indicators suggest that the second quarter of 2026 could be a potential bottom for Ethereum.

"Some charts have indicated that the second quarter of 2026 may be a potential price bottom for Ethereum. Surrender-style sell-offs have occurred, and realized losses are set to soar," Wedson added.

Although the bottom has yet to be confirmed, this possibility could have widespread implications for institutional sentiment; some institutions are choosing to reduce risk, while others continue to accumulate in a weak market.

If Ethereum is indeed close to a bottom, BitMine's continued accumulation could represent a precise bottom-fishing strategy, potentially benefiting from future rebounds.

However, if downward pressure persists, Trend Research's decision to completely liquidate may ultimately be seen as a prudent move to avoid the risks associated with leveraged strategies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。