Relentless selling defined another volatile session for crypto ETFs, with capital continuing to rotate away from bitcoin and ether while selectively flowing into XRP and solana products.

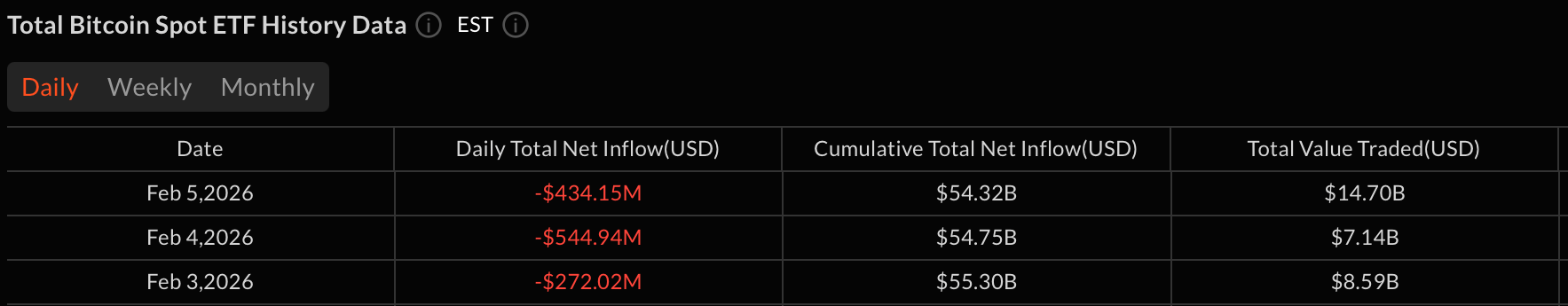

Bitcoin spot ETFs led the retreat, recording a $434.15 million net outflow across six funds. Blackrock’s IBIT and Fidelity’s FBTC shouldered the largest redemptions, losing $175.33 million and $109.48 million, respectively. Grayscale’s GBTC and its Bitcoin Mini Trust followed with exits of $75.42 million and $35.17 million.

Additional pressure came from Ark & 21Shares’ ARKB, which shed $23.12 million, and Bitwise’s BITB with $15.62 million in outflows. Trading activity surged to a record $14.71 billion, yet total net assets slid further to $80.76 billion, highlighting the depth of the ongoing drawdown.

Ether spot ETFs also remained firmly in the red, posting a $80.79 million net outflow. Fidelity’s FETH led the losses with a $55.78 million exit, followed by Grayscale’s ETHE at $27.08 million and Blackrock’s ETHA at $8.52 million. These losses were partially offset by modest inflows of $7.05 million into Grayscale’s Ether Mini Trust and $3.53 million into Invesco’s QETH. Total value traded reached $2.51 billion, while net assets dropped to $10.90 billion.

XRP spot ETFs continued to show resilience, attracting $5.91 million in net inflows. Bitwise’s XRP led with $4.64 million, followed by Franklin’s XRPZ at $1.93 million and Canary’s XRPC with $503.96K. A $1.15 million outflow from Grayscale’s GXRP trimmed gains slightly. Trading volume climbed to $66.84 million, with net assets holding at $832.03 million.

Solana spot ETFs also closed in the green, recording a $2.82 million net inflow. Fidelity’s FSOL brought in $1.86 million, while Bitwise’s BSOL added $1.48 million. A $521.10K exit from Vaneck’s VSOL modestly offset the gains. Total value traded surged to $94.86 million, though net assets slipped to $674.61 million.

Read more: Bitcoin Funds Shed $545 Million as ETFs Exit Deepens

Overall, Thursday’s trading underscored a widening contrast within crypto ETFs. Bitcoin and ether continued to see heavy capital flight, while XRP and solana quietly absorbed inflows, signaling a market that remains risk-averse but increasingly selective in where it deploys capital.

- Why are bitcoin ETFs still seeing heavy outflows?

Ongoing risk-off sentiment is pushing investors to reduce BTC exposure amid February volatility. - How did ether ETFs perform during the session?

ETH ETFs extended losses as selling pressure outweighed small pockets of inflows. - Why are XRP and solana ETFs attracting capital?

Investors are rotating selectively into altcoins showing relative resilience and lower crowding. - What does this divergence signal for crypto markets?

It points to cautious, defensive positioning rather than a broad recovery in risk appetite.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。