While bitcoin’s steady erosion dominated the news cycle this week, ethereum (ETH) stole the spotlight for all the wrong reasons, weathering its most turbulent stretch of the year. In a staggering seven-day freefall, the second-largest digital asset saw $100 billion in market value evaporate, tumbling from a $365 billion valuation on Jan. 28 to a leaner $265 billion by Feb. 4.

With a weekly deficit nearing 27%, ethereum has emerged as the biggest laggard among the crypto top ten. The bleeding intensified on Wednesday as ETH crashed to $2,107—a price point not seen since May 2025.

Although the broader market has recently been hamstrung by macroeconomic jitters—namely geopolitical friction and stubborn inflation— ETH’s nosedive seemed to be triggered by a more technical catalyst. Reports surfaced that Blackrock, the world’s largest asset manager, transferred $170 million in bitcoin and ETH to Coinbase Prime. Historically, such movements have served as a precursor to massive institutional liquidations, spooking retail investors into a defensive crouch.

Despite the bleak price action, underlying network metrics tell a more resilient story. Ethereum’s validator entry queue has surged to 71 days, signaling a massive backlog of institutional and individual demand to stake assets. According to analysis by Elfa AI, the resulting supply-demand mismatch often acts as a springboard for a price recovery.

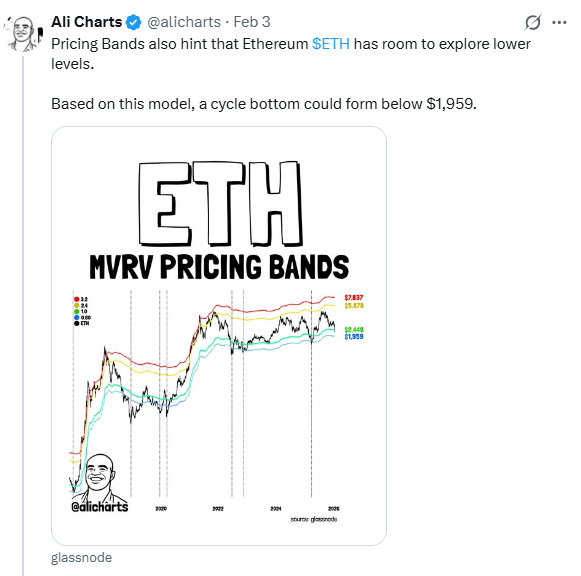

From a technical standpoint, the market value to realized value (MVRV) ratio suggests ETH is nearing a critical support zone. Analyst Ali Charts notes that if history repeats, a “cycle bottom” may solidify just below the $1,959 mark, offering a potential entry point for brave contrarians.

The institutional “diamond hands” are already showing their resolve. Perennial bull Tom Lee continues to double down on the asset, despite his firm currently sitting on a staggering $6 billion unrealized loss on its treasury of 4.3 million ETH.

Read more: Bitmine Tightens Grip on Ethereum With 3.55% of Total ETH Supply

Meanwhile, ethereum’s technical charts reflect a high-stakes tug-of-war between a dominant bearish trend and hidden “coiled spring” fundamentals. While the headline price action is ugly, technical indicators suggest the digital asset is in a “price discovery” phase searching for a definitive floor.

ETH has completed the breakdown of an inverse cup-and-handle pattern. Analysts point to a neckline break at $2,960 that has now flipped from support to a formidable resistance level. This technical breakdown suggests a downside target of $1,665, with immediate structural support sitting between $2,100 and $2,200.

ETH’s relative strength index ( RSI) shows it has dipped below 30, firmly entering “oversold” territory. While this usually precedes a relief rally, the RSI trendline itself is still sloping downward, suggesting momentum has not yet bottomed. Conversely, the moving average convergence divergence ( MACD) histogram is expanding in the negative, and the Chaikin money flow (CMF) is deep in the red. Analysts say this confirms that selling volume is still outpacing buyers and “ liquidation pressure” is still being digested by the market.

- Why did ETH crash this week? BlackRock’s $170M transfer to Coinbase Prime sparked fears of institutional liquidation.

- How much value did Ethereum lose? ETH shed nearly $100B in market cap, dropping 27% in seven days.

- Is there any bullish case for ETH? A 71‑day validator queue signals strong staking demand and potential supply squeeze.

- Where is ETH’s next support zone? Analysts see a possible cycle bottom near $1,959, with resistance at $2,960.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。