Author: Frank, PANews

As the early DeFi model relying on bubble incentives becomes unsustainable, the market sentiment has completely shifted, and investors are now chasing more sustainable "real yields."

BTCFi is an imaginative narrative in the DeFi space. As the largest and most consensus-driven core asset in the crypto world, Bitcoin's immense liquidity potential has long been suppressed. Limited by the lack of native infrastructure, Bitcoin's DeFi potential has not been truly activated for a long time, making it the largest "sleeping capital" in the crypto market.

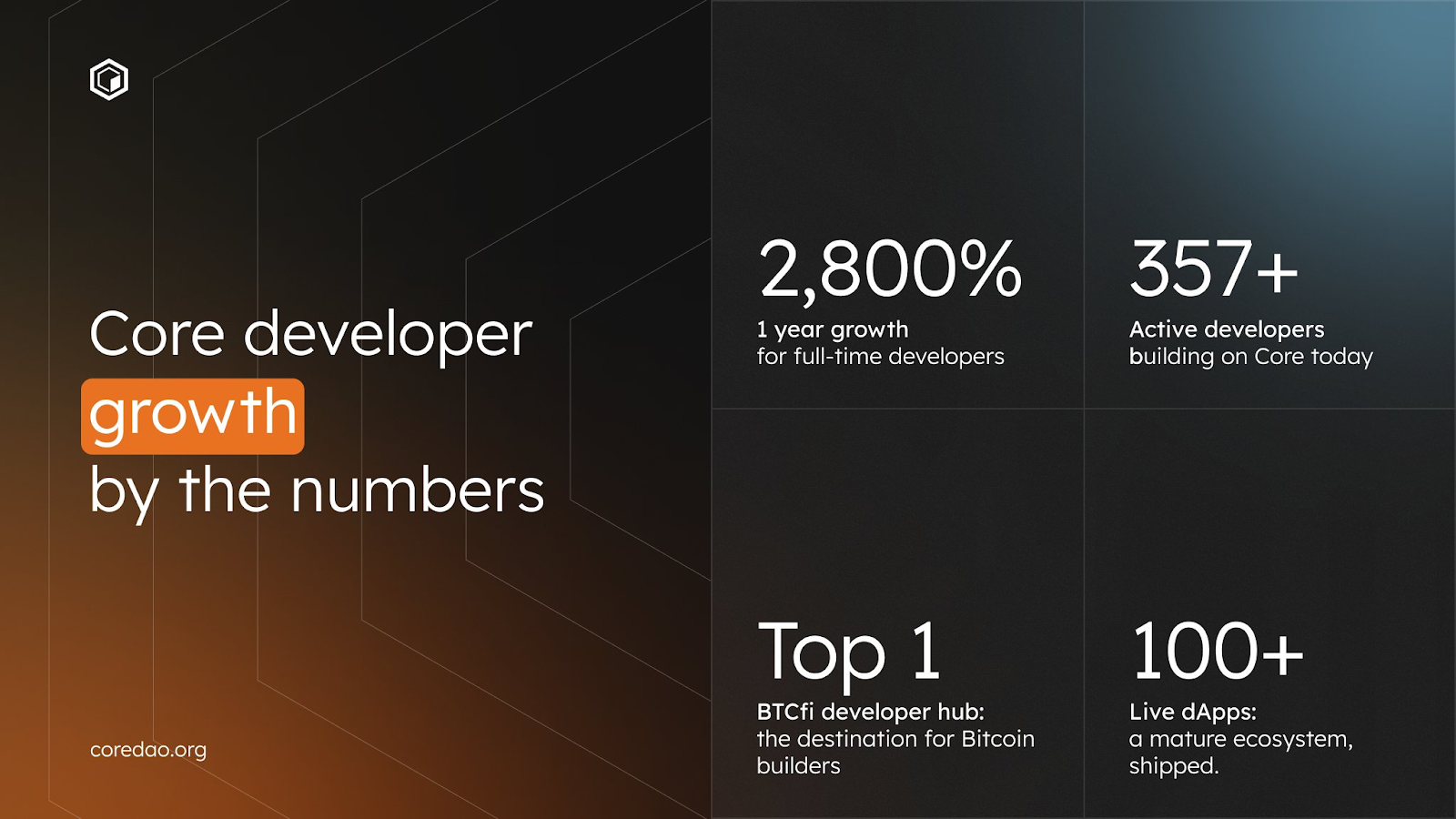

Core DAO has successfully opened a breakthrough in the BTCFi field with its unique "Satoshi Plus" consensus mechanism and non-custodial staking technology. It not only achieved native staking yields for Bitcoin under the premise of "not leaving the coins in hand" by 2025 but also validated its institutional-grade security standards by listing on the London Stock Exchange.

Standing at a new time node in 2026, Core is no longer satisfied with merely being a passive "yield tool." With the release of its latest roadmap, Core is building a vast system that includes smart asset management (AMP), liquid staking (LST), and a new type of Bitcoin bank (Bitcoin Neobank). This new strategy for Core also signifies that BTCFi is entering the next stage of competition, which will no longer be simply about staking yields but about how to leverage real business scenarios to generate sustainable blood-generating capabilities for Bitcoin.

Activating Sleeping Capital, Evolving Bitcoin into a Yield-Generating Asset

Looking back at Core's 2025, it was a year focused on building trust with Bitcoin holders and institutions that are extremely risk-averse. It proved to the outside world that Core is a safe and reliable "native Bitcoin yield infrastructure layer."

From a technical perspective, the SatoshiPlus hybrid consensus mechanism is the core foundation for Core to achieve this goal. This mechanism innovatively combines proof of work and delegated proof of stake, allowing Bitcoin miners to delegate their computing power to Core's DPoS network for validation without consuming additional computing power.

Data shows that currently, over 90% of the global Bitcoin hash power is participating in maintaining the security of the Core network. This means that while Core is compatible with the EVM ecosystem at the application layer, its security directly inherits the robust hash power barrier of the Bitcoin mainnet, thus building an independent security fortress outside the Ethereum system.

In the BTCFi space, the main security risks often come from cross-chain bridges or centralized custodians. Core's biggest technological breakthrough lies in achieving true "non-custodial staking." Users can leverage Bitcoin's native time-lock technology without needing to transfer BTC out of cold wallets or wrap it as WBTC. They only need to connect their Bitcoin mainnet wallet to the Core Foundation's staking platform, and through the time-lock mechanism, staking rewards are settled every 24 hours. This "coins remain still, rights move" risk-free yield model completely eliminates third-party custody risks, and is thus recognized by the market as the true "native Bitcoin risk-free interest rate."

After the non-custodial staking technology has addressed the security challenges at the technical level, Core's "dual staking" mechanism allows users to stake Bitcoin while additionally staking CORE tokens as a "yield amplifier," thereby obtaining higher combined yields than staking Bitcoin alone, significantly enhancing the competitiveness of Bitcoin yield financial products.

The innovative mechanism design has also gained recognition from institutions and the market. In 2025, Core became the largest BTCFi protocol and established deep collaborations with top custodians such as BitGo, Cobo, and Ceffu. Most importantly, Bitcoin yield ETP products supported by Core's underlying technology have officially been listed on the London Stock Exchange and are open to retail trading in the UK. This marks that Core's security model has passed the most stringent compliance audits in traditional financial markets.

It can be said that the launch of Core's solution has opened new yield channels, allowing those massive Bitcoin assets that were originally sleeping in cold storage and merely serving as defensive assets to smoothly transform into financial assets that can continuously generate yields. For traditional institutions constrained by compliance policies that cannot engage in ordinary DeFi products, the Core platform provides a very safe, compliant, and attractive solution.

Making Bitcoin "Move," Building a Blood-Generating Machine with Three Engines

If Core solved the trust issue of whether Bitcoin "dares to move" in 2025, then its core mission in the 2026 roadmap is to demonstrate to the market the value-adding logic of how Bitcoin "moves."

In this strategic upgrade, the Core team did not stop at simple optimizations of the underlying protocol but officially launched three core engines: AMP (Asset Management Protocol), LST (Liquid Staking Tokens), and Bitcoin Neobank - SatPay. These three engines together build a complete business closed loop from asset appreciation to liquidity release and then to real-life consumption, attempting to provide Bitcoin holders with a completely different yield path than before.

AMP: "Democratizing" Institutional-Level Strategies

First, there is the "democratization" of institutional-level strategies brought by AMP. For most Bitcoin holders, DeFi still presents a high barrier to entry, with complex strategies, cumbersome operations, and potential slippage risks deterring participation. The emergence of the AMP asset management protocol essentially introduces a smart "fund manager" to the Core ecosystem.

AMP connects to Core's underlying infrastructure to directly access basic staking yields and relies on Core's existing user network and composable DeFi modules to establish an initial asset scale and strategy execution foundation.

On top of the underlying yields, AMP constructs a yield enhancement layer by adding advanced hedging and arbitrage strategies such as basis trading and delta-neutral strategies. The compound yields generated by the protocol, after deducting a portion as the protocol's sustainable income fee, will be distributed to participating users.

This distribution mechanism not only enhances the overall yield of user assets but also increases the protocol's attractiveness and capital stickiness. Crucially, the protocol systematically reinvests the retained fee income into CORE tokens. Under this development, ordinary retail investors can also enjoy stable alpha yields that were previously only accessible to quantitative funds. AMP not only simplifies the operational process but also achieves risk diversification through strategy combinations, turning "lying down to earn" into stable income based on real market competition rather than mere token subsidies.

LST: The Key to Unlocking Trillions in Liquidity

Additionally, in traditional staking models, security and liquidity are often difficult to reconcile; to earn staking yields, assets usually need to be locked. Core's LST (Liquid Staking Tokens) engine attempts to break this deadlock by completely liberating trillions of Bitcoin liquidity from cold wallets.

Its yield model is as follows: after users stake BTC on Core, they receive LST tokens representing their staking share. These LST not only automatically carry the underlying staking yields, but users can also use LST as collateral in Core's lending protocols or provide liquidity on DEXs (decentralized exchanges) to earn additional DeFi yields.

With the foundation of the London Stock Exchange ETP, LST also has the potential to become the underlying asset for yield-generating BTC ETFs, structured products, and BTC savings accounts on the Core Foundation's roadmap. As the market matures, these yield-capable LSTs are expected to become the foundational yield Lego of the Bitcoin ecosystem, maximizing capital efficiency, similar to how stETH functions within the Ethereum ecosystem.

SatPay: The New Bitcoin Bank and Self-Repaying Loans

If the first two engines are still focused on on-chain financial operations, then SatPay is a significant application that connects to the physical world. This new Bitcoin bank built on the Core chain fundamentally differs from traditional digital banks like Revolut.

In the traditional banking system, consumption means a reduction in principal, but in SatPay, consumption can be seen as a form of asset preservation because users can stake their Bitcoin or LST tokens to borrow stablecoins for daily expenses via a debit card model. Since the staked assets continue to generate yields in the background, this system automatically uses the interest or even principal to repay previous loans without needing to sell appreciating assets (interest).

This innovative model of "spending while earning" achieves consumption without asset depreciation, maximizing the value of idle Bitcoin. It allows loyal Bitcoin holders to meet their daily living expenses without having to sell their assets, perfectly resolving the contradiction between long-term holding and improving living standards based on this core logic.

Saying Goodbye to Bubble Subsidies, Building a Value Flywheel Driven by Real Income

Once Bitcoin achieves asset security through non-custodial staking and realizes rich applications through products like AMP and SatPay, the final piece of the puzzle in Core's new roadmap is how to accurately capture and feedback the immense value of these commercial activities to CORE token holders.

Core's answer is a set of economic flywheel models driven by commercial income that reject inflation dependence: first, transitioning from simple yield rates to commercial income while rejecting inflation dependence; second, achieving the flywheel effect of economic development and establishing a repurchase power driven by commercial income.

In the early stages of the crypto market, most projects' yield performances were heavily reliant on high inflation subsidies of the tokens themselves. Although this model attracted hot money in the short term, it is fundamentally unsustainable.

The Core team has chosen a more challenging but correct path, creating a financial system with proactive blood-generating capabilities. With support from top institutional collaborations and exponential growth in asset management scale (AUM), the fees and management fees generated within the ecosystem, as well as lending interest, will convert into substantial real commercial income. These profits are not mere numbers generated from thin air but are real money produced based on genuine financial interactions.

Regarding the specific flow of these real incomes, the Core team has designed a very sophisticated fund return mechanism to convert ecosystem profits into support for token value. Currently, strategy management fees from the AMP protocol, transaction fees from the SatPay system, and minting fees for LST assets will all flow into the overall ecological fund pool of the protocol. The Core team has also proposed using these real commercial profits to repurchase CORE tokens in the secondary market.

Unlike the common "repurchase and destroy" approach, Core will return these repurchased CORE tokens to the community. This logic, which attracts funds through useful products and enhances repurchase strength after generating income, truly forms an upward economic flywheel.

Revisiting this evolutionary path, it can be seen that the Core team has successfully outlined a progressive curve from infrastructure to commercial operation transformation. In this new model architecture recognized as the Bitcoin power grid, Bitcoin will no longer be a sleeping digital gold but will evolve into the lifeblood that flows freely throughout the entire financial market. Meanwhile, Core is no longer just a single yield financial tool but has evolved into a financial ecosystem with proactive blood-generating capabilities.

While other Bitcoin Layer 2 protocols on the market are still immersed in capturing TVL data or releasing point tasks to fill valuation gaps, attempting to use empty promises to bridge the gap, Core has clearly taken the lead, stepping out of the industry's vicious cycle and pioneering a new path for BTCFi driven by real commercial value.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。