Safe havens are in short supply on Feb. 5, as precious metals, U.S. equities, and the crypto economy led by bitcoin ( BTC) all log sharp pullbacks. At last check, an ounce of .999 fine gold is priced at $4,899, while silver is changing hands at $77.38 per ounce.

According to Kitco analyst Jim Wyckoff, the one-two punch of a strengthening dollar and sliding oil prices is creating a distinctly bearish setup for gold and silver. “A higher U.S. dollar index and lower crude oil prices today are bearish outside market elements for the precious metals,” Wyckoff wrote on Thursday.

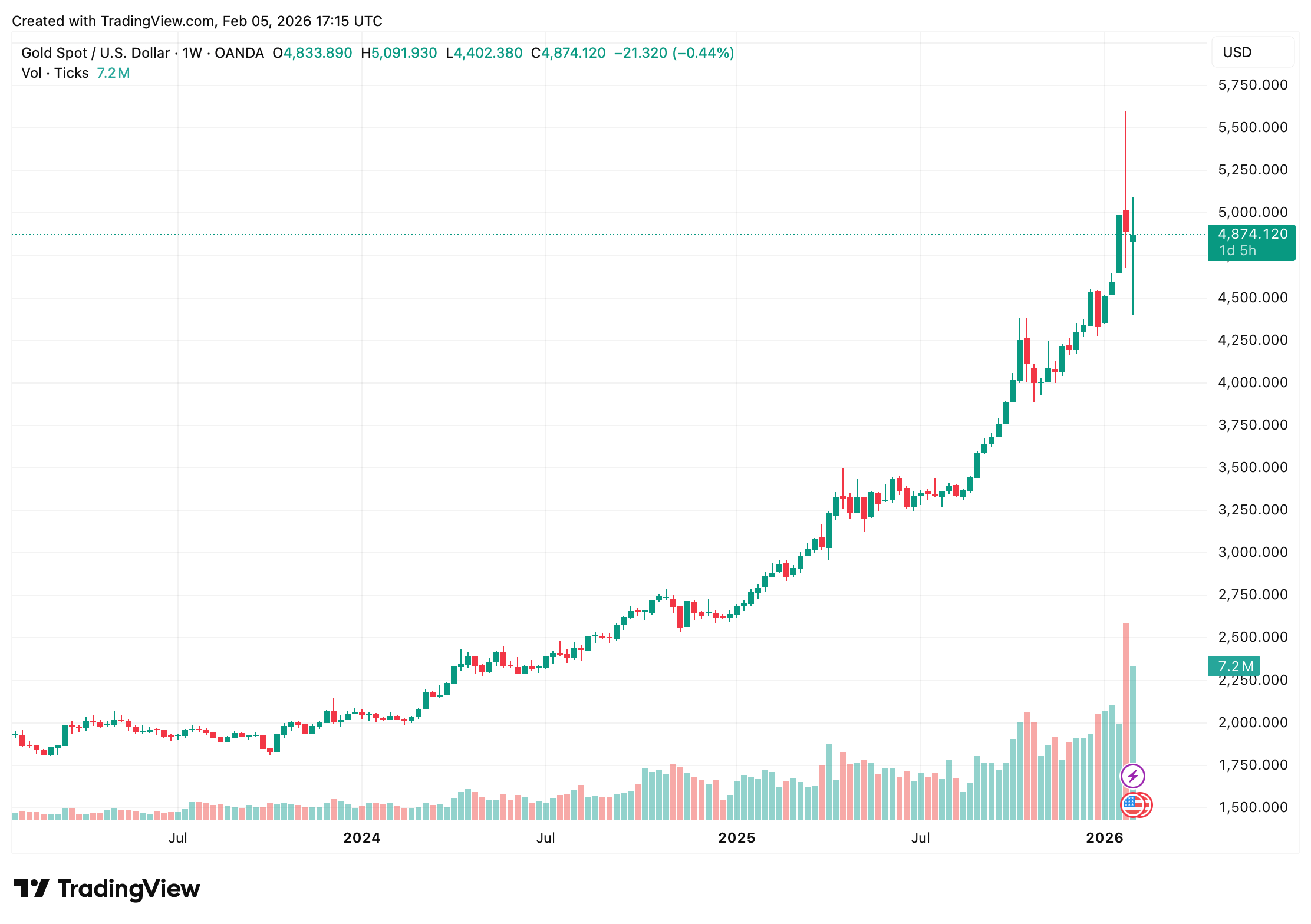

Gold prices on Feb. 5, 2026.

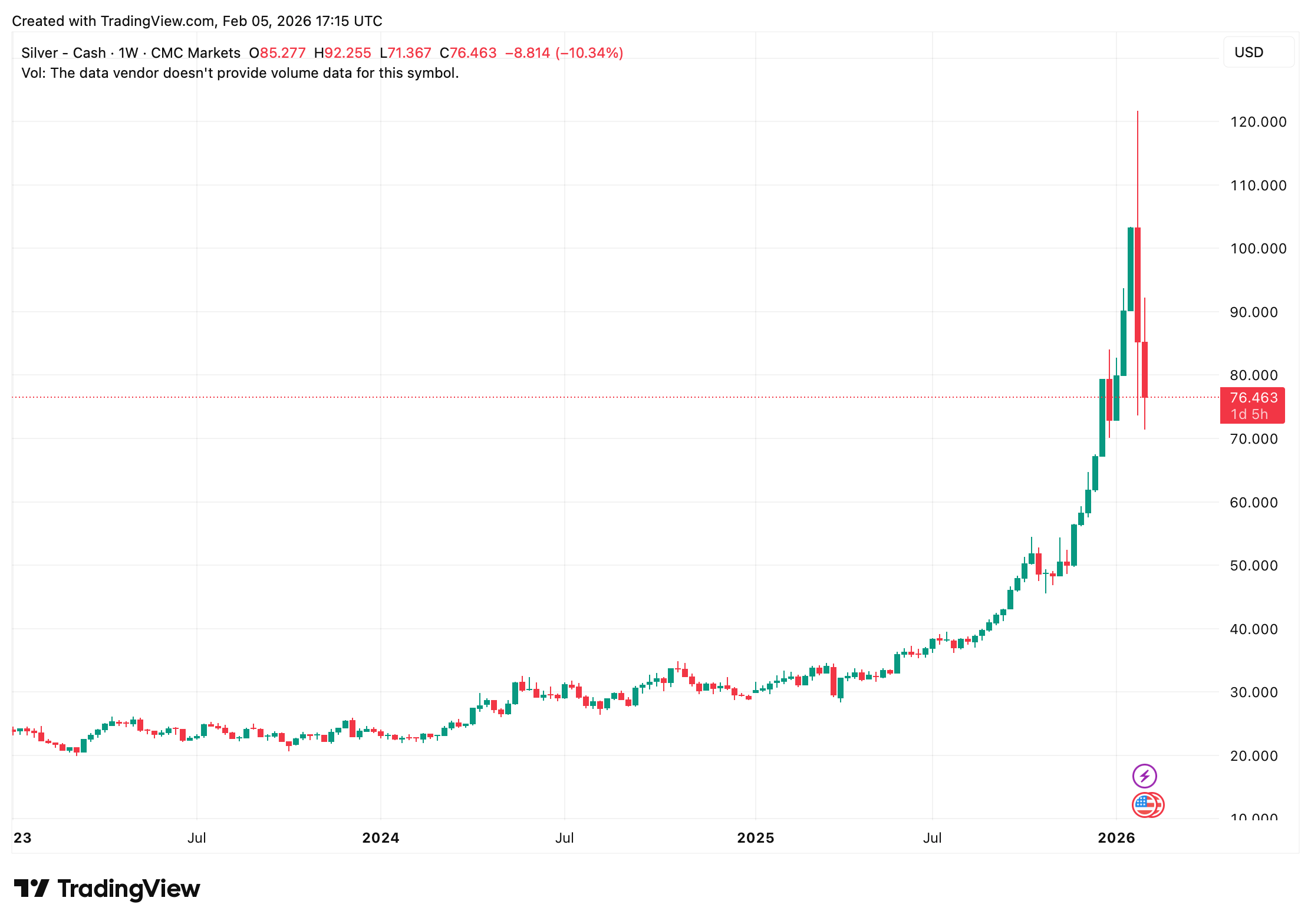

Both metals have endured a bruising week after touching lifetime highs just two weeks ago. Gold has given up 9.87% over the past five trading sessions, while silver is lower by 3.36% across the same stretch. Markets look increasingly strained, and the CBOE Volatility Index (VIX) jumped 20% over the past day, signaling a sharp escalation in market volatility.

The latest downward pressure reflects a cluster of short-term catalysts weighing on both gold and silver. One factor frequently cited by observers is CME’s decision to raise margin requirements— gold to 8% from 6% and silver to 15% from 11%—a move aimed at cooling leverage that pushed overextended traders toward the exits.

Elevated paper-to-physical ratios in futures and derivatives only intensified the near-term strain, with COMEX rolls and shifting open interest adding an extra snap to the move. As Wyckoff noted in his Thursday analysis, softer crude oil prices, a broader pullback in risk appetite, and spillover weakness from base metals such as copper compounded the pressure.

Although precious metals prices have staged a modest rebound this week as bargain hunters step in, volatility is expected to linger in the near term amid lingering Trump-era uncertainties tied to tariffs, Federal Reserve pressure, and fiscal debt. Analysts stress that the move appears to be a temporary air pocket within a broader structural bull trend rather than a true reversal.

For now, gold and silver sit in a tense pause, caught between forced selling and patient accumulation. Volatility has not finished speaking, and policy crosscurrents remain unresolved. Whether this pullback proves cleansing or merely unsettling will hinge on what breaks first: leverage, confidence, or macro pressure. Until then, metals trade less like refuge and more like a question mark, waiting for conviction to return when clarity finally reasserts itself again.

- Why did gold and silver prices fall on Feb. 5? A stronger U.S. dollar, lower oil prices, margin hikes, and broader risk-off selling pressured precious metals.

- How much did gold and silver drop this week? Gold fell nearly 10% over five sessions, while silver declined just over 3% during the same period.

- Did CME margin changes affect metals prices? Yes, higher margin requirements forced leveraged traders to reduce positions, adding selling pressure.

- Is this a trend reversal for precious metals? Analysts view the pullback as a temporary air pocket within a longer-term bull trend, not a structural turn.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。