14 years ago, YC invested in Coinbase as a bet on the future; 14 years later, YC using USDC is becoming the future.

Written by: angelilu, Foresight News

The "top startup incubator" Y Combinator (YC), which has successfully incubated Airbnb, Stripe, and Coinbase, announced on February 3 that starting in the spring of 2026, its funded startups can choose to receive a $500,000 investment in the form of the USDC stablecoin. This is also the first time YC has officially announced the option to invest using stablecoins.

From Bystander to Participant

In 2012, when YC invested in Coinbase, the price of Bitcoin was only between $5 and $13. Over the next 14 years, although YC invested in nearly 100 crypto companies, the investment funds were still transferred through traditional bank methods.

A significant reason for this change by YC is the passage of the "GENIUS Act" in the U.S. in July 2025. This legislation established a federal regulatory framework for stablecoins, requiring reserves to be backed 1:1 and granting holders the right to redeem. The arrival of compliance certainty eliminated the biggest barrier for top institutions to adopt cryptocurrencies. Just seven months later, YC announced the stablecoin payment option.

The real significance of this move is that YC is "using" stablecoins itself. When an institution is willing to migrate its core business processes to new technology, that is a true vote of confidence. From investors to users, from bystanders to participants, YC has completed a thorough role transformation in 14 years.

Why Choose Stablecoins?

The benefits of investing with stablecoins primarily lie in efficiency. Imagine an Indian startup receiving a $500,000 investment from YC; if using traditional wire transfer, it could incur thousands of dollars in fees and wait 3 to 7 days; if using USDC, the cost is almost zero, and the funds arrive in one second.

Moreover, YC's decision is based on a realistic judgment: the new generation of entrepreneurs is already "Crypto Native." YC pointed out in its statement that the actual application of stablecoins is continuously growing among the companies it invests in, especially in markets like India and Latin America.

Startups including Aspora and DolarApp are already using stablecoins to help customers transfer and store funds more efficiently in regions with limited or costly traditional banking infrastructure. To align with this trend, YC specifically emphasized that it will support stablecoins on the Ethereum, Base, and Solana public chains, allowing global entrepreneurs to choose the payment path that best suits them.

Why Choose USDC?

Astute observers have noticed that YC is not just generically saying to use stablecoins, but specifically naming USDC. Although USDC's market cap is less than that of USDT, it is issued by Circle, a company based in the U.S., and is regulated by the Federal Reserve and state authorities. As a benchmark for Silicon Valley venture capital, YC must ensure that every penny complies with U.S. regulatory requirements.

And let's not forget, YC invested in Coinbase back in 2012, which is one of the co-founders of USDC. Additionally, the partner responsible for YC's crypto business, Nemil Dalal, was previously the product director at Coinbase. This "kinship" may have naturally led YC to trust and support the USDC ecosystem more.

The "Nokia Moment" of Venture Capital

In fact, using stablecoins is not new in the crypto VC circle; firms like Paradigm or a16z Crypto have long been using them in "special cases." However, YC's breakthrough lies in the fact that it is the "godfather of mainstream venture capital," with over 90% of its invested projects being in AI, enterprise services, or consumer goods, rather than cryptocurrency companies.

Previously, venture capitalists used stablecoins often out of "necessity" because founders couldn't open U.S. dollar accounts; now, YC has proactively included this option in every founder's standard contract template. Whether you are working on large models or biomedicine, as long as you want to, you can directly receive USDC. This process-oriented and standardized action marks that the venture capital industry is entering its own "Nokia moment"—the traditional transfer model is being disrupted.

Will Other VCs Follow?

Currently, the attitudes of top VCs in Silicon Valley towards crypto are diverging. a16z crypto represents the "radicals," having raised $15 billion in early 2026, focusing on investments in AI and crypto; while YC represents the "pragmatists," entering through payments, not aggressive but extremely stable.

More traditional VCs may still be watching, but history provides a clear reference. Traditional financial institutions typically take 3 to 5 years to go from skepticism to embrace: Goldman Sachs and JPMorgan both experienced the process of calling it "fraud" to launching related businesses.

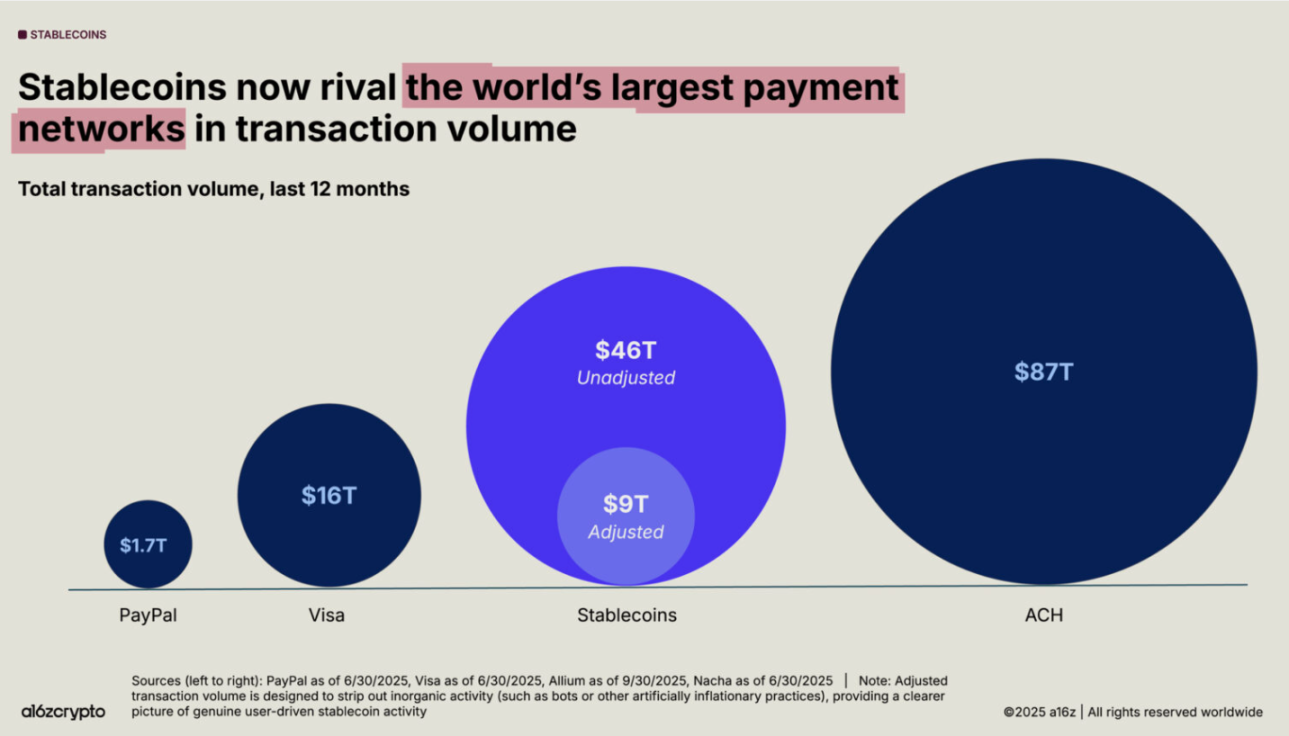

According to an a16z report, currently, 90% of financial institutions are integrating stablecoins. The trading volume of stablecoins reached $46 trillion in 2025, nearly three times that of Visa. The market predicts that the circulation of stablecoins will exceed $1 trillion in 2026. Behind these numbers is an irreversible trend. YC's decision may just be a node in the wave of stablecoins.

What Kind of Entrepreneurs is YC Looking For?

Currently, YC's spring 2026 incubation program is open for applications, with the incubation plan taking place from April to June in San Francisco. The application deadline is 12:00 PM Pacific Time on February 10, and applications submitted before the deadline will receive results by March 13.

In September 2025, YC launched the "Fintech 3.0" initiative in collaboration with Base and Coinbase Ventures, emphasizing its desire to fund on-chain entrepreneurial projects in the following areas: stablecoin applications, tokenization and trading (new credit markets, on-chain capital formation, new trading interfaces), Apps and Agents (including social, financial, collaborative, gaming, etc.).

14 years ago, YC invested in Coinbase as a bet on the future; 14 years later, YC using USDC is becoming the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。