Finding the Next King of Arbitrage

Written by: Zuo Ye

In 2017, Binance quickly became the world's number one through regulatory arbitrage, but by 2025, the more liberated Hyperliquid can only capture 15% of Binance's market share. Is there any room for regulatory arbitrage and a scalable future for RWA as a source of underlying assets in DeFi?

Compliance will become the main theme of 2026, as Binance officially establishes itself in the UAE ADGM, while Coinbase secures both the Genius Act and the Clarity Act, and even major Eastern countries are "principally" testing RWA regulations.

We are at a clear turning point; blockchain will not replace the internet, and Web3 is merely a self-deceiving scam. The effect of listing coins has ended with Binance's acquisition of Bitcoin, but Hyperliquid is making strides in precious metals and prediction markets, while RWA represented by coins (stablecoins), stocks (U.S. stocks), bonds (U.S. Treasuries, subprime bonds), and bases (hedging, active) is timely for on-chain integration.

In this context, compliance transcends the simple ritual of "holding small country cards to extract benefits from large countries" and evolves into a real framework of separated trading, clearing, and custody. When the industry breaks through scale limitations, regulatory benefits will become profitable.

In silence, compliance not only signifies the end of the previous frenzy era but also heralds the existence of arbitrage opportunities for development and scaling in various tracks.

Let’s start with exchanges to glimpse the economic considerations beyond compliance.

Civilized Wall Street, Savage Barbarians

The savage conquerors, according to an eternal historical law, are themselves conquered by the higher civilization of the subjects they have subdued.

In 2022, FTX dramatically collapsed, and Wall Street had once harbored thoughts of occupying the exchange track. Castle Securities, Fidelity, and Charles Schwab collaborated to launch EDX Markets in Singapore, operating under the principle of separated trading and custody within the Singapore MAS compliance framework.

As Gary Gensler's SEC relentlessly pursued Binance, Coinbase and Kraken could only shrink back into the U.S. spot market, unable to venture into high-end markets like contracts and options. At that time, the market had high hopes for EDX Markets.

Barring any surprises, we should witness the fall of Binance, akin to BitMEX after March 12, 2020, but history never repeats itself. Hyperliquid is the true winner, while the deteriorating Binance and the retreating Coinbase in the U.S. market are not the protagonists of the next act.

To understand the experiences of the successful, one must grasp the lessons of the failures.

After its establishment in 2017, Binance at least did two things right:

- While actively embracing overseas expansion, it continued to accept users from mainland China, balancing trading volume and user scale like a seesaw;

- In 2019, it launched IEO (Initial Exchange Offering), creating a real wealth effect before DeFi Summer.

After the September 4 ban, providing trading services to users in mainland China fell into a "gray area." The third regulation directly targeting trading platforms required them not to provide quoting, matching, and clearing services. If we refer to He Yi's response to Cathie Wood, Binance would respond with "not providing services to users in mainland China."

From 2017 to 2019, Binance firmly held the title of the world's leading offshore exchange. From 2020 to 2022, Binance filled the contract market gap left by BitMEX. From 2022 to 2024, Binance dominated the global altcoin market, with the effect of listing coins equating to the effect of Binance itself.

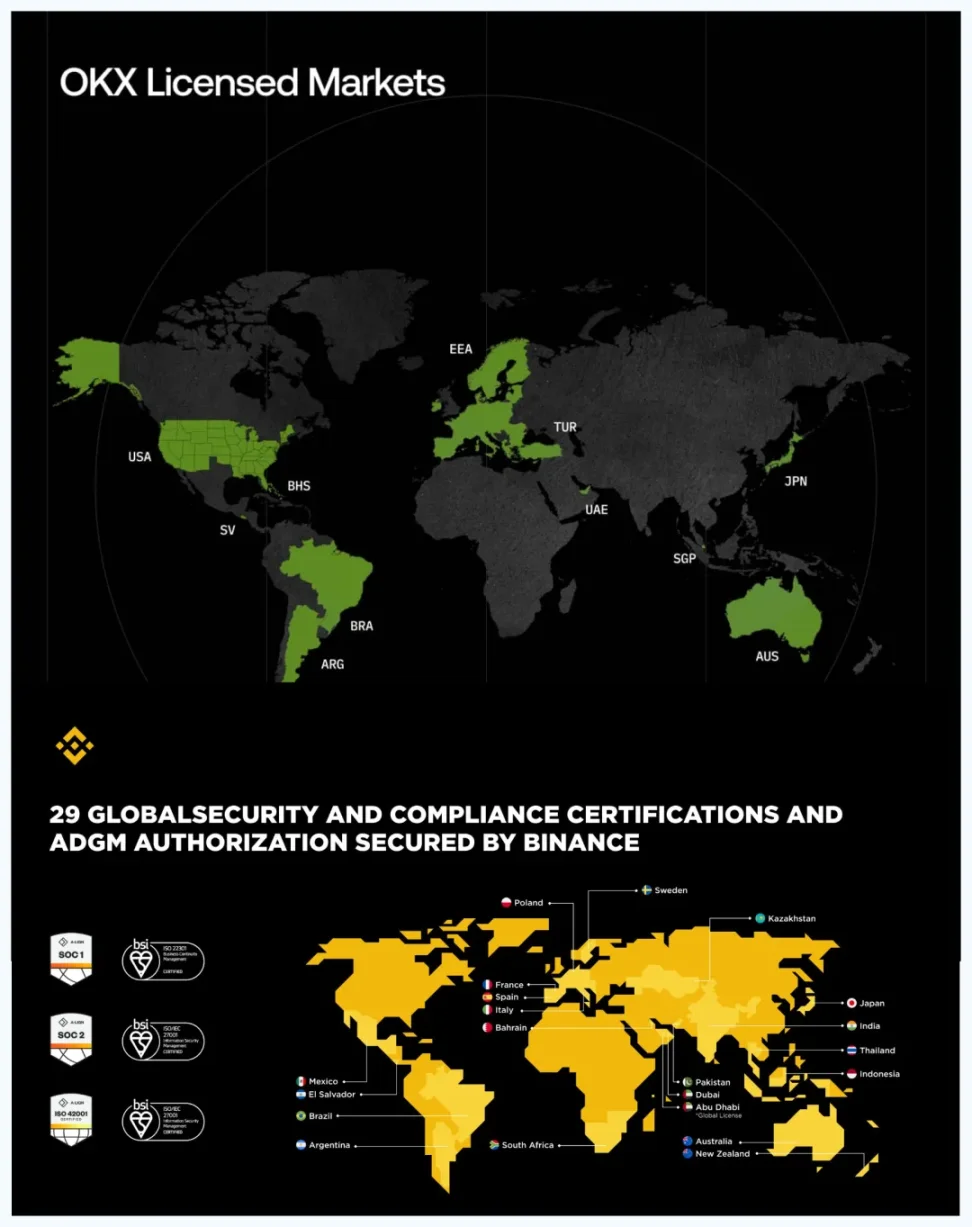

Entering 2025, Binance officially adopts the compliance framework of Abu Dhabi ADGM in the UAE, dividing itself into three entities: trading, clearing, and over-the-counter, while still retaining Binance's unique arbitrage characteristics.

Notably, compliance did not prevent Binance from listing meme coins, and the ADGM and the entire UAE financial system fundamentally lack the capacity to regulate such a behemoth as Binance, similar to the Bahamas' impotence against FTX's global operations.

Image caption: "Only by taking the civil service exam can one go ashore," image source: @binance @okx

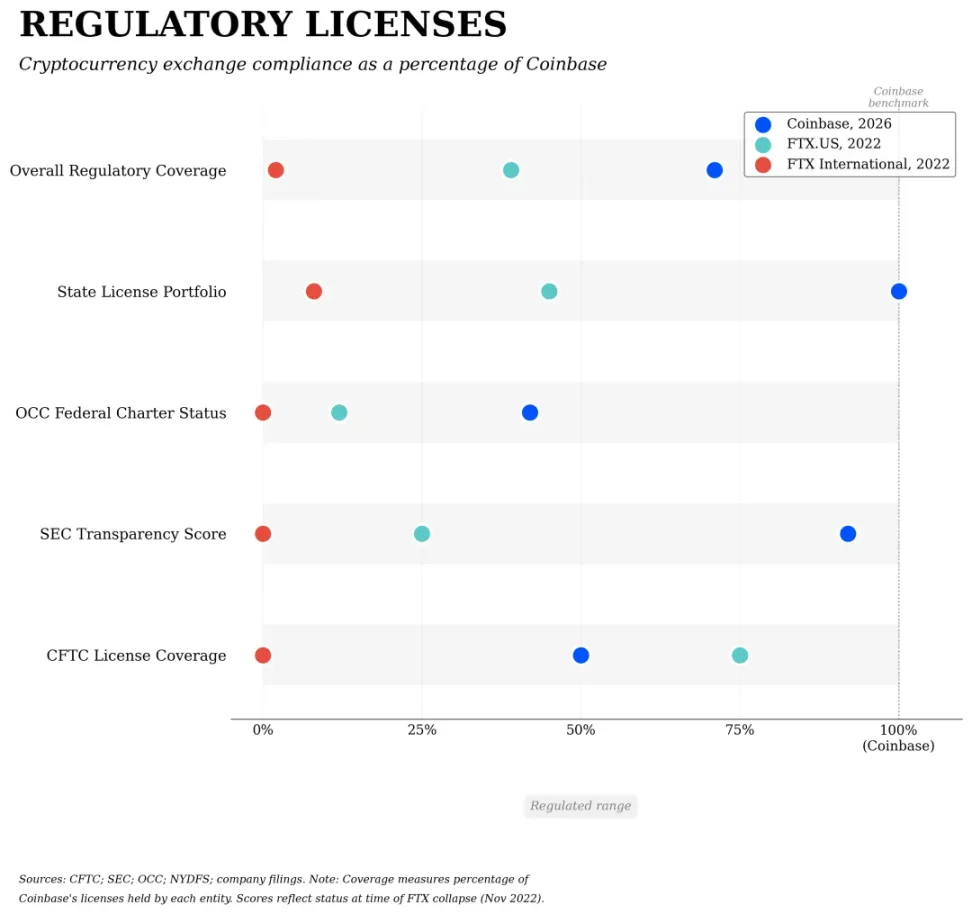

Coinbase, being the most compliant after the FTX collapse, owes this compliance to the continuous reforms of the SEC, CFTC, and OCC since Trump's administration, which demanded more crypto-friendly regulatory measures.

Generally, the SEC is responsible for reviewing whether a token meets the definition of a security, the CFTC oversees derivatives trading, and the OCC manages bank licenses for custody operations. The U.S. does not have a "crypto exchange license" similar to the ADGM; it only has regulatory scopes divided by business type.

Image caption: Regulatory progress, image source: @zuoyeweb3

The construction of this regulatory framework is still ongoing, but it is certain that Coinbase will shape the U.S. compliance framework, covering aspects such as listing (spot, contracts), trading (spot, contracts), custody (retail, institutional), clearing/settlement (fiat, crypto), auditing (technology, assets)/insurance (fiat, crypto).

The licensing of Binance under the ADGM is entirely different from Coinbase's licensing in the U.S., as the latter's license will actually fall under the management of regulatory authorities.

Regulation is about clarifying rules, not protecting retail investors' interests. For instance, institutional clients in Coinbase's custody services enjoy bankruptcy isolation protection, with the corresponding entity being Coinbase Custody Trust Company.

However, the funds deposited by ordinary retail investors in Coinbase correspond to Coinbase Inc. If it is fiat, it may even be protected by the corresponding bank's FDIC deposit insurance, but crypto assets are likely to face the same fate as FTX.

For example, FTX token FTT purchasers were deemed equity owners and were not strictly protected in claims. Coinbase is similar; the only good news is that Coinbase has not faced a bank run crisis.

Hyperliquid "Unlicensed" Entry into the RWA Field

Human progress will no longer resemble terrifying pagan monsters, where one must drink sweet wine from the skulls of the slain.

Regulatory arbitrage still exists. In the field of crypto asset trading, EDX's American counterpart Hyperliquid has also started in Singapore, encroaching on Binance's global market and Coinbase's U.S. market.

This can be termed "second-order arbitrage," where Binance extracts benefits from global regulation, and Hyperliquid extracts benefits from Binance.

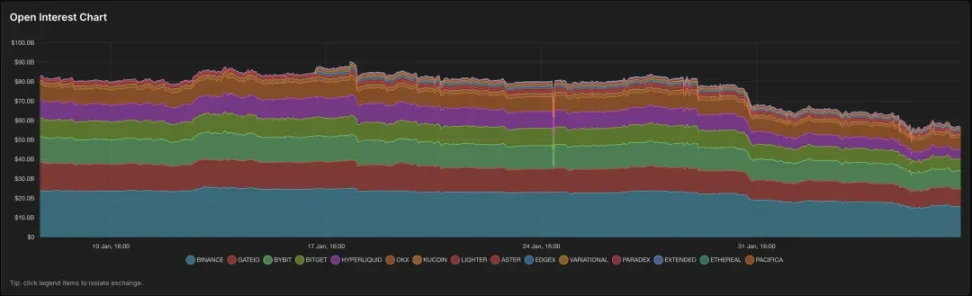

Image caption: CEX and DEX are hard to distinguish, image source: @LorisTools

Hyperliquid has banned U.S. IP addresses, but this ban has no practical effect. Comparatively, U.S. users can hardly open accounts on Binance's global site and can only use Binance's U.S. site.

Coinbase initially allowed contract services for U.S. users, but its business volume was negligible. Thus, in a peculiar space, Hyperliquid has captured some European and American users outside of Binance and Coinbase, engaging in derivatives business.

However, it is important to note that Hyperliquid's arbitrage cannot replicate Binance's growth miracle, nor can it learn from Coinbase's dominance in the U.S. compliance market; it can only capture about 15% of Binance's market share.

As Hyperliquid makes strides in non-traditional businesses like precious metals and prediction markets, its impact on the global financial market is gradually strengthening. If the U.S. can regulate Binance and Tornado Cash, actions against Hyperliquid will likely not encounter resistance from Singapore.

Ultimately, most "underground economy" models cannot enter scalable fields. Take USDT as an example; its issuance reserves and circulation restrictions are becoming increasingly stringent. The attacks on Bybit hackers who released USDT and the freezing of black U funds after the Huiwang incident are clear evidence.

- Huiwang can support the entire underground economy of Cambodia and even Southeast Asia, but Cambodia cannot afford the cost of being placed on the FATF's "gray list" for money laundering.

- Binance can support an economy dominated by altcoins on the BNB chain, but the squeezing effect between China and the U.S. prevents Binance from accessing higher-quality trading assets.

This essentially reflects the low regulatory cost advantage that the U.S. possesses. The core of U.S. economic sanctions is not the dollar or the U.S. military; the U.S. is the largest single consumer market and the primary financial market globally. Once Cambodia and Binance are cut off from the U.S., the outcome will be akin to North Korea.

Thus, Binance pays a high price to comply, and Hyperliquid's compliance is merely a matter of time.

This leads to an extended question: Can RWA replicate the trajectory of the crypto asset trading track, retaining its essence in regulatory arbitrage while developing its business volume within a compliance framework?

This is based on the premise that Hyperliquid is almost impossible to surpass Binance in the crypto asset trading field and is unlikely to exceed Coinbase in terms of compliance.

If we look back to 2017, CZ himself might not have believed that CEX was the future. Looking forward, postal currency cards, P2P, O2O, and ofo are all fleeting trends. Looking back, DeFi mining, NFTs, GameFi, and SocialFi have all ended without a trace.

Thus, both Binance and BNB should be understood as project-based, with their halo continuously extended by the wealth effect, which should have ended hastily, like one financial bubble after another.

However, under the network effect, the trading network effect breaks free from the constraints of crypto assets and enters all financial fields, thus intersecting with the broadly defined RWA. Stablecoins' yield impacts CBDCs, and asset-based securitization will eventually lead to tokenization.

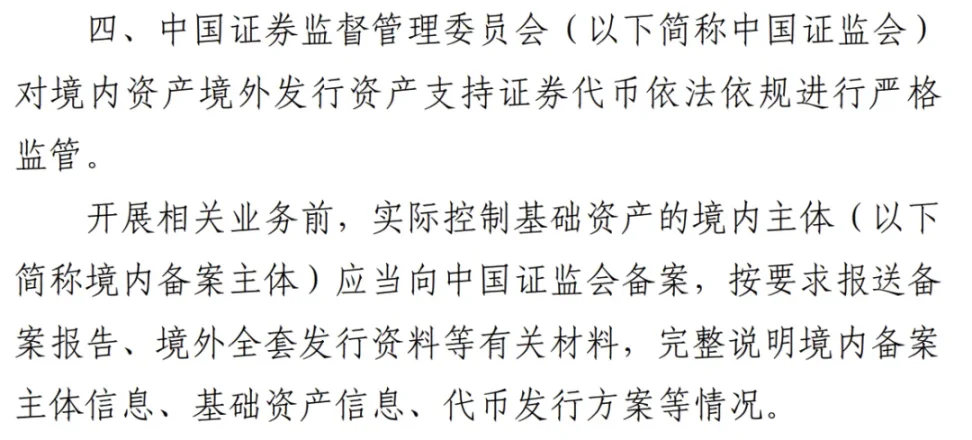

For instance, the recent regulatory guidelines from the University of Tokyo essentially represent the spillover of U.S. impacts in the financial sector, which will rewrite on-chain finance in peculiar ways.

Image caption: Flowers bloom inside the wall, fragrance wafts outside.

Regarding the new regulatory measures from the University of Tokyo, Caixin's interpretation categorizes them into four types: external debt, equity, asset securitization, and others. However, in my view, the only meaningful aspect is the angle of securities tokenization, aligning with the reform direction of "securitizing all assets," which includes:

- Clearly defining the regulatory authority as the Securities Regulatory Commission

- Requiring approval from the Securities Regulatory Commission before issuance

- Only allowing issuance from domestic to overseas

Moreover, this securities tokenization guideline clearly states that rights and benefits must comply, corresponding to the SEC's encouragement of the evolution of native "stock tokenization," while the situation of overseas RMB stablecoins, external debts, and funds is relatively special.

- Overseas offshore RMB stablecoin businesses have always existed, with Tether also involved, but they lack practical use and have very small business volumes.

- Overseas bond issuance and fund on-chain activities have already been conducted, completely isolating domestic assets for issuance to overseas clients, unrelated to this guideline.

This regulation involves the overseas issuance of domestic assets, essentially emphasizing this isolation: what belongs overseas stays overseas, and what belongs domestically stays domestically. Only when the two intersect does it require entering the regulatory process.

In the current RWA field, both China and the U.S. have effectively begun to stake their claims, and this liquidity spillover onto the chain is sufficient to rewrite the current financial landscape.

Conclusion

The fate of an industry relies on self-struggle, but it must also consider the course of history.

CZ might not even believe that CEX is the future; even Bitcoin is merely a stage in a new form of pyramid scheme, destined to quickly become a historical term like P2P and high-interest loans that fade away.

Yet, no one expected that CEX would survive until 2026, with Hyperliquid targeting new forms like precious metals and prediction markets, but it still has not flipped Binance.

If Hyperliquid adds RWA, this time, can it reach the other shore?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。