A $100,000 bet, with an absent opponent.

Author: David, Deep Tide TechFlow

There aren't many projects worth mentioning in this round of decline, but Hyperliquid is one of them.

$HYPE has nearly doubled since its low in January. Regardless of how you view this project, the market is voting. However, Kyle Samani, the former co-founder of Multicoin, voted against it.

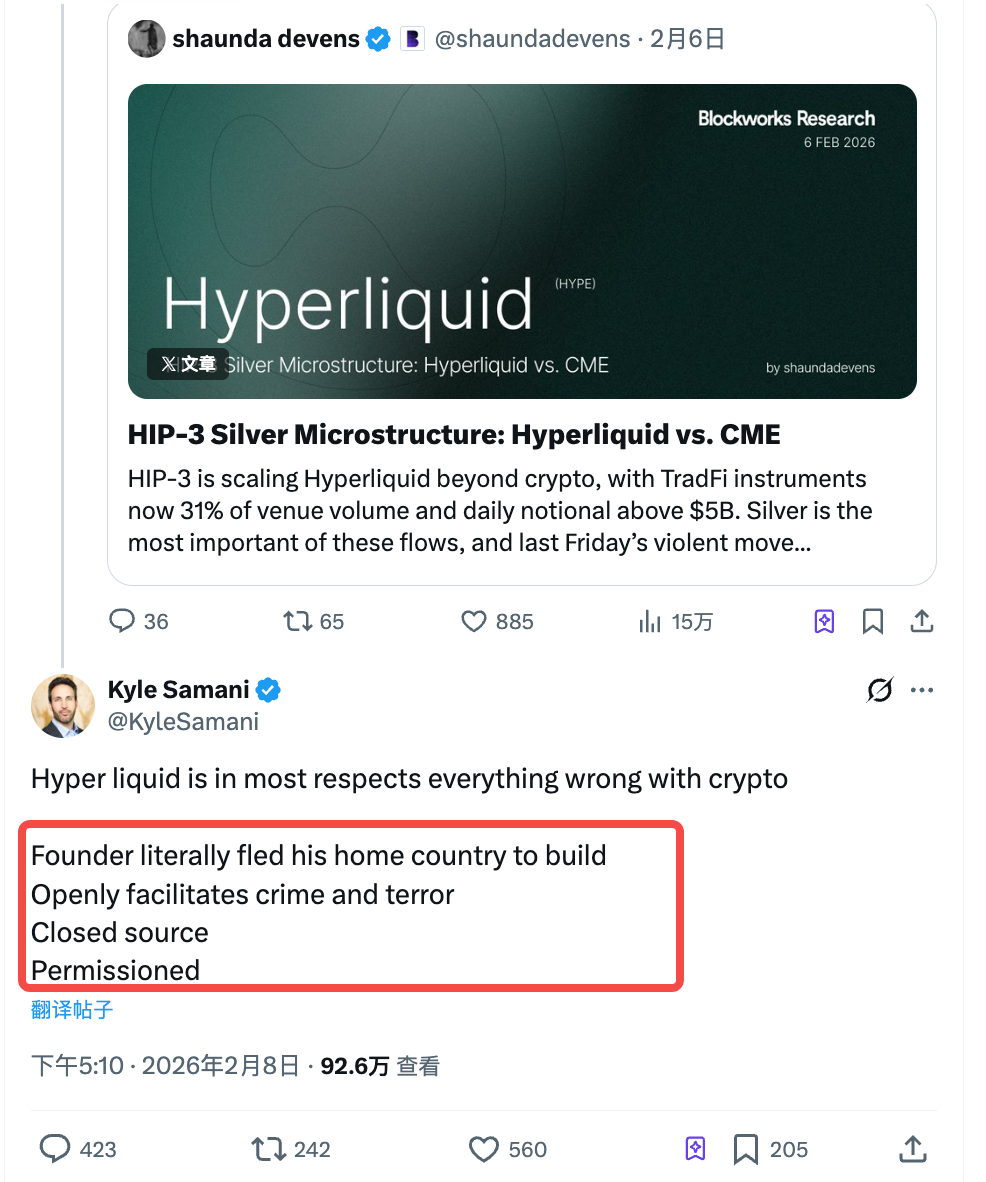

On February 8, Blockworks Research published a report stating that Hyperliquid's silver contracts have begun to compete directly with traditional futures exchanges like CME in terms of price spreads and execution.

Many in the community shared this, believing it to be a signal that on-chain finance is truly starting to encroach on traditional finance's territory.

But Kyle poured cold water on it.

He believes that Hyperliquid represents classic issues in the crypto industry in almost every aspect:

- The founder fled his homeland to build this project

- The platform openly facilitates crime and terrorism

- The code is closed source

- The product operates with permissions, not fully open

This statement, if placed earlier, would be a common occurrence in crypto CT where projects criticize each other.

But don't forget, four days ago, Kyle just announced his departure from Multicoin Capital (Reference: Kyle left the crypto industry, and I'm a bit sad), and before the departure announcement, he tweeted something that he later deleted:

"Cryptocurrency isn't as interesting as many (including myself) once imagined."

And old acquaintance Arthur Hayes clearly disagreed with this assessment, directly expressing his confidence in HYPE after Kyle's comments:

"Since you think HYPE is so bad, let's make a bet. From February 10 to July 31, if HYPE outperforms any coin with a market cap over $1 billion that you choose, the loser donates $100,000 to a charity chosen by the other. You pick the coin, I just bet on HYPE winning."

Critique, Leaving the Table

As of the time of writing, Kyle has not accepted Arthur's bet and likely will not.

A person who just said "crypto isn't that interesting anymore" is unlikely to sit back at the table and compete over whose coin rises more.

However, Kyle's accusations about Hyperliquid are worth discussing.

For instance, "the founder fled his homeland." Hyperliquid's founder, Jeff Yan, grew up in Palo Alto, California, graduated from Harvard, and previously worked in quantitative trading at Hudson River Trading.

The team is based in Singapore, the company is registered in the Cayman Islands, and the platform blocks U.S. users.

This structure is standard operating procedure for offshore compliance, used by everyone from Binance to dYdX. Kyle has been in this industry for nearly ten years, so he cannot be unaware that this is a common practice.

Calling it "fleeing the homeland" seems somewhat deliberate for an American who grew up in Palo Alto.

The points about closed source, permissioned access, and facilitating crime are not without merit, but in the past, Kyle might not have publicly voiced such criticisms. When he was at Multicoin, his job was to find projects, invest in them, and promote them; these gray areas are costs that everyone in the industry tacitly accepts.

The change is that Kyle is no longer in that position.

What a person sees after leaving the table is different from what they see while sitting at it.

Pump, No Need for Words

On the other hand, you notice that Arthur Hayes did not refute any of Kyle's accusations, did not defend Hyperliquid's closed source, nor did he explain why Jeff Yan moved to Singapore.

His response is simply a price bet.

This is a familiar logic in the crypto space: a pump means a good product. Choosing to respond with price is because, for those still working full-time in this industry, price is the only meaningful language.

You say Hyperliquid has moral flaws, he says HYPE will outperform any large-cap altcoin in five months.

These two statements may seem to be discussing the same thing, but they are not on the same plane at all.

Kyle is talking about "should it or shouldn't it," while Hayes is talking about "will it or won't it."

This kind of talking past each other happens in every cycle in crypto. Every time the market reaches a mid-to-late stage or enters a bear market, there are always people who start to stand up and say there are problems in the industry, while those who remain at the table always respond with the same line:

"Just look at the price."

The price is the most handy weapon for those still in the game, because as long as it is still rising, all criticisms can be temporarily set aside.

The problem is, Kyle may no longer be a player in the game. A co-founder of a fund publicly expressing disillusionment with the entire industry before officially leaving is not very appropriate in any circle.

The post was deleted, but the thoughts cannot be erased.

Now, his bombardment of Hyperliquid carries a tone that seems to leave no room for doubt; it feels less like criticism of a project and more like a severing from certain aspects of his past eight years.

However, while he can sever his personal ties, Multicoin itself is still in the game.

Starting November 22 of this year, on-chain analysts discovered that wallets suspected to be associated with Multicoin deposited about 87,000 ETH into Galaxy Digital, and the next day began to make 17 purchases of HYPE, totaling about $46 million.

In other words, just before and after Kyle left Multicoin, his former fund was making significant investments in the project he just criticized.

The 17 purchases likely indicate that someone within Multicoin made a judgment and a decision.

Kyle believes Hyperliquid represents all the problems in the crypto industry, but at least someone within Multicoin thinks it is worth voting with real money; holding it is itself a stance.

Kyle has left, but perhaps his old employer's money has sat down. And it has sat down at the very table that Kyle looks down upon the most.

Beyond the confrontation between Arthur and Kyle, the reactions in the comments section are also quite interesting.

A user in the Hyperliquid community named Max dug up an old post he made in September 2024. The background of that post was that there were already people questioning Multicoin's operations in the circle, and Max had criticized Kyle at the time, implying:

"You are always trying to use LP's money to chase the beta returns of your heavily invested assets, while conveniently boosting your own portfolio."

A year and a half later, Kyle is now criticizing Hyperliquid, and Max believes that this pattern hasn't changed:

Kyle is still the same Kyle, always wearing his own position filter when criticizing others. He defended Solana back then, and now he criticizes Hyperliquid; the root lies in Multicoin's ecological interests and competitive anxiety.

After seeing this, Kyle couldn't help but reply with a classic crypto phrase: "The money I directly invested in crypto is at least ten times your lifetime total."

And Max's sharp retort hit the nail on the head: "Last September, your assets might have been 30 times mine…"

From September 2025 to February 2026, the market experienced several ups and downs, and the crypto assets that Kyle previously represented at Multicoin clearly shrank significantly; meanwhile, Hyperliquid has relatively stood firm.

Positions are always tied to stances.

When a project begins to threaten the traffic and valuation of an existing ecosystem, criticisms are often quickly labeled as "conflict of interest"; conversely, defenders will counter with "you're just jealous."

In this wave, Kyle attempted to launch an attack on Hyperliquid from the heights of morality and decentralization purity, but was easily pulled back by his opponent to the jungle law of "whoever makes money is right."

Ultimately, rational discussion drowned in tribal revelry, leaving only screenshots and jokes.

Every cycle is like this. Some sit down, some stand up. Those who sit down talk about price, while those who stand up talk about morality.

But whether it is disappointment with the industry that leads to seeing problems, or seeing problems that leads to disappointment with the industry, this order is actually hard to clarify.

Regardless of whether HYPE rises or falls in five months, Kyle probably won't care anymore. He is already looking at other things.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。