Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The Japanese market is buoyed by the historic victory of Kishi Nobumasa in the elections, with expectations that he will implement expansionary fiscal policies, leading to a resurgence of the so-called "Kishi trade." The Nikkei 225 index surged over 5% during the session, surpassing 57,000 points for the first time, setting a new historical high, while the South Korean KOSPI index also rose by 4.1%. However, the expectations of fiscal stimulus have put pressure on the bond market, with yields on 10-year and 30-year Japanese government bonds rising across the board, and the yen, after a brief strengthening, faces intervention risks.

Turning to the United States, although the S&P 500 index rebounded by 2% last Friday, Goldman Sachs' trading team warned that the selling pressure led by trend-following algorithm funds (CTA) remains, and if the S&P 500 index falls below 6,707 points, it could trigger up to $80 billion in systemic selling within a month. Coupled with weakened liquidity and a negative gamma pattern in the options market, market volatility may intensify. Bank of America strategist Michael Hartnett's "Bull-Bear Indicator" has also surged to a sell signal of 9.6, suggesting "buy Main Street, sell Wall Street," meaning funds should withdraw from tech giants and cryptocurrencies and shift towards small-cap stocks and international markets that benefit from the recovery of the real economy. He also warned that the massive capital expenditures of tech giants are fundamentally changing their business models, and the global market may be entering a rebalancing era that ends the "American exceptionalism." Meanwhile, U.S. Treasury yields continue to rise, with the 10-year yield climbing to 4.242%.

In the commodities sector, JPMorgan analyst Jason Hunter pointed out that major metals like gold, silver, and copper will enter a "consolidation period" after experiencing a frenzied rise, but he believes this is a necessary rest in a long-term bull market. He predicts that copper, supported by the global manufacturing cycle, will rebound ahead of gold in the second quarter, while oil is expected to fluctuate in the $60-70 range. Specifically, spot gold, after returning to the $5,000 mark, faces resistance in the $5,100-5,150 range, with key support at $4,264-4,381; while spot silver, despite price fluctuations, continues to see retail investors pouring money into silver ETFs, with the Guotou Silver LOF opening its trading limit after five consecutive days of decline and surging over 7.8%, with a premium rate still as high as 34.14%.

Bitcoin has rebounded after a historic plunge, with prices rising above $70,000, but there is significant disagreement in the market regarding the sustainability of this rebound. Most analysts believe this is primarily a relief rally driven by short covering rather than new bullish demand. Various theories circulate regarding the reasons for the plunge: one is that some Hong Kong hedge funds faced liquidation due to leveraged long bets using cheap yen; another is that former BitMEX CEO Arthur Hayes pointed out that large banks like Morgan Stanley were forced to sell due to hedging structured notes linked to Bitcoin ETFs, creating a "negative gamma" effect that accelerated the decline; and a third is that some miners are shifting to AI data center businesses for higher profits, leading to a decrease in hash power.

On the bullish side, Tom Lee firmly believes that the crypto market recovery has begun and can recover quickly; Ardi stated that Bitcoin has completed the inflow at $72,000, and it now needs to maintain the $70,000 support level to push prices into the $76,000 range; Michaël van de Poppe noted that the weekly chart shows a surrender candle has appeared, with $65,000-$70,000 being the bottom area, and it is expected to test $85,000 in the future. Additionally, there remains a CME futures gap at $84,000 that attracts bullish attention. Mel Mattison even predicts a historical high this summer. On the institutional side, despite market turbulence, Bitmine Chairman Tom Lee and MicroStrategy both stated they have never reduced their positions, and Huobi co-founder Du Jun confirmed that Li Lin has not reduced his BTC holdings, with his family office Avenir Group still being the largest holder of BlackRock's IBIT in Asia. Binance today increased its SAFU fund holdings by 4,225 Bitcoins, bringing its total holdings to 10,455 BTC.

However, the voices of bears and cautious investors remain loud. Trader Astronomer plans to open short positions again after Bitcoin reaches $72,000, while Doctor Profit analyzes that Bitcoin will range between $57,000 and $87,000 before potentially falling to the $44,000-$50,000 area; Filbfilb and Tony Severino compare it to the 2022 bear market, believing that the final surrender has not yet occurred, with BitBull bluntly stating that the "real bottom" will be below $50,000; Keith Alan emphasizes that this is merely a relief rally, and capital preservation is paramount; trader Eugene also stresses the need for strict stop-loss measures in a bear market, prioritizing survival.

The Ethereum market has also experienced turmoil, with Yili Hua being forced to "liquidate" about 400,000 Ethereum within a week due to leverage pressure, incurring losses of up to $700 million, with his fund's holdings plummeting from a peak of 651,000 ETH to 20,000 ETH. Despite the severe setback, Ethereum's price has rebounded above $2,000. There are also differing views on Ethereum's future. Analyst Poseidon believes that Ethereum's five-year consolidation period (oscillating between $2,000 and $4,000) is a significant accumulation phase, similar to the state of gold and silver before historical breakthroughs, and once it breaks above $4,000 and stabilizes, it will usher in the most intense expansion in history. Technical indicators also provide some positive signals, with analyst BigBullMike7335 noting that its 3D RSI indicator has entered the oversold zone, a signal that has historically indicated market bottoms; Ali Charts also stated that Ethereum's price breaking below the $1,959 0.80 pricing band is also a marker of past market bottoms. However, there are still bearish voices in the short term, such as analyst Crypto Tony, who is looking for opportunities for prices to further dip into the $2,000-$2,050 range.

In the altcoin market, Solana has technically held the key support at $61.64, with analyst Man of Bitcoin believing it still has the potential to push up to the resistance range of $141 to $215 in the fifth wave. Despite the overall market facing liquidity pressure, some narrative-driven sectors are still seeking opportunities for independent trends.

2. Key Data (as of February 9, 13:00 HKT)

(Data source: CoinAnk, Upbit, SoSoValue, CoinMarketCap)

Bitcoin: $70,820 (Year-to-date -19.2%), daily spot trading volume $46.36 billion

Ethereum: $2,081 (Year-to-date -29.8%), daily spot trading volume $21.24 billion

Fear and Greed Index: 14 (Extreme Fear)

Average GAS: BTC: 10.06 sat/vB, ETH: 0.35 Gwei

Market share: BTC 58.9%, ETH 10.5%

Upbit 24-hour trading volume ranking: XRP, BTC, ETH, AXS, SOL

24-hour BTC long-short ratio: 51.58% / 48.42%

Sector performance: The crypto market maintains a downward trend, with the Meme sector leading the decline by over 5%

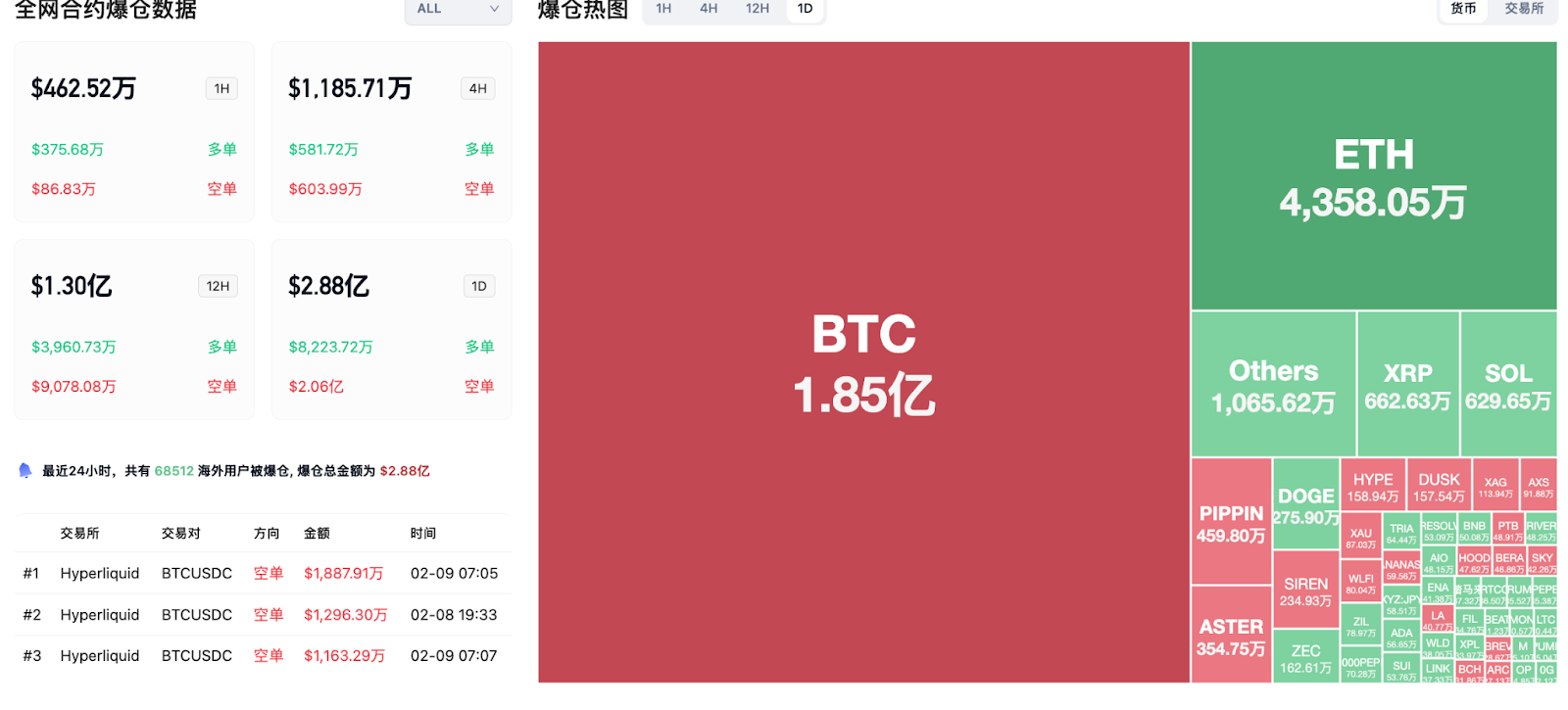

24-hour liquidation data: A total of 65,512 people were liquidated globally, with a total liquidation amount of $288 million, including $185 million in BTC liquidations, $43.58 million in ETH liquidations, and $4.59 million in PIPPIN liquidations.

3. ETF Flows (as of February 6)

Bitcoin ETF: Net outflow of $318 million last week, marking three consecutive weeks of net outflows

Ethereum ETF: Net outflow of $166 million last week, marking three consecutive weeks of net outflows

XRP ETF: Net inflow of $39.04 million last week

SOL ETF: Net outflow of $8.9204 million last week

4. Today's Outlook

CME plans to launch 100-ounce silver futures contracts on February 9

Robinhood will release its full-year performance report for 2025 on February 10

Binance will delist RVVUSDT and YALAUSDT perpetual contracts on February 10

Shanghai Gold Exchange, Shanghai Futures Exchange, Zhengzhou Commodity Exchange: Adjusting margin ratios for trading futures contracts of gold, silver, and copper (February 9)

Iran situation: Trump states that the U.S. will negotiate with Iran again (event of the week)

The largest gainers among the top 100 cryptocurrencies today: Maker up 30.7%, World Liberty Financial up 12%, Stable up 9.5%, Decred up 9.3%, Aster up 6.2%.

5. Hot News

Trend Research sold 658,000 ETH in 8 days, incurring a loss of $688 million

Bitcoin's Sharpe ratio has fallen to -10, nearing the lows of the 2018 and 2022 bear markets

Jack Dorsey's Bitcoin payment company Block plans to lay off 10% of its workforce

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。