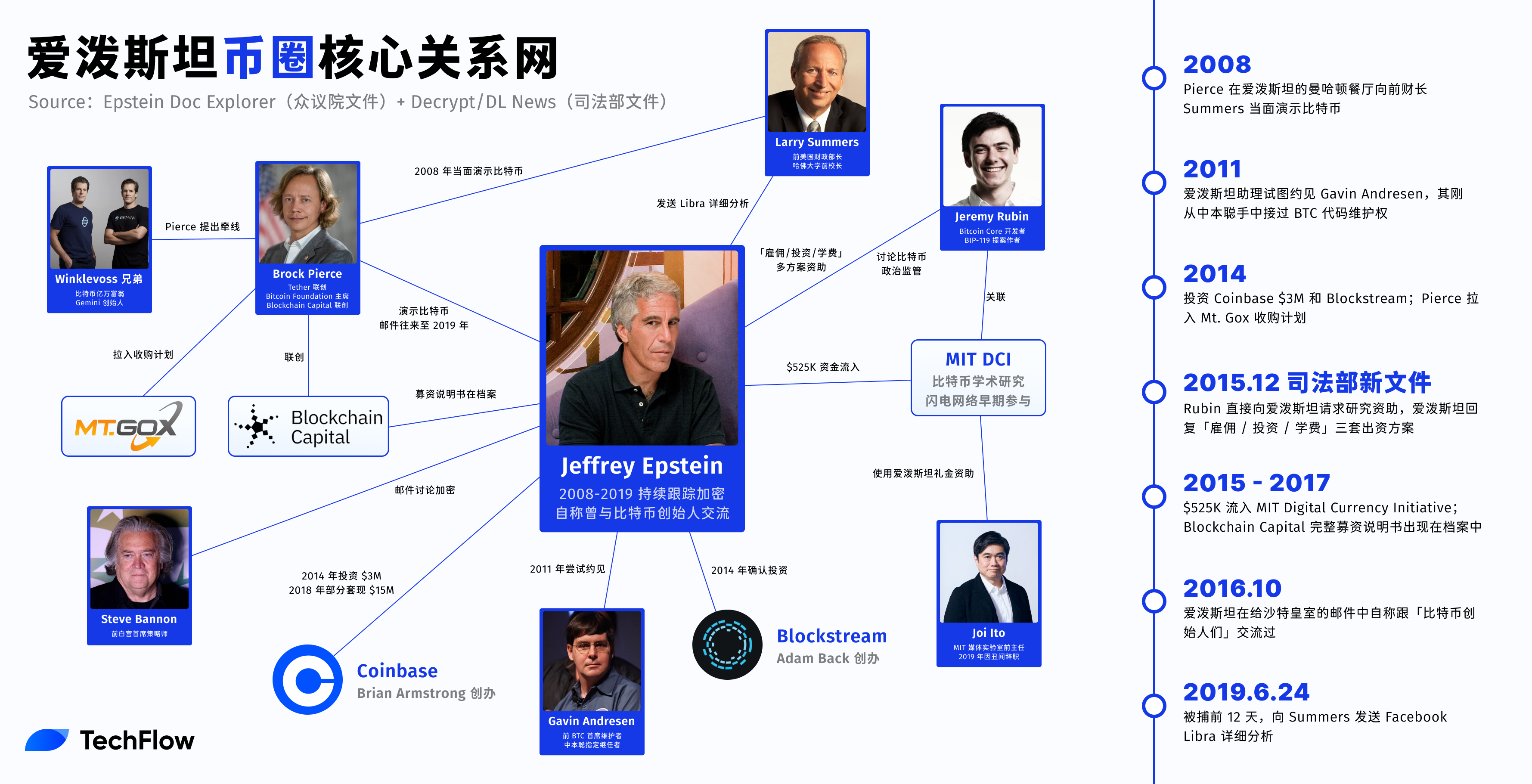

After the investigation, I found that Epstein was not a bystander in the cryptocurrency world, but more like an information broker.

Author: David, Deep Tide TechFlow

Recently, documents related to the Epstein case have been intensively unsealed, and social media is buzzing with people digging through the lists.

People in the cryptocurrency space are also asking: Are there any individuals from our industry involved?

I was quite curious, so I decided to research it. However, the problem is that the volume of documents released is too large, with thousands of PDFs, making manual review unrealistic, and I don't have much coding background.

I ended up doing a lot of online surfing until I discovered a project on GitHub.

This project is called Epstein Doc Explorer. The author used AI to structure the legal documents related to Epstein released by the House Oversight Committee, extracting the relationships between people, events, times, and places, all stored in a database.

It also has an online visual webpage for searching, but due to the large amount of data and my outdated computer, it was very laggy, making it difficult to obtain the desired information.

What I wanted was batch querying to extract all individuals and events related to cryptocurrency at once.

Crawling Method

I shared this GitHub project with Claude and asked how to query this database.

After reviewing the project structure, Claude informed me that the core data is in an SQLite database file called documentanalysis.db, which contains a table named rdftriples. Each record follows a structure of "who-did-what-to-who-when-where." For example:

However, the entire database contains over 260,000 such records, covering all publicly known relationships in the Epstein files, and I only wanted those related to cryptocurrency.

At this point, my idea was to filter relevant records using keywords. But I encountered two pitfalls in practice.

First Pitfall: The file is "fake."

I downloaded the project zip file from GitHub, and after unzipping, I tried to open the database, but my computer couldn't read it. After troubleshooting with Claude, we discovered that what I downloaded was just an index file, not the actual database. I returned to the GitHub page to manually download the complete file, totaling 266MB.

Second Pitfall: The selection of query terms.

In my first version of the query, I used 25 keywords, including direct terms like Bitcoin, Crypto, Blockchain, as well as names and institutions like Peter Thiel, Bill Gates, and Goldman Sachs that were not entirely relevant. The idea was to err on the side of caution.

As a result, I retrieved 1,628 records, but there was a lot of noise. For example, searching for Goldman Sachs yielded 90% economic forecast reports, and searching for Virgin Islands returned local tourism data.

So, I had Claude help me conduct three rounds of searches to gradually narrow it down:

- First Round: Broad keywords, 1,628 records, a lot of noise but established a panorama, locking in a group of people.

- Second Round: After reviewing the first round results, Claude noticed that I hadn't searched for some specific terms in the cryptocurrency field, such as Libra, Stablecoin, and Digital Asset. I added those and ran it again to ensure nothing was missed.

- Third Round: I reversed the search. Instead of searching for names, I only searched for records that included Bitcoin, Crypto, or Blockchain in the "did what" section.

The third round was crucial, filtering directly by behavior, and every record retrieved had a strong correlation.

After cross-referencing the three rounds and eliminating weak correlations, I compiled the following list.

1. Brock Pierce: Demonstrated Bitcoin to Epstein at his restaurant

Identity: Co-founder of Tether, Chairman of the Bitcoin Foundation, Co-founder of Blockchain Capital.

Contact with Epstein: Multiple face-to-face meetings at Epstein's Manhattan Upper East Side mansion.

Involved Cryptocurrency Topics: Bitcoin demonstration, blockchain discussions, cryptocurrency volatility.

Timeline: The earliest record is marked as 2008, with multiple records lacking specific dates but consistent locations. An email record from March 2015 shows someone facilitating a follow-up meeting.

The reason I highlighted this first is that Pierce's records have the strongest visual impact in the entire database.

Records show that he demonstrated Bitcoin in Epstein's mansion restaurant in front of former U.S. Treasury Secretary Larry Summers. After listening, Summers expressed concerns about investment risks but also "offered opportunities" to Pierce.

Epstein was not just listening; he actively called Pierce to the front hall for a private discussion and later invited him back to the restaurant to continue talking. The two also discussed the volatility of cryptocurrencies privately.

This was not a casual dinner chat.

An email dated March 31, 2015, shows that a person named Alex Yablon specifically wrote to Epstein asking if he could arrange for Pierce and Summers to discuss Bitcoin.

Someone was facilitating this meeting, indicating that such meetings were deliberately organized.

Epstein's Manhattan mansion played a role as an informal roadshow venue during that period. Pierce brought his project, and the guest was a former Treasury Secretary.

For a cryptocurrency entrepreneur, such resource channels are almost non-existent in normal business avenues. Conversely, Epstein positioned himself as a connector between the cryptocurrency industry and policymakers by arranging such meetings.

Our database only processed documents from the House Oversight Committee, so the clues about Pierce end here. However, during the writing of this article, the U.S. Department of Justice released another batch of over 3 million pages of Epstein documents, and Decrypt reported based on this new batch, revealing that the relationship between the two was much deeper than what the database indicated.

Several key supplements:

Their email correspondence lasted from 2011 until the spring of 2019, far beyond just a few restaurant meetings.

Pierce excitedly messaged Epstein saying, "Bitcoin has surpassed $500!" He involved him in plans to acquire the then-still-standing Mt. Gox exchange and even offered to connect Epstein with Bitcoin billionaires, the Winklevoss twins.

Epstein claimed he didn't know the Winklevoss twins but wanted to send someone to understand their dynamics in the cryptocurrency field.

The starting point of their relationship is also clearer.

In early 2011, Pierce attended a small invitation-only meeting called "Mindshift" held in the Virgin Islands, aimed at helping Epstein restore his image after his 2008 conviction for sex crimes.

After the meeting, Epstein's executive assistant, Lesley Groff, marked Pierce as one of Epstein's "liked individuals" and handed over his contact information.

2. Blockchain Capital: A fundraising document from a crypto VC appears, Epstein may be an investor

Identity: A cryptocurrency venture capital fund established in 2013, headquartered in San Francisco. Co-founders Bart Stephens, Brad Stephens, and the aforementioned Brock Pierce. One of the earliest professional crypto VCs in the industry.

Connection to Epstein: The complete investment prospectus for the CCP II LP fund appeared in Epstein's document files.

Involved Cryptocurrency Topics: Complete investment portfolio of the fund, service provider system, investment strategy.

Timeline: The prospectus is dated October 2015, with investment records covering 2013 to 2015.

In the entire publicly available Epstein database, there are 82 records related to Blockchain Capital.

These are not just scattered name mentions; it resembles a complete fundraising document broken down into structured data.

Upon examining the data, it can be seen that Blockchain Capital's list of investment targets is very detailed: Series C of Coinbase, Series A of Kraken, Series A of Ripple, Series A of Blockstream, as well as several projects like BitGo, LedgerX, itBit, ABRA, etc.

Even the fund's service provider system is recorded: legal advisor Sidley Austin, banking relationship Silicon Valley Bank, cryptocurrency asset custodians Xapo and BitGo.

A fundraising prospectus appearing in someone's files has only one conventional explanation in the financial world:

This person has been approached as a potential LP.

Considering that Pierce is both a co-founder of Blockchain Capital and demonstrated Bitcoin in Epstein's restaurant, these two lines are likely connected?

The process I imagined is that Pierce first demonstrated Bitcoin to spark interest, then presented his fund's fundraising materials, completing a full roadshow process…

(The above is just a reasonable guess, not guaranteed to be accurate.)

During the writing of this article, I did not find evidence of Epstein's actual investment.

However, Decrypt's report based on the new documents from the Department of Justice answered this question: Epstein did indeed invest in Coinbase, with the opportunity initially brought by Pierce.

Blockchain Capital stated to Decrypt that Epstein's investments were ultimately made independently of Pierce's company. The same batch of documents also shows that Epstein invested in Blockstream—the Bitcoin infrastructure company founded by Adam Back.

3. Jeremy Rubin: Bitcoin Core Developer Seeks Funding from Epstein

Identity: Bitcoin Core contributor, author of the BIP-119 (OP_CTV) proposal, associated with MIT's Digital Currency Initiative. He is among those writing the underlying code in the Bitcoin technical community.

Contact with Epstein: Direct communication, with discussions clearly involving Bitcoin.

Involved Cryptocurrency Topics: Bitcoin regulatory outlook, Bitcoin political speculation, teaching Bitcoin courses in Japan, requesting research funding.

Timeline: February 2017, records concentrated over four days.

On February 1, 2017, Rubin discussed the "Bitcoin regulatory outlook" and "Bitcoin regulatory and political speculation" with Epstein.

Three days later, he reported to Epstein on his progress teaching Bitcoin to engineers in Japan.

This set of records has the highest information density in the entire database.

The topics they discussed were not about "how Bitcoin works," but more about regulatory trends and political maneuvering, indicating that by 2017, Epstein had moved beyond the stage of needing to be educated about Bitcoin.

Isn't Rubin's behavior pattern somewhat suspicious?

He proactively reported his work progress to Epstein, resembling a continuous information exchange relationship rather than a one-time social interaction.

As for what Rubin received from Epstein, we have no way of knowing.

However, according to DL News based on Department of Justice documents, in December 2015, Rubin directly emailed Epstein requesting funding for his cryptocurrency research.

Epstein's response was quite specific, offering three funding options: first, directly paying Rubin a salary; second, Rubin starting a company with Epstein as an investor (requiring more paperwork); third, funding Rubin's research (with tax benefits).

Bitcoin Core developers actively sought funding from Epstein, and Epstein provided a systematic response.

Here, it's important to explain the MIT Digital Currency Initiative. DCI was established in April 2015 by Joi Ito, the director of the MIT Media Lab, as a research project focused on academic research in Bitcoin and digital currencies, later participating in early work on infrastructure like the Lightning Network.

In the Bitcoin technical community, DCI is not a marginal academic institution; its research directly influences the development direction of the Bitcoin protocol, and Rubin is one of the developers associated with this project.

4. Joi Ito: Using Epstein's Money to Launch the MIT Digital Currency Initiative

Identity: Former director of the MIT Media Lab. Resigned in 2019 after being revealed to have accepted funding from Epstein.

Connection to Epstein: Received funding, direct communication.

Involved Cryptocurrency Topics: Funding sources for the MIT Digital Currency Initiative.

Timeline: Launched the digital currency initiative in April 2015, with communication records still present in 2017.

The fact that Ito accepted funding from Epstein was reported by media outlets like The New Yorker in 2019, so it's not a new discovery. However, the records in the database supplement a detail that was somewhat unclear in those reports:

The specific flow of that money.

The database directly states, "Joichi Ito used gift funds to finance MIT Media Lab Digital Currency Initiative," as mentioned above.

Thus, Epstein's funds did not go into the general operating pool of the Media Lab, but were directed specifically into cryptocurrency research.

This ties back to the clues regarding Rubin.

Rubin is associated with the MIT Digital Currency Initiative, and this project used Epstein's money.

While we cannot directly infer that Rubin met Epstein through Ito, these two clues point in the same direction: Epstein's penetration into the cryptocurrency industry is not just at the social level; by funding academic research, he accessed the core developers of the cryptocurrency technology community.

Now, let's connect these clues:

Epstein's money flowed into DCI, which is an important institution for Bitcoin core technology research, and the developer Rubin, associated with DCI, was directly discussing regulatory politics with Epstein and reporting his work.

This funding chain raises an uncomfortable question:

Did Epstein gain access to Bitcoin core developers through funding academic research, potentially even indirectly influencing the research direction of Bitcoin's infrastructure?

Current data cannot prove this. However, the chain of "money → institution → developer → direct communication" does exist in the records of the database, and readers can judge for themselves how strong the causal relationship is.

5. Epstein Himself: Tracking from Bitcoin to Libra for at Least a Decade

Arranging Epstein's own records related to cryptocurrency chronologically reveals a clear evolution line:

Looking at this table together, there are two judgments.

First, Epstein's interest in cryptocurrency was not a sudden curiosity in a particular year.

The earliest records are marked around 2008, just after the Bitcoin white paper was released, with perhaps only a few thousand people globally paying attention to cryptocurrency.

His ability to access Bitcoin at that stage indicates that his information network reached some of the earliest individuals in this field. There have been continuous records related to cryptocurrency over the following decade, forming an uninterrupted line.

Second, his level of attention deepened over time.

In 2008, it was "listening to demonstrations"; by 2017, it was discussing regulatory politics with developers; in 2018, it was incorporating cryptocurrency into geopolitical agendas alongside John Kerry and Qatar; and by 2019, he was able to produce a detailed analysis within six days of the Libra white paper's release…

This trajectory is no longer that of an amateur observer; it is evident that he was attempting to establish influence in the cryptocurrency industry.

The last record, regarding the timing of the Libra analysis, is also interesting.

He completed the analysis on June 24, 2019, and was arrested on July 6. In the last two weeks of his freedom, he was still analyzing Facebook's stablecoin proposal.

In such a role, being so concerned about cryptocurrency evokes a sense of irony.

Individuals Not Found in the Database

To add a reverse discovery.

CZ, Sam Bankman-Fried, Brian Armstrong, Vitalik Buterin, Winklevoss twins…

These well-known faces in the cryptocurrency industry have not been found in the currently processed documents with direct interaction records with Epstein.

Vitalik Buterin actually has a record of "authored What is Ethereum," but the publicly cited information in the documents does not involve interpersonal relationships.

Not being in the database does not mean there are no connections; it simply means there is currently no evidence within the data range. The House of Representatives is still continuously unsealing documents, and this database is also being updated.

What Do These Clues Indicate When Combined?

Epstein is not an investor in the cryptocurrency industry; at least there is currently no evidence showing he has invested real money in any cryptocurrency projects.

He is also not a technical participant, having never written code, issued coins, or been on-chain.

However, he is clearly not a passive observer.

After reviewing these records, I feel that what he did resembles more of an information broker.

Having Pierce demonstrate Bitcoin to a former Treasury Secretary in his restaurant, possessing the complete fundraising materials of Blockchain Capital, discussing regulatory politics with Bitcoin Core developers, funding MIT's digital currency research, and analyzing Facebook's Libra just two weeks before his arrest…

The common characteristic of these actions is: positioning himself at the intersection of information flow, connecting cryptocurrency entrepreneurs, policymakers, and academic researchers.

This aligns with his behavior patterns in other fields.

Epstein does not directly conduct scientific research, but he funds scientists; he does not directly make policies, but he arranges meetings between politicians and businessmen. Cryptocurrency is just another field he penetrated using the same methodology.

The possible distinction is that the cryptocurrency industry was in a critical window of transitioning from underground to mainstream between 2008 and 2019, and this phase particularly relied on informal networks to obtain policy information and capital channels.

And isn't that precisely what Epstein excelled at providing?

However, the author has done his best; there is a reasoning distance between "contact records" and "substantive influence." This article aims to present the former.

To reiterate, all findings come from an open-source database and Claude's analytical assistance; the article is not a final conclusion, and it is more appropriate to consider it a snapshot of data at a certain stage.

If you discover any cryptocurrency-related clues I missed in this database, feel free to let me know.

-

References:

- Epstein Browser Open Source Project:

https://github.com/maxandrews/Epstein-doc-explorer

- 260,000 text key database locations:

https://github.com/maxandrews/Epstein-doc-explorer/blob/main/document_analysis.db

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。